chonticha wat

Only a few days ago, Western Copper and Gold (NYSE:WRN) released the long-awaited results of the feasibility study. The results confirmed the world-class nature of the Casino project. Unfortunately, as expected, it also presented increased costs. The estimated production costs increased. However, due to the high gold credits, the AISC per pound of copper should remain negative. A bigger problem is that the originally estimated CAPEX of $2.6 billion grew to nearly $2.9 billion.

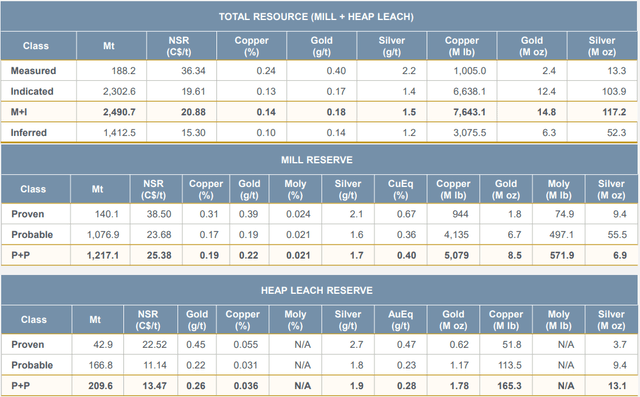

The reserves, as well as resources, remained almost unchanged. Right now, Casino contains reserves of 10.28 million toz gold, 5.24 billion lb copper, 571.9 million lb molybdenum, and 20 million toz silver. However, the measured, indicated, and inferred resources (including reserves) contain 21.1 million toz gold, 10.7 billion lb copper, and 169.5 million lb molybdenum. And the deposit is still open for expansion.

Source: Western Copper and Gold

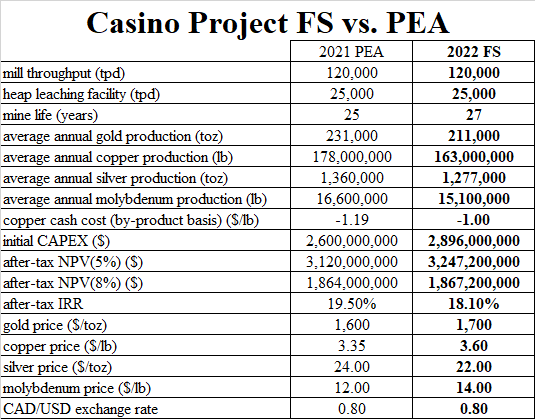

According to the feasibility study, the mine should consist of a mill with a throughput rate of 120,000 tpd, and a heap leaching facility with a throughput rate of 25,000 tpd. These parameters remained unchanged when compared to the PEA prepared a year ago. The projected mine life increased slightly, from 25 to 27 years. However, the expected average annual production volumes declined. The mine should be able to produce 211,000 toz gold (compared to 231,000 toz in the PEA), 163 million lb copper (vs. 178 million lb copper), 1.277 million toz silver (vs. 1.36 million toz silver), and 15.1 million lb molybdenum (vs. 16.6 million lb molybdenum). It equals 329 million lb of copper equivalent or 697,000 toz of gold equivalent per year (using the base-case metals prices).

Source: Own processing, using data of Western Copper and Gold

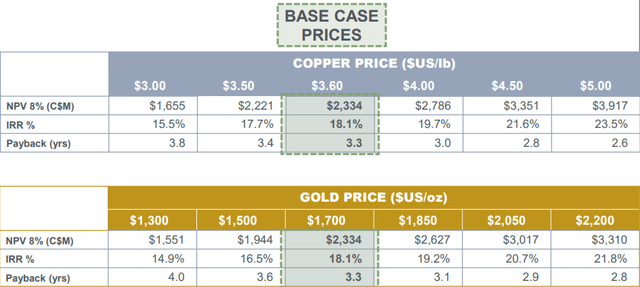

The copper cash costs on a by-product basis increased from -$1.19/lb to -$1/lb. The sustaining CAPEX is projected at $751 million, which means that the AISC should be around -$0.8/lb copper. It is worse than -$1/lb presented by the PEA, but still a great number. The initial CAPEX increased from $2.6 billion to nearly $2.9 billion. However, the negative impacts of the increased costs were compensated for by the positive impacts of increased base-case prices. The gold price increased from $1,600/toz to $1,700/toz, copper price from 43.35/lb to $3.6/lb, and molybdenum price from $12/lb to $14/lb. Only the base-case silver price declined from $24/toz to $22/toz, and the CAD/USD exchange rate remained unchanged at 0.8. As a result, the after-tax NPV increased slightly. At a 5% discount rate, the after-tax NPV equals $3.247 billion, and at an 8% discount rate, it equals $1.867 billion. The after-tax IRR equals 18.1%, which is slightly worse than the 19.5% projected by the PEA.

Source: Western Copper and Gold

However, as can be seen in the tables above, higher metal prices may boost the economics of the project further. At the 8% discount rate, a $0.1 growth in copper prices adds approximately $90 million, and a $100 growth in gold prices adds approximately $156 million to the after-tax NPV.

The feasibility study is an important milestone as it further de-risks the project. Right now, Western Copper and Gold has to wait for obtaining the permits. It will probably take several years. It means that there is enough time to further optimize the project and also to find a development partner, as the price tag to build the mine is simply too high for a junior explorer.

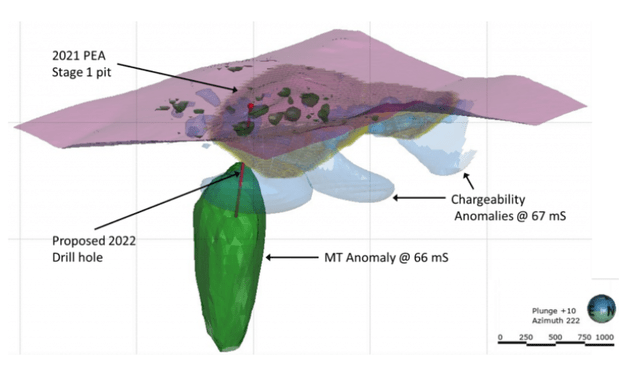

In terms of optimization of the project, Western Copper and Gold is trying to further expand the resources. The drill campaign that is underway should help in this process. Its main target is a large anomaly identified below the current resources. It is 1,300 meters long and 500 meters wide. Given the size, it has the potential to expand the current resources significantly.

Source: Western Copper and Gold

When talking about the potential partner, as I wrote in my previous article, there are several candidates. The main candidate is Rio Tinto, Western Copper and Gold’s biggest shareholder, with a 7.8% equity interest. However, some other heavyweights including Newmont (NEM), Agnico Eagle Mines (AEM), and Kinross Gold (KGC) are active in the Casino Project area.

Conclusion

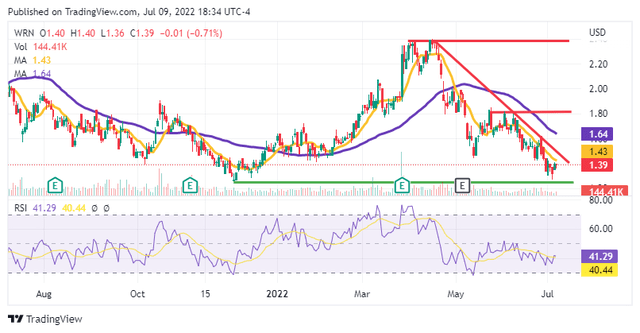

Since the April peak at $2.4, Western Copper and Gold’s share price declined by 42%. But it seems like the bottom could be in place. The share price encountered a long-term support line that has been holding for now. From a technical standpoint, it will be important to break through the 10-day moving average and subsequently also through the bearish trend line and the 50-day moving average. After this, the way to the next resistance in the $1.85 area should be clear. A return to the recent highs at $2.4 would be nice, but it would take the copper and gold prices to recover first.

Following the release of the feasibility study, Western Copper and Gold’s fundamentals strengthened. However, the current valuation of the company doesn’t reflect it. The market capitalization is only $201 million and the enterprise value is around $165 million. This is a very low value for a company holding an advanced-stage development project with an after-tax NPV(8%) of nearly $1.9 billion. Moreover, the reserves contain 27.56 million toz of gold equivalent at the current metals prices. It means that the market values 1 toz of gold equivalent contained in reserves only at $5.99. The resources contain even 44.7 million toz of gold equivalent, which means that the market attributes a value of only $3.69 to each toz of gold equivalent contained in resources. Although there is the risk that given the current market sentiment, the share price might continue even lower, Western and Copper Gold is highly attractively valued at the current price levels.

Be the first to comment