Marina113

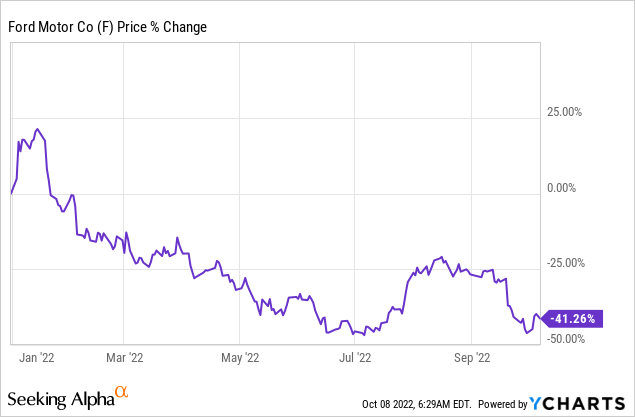

Ford (NYSE:F) just announced that it was once again raising its electric vehicle prices due to higher material costs and persistent supply shortages of critical car components. Ford already warned a few weeks ago that it is facing higher material costs, creating down-ward pressure on the firm’s shares. While Ford already said that some of its EBIT and revenues will be pushed into the fourth quarter due to supply shortages, higher electric vehicle prices may put consumers, who are already suffering from high inflation, further under pressure. I don’t expect that Ford will change its FY 2022 outlook for EBIT and free cash flow, but I believe Ford’s earnings picture will deteriorate drastically in FY 2023 and shares are not a buy before Q3’22 earnings!

Ford is raising EV prices again, potentially impacting demand situation

According to car magazine “Car and Driver”, Ford is raising prices for the new F-150 Lightning by $5,000 to account for higher material prices that are the result of Covid-19 related production shutdowns. Ford already warned of higher supplier costs in September which are expected to be $1.0B above plan. Due to these price effects, Ford has said it expects Q3’22 EBIT of between $1.4B and $1.7B, implying a 58% quarter over quarter drop-off in adjusted earnings before interest and taxes. However, the car brand confirmed its guidance for FY 2022 adjusted EBIT of $11.5-$12.5B.

I believe the increase in pricing could have a negative demand effect as consumers are increasingly conscious about inflation. With inflation already being a serious problem for a lot of consumers, a $5,000 price increase on a $46,974 electric vehicle is not just a small increase. Although the 10% price hike was likely necessary for Ford to pass higher costs on to customers, higher prices could also result in cooling demand for the company’s flagship electric vehicle pick-up truck which is just about to ramp up production. Ford clarified, however, that the price increase will only affect new reservations and not existing reservation holders.

Electric vehicle sales are surging

Ford saw a 197% increase in electric vehicle sales in September due to the launch of new EV models and accelerating product adoption. Ford sold 4,691 electric vehicles last month which included 2,324 Mustang Mach-Es, the company’s top-selling electric vehicle SUV. Ford also raised prices for the Mustang Mach-E sport utility vehicle in August, with prices going up $3,000 for the base model and up to $8,000 for the top-range GT with extended-driving range. Mustang Mach-E sales have ramped up nicely over last year as well, increasing 47.3% year over year in September. Ford said that it had a 7% electric vehicle share last month and I estimate that Ford could achieve a 10% electric vehicle share by the end of FY 2023 if the company’s supply situation improves.

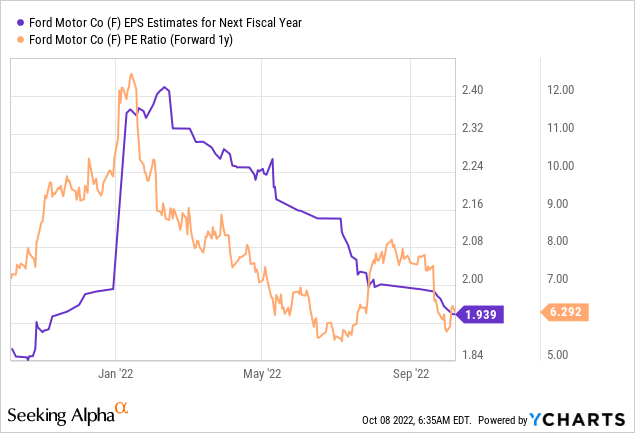

Ford’s earnings in FY 2023 set for a contraction

I expect Ford’s guidance for FY 2023 — which won’t be revealed until January — to be weaker than the guidance for FY 2022. To recap, Ford expects $11.5B to $12.5B in adjusted EBIT this year and between $5.5B to $6.5B in free cash flow, but results this year are boosted by the release and production ramp of new electric vehicle models like the F-150 Lightning and the Maverick which are seeing growing customer interest and strong dealer turnarounds. The Ford Maverick pick-up truck had just a 6-day dealer turnaround in September. Because higher prices may put off some buyers and supply chain problems are still an issue for Ford, I believe margins are set to come under pressure and earnings estimates for FY 2023 will continue to trend down. Based off of earnings for FY 2023 ($1.94), the firm’s shares are valued at a P-E ratio of 6.3 X.

Risks with Ford

The commercial risks with Ford are obvious: the company was just forced to raise prices due to higher supplier costs and a persistent supply shortage of critical parts that has its origin in COVID-19 factory lockdowns. Supply shortages may translate to longer wait times for customers while higher product pricing may slow Ford’s reservation growth going forward. Ford’s announcement of the F-150 Lightning price increase also implied that the supply chain situation has not improved and that it is not expected to improve any time soon. For Ford, this could create problems in 2023.

Final thoughts

There is a lot of uncertainty now with Ford and investors may not want to buy the stock until the company has explained how higher product pricing is affecting its demand situation.

The unexpected price hike for the F-150 Lightning pick-up truck is also an admission that supply chain problems are here to stay for the foreseeable future. With wait times also likely to increase due to an ill-calibrated supply chain, I see growing risks for Ford’s FY 2023 guidance which I believe will under-perform FY 2022 guidance. Since Ford is valued cheaply based off of earnings, I believe it is worth keeping the firm’s shares, but the risk profile is more skewed to the down-side than at the beginning of the year!

Be the first to comment