Mykola Pokhodzhay/iStock via Getty Images

AMD (NASDAQ:AMD) has been surrounded by bearish narratives of late. Where many believe that intensifying competitive pressures from Intel (INTC) and Nvidia (NVDA) will lead to a slump in its business, others feel its shares are overextended and are poised to correct. While these arguments have some merit, the Street is acting out differently altogether. Latest data reveals that short interest in AMD dropped by a massive 40% in the last cycle. This suggests that market participants are skeptical of betting against the chipmaker and that its shares may have limited downside potential from current levels.

The Shorter’s Exodus

Let me start by saying the short interest metric is basically the total number of short positions that are open against any given stock at the end of bi-monthly reporting cycles. A material rise in the metric indicates that market participants bet against a given stock as, perhaps, they perceive it to be overvalued and anticipate it to decline in value in coming weeks. Conversely, a sharp drop in the metric highlights a rapid short unwinding as, perhaps, market participants feel the stock has bottomed out and has limited downside potential. So, the short interest metric is a handy tool to gauge the Street’s ever-evolving sentiment pertaining to any given stock.

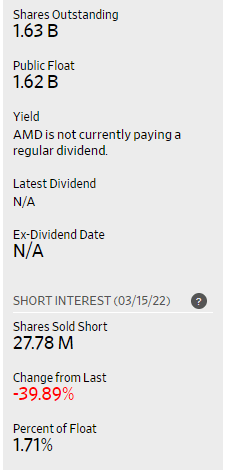

Now, coming back to AMD, several interesting data points came to light in the latest short interest publication. For starters, its short interest amounted to roughly 27.8 million at the end of the latest cycle. Before we dive deeper into what this means and represents, it’s important to note that AMD’s short interest figure was down by a massive 39.9% sequentially and 68% in the last 2 months. The preliminary assessment suggests that short-side market participants exited their positions in the chipmaker as quickly as they could.

Wall Street Journal

Secondly, AMD has around 1.62 billion floating shares. This means that only 1.7% of its public float had been shorted at the end of the last cycle. If market participants felt that the bearish arguments surrounding AMD were legitimate and held merit, they would have initiated short positions in the name and we would have seen higher shorting levels in the stock. But clearly, market participants felt it was best to avoid shorting AMD for the time being at least.

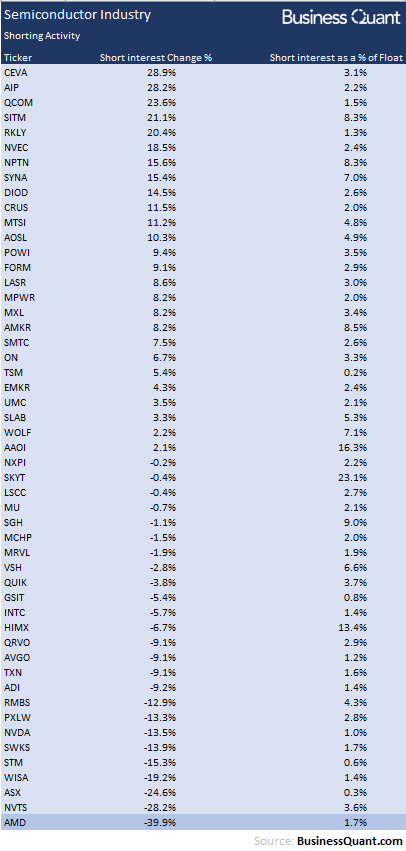

Next, I wanted to confirm if this short unwinding was market-wide across the entire semiconductor industry or if it was prevalent specifically in AMD’s case. So, in order to test the hypothesis, I pulled the shorting activity for 50 other semiconductor stocks that are listed on US bourses.

As it turns out, there was an even split between the stocks that saw their short interest figures rise, and decrease, in the last cycle. So, market participants were, overall, neutral on the semiconductor industry. There were stocks that saw their short interest figures surge by as much as 29% but, interestingly, AMD’s short interest figure declined the most in the entire study group. Also, it’s worth noting that AMD’s short interest as a percentage of its entire float, was one of the lowest in our study group.

Business Quant

These data points confirm that short-side traders actively wound up their positions in AMD and are wary of initiating any new positions. But this begs the question – why are they so skeptical in betting against the chipmaker in the first place?

Reasons for Skepticism

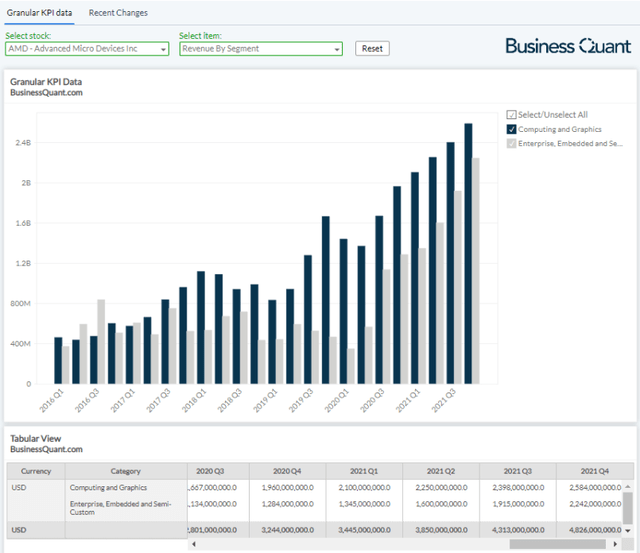

There are broadly three reasons, in my opinion, which is keeping short-side traders at bay. First, AMD, as a company, has been growing at a rapid pace over the past several quarters. It has two reportable segments – namely Computing and Graphics, and Enterprise, Embedded and Semi-Custom – and both of them have been posting sequential revenue growth for many quarters now. The chipmaker is yet to exhibit signs of its growth plateauing which makes it a short-side trader’s nightmare.

Secondly, AMD has a number of catalysts lined up to ensure that its revenue growth momentum remains intact, or accelerates further, in the next few quarters at the very least.

- It launched 7 new CPU SKUs about three weeks ago, which will be generally available later this month, to finally target the budget computing space that Intel has dominated for the past 5 to 6 quarters.

- AMD’s upcoming 6000-series APUs reportedly pack in significantly powerful and efficient integrated graphics cores. This should help it win ground in the notebook space against both Nvidia and Intel.

- The chipmaker also slashed prices for existing SKUs to compete better against Intel’s 12th-gen SKUs.

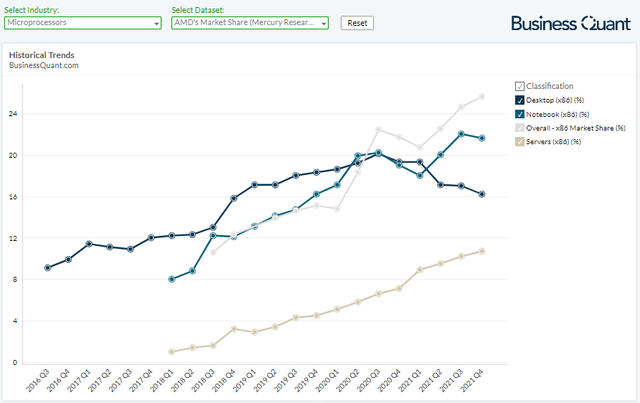

Altogether, these initiatives are likely to boost AMD’s revenue and its market share across desktop and notebook segments. Also, it’s worth noting that these are interim moves to keep AMD’s product portfolio competitive until it transitions to Taiwan Semiconductor’s (TSM) 5nm fabrication process and reclaims process leadership. (Read – AMD: The Untold Truth).

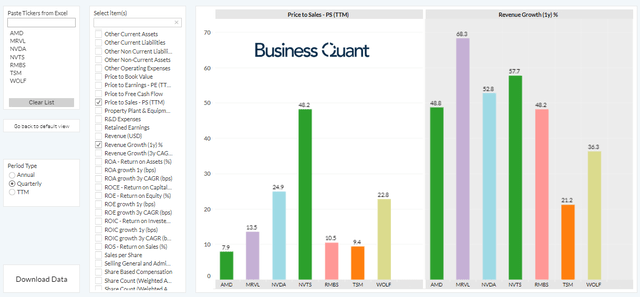

Lastly, AMD’s shares are down roughly 30% since January highs, in spite of having ample growth catalysts and strong fundamentals. This has made its shares attractively valued at current levels, especially when compared to some of the other rapidly growing semiconductor stocks. This suggests that AMD’s shares have ample upside, and limited downside potential, from its current levels. This also explains why short-side market participants may have been avoiding AMD of late.

Investor Takeaway

There’s no denying that AMD has had its share of controversies in the past. In fact, it’s been only a few years that yours truly was explaining how the chipmaker was unlikely to go bankrupt and was actually poised for rating upgrades. However, things have changed drastically over the years and AMD’s management has done a mighty fine job at competing with Intel in notebook, desktop and server markets. I expect this fight to only get fiercer in the coming quarters as AMD launches new SKUs and eventually transitions to TSM’s 5nm process.

Besides, if the bearish narratives surrounding AMD truly held any merit, and presented legitimate risks to its growth momentum, market participants would have actively bet against the stock and we would have seen a notable increase in its short interest. But that clearly did not happen and the chipmaker’s short interest declined instead. So, investors with a long-term time horizon may want to ignore the fear, uncertainty and doubt surrounding the name, and accumulate its shares on potential price corrections. AMD remains an attractive growth opportunity and I reiterate my bullish stance on it. Good Luck!

Be the first to comment