Scott Olson

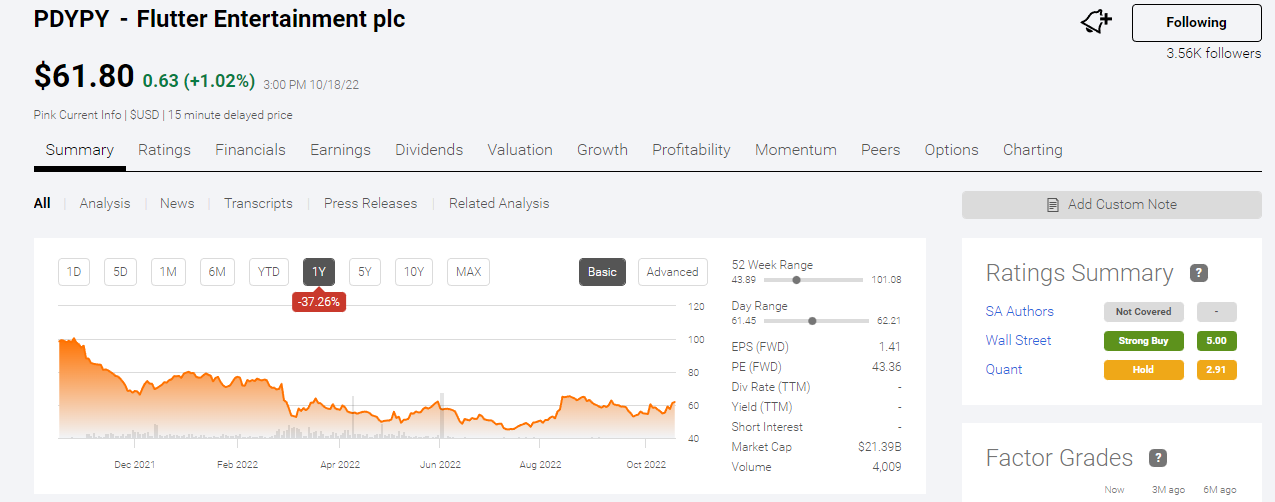

I endorse Flutter Entertainment plc (OTCPK:PDYPY) as a buy. This contradicts the hold rating that Seeking Alpha’s Quant rating platform has for PDYPY. I think the 1-year price return of -37.26% justifies going long this stock. PDYPY is a good bounce-back investment. It currently trades below $63, way below the 52-week high of $101.08.

Seeking Alpha

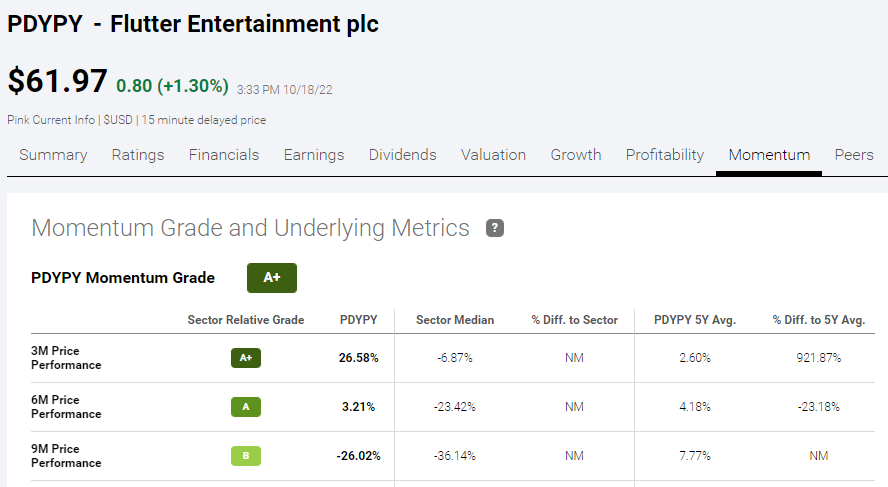

JPMorgan Chase & Co. (JPM) recently said Flutter Entertainment’s stock could rise by 30.71% from its current price. This endorsement could add additional fuel to the stock’s +26.58% 3-month price performance. Seeking Alpha gives PDYPY a momentum grade of A+. If you like trading momentum bounce-back stocks, then consider investing in Flutter.

Seeking Alpha Premium

The momentum endorsement from Seeking Alpha’s quantitative rating is congruent with PDYPY’s RSI indicator. In spite of its recent rally, PDYPY’s RSI is only 60.98, so I don’t think this stock is in oversold territory yet.

StockTA.com

I’d advise going long Flutter Entertainment’s stock before JPMorgan’s buy recommendation pushes the stock’s RSI score to over 70.

Why The Stock Is Rebounding

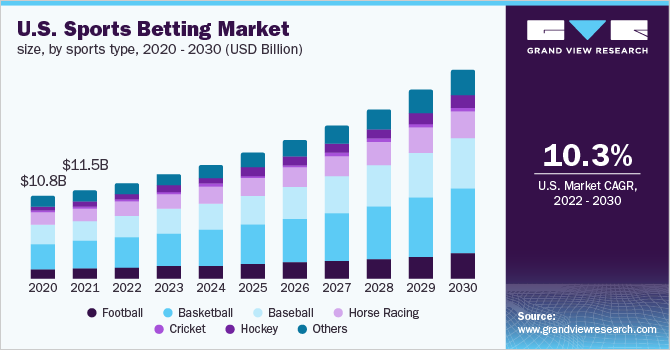

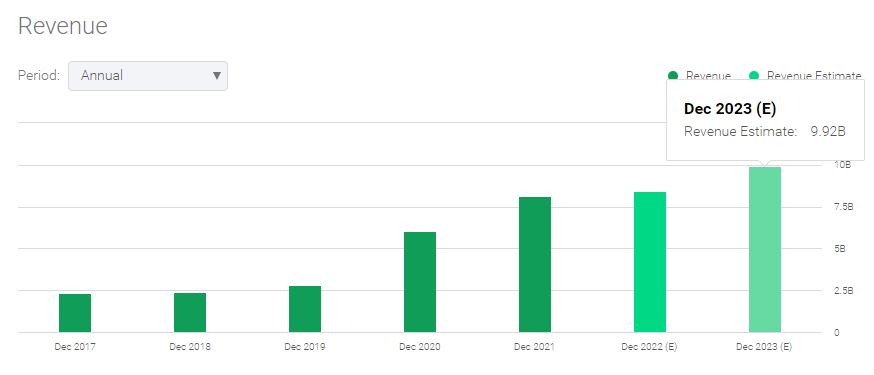

Flutter Entertainment owns several sports betting platforms like Paddy Power, FanDuel, and FOXBet. The global sports betting industry was estimated to be worth $76.75 billion last year. The 10.2% CAGR of this particular industry is a good reason to go long on PDYPY.

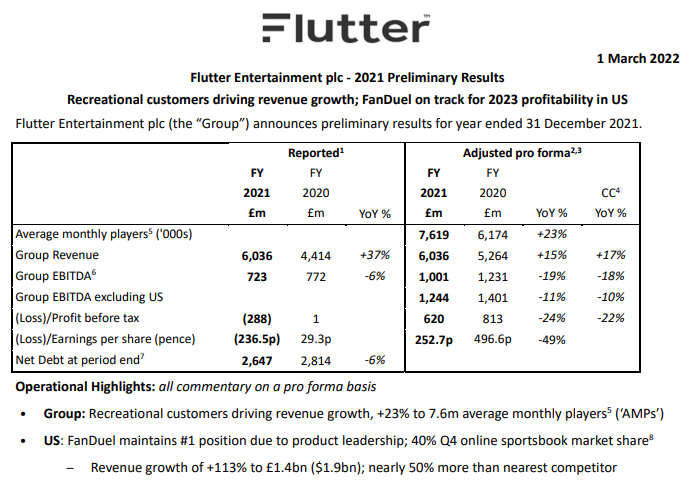

FanDuel and FOXBet are very popular in the United States. The sports betting business in the U.S. was worth $11.5 billion in 2021. This market is growing at 10.3% CAGR.

grandviewresearch.com

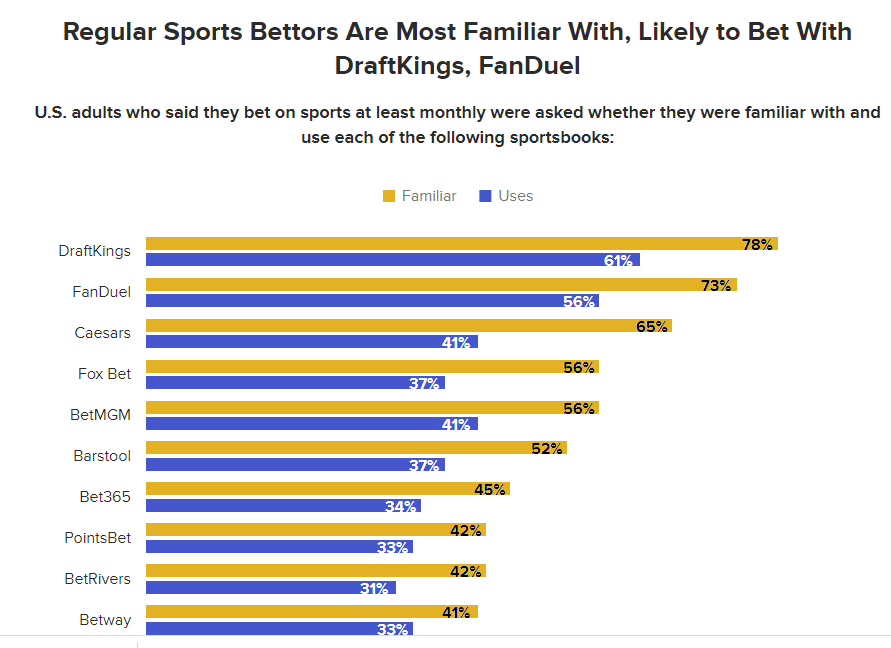

As per the recent survey of Morning Consult, FanDuel is the number 2 most popular sports betting platform in the U.S. It is the biggest rival of DraftKings (DKNG). FOXBet is number 4. It is speculative, but the combined bets on FanDuel and FOXBet could be higher than DraftKings’. PDYPY could be a better investment than DKNG, in my opinion.

morningconsult.com

The strong U.S. presence of Flutter Entertainment could help it return to profitability faster. The stock got beaten down because of its 2021 net loss of $572 million. Since FanDuel is already very popular in America, Flutter Entertainment could reduce its marketing budget there. Morning Consult’s article mentioned that Flutter spent $291 million on marketing in the U.S. for the first six months of 2021. Flutter spent over $1 billion promoting and marketing its U.S. business last year.

Contrary to Morning Consult’s survey, Flutter management claimed that FanDuel is the number 1 sports betting platform in the U.S.

Flutter Entertainment IR

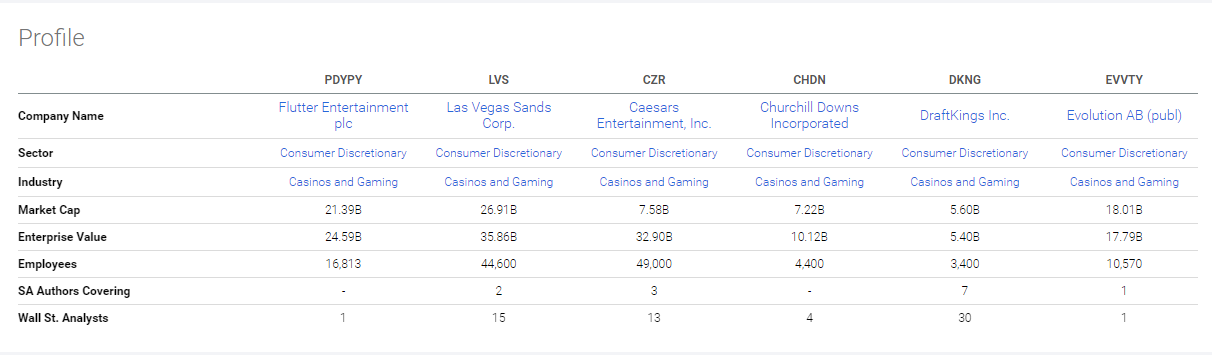

The Third-Largest Gambling Company

Flutter has a tailwind from the 18.4% CAGR of the $287.43 billion global gambling industry. The online/mobile casinos and horse racing betting platforms of Flutter make it a desirable stock.

Based on market cap, PDYPY is the third-largest casino and gaming company. It is therefore a top beneficiary of the $287.43 billion gambling industry.

Seeking Alpha Premium

The fast-growing global gambling business should help Flutter achieve that $9.92 billion revenue estimate for F2023.

Seeking Alpha Premium

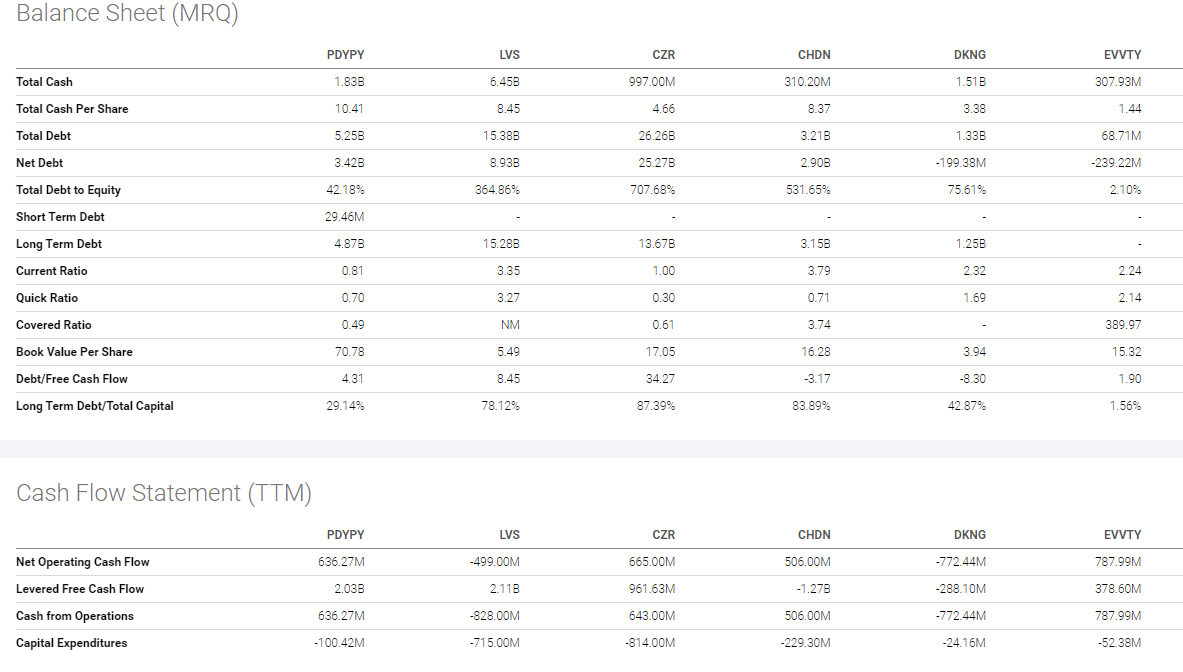

Strong growth in gambling and sports betting fortifies the finances of Flutter Entertainment. Yes, Flutter’s total debt is $5.25 billion. On the other hand, its levered free cash flow is $2.03 billion, so Flutter is probably not having a hard time meeting the principal and interest payments.

Seeking Alpha Premium

Is It Overvalued?

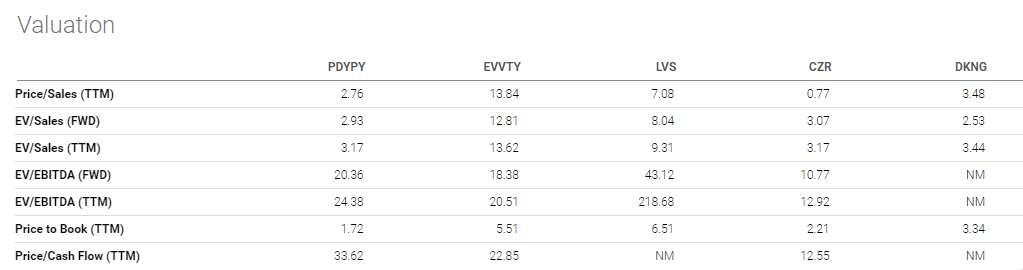

We cannot use the P/E ratio to evaluate a company with a net loss like Flutter. We can use Price/Sales and compare it to its casino and gaming peers. Based on the chart below, PDYPY is relatively undervalued compared to most of its competitors.

Seeking Alpha Premium

The TTM Price/Sales valuation of Flutter is only 3.17x. This is notably lower than DraftKing’s 3.44x and Las Vegas Sands’ (LVS) 7.08x.

Price to book is also a good way to gauge the value of a stock. Flutter’s TTM price/book ratio is only 1.72x. Compare this to DraftKing’s 3.34x and LVS’s 6.51x. PDYPD is relatively undervalued.

Downside Risk

The biggest risk to Flutter Entertainment is stricter government rules over online gambling and sports betting. Gambling-related companies are subject to the whims of politicians. Invest only in PDYPY if you believe politicians are not going to curtail our inalienable right to wager our hard-earned money.

I and my three younger brothers love PokerStars and PP Poker, and live PokerStars is still allowed in the Philippines. There is no guarantee it will remain so forever.

Real-money PokerStars is banned in 100 countries. Only three U.S. states allow real-money PokerStars gambling. These prohibitions from too many countries are a long-term handicap. PokerStars is no longer the most actively used online poker platform.

pokerscout.com

Flutter was able to merge with The Stars Group. It can also merge with or buy GGPoker. Privately-owned NSUS Group owns GGPoker.

The other solution to Western governments’ becoming stricter on gambling is for Flutter to expand in developing countries. The Philippines and Myanmar are great examples of gambling-friendly countries.

There are 34 licensed Philippine Offshore Gaming Operators (POGO). Most of them are owned by Chinese businessmen. Ireland-based Flutter should start using the Philippines as an offshore gambling and sports betting site.

The Philippines likely welcomes gambling operators because its foreign debt is already $109 billion, and so it might need the cash inflow from foreign bettors. It could help service the Philippines’ massive foreign debt, therefore.

My Takeaway

The discounted stock of Flutter Entertainment should be exploited, so I think investors should go long while it trades below $65. Based on the 30.71% upside estimate by JPMorgan, PDYPY’s price target is $80.77. This is lower than another Wall Street analyst’s PT of $97.06.

Flutter’s return to profitability could be faster if it reduced its annual marketing budget. Spending more than $1 billion a year in U.S. promotions is not a conducive tactic in my opinion. Instead of spending too much on marketing, Flutter should build mobile gambling apps. Market Research Future estimates that mobile gambling is growing at a 12.10% CAGR. It could be worth $154.81 billion by 2030.

Betting on PYDPY could be safer than gambling in Las Vegas casinos or Pokerstars.net. Investing in the gambling habits of 1.6 billion people could be a good way to fund your retirement, in my opinion.

“Editor’s Note: This article was submitted as part of Seeking Alpha’s Top Ex-US Stock Pick competition, which runs through November 7. This competition is open to all users and contributors; click here to find out more and submit your article today!”

Be the first to comment