Jan-Schneckenhaus/iStock Editorial via Getty Images

I’ve looked at Fortis (NYSE:FTS) a few times now, and each time I’ve said that the company while great, comes in at an unfortunate overvaluation that prevents us from really investing here at a great upside.

Now, since my last article, the company is actually down somewhat – but the market is down more. However, there are new quarterly reports to consider, and new valuations and forecasts to take into consideration for investing.

So with that, let’s look at what Fortis gives us here.

Updating On Fortis

In my last Fortis article, I made the point of balancing between great quality but an unfortunate overvaluation. The way energy costs are going, the company will see impacts from higher natgas prices which will impact fuel and power costs at its utilities. There is also the fact of Fortis’ high USD exposure and the portion of earnings that come from Caribbean geographies – typically geographies with significant climate risks.

Let’s look at the most recent set of results to see what we have here.

The current environment hasn’t in any way offset the company’s CapEx plan – CapEx is very much on track, and as of 1H22, it’s up to nearly $2B, forecasting that $4B 2022E annual spend. The company also filed a new rate case in June. Based on the last rate case, it’s unlikely that the company will reach the applied RoE of 10.25%, but more likely down to 9.1-9.2%, as in the latest rate case.

Still, the company’s current CapEx plans do support Fortis’ growth plans and the current capital plan, with a rate base growth of 6%. The company also has a number of opportunities to deliver and expand its growth, such as the Miso Long-Range Transmission plan. The company was active in the Lake Erie Project – but this project was suspended a few months back due to inflation, interest rates and FX making the project non-viable.

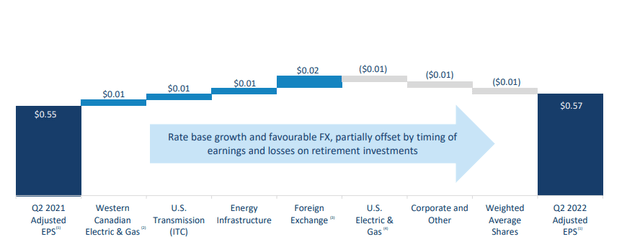

The company retains its unbroken, 48-year dividend tradition with an average growth rate of 6% – and the second-quarter EPS, while not terrific, was decent in terms of growing 2 cents YoY.

Similar trends are visible for the YTD perspective, where results are up very slightly, but offset by the timing of certain projects and losses on retirement investments (which are down for most companies that chose to stay in the market here).

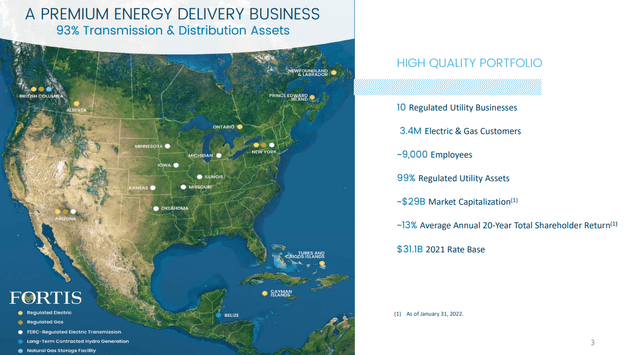

The company’s portfolio remains, however, at very high quality with 10 regulated businesses delivering to 3.4M customers across NA and the Caribbean. 99%+ of the assets are regulated utilities, and at nearly $30B worth of market capitalization, the company is anything but a small player here.

FTS IR (FTS IR)

Many would argue Fortis deserves a stiff premium for this sort of tradition and these sorts of fundamentals that we can see for the company. I can agree to some – just not as high as they’re currently seeing.

Fortis retains some of the sector’s best credit ratings at A- and Baa3, and has continued access to liquidity and credit facilities worth several billions as it needs. The company has no issue raising capital at sub-2.2% levels early this year, with $500M 7-year notes coming in at 2.18% back in 2021. Now, the credit costs and interest rate costs for the company are up since the overall situation has changed, but it will take some time for these impacts to fully materialize in earnings and results.

For now, things are fine – and Fortis retains its position as an excellent investment due to its focus on transmission as opposed to just generation, giving it a low-risk profile (excepting climate/infrastructure risk). It’s almost fully regulated, giving extreme clarity in terms of earnings. It’s already an ESG leader, and it’s essentially Canadian dividend king – one of the few with as many years as that.

The company also leverages new technologies, expected to bring significant opportunities in the form of battery storage, additional capacities from renewables, and similar things.

The company’s ambitions and its results are really very impressive – especially in the renewables sector. However, you really can’t take away from valuation in any company when you invest.

Still, the latest signals out of the political sphere in NA are positive. With hundreds of billions slated for investment in energy and climate, Fortis may be one of the primary beneficiaries of the climate portion of the inflation reduction act – or at least a company that will certainly enjoy advantages from it.

News in the earnings calls centered mostly on the lake Erie cancellation – which makes sense. I believe, however, that the company’s choice here was very prudent. The expected RoR and the current circumstances were no longer in line with expectations – and Fortis showed the quality that a company in their situation needs to show when the math no longer “works out”.

All in all, Fortis remains safe. Fortis remains sound. Fortis remains profitable.

However, in the end…

Fortis Valuation

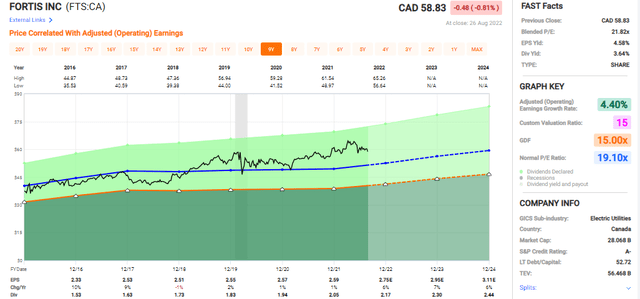

… Fortis also remains very expensive. Despite dropping around 1-2% or so since my last piece, the company cannot in good conscience be said to be “cheap”. Current trends see FTS trading close to 22x P/E, and this is simply too much for a utility, no matter how good the company is.

It’s too much because even in a bullish scenario, there are no grounds for expecting a double-digit long-term EPS growth out of this company. Single digit – and usually low single digit is all we can expect here. This makes the company somewhat expensive, and we can also see this when we view the company’s historical EPS and P/E trends.

FTS Valuation (F.A.S.T Graphs)

So, the company can tendentially drop below 19x P/E, and when it does, this company becomes a very interesting investment. Over 21.5x, it yields less than 3.7%, and despite it having an A-grade credit rating, there are plenty of indicators out there that it will not be delivering as solid a growth rate as we might overall expect.

At over 21.8X+ normalized P/E, Fortis is one of the highest P/E trading utilities out there. At a 3.7% yield, it’s also well below the public comp level in terms of payouts, where yields can often go up toward the 5-7% level.

Fortis does offer an almost unparalleled level of safety – consider for a moment what has happened with many of the Russian/Ukraine-impacted utilities, and you can see how some of these businesses can really “shake”, but as you can see from the history, that does not mean it has always-low volatility. if you invested at 22X P/E levels in the past, there’s only one way that investment could have gone over time – down or flat.

Sub-par.

At any time this company was bought at 21-22X P/E or above during the last 20 years, your long-term returns over time would have been less than 5-6% including dividends.

That’s sub-par.

We want to still buy Fortis at an attractive price. In my last article, I guided for 18x P/E. With the world going the way it’s going, I’m now willing to slightly revise this target. If you bought the company at 15-19X P/E, that minimum RoR goes up to between 7.5-15% annually, including dividends. So I’m willing now to extend my “BUY” range up to 19x P/E for the company, which is closer to the company’s 5-year average here.

Some calculations on the basis of this. On the basis of the current valuation and forecasts, Fortis can generate a 2024E 19-20x P/E RoR of 4.96%. Fairly abysmal returns when compared to virtually any other opportunity with undervaluation on the market today.

S&P Global does not agree with my assessment of overvaluation. An average range of $49 to $65 brings us to a PT of $60.56, which is an undervaluation of 3%. However, out of 17 analysts, only a single one has a “BUY” rating, which is more indicative of the appeal as I see things.

Forecasts? Single digit EPS growth could grow faster as some of the company’s green/ESG ambitions become realized. But even in this scenario, we’re not talking massive double-digit growth.

So – growth is poor, momentum really isn’t there at this valuation, and the company recently cut a large project. On the basis of this, we’ve seen some valuation decline.

Just not enough.

I believe this illustrates well how high things have been going here.

I want to “BUY” Fortis, but I won’t touch it, until around 19X P/E at the earliest. If we average out a conservative GAAP EPS and use as a P/E multiple based on the last 5 years including 2022E, we get around a $52/share price target there. That’s where I’ll put my price target for Fortis here – no higher. So we need another slight drop.

Because of that, Fortis is a definite “HOLD” here in my book.

Thesis

My thesis for Fortis is:

- An absolutely solid, A-grade utility with safety that can’t be beaten by really any business on the NA market in the same sector. A definite “BUY” at the right valuation, with an excellent potential yield.

- However, 22X P/E is the historical high. The P/E to “BUY” FTS is no higher than 18-19X, and preferably lower than 17X P/E. That’s when you stand to gain those double-digit RoR that we so want to have.

- FTS is a “HOLD” here. A price target that I would consider attractive for investment based on my goals would be around $48/share for the native Canadian ticker – though every investor of course needs to look at their own targets, goals, and strategies. I would also always consult with a finance professional before making investment decisions such as this.

Remember, I’m all about :

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them.

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

Be the first to comment