fredrocko

Price Action Thesis

We follow up on our Ford (NYSE:F) post-earnings article in May, as there were significant changes in its price action. We cautioned in our previous article that we expected the market to continue its price discovery, as there were no signs of a sustained consolidation yet. Therefore, given its tentative price structures, we urged investors to layer in over time.

Consequently, F has fallen further since we published our previous article, by another 18.8% (as of July 8’s close). As a result, it underperformed the market significantly, despite its “cheap” valuations.

We believe the market has de-rated F substantially, likely pricing in the impact of a potential recession on large-expense consumer discretionary spending. However, despite the worsening macros, management remains steadfast in its operating model, as it maintained its FY22 guidance.

Furthermore, the bear trap (significant rejection of selling momentum) price action that we have been waiting for some time has finally arrived after last week’s close. Therefore, our conviction in F has increased, and we believe that investors are afforded an entry point that can provide a more attractive risk/reward profile.

Accordingly, we reiterate our Buy rating on F stock.

F – Price Action Forms The Long-Awaited Bear Trap

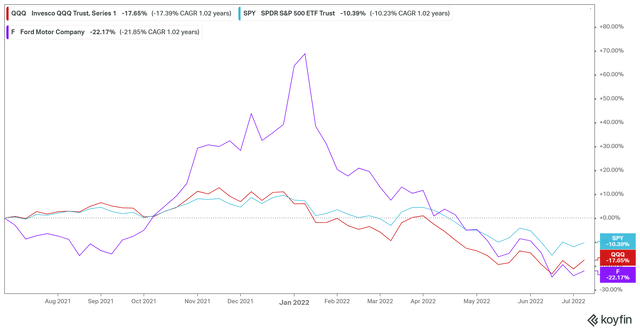

F stock 1Y performance % (Koyfin)

We highlighted in our previous article that it’s critical for investors to pay attention to price action. For instance, the market set up January’s bull trap (significant rejection of buying momentum) to draw investors rapidly into its topping price structure before digesting its massive gains from 2020-21.

As a result, even a “cheaply” valued F stock underperformed the market over the past year, as seen above. But, January’s bull trap also highlighted a key observation: price action is forward-looking. As a result, we believe the market has already been pricing the impact of a potential recession since its bull trap in early 2022.

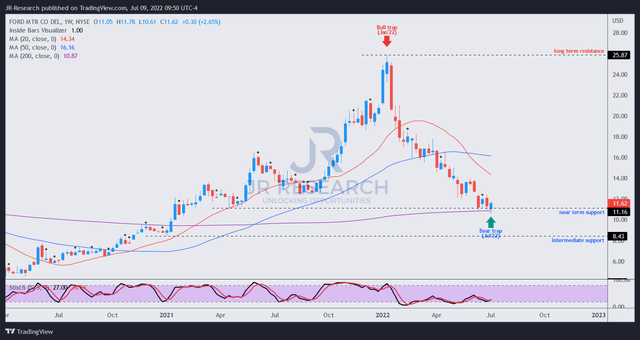

F stock price chart (TradingView)

Notwithstanding, we finally observed a validated bear trap that formed last week (July 8’s close). The bear trap is also corroborated by a bullish divergence in its stochastics, which is also oversold. Therefore, we believe a potent price structure has formed, giving investors a Buy signal to add exposure more confidently.

Notwithstanding, F remains in a bearish bias and has just entered a medium-term downtrend. However, bear trap price actions are usually early indicators of a possible trend reversal and thus do not need moving averages confluence. By the time the moving averages start to give validation signals of a trend reversal, F stock would have likely recovered significantly.

Ford Remains Confident In Delivering Its EV Transformation And Profitability

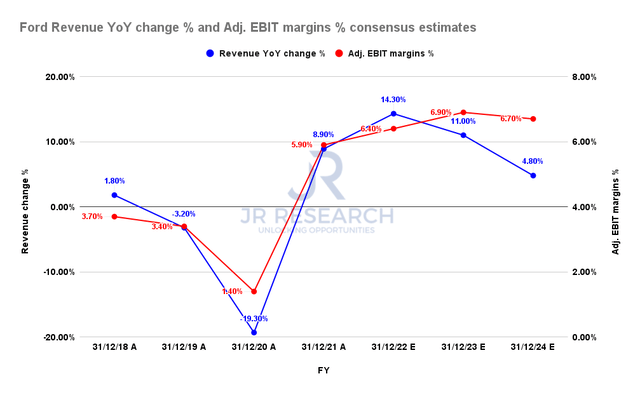

Ford revenue change % and adjusted EBIT margins % consensus estimates (S&P Cap IQ)

Notably, we observed that the consensus estimates (generally neutral) have modeled for a marked slowdown in its revenue growth, as seen above. As a result, Ford’s revenue growth is expected to slow through FY24, reaching 4.8%. Notwithstanding, its adjusted EBIT profitability is expected to remain robust, indicating that Ford could maintain its operating efficiencies.

Despite the macro uncertainties, management remains confident in delivering its EV transformation plans. CFO John Lawler articulated in a June conference (edited):

Consumer demand continues to be strong for us. We have over 300K orders across many of our vehicles. We are modeling a moderate recession. But, it’s a completely different environment heading into what could be a potential recession. And so we’ve modeled it through. We know what we need to do. But as an industry and as a company, we’re heading into this in a much different position than we’ve ever been in before. We’re very lean on inventories. We have an order bank that’s significant at over 300K units. We have the battery capacity in place to meet the 600K units by the end of 2023. We’re not all the way there for the 2M units, but we have time through 2026. (Deutsche Bank 2022 Global Automotive Conference)

Is F Stock A Buy, Sell, Or Hold?

We reiterate our Buy rating on F.

We have been waiting for a significant price structure to form, and we have finally gotten it through last week’s validated bear trap. It’s the most critical price action we have observed since January’s massive bull trap.

We also believe that the market has de-rated F stock since January, and the consensus estimates have also modeled a marked slowdown. Therefore, the bad news or sentiments appeared to have been priced in substantially.

Also, management remains committed to delivering its EV transformation plan with a strong order book and lean inventories to help sustain its near-term profitability.

Be the first to comment