Tom Merton/OJO Images via Getty Images

Investment Thesis

FMC Corporation (NYSE: FMC) will see growth as improved crop yields are needed to support rising food consumption, especially from emerging markets led by India and sub-Saharan Africa. Limited options to expand arable land in most regions means higher crop yields are needed. FMC can provide an excellent return from covered call premiums and dividends even if the stock does not move much.

FMC Corporation

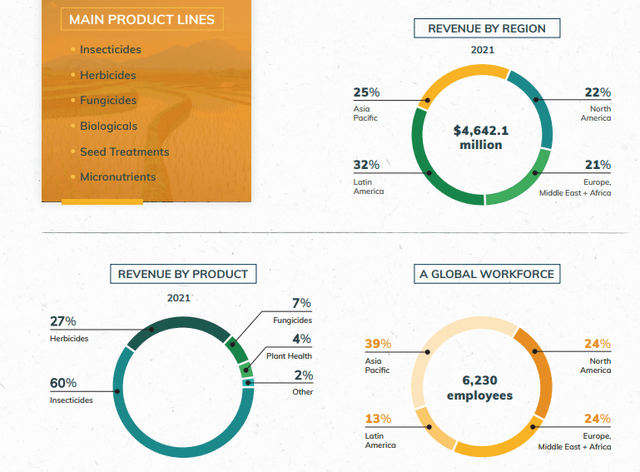

FMC is a chemical company that provides solutions to growers with a product portfolio, including crop protection, crop enhancement, and professional pest and turf management. Its insecticides control pests, while its herbicide portfolio is used to control weeds. The company has diversified its sales to create a balanced crop chemical portfolio across geographies and crop exposure. Through acquisitions, FMC is now one of the five largest patented crop chemical companies. It will continue developing new products, focusing on biologicals, through its research and development pipeline.

Farmers will pay for more crop protection applications when crop prices rise. When crop prices fall, farmers look to cut expenses, including crop protection products, but FMC’s strong pipeline of new premium products helps farmers deal with difficult pests. In a low crop price environment, farmers tend to continue paying for premium crop protection products as they prevent crop yield losses from pests, even if farmers cut back on more generic crop protection applications.

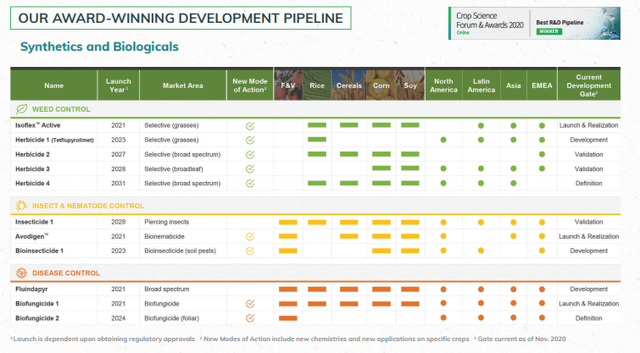

The company plans to launch ten new molecules over the next decade that feature new modes of action. FMC will launch new biological or environmentally friendly pesticides and increase its exposure to these products by acquiring BioPhero. Biologicals should help farmers fight resistant pests, which increasingly render older crop chemicals ineffective.

www.fmc.com/sites/default/files/2022-07/FMC%202022%20Corporate%20Fact%20Sheet.pdf

www.fmc.com/sites/default/files/2022-07/FMC%202022%20Corporate%20Fact%20Sheet.pdf

Please go here if you want to view a two-minute video about FMC.

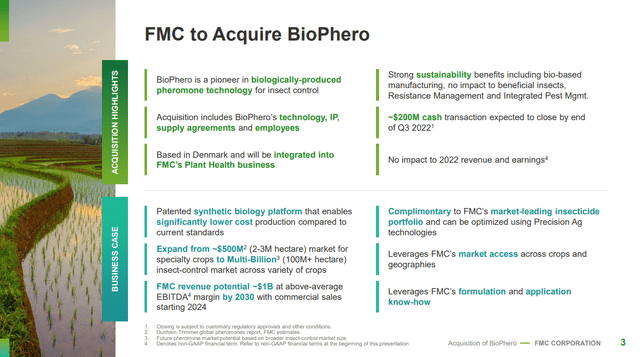

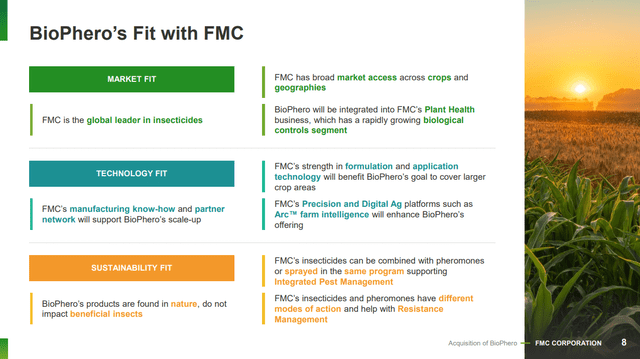

FMC Acquisition of BioPhero

Below are slides I selected from their June 30, 2022, presentation on the corporate website. They are acquiring BioPhero, a Denmark-based company with $200M in cash. BioPhero has a patented synthetic biology platform that enables significantly lower-cost production than current standards. FMC’s revenue potential from the acquisition is about $1B at an above-average EBITDA margin by 2030, with commercial sales starting in 2024.

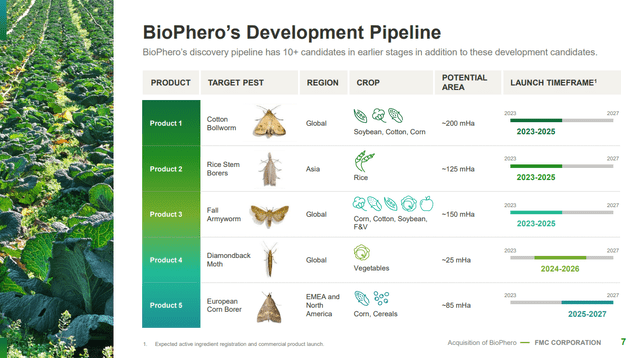

BioPhero has significant new products in its pipeline.

The combined companies will enjoy multiple synergies toward increased profitability.

FMC has annual sales of $5.6B with 6.4K employees. They are 91.9% owned by institutions, with only 1.5% short interest. Their return on equity is 20.3%, and they have an 11.7% return on invested capital. The free cash flow yield per share is 2.5%, and their buyback yield per share is 0.6%. The price-to-book ratio is 5.1. Their Piotroski F-score is six, indicating some strength.

Q3 Earnings and Full-Year Outlook

Some may think their quarterly press release showed good results since they beat analyst estimates. That’s good, but I’m not highly impressed. Q3 Revenue of $1.38 billion increased by 15 percent versus Q3 2021 and was up 19 percent organically. However, adjusted earnings per diluted share of $1.23 were down 14 percent versus Q3 2021.

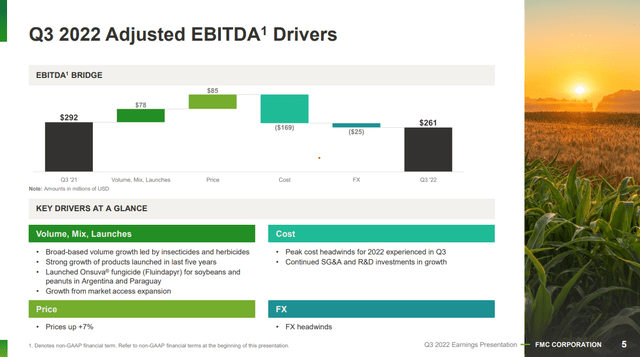

Q3 EBITDA vs. last year was helped by increased volumes, product mix, and product launches, plus price increases. But cost increases and FX headwinds more than offset the gains.

During the quarter, adjusted EBITDA fell 11% as cost inflation outpaced price increases. However, the company should be able to continue raising prices, allowing the company to expand margins as cost inflation subsides, eventually leading to stable profit growth.

Below is their full-year outlook from the November 1st press release.

Full-Year Outlook

- Raises revenue outlook to a range of $5.6 to $5.8 billion, reflecting 13 percent growth at the midpoint versus 2021;

- Narrows adjusted EBITDA outlook to a range of $1.37 to $1.43 billion, reflecting 7 percent growth at the midpoint versus 2021;

- Narrows adjusted earnings per diluted share outlook to a range of $7.10 to $7.60, reflecting 7 percent growth at the midpoint versus 2021, excluding any impact from potential 2022 share repurchases;

- Reduces free cash flow outlook to a range of $440 to $560 million, reflecting the increased revenue outlook and inflationary impacts on working capital;

- Expects up to $200 million in share repurchases, including $100 million completed in October;

The revised full-year outlook is not much different than the previous guidance. Revenue guidance was $5.5B to $5.7B. Adjusted EBITDA outlook was $1.36B to $1.44B. The adjusted EPS outlook was $7.00 to $7.70.

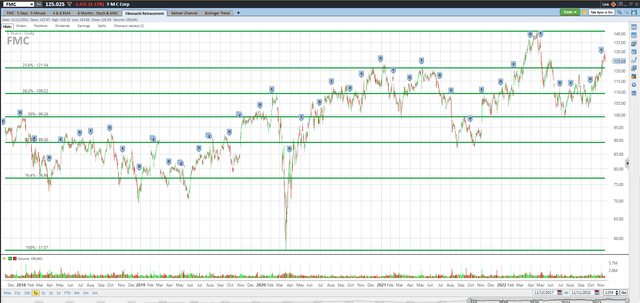

Technical Entry Point

The share price of FMC is trading at $125.00 on November 11th. I’ve added the green Fibonacci lines, using FMC’s high and low for the past five years. It’s interesting to note how the market pauses or bounces off these Fibonacci lines. They can be one clue as to where the stock price may be headed. FMC is above the 23.6% Fibonacci retracement level but could go lower. However, I believe that FMC will trade at or above $130.00 by June for the reasons in this article.

The six most accurate analysts have an average one-year price target of $134.83, indicating a 7% potential upside from the November 11th trading price of $125.00 if they are correct. Their ratings are mixed with five buys and one sell. Analysts are just one of my indicators, and they are not perfect, but they are usually in the ballpark with estimates. They often seem a bit optimistic, so I suspect prices may end up lower than their one-year targets to be on the safe side.

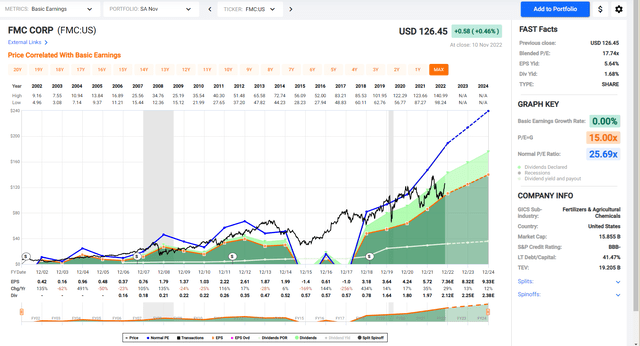

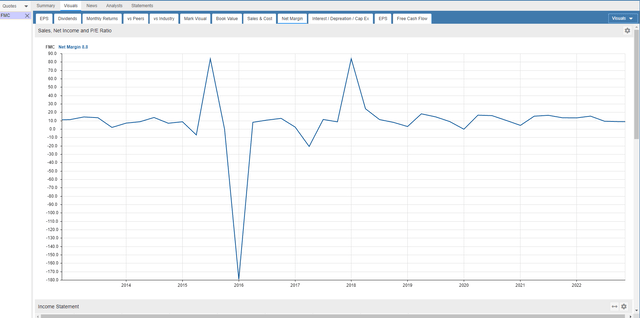

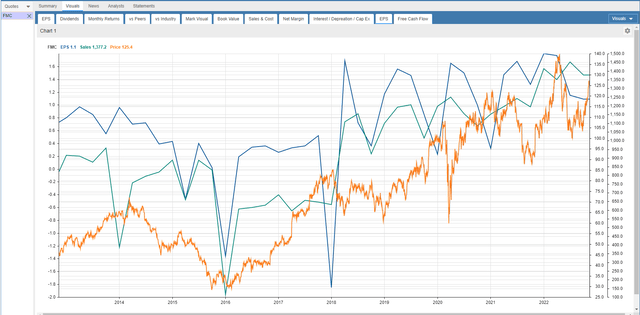

Trend in Earnings Per Share, P/E Ratio, and Net Margin

The black line shows FMC’s stock price for the past twenty years. Look at the chart of numbers below the graph to see FMC’s consistent growth. Earnings were $3.64 in 2019, $4.24 in 2020, and $5.72 in 2021, and they are projected to earn $7.36 in 2022 and $8.32 in 2023.

The P/E ratio for FMC is currently at 17, but the average ratio over the past ten years is 24. I don’t think the P/E will rally back to 24 anytime soon. If FMC earns $8.32 in 2023, the stock could trade at $133.12 if the market only assigns a 16 P/E ratio.

FMC has seen relatively steady net margins near 10% for the past ten years.

Sales, earnings per share, and the stock price have been appreciating since 2016.

Sell Covered Calls

My answer to uncertainty is to sell covered calls on FMC five months out. FMC traded at $125.00 on November 11th, and April’s $130.00 covered calls are at or near $8.10. One covered call requires 100 shares of stock to be purchased. Selling an April covered call will allow the investor to collect dividends in December and March at $0.53 each. The stock will be called away if it trades above $130.00 on April 21st. It may even be called away sooner if the price exceeds $130.00, but that’s fine since capital is returned sooner.

The investor can earn $810 from call premium, $106 from dividends, and $500 from stock price appreciation. This totals $1,416 in estimated profit on a $12,500 investment, which is a 25.6% annualized return since the period is 161 days.

If the stock is below $125.00 on April 21st, investors will still make a profit on this trade down to the net stock price of $115.84. Selling covered calls and collecting dividends reduces your risk.

Takeaway

I expect FMC Corporation’s stock to appreciate as demand for their new and existing products remains strong. Inflation pressures are expected to ease in 2023, and FMC can continue to raise its prices if needed. Even if FMC’s stock price only moves from $125.00 to $130.00 by April 21st, a 25.6% potential annualized return is possible, including covered call premiums and dividends.

Be the first to comment