GoodLifeStudio

After several years in which “beat and raise” quarters became more or less the norm and expectation in the tech sector, we’re seeing the reverse happen in 2022. Tech companies, especially those that are not built on sturdy recurring revenue bases, are citing macro-related headwinds in cutting their guidance. Added on top of a deep valuation reset as investors weigh the attractiveness of equities in a rising interest rate environment, many tech stocks are completely underwater.

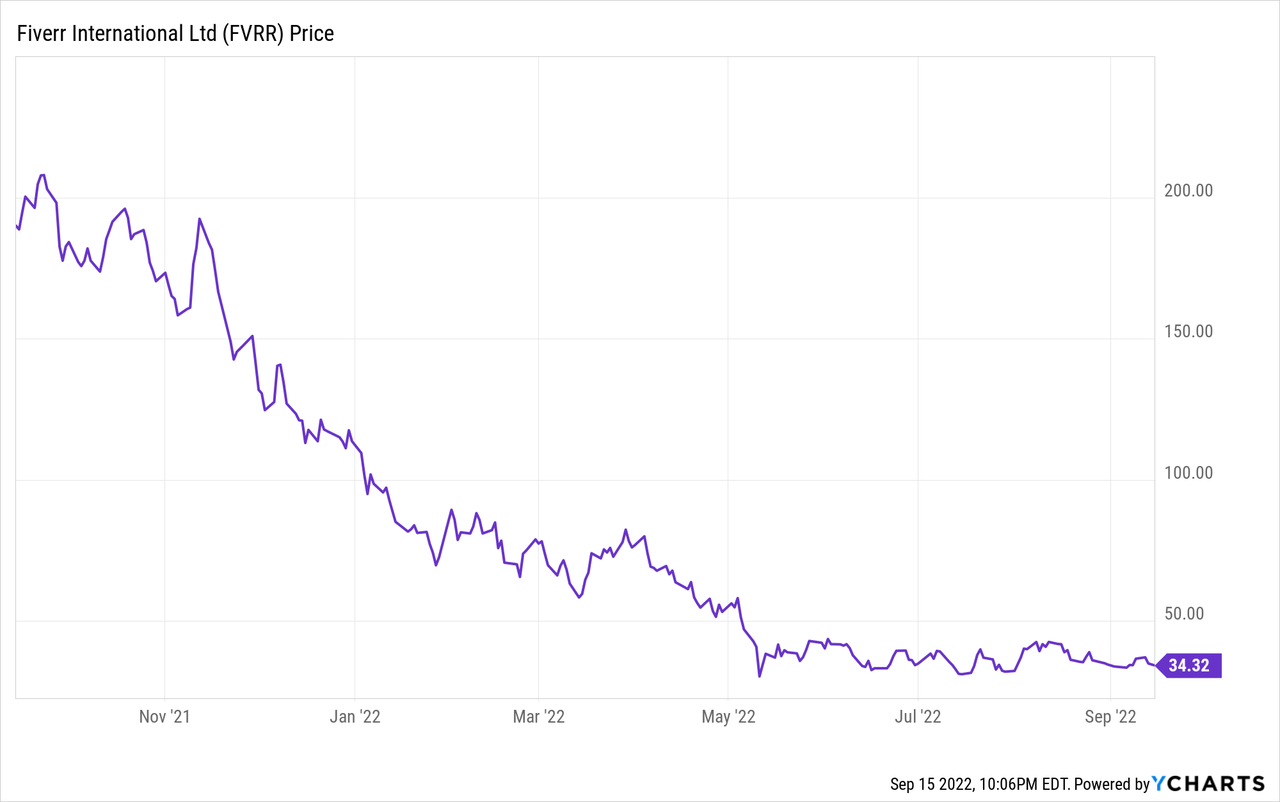

Fiverr (NYSE:FVRR) is a prime example of a company that went from Wall Street darling to a throwaway. This freelance/gig work site is one of the premier brands in its space, but it can’t avoid macro pressures and the penny-pinching that many businesses (large companies and especially smaller businesses) are having to do in order to prepare for a recession. Year to date, shares of Fiverr have fallen nearly 70%:

To be fair and to justify this drop, Fiverr has cut its guidance outlook twice this year already – a rarity among most companies, as most prefer to do a one-time ‘big bath’ and reset expectations lower. In cutting its outlook again alongside its second-quarter earnings, Fiverr cited a slowdown in spending among SMB (small and mid-sized business) customers. This makes sense, as a lot of the services offered on Fiverr can be classified as discretionary spend, and a small business that is looking at tough times ahead will choose to reduce and preserve its bottom line.

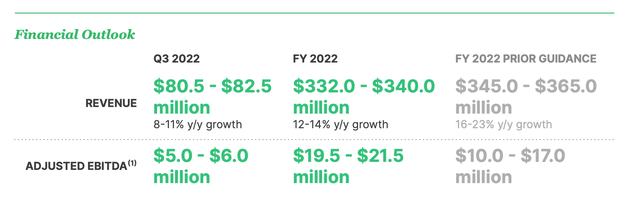

Fiverr updated guidance (Fiverr Q2 shareholder letter)

As shown in the chart above, Fiverr is now guiding to 12-14% y/y revenue growth to a range of $332-$340 million, reduced from its prior outlook of 16-23% y/y growth, and an original expectation of 25-27% y/y growth prior to the first guidance cut in Q1. It is, however, raising its adjusted EBITDA outlook to a new midpoint of $20.5 million or a 6.1% margin, versus $13.5 million and a 3.8% margin previously. Fiverr is effectively doing the same thing its SMB clients are doing: it’s cutting spend (eliminating 60 positions from its headcount) and focusing on retrenching the bottom line until demand signals return to strength.

To me, the fact that Fiverr intends to remain profitable during this demand slowdown is a positive signal. Fiverr is subject to the volatility of the business cycle, yes, but we can’t discount the appeal of this product and platform in the long run. As a refresher for investors who are newer to this stock, here is what I view to be the key bullish drivers for Fiverr for the long term:

- The gig economy is growing; Fiverr is expanding the types of gigs available on its marketplace. Americans are quitting their jobs at a greater rate than ever, and more people are supporting themselves through means of gig-based or freelance jobs. In addition, Fiverr itself is acknowledging the wider diversity of skills and gigs and is adding/featuring more services on its site (in its most recent quarter, one of the biggest growth areas was 3D animation).

- Employers are taking note of the shifts. Widespread labor shortages have been well-documented across industries. While some employers are sweetening their employees’ packages to reduce churn, many employers are also shifting their hiring mindset and filing many positions with contract-based or gig-based roles.

- Fiverr’s clout is growing. The company is expanding upmarket into more business-oriented service buyers, growing its take rates, and expanding its geographical presence.

- Subscriptions. Though the majority of Fiverr’s gigs are done on a one-time contract basis, for its larger buyers, the company has introduced the concept of subscriptions, or being able to order the same recurring service on a set schedule.

- Profitability expansion made possible by huge growth margins. Fiverr generates positive and growing adjusted EBITDA, which is a relative rarity for a stock of Fiverr’s scale. Fiverr also carries a very high mid-80s pro forma gross margin. When a company is still growing revenue at a mid-teens to low 20s pace, at that gross margin profile, the opportunities for operating leverage are dramatic.

Valuation is another big draw for Fiverr. At current share prices near $34, the company has a market cap of $1.27 billion. After we net off the $528.3 million of cash and $451.5 million of debt on Fiverr’s most recent balance sheet, the company’s resulting enterprise value is $1.20 billion – which represents a rather modest 3.6x EV/FY22 revenue multiple against the company’s reduced guidance revenue range.

All in all, I think “sticking it out” here is the best move, and Fiverr’s bargain-basement valuation for a company with positive adjusted EBITDA and a history for strong growth execution make it a relatively safe bet.

Q2 download

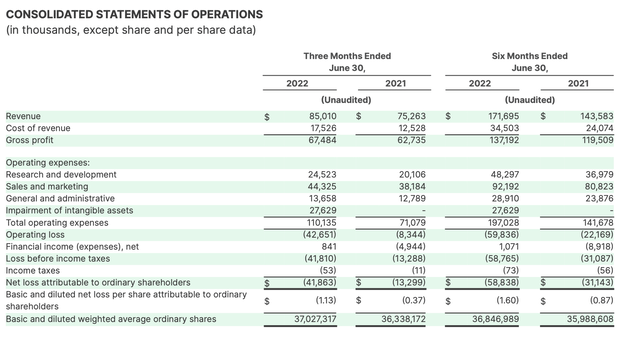

Let’s now discuss Fiverr’s latest Q2 results in greater detail. The Q2 earnings summary is shown below:

Fiverr Q2 results (Fiverr Q2 shareholder letter)

Revenue grew 13% y/y to $85.0 million, missing Wall Street’s expectations of $86.6 million (+15% y/y) by a two-point margin. Revenue growth also decelerated quite substantially relative to 27% y/y growth in Q1, driven by the aforementioned slowdown in SMB spending. It noted that spending trends in Europe continued the slowdown that began in Q1, while U.S. revenue also started to see signs of weakness in June.

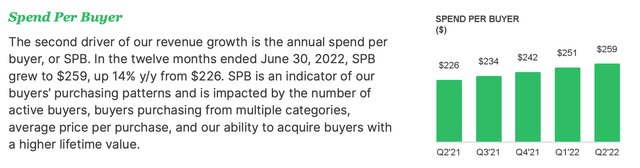

The company’s shift upmarket, however, is still vibrant. It noted that among its larger customers, wallet share expansion remained robust. In addition, spend per buyer also continued to grow, up 14% y/y to an average of $259.

Fiverr spend per buyer (Fiverr Q2 shareholder letter)

Some more anecdotal commentary on market performance from CEO Micha Kaufman’s prepared remarks on the Q2 earnings call:

We continue to see a rapid consumer and SMB sentiment shift amidst the challenging global macro environment. Geopolitical volatility, spiking inflation, and elevated energy prices meant that spending power of consumers and SMBs was impacted more than expected. This trickled through to the overall demand for freelancer spending. We are not immune to these macro trends.

We are encouraged however that Fiverr continues to serve as a backbone for millions of businesses to connect and engage with freelancers. Active buyers were 4.2 million, up 6% year-over-year and spend per buyer was $259, up 14% year-over-year. Our market base scaled up significantly during the COVID years and most of that gain continues to hold today. We see older cohorts continuing to spend more today versus pre-COVID and we continue to attract a significantly larger amount of new buyers to our market base every quarter compared to our pre-COVID.”

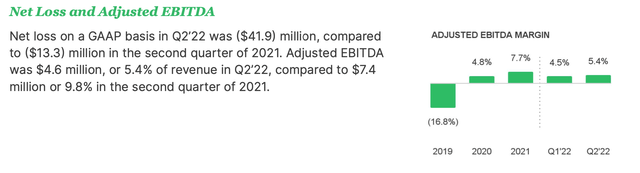

Sequentially versus Q1, Fiverr reduced its operating expenses as it started to trim headcount. Q2 adjusted EBITDA margins stood at 5.4%, a 90bps improvement sequentially but a roughly four-point loss year over year:

Fiverr adjusted EBITDA (Fiverr Q2 shareholder letter)

The company expects adjusted EBITDA margins to improve to a full-year result of >6% as cost cuts take place, and it is not changing its long-term target of achieving a 25% adjusted EBITDA margin at scale.

Key takeaways

I view Fiverr as a cyclical business that will quickly get back on its feet. In the meantime, the operational fine-tuning it is making to its expense base will ultimately make the company emerge as a much more profitable entity. Don’t miss the chance to buy Fiverr cheaply.

Be the first to comment