Different_Brian/iStock Editorial via Getty Images

Overview:

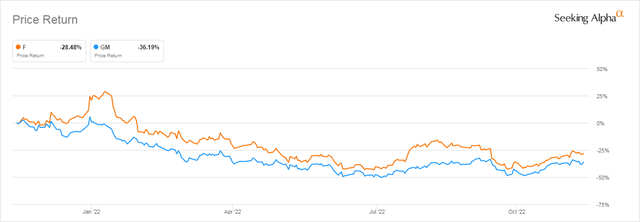

As the world rushes headlong into the EV (Electric Vehicle) future, two American auto icons are struggling with chip shortages, logistical problems, inflation, and higher interest rates. Both Ford Motor Company (NYSE:F) and General Motors Company (NYSE:GM) have seen their share price drop more than 25% over the last year as shown by the following chart:

The investment question becomes: what are their prospects going forward into 2023 and beyond?

In this article, I will examine Ford’s and GM’s business and financial factors to see if the 25% plus decrease in share price is warranted or are one or both of them are turnaround prospects.

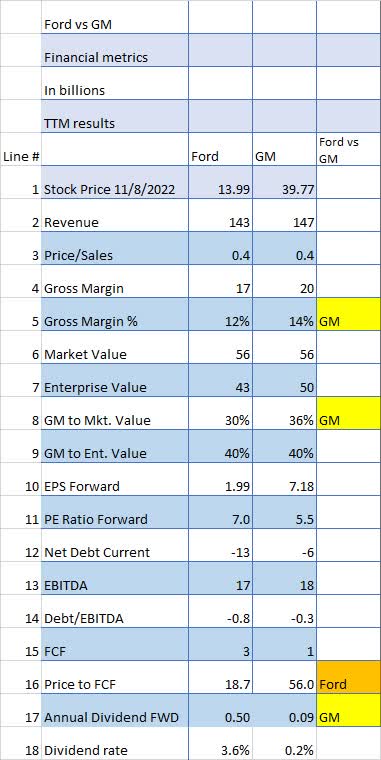

Financial metrics

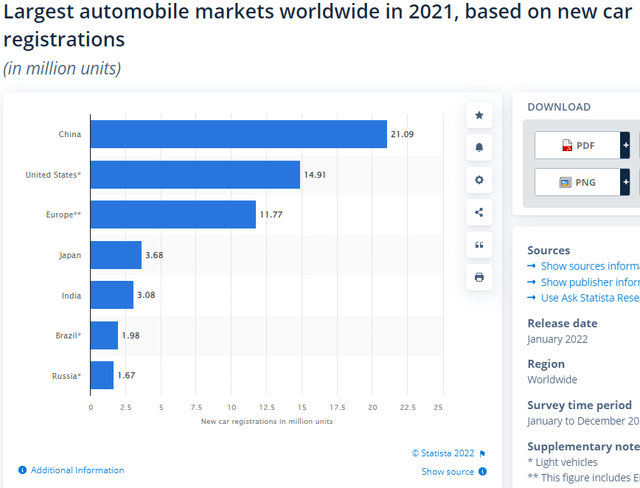

When we look at the financial metrics comparing the two companies on a TTM (Trailing Twelve Month) basis, we can see two very evenly matched competitors.

Revenue (Line 2) is $143 billion for F and $147 billion for GM a difference of 2%. Also, the Price/Sales (Line 3) ratio is identical at .4 as is the Market Value (Line 6) at $56 billion. These metrics are the closest I have ever seen two competitors have.

Gross Margin % (Line 5) is 14% for GM vs. Ford’s 12%. But based on Gross Margin to Market Value Percentage (Line 8), GM’s margin is somewhat higher 36% compared to Ford’s 30%. That could indicate GM is slightly undervalued compared to Ford.

Seeking Alpha and author

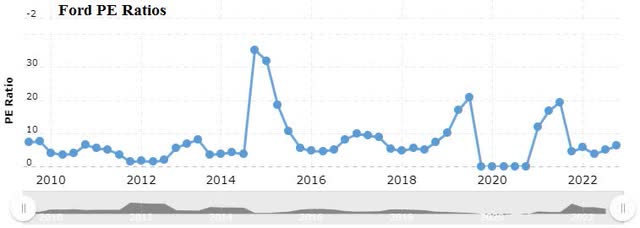

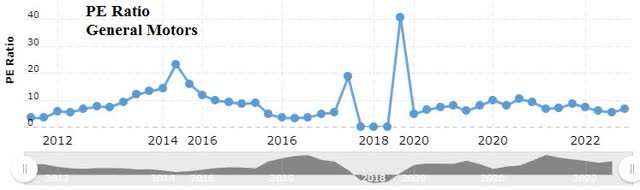

Looking at the P/E Ratio (Line 11), both companies are in the single digits although GM is slightly lower at 5.5 compared to Ford’s 7.

Generally speaking, neither company has historically had high PE Ratios, averaging in the single digits for the last 10 years.

When it comes to Debt/EBITDA (Line 14), both companies are in great shape with negative ratios.

Price to free cash flow (“FCF”) (Line 16) also shows a huge advantage to Ford at 18.7x versus GM’s very high 56x. It is the nature of the automotive business to make huge CAPEX investments and that is even more true when it comes to the rapid expansion of EV manufacturing so GM’s high ratio should come down over time.

And finally, the dividend rate (line 18) is much higher for F at 3.6% compared to GM’s .2%.

Based on financial metrics, I would call it a tie with neither company having a clear advantage.

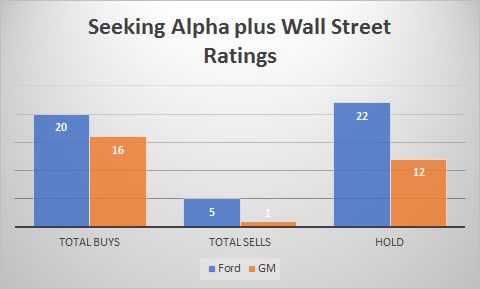

Wall Street analyst ratings show Ford and GM are well-liked by analysts but quants like Ford more than GM

Wall Street analysts appear to have positive ratings for Ford and GM, with Wall Street plus Seeking Alpha analysts combined showing 20 Buys and 5 Sells for Ford and 16 Buys and only 1 Sell for GM.

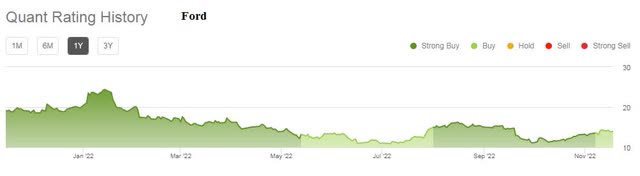

Seeking Alpha

Quant ratings over the last year are different, showing nothing but Buy ratings for Ford and mixed Buy and Hold ratings for GM over the entire time period. I find it curious there are no Sells in the quant ratings.

So quants seem to really like Ford but are less enthusiastic about GM.

Dividends, share buybacks, and debt

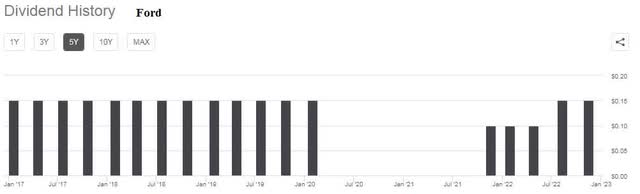

Both Ford and GM have dismal records on dividends with both companies dropping their dividends completely during the reign of COVID in 2020 and 2021.

Both have reinstated their dividends but GM’s rate is a fraction of what it used to be.

So, if you’re looking for a steady, consistent dividend, look elsewhere because neither company is a viable choice.

As for share buybacks, neither company has an active buyback initiative.

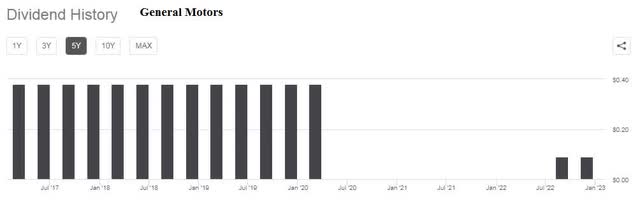

If we compare the last 10 years of Debt/EBITDA data we see that both companies have amazing numbers i.e. the Debt to EBITDA ratio is negative for the entire 10-year period.

Since lower ratios are better, negative ratios are the best so you can assume when analyzing Ford and GM that debt is not an issue at least at this point in time.

Based on dividends, share buybacks, and debt ratios, I can see no distinct advantage to either Ford or GM.

Risks

Many problems are plaguing the auto business right now including but not limited to chip shortages, logistic backlogs, inflation increases in virtually every cost category, and interest rates that make it harder and harder to buy a car and finance it.

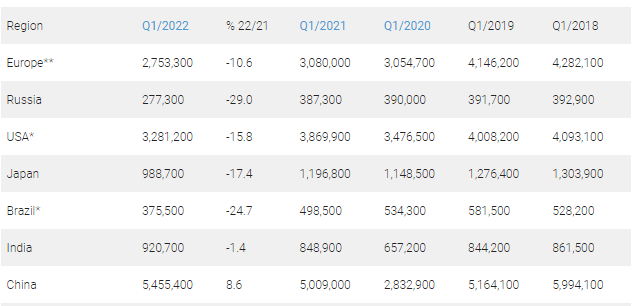

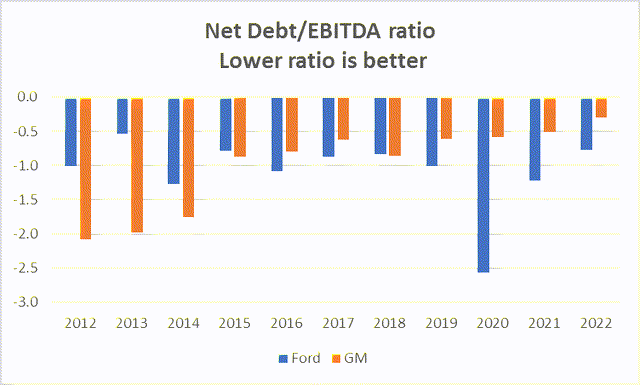

Globally, Europe is in a severe recession due to fuel prices and the war in Ukraine and in addition, China has closed down large areas of its country due to COVID restrictions. Remember, China is the largest automotive market in the world.

In a volatile environment like we’re facing now, cash is always a viable alternative. CD rates are now in excess of 4% a number we haven’t seen literally in years.

In addition, there could be a recession coming or even a depression according to several economists. That may make profits elusive at best and provide losses at worst.

So please, do your own due diligence on every investment option.

Conclusion

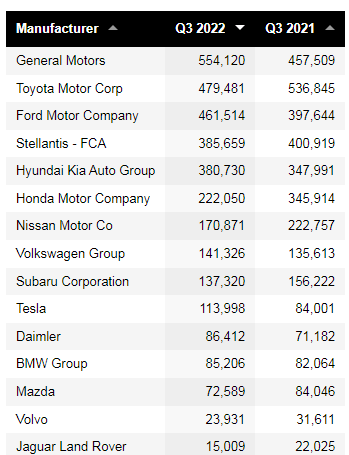

In the US the 3rd quarter of 2022 auto market looks good for both Ford and GM both having increased unit sales compared to the 3rd quarter of 2021.

goodcarbadcar.net

But worldwide it’s not quite as good as every region is down compared to 2021 except China.

bestsellingcars.com

With the inflation numbers going up, both companies have initiated some pretty severe price increases which will no doubt affect sales in the coming year.

For example, Ford has increased the base price of the Mustang Mach E-GT from $63,000 to $69,900.

GM has also announced an across-the-board increase in both prices and delivery charges:

GM’s truck lines are particularly hard hit in this case, with the Silverado 1500 also subject to an $800 increase to base MSRP across the range. It’s the third time GM has hiked the price this year, with various models now $3,000 to $3,400 more expensive than the introductory pricing announced in December. Source: thedrive.com

and

As reported by GM Authority, the destination freight charge for many of GM’s regular-sized vehicles has been hiked up by $200, from $1,195 to $1,395.

Obviously, this is not going to help sales going forward and will almost certainly have a negative influence on both revenue and profits.

Based upon the above analysis, both Ford and GM are Holds until the problems and risks noted above have lessened by a significant margin.

Be the first to comment