JackF/iStock via Getty Images

Intro

Healthcare Services Group, Inc. (NASDAQ:HCSG) came across our desk from a screen we ran where the objective was to find dividend-paying companies which had attractive valuations, strong balance sheets and most of all were profitable. Shares of HCSG have been struggling for well over 2 years now, but fortunately the company has had the wherewithal to remain profitable. A big reason for this is the company’s very low-interest expense on the income statement, which basically has ensured that a high percentage of the company´s operating profit can drop to the bottom line.

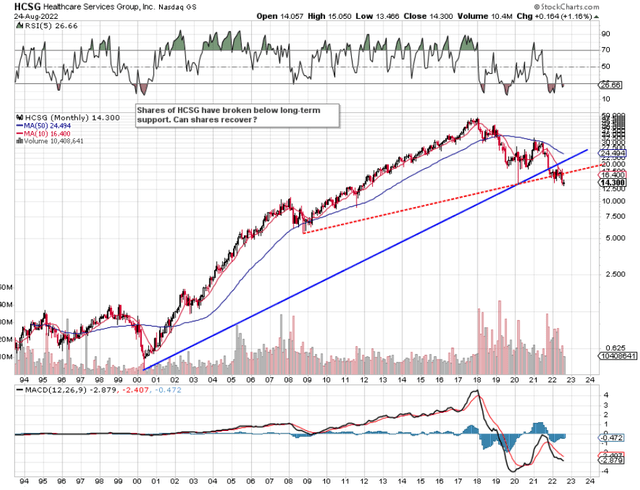

However, when we delve more into the company’s numbers and technicals, it becomes evident that caution is required here at least over the near term, As we can see below from the stock’s long-term technical chart (where we have depicted two distinct multi-year trendlines), both support levels in recent months have been breached to the downside. The problem here is that if these support levels are not recovered soon, they will convert into very strong overhead resistance which is obviously something the bulls do not want to see. Remember, the chart has fully digested the company´s ongoing modification of service agreements and how these modifications will affect the company’s financials going forward.

What was encouraging, though, was that the recent second quarter top and bottom-line miss did not spike the short interest ratio (10.8%) to any significant degree. Management reported Q2 GAAP earnings of $0.09 per share and sales of $424.8 million both of which missed consensus estimates. This transpired in a quarterly net profit number of $6.8 million, which means HCSG has made just under $30 million in net earnings over the past four quarters. Suffice it to say, the dividend payout ratio ($62.7 million paid out in dividends over the past four quarters) presently comes in at 211% which is obviously not sustainable. Reporting almost a 6% dividend yield where the annual payout has now grown for 17 years straight is all well and good but only if it can be sustained by earnings and cash flow in the long run.

HCSG Losing Long-Term Support (Stockcharts.com)

Suffice it to say, when we have setups such as we have in HCSG at present, it is all about sizing up the company´s valuation and profitability (Quality) against the adverse trends concerning the dividend. Choosing successful investments is all about trying to skew the risk/reward profile in our favor as much as possible.

Earnings Yield

Notwithstanding the company’s almost 6% dividend yield, when we divide trailing earnings of $29.7 million into the HCSG´s present market cap ($1.059 billion), we get a trailing earnings yield of 2.8%. In the present environment, a 2.8% return is simply not good enough especially when you take into account the prevailing inflation rate as well as the fact that a risk-free investment such as the US 10-year bond is now yielding well over 3%.

However, when we look at bottom-line expectations in 2023 ($0.75 per share), this would constitute a 5.24% forward earnings yield for fiscal 2023. Obviously, the higher expected earnings would also have ramifications for the dividend but the recent dialing down of earnings revisions means that the $0.75 per share bottom-line figure for next year remains far from being achieved at this juncture.

Profitability

HCSG´s gross margin comes in at 11.44% over a trailing twelve-month average. The recent second quarter numbers of $424.9 million in top-line sales and gross profit of $45.5 million resulted in a gross margin of 10.71% which actually trailed the 12-month average. Suffice it to say, the return to top-line growth in HCSG really only has merit if that extra turnover can meaningfully impact the income statement.

This is crucial because the gross margin in the sector at large averages almost 30%. Keeping margins elevated is crucial for HCSG over the near term for the following reason. At present, over a trailing twelve-money average, Healthcare Services Group´s net income margin comes in at 1.77%, whereas Q2´s net income margin once more was lower than the average at 1.6%. Evidently, this bottom-line margin is too low because if sales for example do not increase as expected and we see a further increase in inflation on the costs side, bottom-line profitability will become hard to report for HCSG. There simply just is not enough buffer there because the company is working off a low gross margin base so it will be interesting to see how the income statement fares out in upcoming quarters.

Conclusion

On the surface, Healthcare Services Group’s sales (P/S of 0.63) and dividend yield may look very attractive, but the company’s technicals, low earnings, and margins demonstrate that the company has a hard fight ahead of it. The prudent play is to liquidate holdings to see if shares can regain solid footing above long-term support. We look forward to continued coverage.

Be the first to comment