tum3123

Action and flexibility create opportunity. – Garrison Wynn

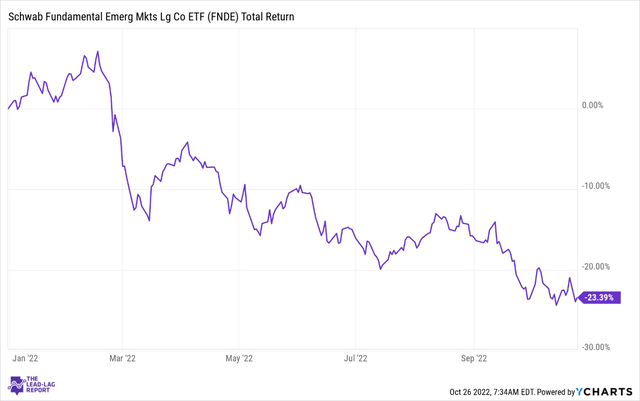

The Schwab Fundamental Emerging Markets Large Company Index ETF (NYSEARCA:FNDE) is a portfolio of large EM stocks that are chosen and weighted on the basis of certain fundamental screeners ranging from adjusted sales, retained operating cash flow, and shareholder distributions. Like most equity products, 2022 has been a disappointing year for FNDE, with the product losing 23% of its value on a YTD basis.

Conditions moving in favor of EMs

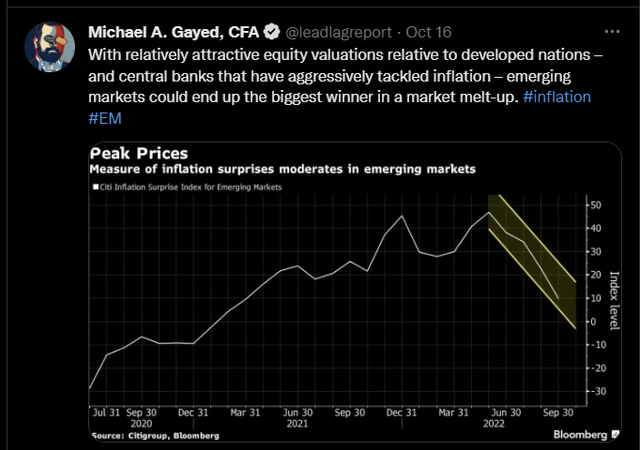

Nonetheless, the other day, I put out a tweet on the timeline of The Lead-Lag Report highlighting how emerging markets could be one of the principal flagbearers of a potential melt-up rally. With lumber showing great strength in recent weeks, coupled with ongoing weakness in utilities, it appears that conditions for high-beta plays such as emerging markets look very appealing.

If I may highlight the attractive valuation differentials in play, do note that FNDE currently only trades at a forward P/E of 6.5x! That multiple is almost 50% cheaper than a portfolio of global stocks, as represented by Vanguard Total World Stock ETF (VT), and 38% cheaper than a portfolio of developed market stocks, as represented by the Vanguard FTSE Developed Markets ETF (VEA).

Interestingly enough, the large companies of FNDE can also be availed at a 35% discount to a diversified basket of emerging market stocks, as represented by the popular- iShares MSCI Emerging Markets ETF (EEM).

I’ve also spoken about the potential of another scenario further down the line where we see another bout of risk aversion pick up, where treasuries finally decide to drape themselves in that safe-haven hood they’d forgotten about for much of this year. If that scenario were to play out, and you still want exposure to EMs, I believe it makes more sense to own a “large” company-driven EM portfolio such as FNDE, where the respective business models of these stocks are a lot more well-rounded and diversified. The innate strength of the business models is also reiterated by the superior and sustainable cash-generating potential, which in turn also enables them to be more generous with their shareholder distributions.

Fundamentally, I think it’s fair to say that a lot of these EMs have done a better job of managing inflationary pressures by raising nominal policy rates well ahead of the curve. With developed markets, inflation management has been a lot less convincing as a lot of these nations have been unable to cope with energy-driven pressures that could leave a lasting effect for the foreseeable future. Besides, it does not appear that we are anywhere close to hitting a ceiling with regard to tighter financial conditions in the DM landscape which could put further pressure on the economic output there.

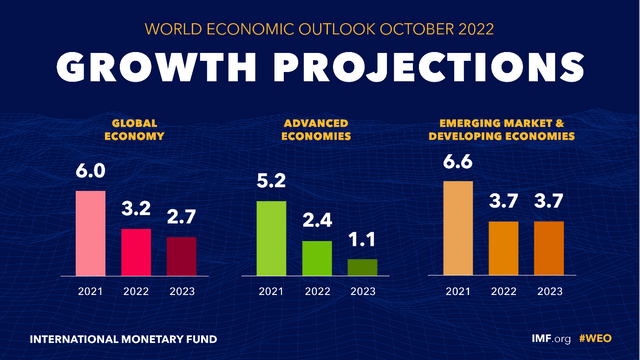

A few days back the IMF came out with its latest economic outlook for different parts of the globe in 2023; It was quite telling to note that whilst GDP for advanced economies is poised to slow by 130bps, the GDP growth for EMs is likely to come in at stable levels of 3.7% yet again. I understand that championing a flattish growth trajectory YoY is something of a low bar, but in an increasingly unstable and uncertain macroeconomic environment, this stability ought to be commended.

Then, the dollar’s strength for much of 2022 has also proven to be a massive bugbear for a lot of these EMs, but as I’ve noted in the ‘Leaders-Laggers’ section of my paid subscription research, the dollar has been displaying signs of fatigue for a while now and could be poised to reverse. It has essentially been moving sideways for much of the last month, and there’s a lot of chatter now, over whether yet another aggressive 75bps hike would be warranted in the December meeting.

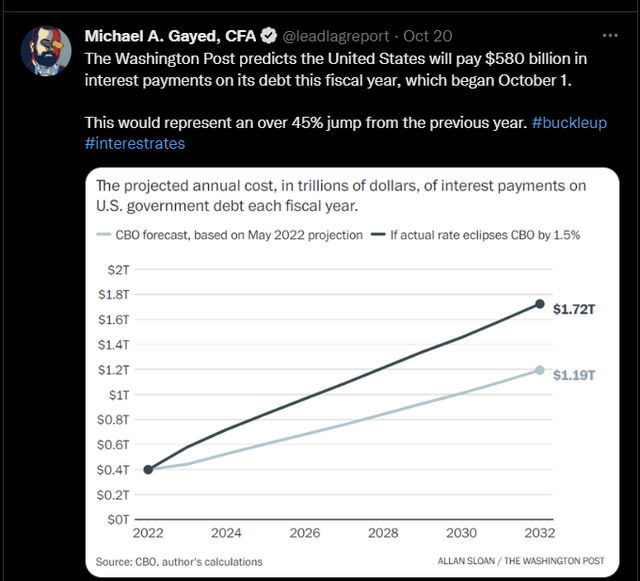

Whilst everyone appears to be caught up in this discussion over how much rates need to go up by to negate inflation, the consequences of what this does to a higher financing bill for the US government appear to have taken a backseat. As flagged in The Lead-Lag Report, the US government’s interest payments on debt are already up by a whopping 45% on a YoY basis, and this has got to send alarm bells ringing.

All in all, as the ferocity of rate hikes dims, we could see the dollar’s relentless strength become a thing of the past. This would do a world of good for a lot of these EM currencies, particularly something like the Yuan where recent reports show that state-owned banks have been eagerly selling the greenback (on behalf of the People’s Bank of China) in the onshore and offshore markets to prop up the local currency.

Risks

The biggest risk to FNDE’s prospects could be its strong exposure to Chinese stocks. It looks like the zero-COVID policy is here to say, and the real estate crisis could afflict other cogs of the economy such as banks; according to the IMF, 45% of the Chinese real estate developers would be unable to meet their loan obligations if their properties were marked to current property prices.

More crucially, recent developments from the Congress meeting there raise concerns over the growing autocratic profile of Xi Jinping. The rebranded leadership team is unlikely to question the status quo and we could see the dominance of a more nationalistic regime with little patience for market-friendly policies.

Anticipate Crashes, Corrections, and Bear Markets

Anticipate Crashes, Corrections, and Bear Markets

Sometimes, you might not realize your biggest portfolio risks until it’s too late.

That’s why it’s important to pay attention to the right market data, analysis, and insights on a daily basis. Being a passive investor puts you at unnecessary risk. When you stay informed on key signals and indicators, you’ll take control of your financial future.

My award-winning market research gives you everything you need to know each day, so you can be ready to act when it matters most.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

Be the first to comment