Blacqbook

[Please note that all currency references are to U.S. dollars except if indicated otherwise.]

Tricon Residential Inc. (NYSE:TCN) owns and manages residential rental properties located in the U.S. and Canada. The company was listed on the Toronto exchange in 2010 and New York in 2021 with TCN being the ticker on both exchanges. The headquarters is in Toronto, Canada.

Tricon has a decades-long track record as a real estate investor and more recently as a landlord focused on single-family rental homes. The company’s home-buying program ramped up significantly since 2019 spending more than $4 billion in the process. Rising interest rates, a cooling of demand, lower rent growth, and declining home values will combine to depress profits and asset values for the foreseeable future. The discounted valuation reflects the challenging outlook for the company.

Apologies for the complexity, but here are some of the key terms that we use in the report to describe the key performance indicators of the company:

Net Operating Income (“NOI”): Revenue from rental properties, less direct operating expenses and property management expenses.

Funds from Operations (“FFO”): Net income excluding fair value adjustments and amortization of intangibles.

Core Funds from Operations (“Core FFO”): FFO adjusted for transaction costs, and non-recurring and non-cash items.

Adjusted Funds from Operations: (“Adjusted FFO”): Core FFO minus recurring capital expenditures.

Single-family rental homes in the U.S. Sun Belt

Tricon owns and operates a portfolio of about 35,000 single-family rental homes in the United States. This makes up 97% of the $10.8 billion portfolio assets and currently contributes 70% of the Core FFO.

There is also a multi-family rental business in Canada with a portfolio of 500 apartments, and residential development portfolios in Canada and the U.S. In addition the company provides management services to external clients which contributes about 20% to the Core FFO.

Of the total portfolio, 98% of the assets are located in the U.S. with a concentration of properties in Florida, Georgia, North Carolina, Texas, Arizona, and California.

The main source of revenue is the income from rental contracts, earned directly from the leasing of homes, as well as an assortment of fees including application fees, pet fees, and early termination fees. Tricon also earns fees from developing and managing residential asset portfolios on behalf of third parties such as pension funds. These fees include asset and property management fees, performance fees, and development fees.

Major growth spurt during the peak Covid years

Tricon evolved over the past decade from an investor in residential developments to an owner and operator of multi-family and single-family rental units. From 2019 onwards the company’s focus narrowed to single-family residential ownership and rental.

Tricon has doubled its portfolio of single-family homes since 2018. This was done using its own capital and cash flows, loans, asset sales, and capital contributed by external partners in joint venture arrangements.

After a lull in 2020, the company redoubled its efforts to acquire single-family homes by adding more than 13,000 homes in 2021-22 at a cost of over $4.0 billion. This substantially expanded the balance sheet.

This rapid expansion was somewhat fortuitous as it coincided with a time when Covid-related demand for single-family residential accommodation picked up considerably. In the 2021 annual report, company President Gary Berman reported that: “…in any given week, Tricon has only 200 to 300 homes available for rent but receives up to 10,000 leasing inquiries”.

Market conditions were also ideal for Tricon to raise capital to fund the rapid expansion. Low-interest rates and a high level of institutional interest to participate in a stable, cash-flow-generating venture provided fertile ground for Tricon to tap ready investors. Berman also commented on this matter saying that “Tricon raised more private capital in 2021 than in its previous 32 years of operations combined.”

Joint ventures for the acquisition of around 28,000 new or existing homes with an equity commitment of $3.0 billion were agreed upon with investors over the past few years. There was also a $1.1 billion commitment from a major institutional investor for the development of multi-family units in Toronto. Tricon typically contributes between 20-30% of the required equity capital.

Tricon tapped the capital markets in 2021 by raising $570 million of equity capital during the New York listing as well as $167 million from a private placement. More capital was raised from a $300 million investment by Blackstone (exchangeable preferred shares) and the sale of the U.S. multi-family portfolio to two institutional investors in 2021 for $432 million (and more recently the remaining 20% for gross proceeds of $315 million).

All these capital-raising actions helped the company to embark on the rapid expansion of the single-family residential portfolio while keeping its debt levels manageable.

Growth ambitions scaled back

In early 2022, Tricon set a 3-year target to grow the single-family home portfolio to 50,000 homes by the end of 2024. To meet this objective, the company would have to acquire on average 7,000-8,000 homes in each of the three years until 2024.

However, in its recent quarterly results announcement the company signaled a slowdown in single-family home acquisitions. Higher home prices combined with rising financing cost is making it less attractive to acquire homes, despite the sharp increase in house rents. The initial target of 8,000 homes in 2022 is now unlikely to be met and we would submit that the 2024 target is also questionable under current market conditions. Meanwhile, the company is paying down debt and repurchasing its own shares (see below).

The company also has a 3-year target to grow the FFO per share by 15% per year between 2021 and 2024 when it aims to earn $0.83-$0.86 per share. Should the tough macro-environment of high-interest rates continue for much longer, and rents decline to more normal levels, Tricon may struggle to meet the FFO target.

The co-founders are still involved with the business

The executive chair of the Board is David Berman. He co-founded the company in 1988 with Geoff Matus who is also a member of the board. The President and CEO is the aforementioned Gary Berman, age 48; he has been with the company for the past 20 years.

Frank Cohen, the CEO of the Blackstone REIT, also serves on the board, presumably to look after the interests of Blackstone’s investment in the company.

The two co-founders together with the CEO hold about 2.5% of the common shares of the company. The major shareholders are all institutions including Wellington Asset Management, Vanguard, CI Global Asset Management, T Rowe Price, Blackstone, and BMO.

Key aspects of executive compensation are a base salary, a short-term profit participation plan, and a long-term incentive plan. The President and CEO received a total compensation of $8.5 million in 2021, of which 90% was considered to be variable and linked to the performance of the business.

Rising interest rates

The company had shareholders’ equity of $3.8 billion at the end of September 2022, while total pro rata debt amounted to $2.84 billion. The consolidated balance sheet shows net debt of $5.3 billion which includes the debt held in joint ventures and other entities where Tricon has control but holds only minority economic interests.

Only considering the proportionate debt – the debt-to-asset ratio was 36.7% and the net debt-to-EBITDA ratio was 8.3 times at the end of September. Although the debt level is still considerable, it is considerably lower than at the start of 2020 when the debt-to-asset ratio was over 50% and the net debt/EBITDA ratio 15.3 times. The improvement was helped along by the sale of the U.S. multi-family portfolio, the issue of equity at the time of the U.S. listing, and the redemption of convertible debentures.

At the end of September, 69% of the proportional debt was fixed rate while the balance was floating rate debt. The weighted average interest rate was 3.4%. Fixed-rate debt that matures in 2022 and 2023 is negligible, with larger maturities from 2024 onwards.

Based on the company’s estimates, a 1% increase in the effective interest rate will increase the interest burden by 5%. We note that a recent 6-year financing secured by residential properties, attracted a fixed rate coupon rate of 5.47%, well above the current weighted average interest rate.

The unexciting dividends

Tricon pays a regular U.S. dollar-denominated quarterly dividend. The 10-year dividend record is stable but with only small increases every few years. The current annualized dividend is $0.23 per share which is covered about twice by the Adjusted FFO.

The company has received approval to repurchase 2.5 million of its common shares over the next 12 months. This amounts to less than 1% of the issued shares.

Recent results: Sound but momentum slowing and interest cost is biting

In the most recent quarter to the end of September 2022, profits increased but a large increase in the share count reduced the positive impact of the growth. Core FFO per share amounted to S0.15, which was 7.1% better than the same quarter in the previous year while Adjusted FFO per share was down by 8.3%. For the first nine months of the year, the Core FFO increased by 7.1% and the Adjusted FFO by 6.1%.

Net Operating Income from single-family rentals grew by 26% in the quarter as the number of homes under management increased as well as average rents. Same-home NOI increased by 10.2%. Operating costs were up by 14.9%, driven by higher property taxes, and property management expenses. The same home NOI margin came in at 68.5% – a quarterly record.

Same-home occupancy remained high at 97.9% while same-home average monthly rent increased by 8.4% from the previous year; new move-in rent was up by a whopping 16.3%. Management commented that while demand remained solid, a higher supply of rental homes and lower demand is putting downward pressure on rent growth.

Fees received for the management of external client properties increased by 13% as the number of homes managed on behalf of external parties through joint venture arrangements increased.

At the consolidated level, new home acquisitions totaled 1,988 during the quarter for a total cost of $700 million bringing the acquisition cost so far this year to $2.3 billion. The company commented that the pace of acquisitions will slow given the significant increase in financing cost. The target of 8,000 acquired homes in 2023 and 2024 now looks unlikely.

The proportional interest expense amounted to $23.6 million in the quarter, which was 19% higher than in the same period in 2021. The weighted average interest rate increased from 2.86% to 3.20%.

The fair value gain on the property portfolio slowed significantly in the third quarter. Management commented that “…higher mortgage rates and rising economic uncertainty in the third quarter of 2022 have led to a deceleration in home prices and in some cases, a decline in certain markets”. Management also expects that home prices will further “moderate” in the near future. Fair value changes do not have an impact on cash flows but on the net asset value of the property portfolio and consequently the net asset value ascribed to each share.

The financial targets for the current year have been moved up at the time of the quarterly results but we consider the increases of poor quality. The company indicates that same home NOI should increase by 10%-11% in 2022 based on revenue growth of 8%-9% with expenses growing at a slightly lower clip. However, the Core FFO in the final quarter of the year will include a large performance fee that was realized on the sale of the U.S. multi-family portfolio while operating costs were reduced courtesy of the capitalization of some repair and maintenance expenses.

The valuation reflects the challenging prospects

The company estimates that a rise in the cost of debt to 5.5% will have to be accompanied by an 8% rise in the same home net operating income to achieve the $0.855 per share FFO target for 2024.

However, given a slowing economy, the possibility of lower wage growth, and higher unemployment, it would probably be prudent to assume that there will be no growth or even declines in same-home NOI in 2023 and 2024 while interest costs will rise substantially. We, therefore, consider the company’s medium-term targets as optimistic.

Declining home values will not influence the cash-based FFO but it will depress the net asset value.

Consensus FFO estimates indicate FFO growth of 10.1% per year between 2021-23. That is well below the 15% targeted by the company but may still turn out to be optimistic. However, we will use the consensus estimates for a comparative valuation.

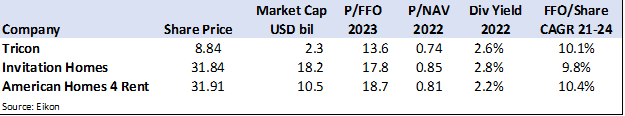

Given Tricon’s current price and consensus estimates of FFO, the shares are valued at a 2023 Price/FFO ratio of 13.6 times and a dividend yield of 2.6%. Compared to the peer group indicated in the table, Tricon trades at a discount to the main publicly listed comparables, American Homes 4 Rent, and Invitation Homes.

Eikon

At the end of September 2022, we estimate a fully diluted net asset value of $12.00 per Tricon share. Fair value gains recorded in 2021-2022 boosted the asset values but with U.S. and Canadian home prices declining, the asset values in the portfolio will also drop. The current Price/NAV ratio is 0.70 which seems low even assuming a 20% decline in the NAV over the next two years. Historically the share price traded at a small premium to the NAV.

Buckling up for a tough ride

Tricon was a major beneficiary of the macro trends that occurred during the peak Covid years of 2020 and 2021. Not only did the demand for their single-family homes increase dramatically, but investors were also eager to provide capital to gain access to a stable and cash-generating asset class. But times have changed and the next two years may prove difficult for Tricon and its peers as high-interest rates make acquisitions less attractive, while cooling demand for their product will put downward pressure on rents.

By Deon Vernooy, CFA, for TSI Wealth Network

Be the first to comment