da-kuk/E+ via Getty Images

This article was first released to Systematic Income subscribers and free trials on Mar. 28

The increasingly hawkish stance by the Fed and the associated backup in longer-end rates has put many income investors on the back foot. In this article we take a look at some of the floating-rate investment options – securities that will see rising income levels as the Fed continues on its hiking trajectory. Floating rate securities can, not only deliver a rising level of income, but also maintain a defensive position if longer-end rates continue to rise.

The Rate Landscape

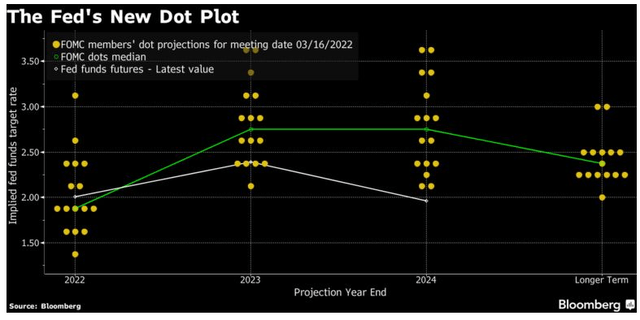

That short-term rates will keep rising is a near certainty. The current Fed policy rate has only been moved up once with the lower limit on the Fed Funds rate now at 0.25% from zero before. By the end of this year the Fed expects to move the Fed Funds rate to just below 2% (with the market consensus at 2%). It then expects to raise it further to around 2.75% (with the market consensus near 3%). In short the base case is for the short-term rate to rise another 2-3% over the next couple of years.

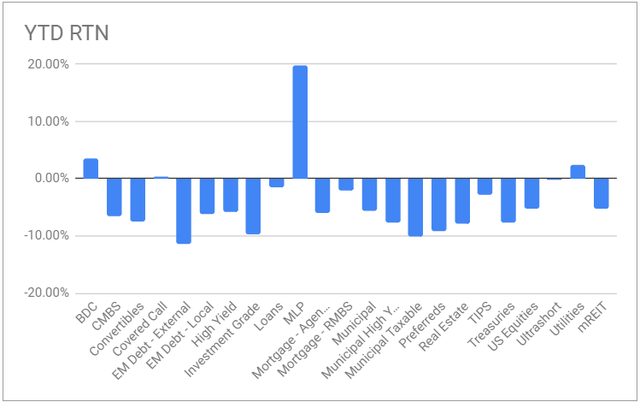

An eventual rise in short-term rates was not exactly a secret and it’s true that a hawkish Fed pivot as well as the current geopolitical crises were somewhat, though not totally, unexpected. At the same time the fact that higher rates were a clear consensus did not prevent most sectors (as proxied by benchmark ETFs in the chart below) from falling 5-10% this year.

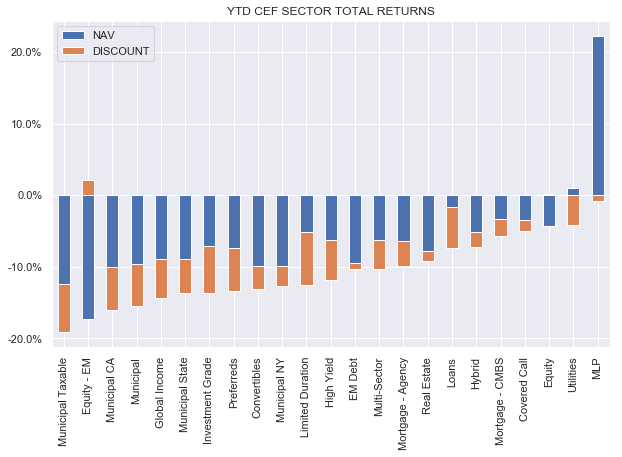

CEFs have fared even worse with more than half of sectors falling by double digits.

Systematic Income

These developments raise two questions – how can investors allocate to take advantage of rising short-term rates and how can they potentially avoid or take advantage of the drawdowns year-to-date. We explore this in the section below.

Some Ideas

In this section, we highlight some floating-rate income opportunities, i.e. those securities that are well-positioned to take advantage of rising short-term rates. It is important for investors to keep in mind that income and price action are not always directly related. Specifically, securities whose underlying income (and, very likely, distributions) are expected to increase in the near term due to the continued rise in short-term rates may continue to suffer elevated price volatility.

In short, just because income will be going up doesn’t mean that prices will be going up as well. Everything depends on what happens to both longer-term rates and risky assets such as equities and credit securities. This is why it makes sense, in our view, to continue to position in a barbell way – by allocating to both higher-quality and higher-yielding floating-rate securities. At the moment the broader credit market is neither terribly cheap nor terribly expensive – therefore a balanced allocation makes sense to us.

Below we highlight some of the floating-rate options across the broader income space moving from higher-quality to higher-yielding securities.

On the very high-quality side there are the WisdomTree Floating Rate Treasury Fund (USFR) and the iShares Treasury Floating Rate Bond ETF (TFLO) which hold floating-rate Treasuries. Only very slightly lower in quality is the Invesco VRDO Tax-Free ETF (PVI) which holds investment-grade muni VRDO’s which are basically tax-exempt muni money market securities. The yields of these is wrapped around zero but should start to rise shortly.

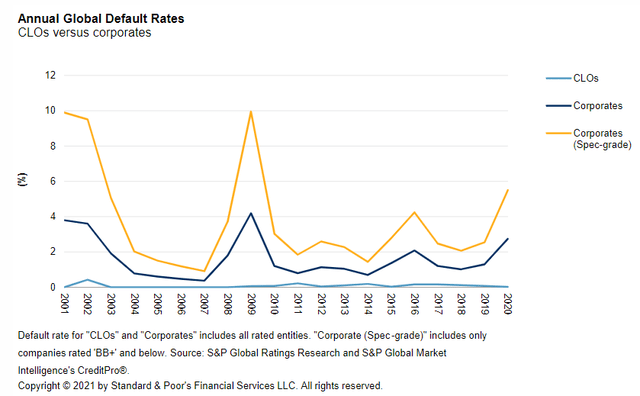

Staying in the high-quality pocket, we would put something like the Janus Henderson AAA CLO ETF (JAAA) into the same bucket which holds AAA-rated CLOs and has a SEC yield as of February of around 1% which, looks like the most attractive option to us in this group outside of tax considerations. The fund’s yield is very likely closer to 2% on a going-forward basis since Libor is set in arrears, i.e. at the start of the period and so current yield figures don’t yet reflect the recent sharp run-up in Libor. The CLO structure (particularly, the 2.0 version created after the GFC) is very robust and the historic default rate for rated CLOs has been exceptionally low both in absolute terms as well as relative to corporate bonds.

Moving lower into the investment-grade rated corporate space there are the SPDR Barclays Capital Investment Grade Floating Rate ETF (FLRN) as well as the iShares Floating Rate Bond ETF (FLOT) at yields of 0.5-1%. Slightly lower quality, but still mostly investment-grade is the Janus Henderson B-BBB CLO ETF (JBBB) which is a mostly BBB version of JAAA and is a very attractive decent-quality choice with a 3-4% yield that, again, will also continue to rise.

For sub-investment-grade corporate debt there is half a dozen loan ETF options at around 4% yields. These include two actively-managed funds: the SPDR Blackstone/GSO Senior Loan ETF (SRLN) and the First Trust Senior Loan Fund (FTSL). This yield will continue to move higher as the Fed keeps hiking and, if current market expectations are at all accurate, should top out not far from 6% – a very attractive level for a low-duration actively-managed unleveraged fund.

Investors should keep in mind that there are also funds that advertise themselves as variable-rate preferred funds such as the Global X Variable Rate Preferred ETF (PFFV) and the Invesco Variable Rate Preferred ETF (VRP); however, these mostly hold Fix/Float preferreds with fixed current coupons which may eventually have a variable rate past their redemption dates. These funds are down around 6% year-to-date which is certainly better than fixed-rate preferreds but not exactly what most investors have in mind when they think of floating-rate securities. In short, these funds are not true floating-rate funds.

Investors with a higher level of risk appetite and / or higher yield target level should consider CEFs or BDCs. In the CEF space we like the Eagle Point Income Company (EIC) trading at a 9.26% current yield and a pretty flat discount. The fund holds primarily sub-investment-grade CLO Debt securities as well as some CLO Equity. The fund’s valuation is not cheap (for instance, many loan CEFs are trading at double-digit discounts at present) and we have a Hold rating on the fund at the moment in our High Income Portfolio.

We also like the Ares Dynamic Credit Allocation Fund (ARDC), trading at a 12% discount and an 8.5% current yield which we recently highlighted here and for which we have a Buy rating in our High Income Portfolio. Overall, after boasting expensive discount valuations for nearly half the year, many loan CEFs are back to trading at attractive valuations, making the space quite attractive for income investors.

In the BDC space we like the Golub BDC (GBDC), trading at a 8% dividend yield and a 99% valuation as well as the BlackRock TCP Capital Corp (TCPC), trading at a 8.5% dividend yield and a 98% valuation. These two BDCs have delivered strong returns of high-single to low double-digits in annual total NAV terms over the past 3-5 years, trade at an attractive valuation and are positioned very well (better than the average BDC) for rising short-term rates. Their net income is expected to increase close to 20% when Libor moves to 2% from a near-zero level – it is about half-way there already.

Takeaways

The steady continued increase in short-term rates is one of the key dynamics in the current market environment. Floating-rate assets are able to deliver increasing levels of income over the coming years as the Fed continues to hike. They can also offer a more defensive position for potentially higher longer-end rates as well, something we have already seen this year. Loan CEF NAVs, for example, have held in much better than those of High-Yield bonds, outperforming by 5% so far this year while BDCs, which hold primarily floating-rate loans, have actually gained this year, in contrast to nearly all other income sectors which are down for the year.

Be the first to comment