ansonsaw

Overview

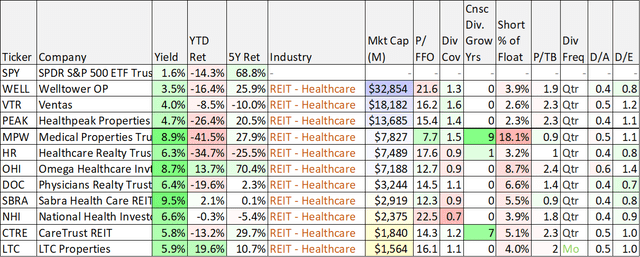

Like most of the market, the real estate sector (XLRE) has been terrible this year (-24.4% ytd). And things can still get worse as inflation remains high and the possibility of an ugly recession looms. In this report, we share data on over 45 big-dividend Real Estate Investment Trusts (“REITs”) that are down big, and then dive into three names from the list that are particularly interesting and worth considering. We have a special focus on Medical Properties Trust (NYSE:MPW) (including the four big risk factors it currently faces, its dividend safety and its current valuation), so let’s start with that one.

Medical Properties Trust (MPW), Yield: 8.9%

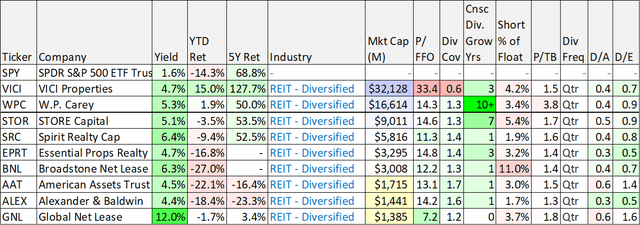

As you can see in the table below (which is sorted by REIT industries), healthcare REIT Medical Properties Trust stands out as particularly ugly considering its awful year-to-date performance, very high short interest (i.e. people betting against it) and unusually high dividend yield (mathematically the yield has risen as the price has fallen).

data as of Fri close 25-Nov-22 (Stock Rover)

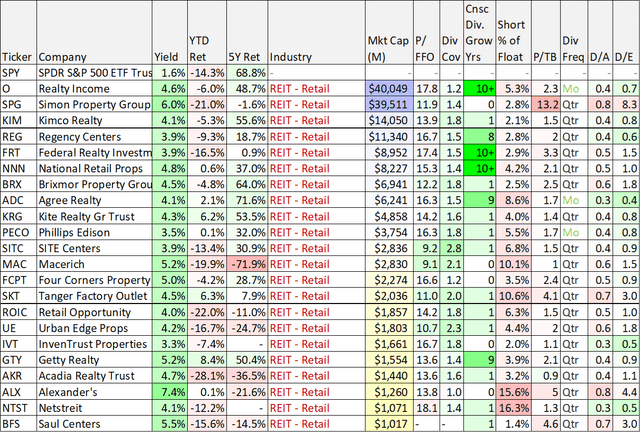

data as of Fri close 25-Nov-22 (Stock Rover)

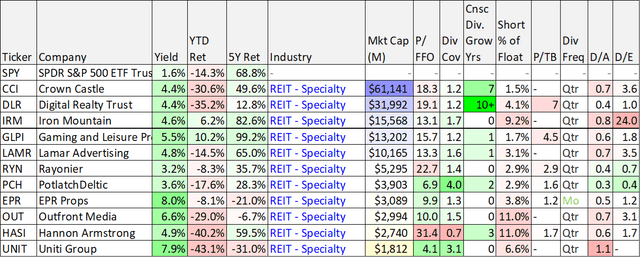

data as of Fri close 25-Nov-22 (Stock Rover)

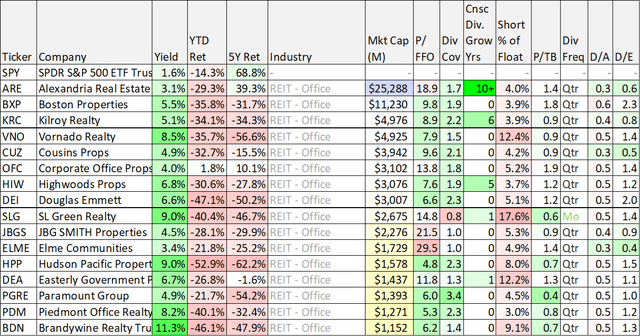

data as of Fri close 25-Nov-22 (Stock Rover)

data as of Fri close 25-Nov-22 (Stock Rover)

You likely recognize at least a few of your favorite REITs in the tables above, but let’s start with some details on Medical Properties Trust.

Business Overview: Medical Properties Trust

Medical Properties Trust is “the global source for hospital capital.” Basically, it provides cash to hospitals (often those that are struggling financially) by buying their physical properties (hopefully at a low price, for MPW shareholders’ sake) so the hospitals receive the cash they need to continue (and hopefully improve) their operations.

For more details on the business model, here is how we described it in our previous MPW report:

“In theory, the business model goes something like this. Individual hospitals face dire cost cutting pressures and many of them have gotten into financial trouble whereby it costs them an arm and a leg to borrow capital to improve their operations because lenders don’t trust that they’ll even be able to pay back the loans. MPW can help alleviate this problem by giving the hospitals the cash they need to improve their operations in exchange for ownership of the physical hospital real estate. And MPW can get the real estate for a low price because the hospitals don’t have a lot of other financing options.

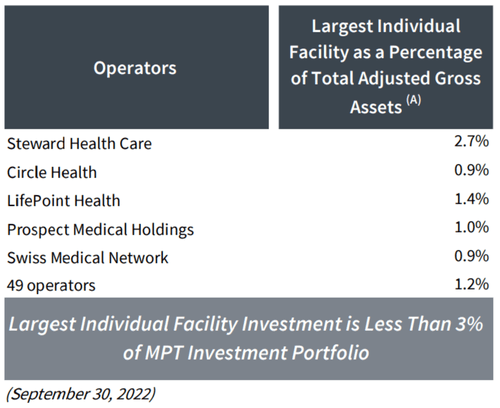

Furthermore, MPW is not in great financial shape itself (it has a stable BB+ credit rating, which is below investment grade), but it’s still in much better financial shape than the hospitals themselves. And MPW can reduce its risks by diversifying across many hospitals (it owns hospitals in 32 U.S. states, seven European countries, Australia and South America) which they have done increasingly well over the years (its single largest property is less than 3% of its total portfolio). Furthermore, because MPW is organized as a REIT, it can avoid paying most corporate taxes by paying out most of its income as dividends to shareholders.

Basically, … [MPW] has the financial wherewithal to provide much needed capital to hospitals while simultaneously reducing risks through portfolio diversification and its own lower cost of capital as compared to the at-risk hospitals themselves.”

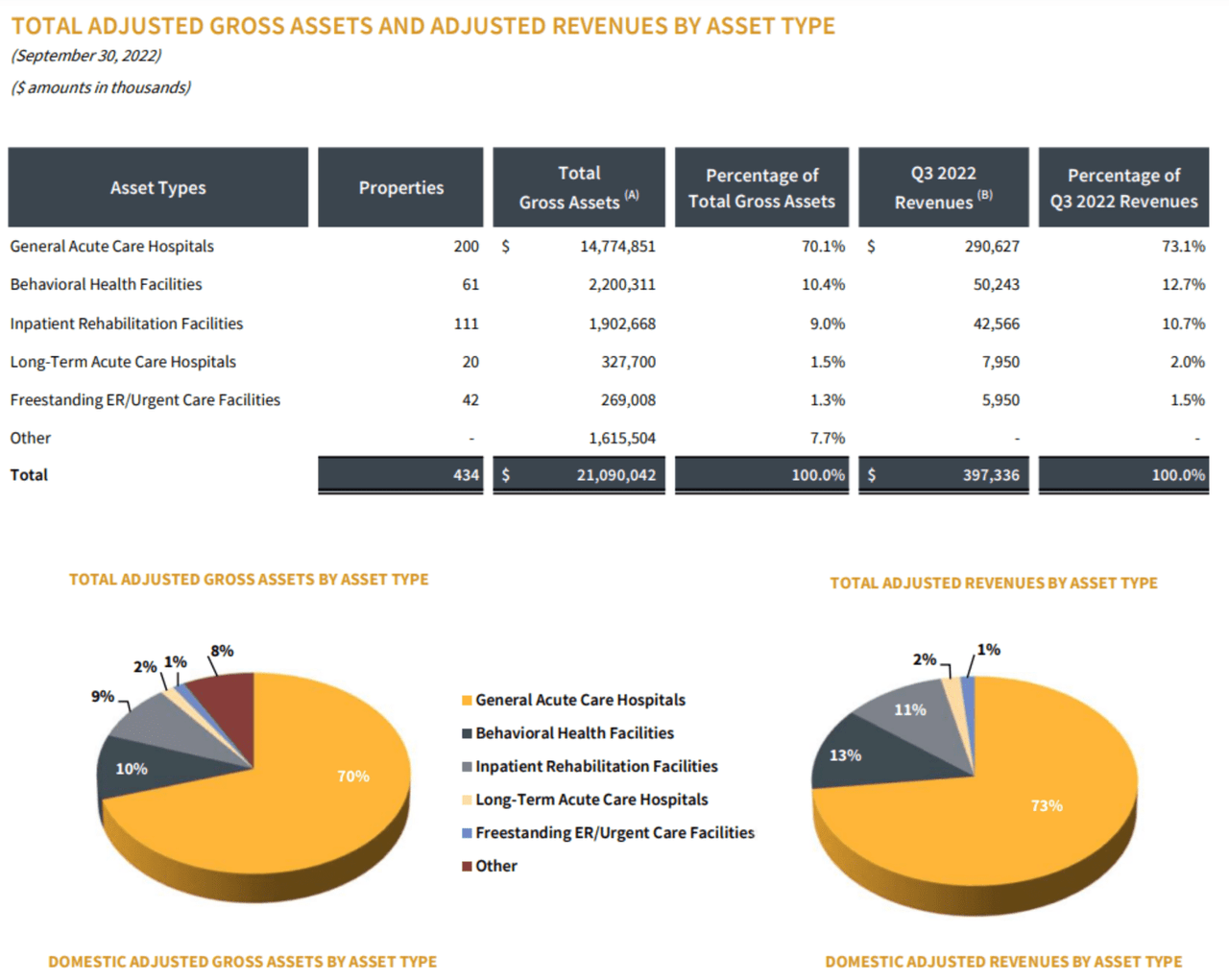

And here is an updated look at MPW’s portfolio assets, as of the end of Q3 (as per its latest quarterly Supplement).

Medical Properties Trust Q3 Supplement

As you can see above, MPW remains largely focused on general acute care hospitals, which have been struggling, as we will describe below.

Four Big Risks: Overblown and Abating

In our view, there are four big risk factors driving all the MPW negativity. We describe them below, and explain why we believe they are all now overblown and abating.

1. Troubled Operators: fundamentals are improving

Perhaps the number one reason why MPW shares have sold off so hard this year is because many of its hospital operators were struggling to begin with and then pushed closer to the brink by pandemic challenges (such as increasing costs and risks). However, according to CEO Ed Aldag on the third quarter call, conditions are starting to improve and will continue to do so. Specifically, he explained:

“As our operators effectively work to bring down cost and as reimbursement rates increase, we expect to continue to see coverages improving within our portfolio.

It’s also important to recognize the total portfolio is well diversified and the trouble operators are relatively small (as you can see in the following table). However, to keep this in perspective, as per MPW’s most recent annual report.

Our revenues are dependent upon our relationships with and success of our tenants, particularly our largest tenants, like Steward, Circle, Prospect, Swiss Medical Network, and HCA… As of December 31, 2021, our largest tenants – Steward, Circle, Prospect, Swiss Medical Network, and HCA – represented 18.5%, 11.1%, 7.3%, 5.8%, and 5.6%, respectively, of our total pro forma gross assets (which consists primarily of real estate leases and loans).

MPW Investor Presentation

Furthermore, Bank of America analyst, Joshua Dennerlein, recently upgraded the shares to “Buy,” explaining that “we expect the Steward ABL to be permanently extended in December, and management has alluded to a multi-party transaction involving Prospect.” These are good signs for two of MPW’s largest operators (see table above). Dennerlein also noted that “tenants should start to see improving fundamentals from payor rate hikes, improving labor markets and slowing inflation.”

Further, MPW announced encouraging financial results during its most recently quarterly call whereby the company announced FFO in-line with expectations and it also raised the lower end of its guidance range. It’s also important to note that the hospitals are strategically important to the communities in which they exists, an indication of further portfolio value.

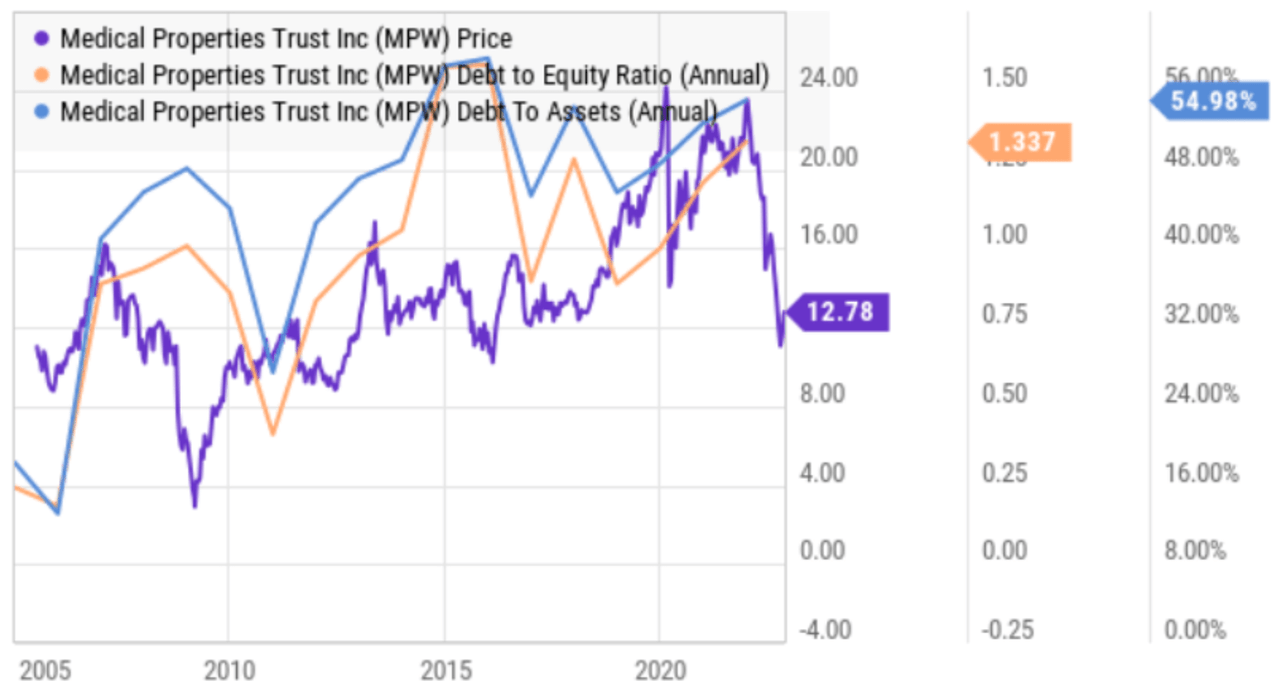

2. Significant Debt: Risks are Reducing

It’s also critically important to note that improving fundamentals will help reduce the risks related to the company’s significant debt load. Specifically, MPW currently has a debt-to-assets ratio of 55% and debt-to-equity of around 1.3x. These are significant, and the company has a credit rating of BB+/stable (from Standard & Poor’s), just barely below investment grade.

YCharts

However, the company’s improving fundamentals (as noted in the previous section) are a very good sign for the debt. A big part of the reasons for this year’s share price decline has been the risky operators and fundamentals. However, with conditions now improving, the high debt load risks are reducing.

3. Rising Interest Rates: Massive Fed Pivot

Another factor in this year’s steep MPW share price decline has been sharply rising interest rates from the US fed. In a complete 180 from its easy-money policies during the pandemic, the fed is now raising rates rapidly to combat high inflation (a high inflation rate they helped create in the first place), and this has been slowing the economy and crushing companies with higher risk debt (as rates rise, it costs more to refinance debt when it matures). The Fed’s policies have been hurting MPWs significantly.

However, there are reasons to believe the Fed may soon embark on another massive pivot. Specifically, the most recent CPI and PPI inflation readings have been lower than expected, an indication that the fed may NOT need to be so aggressive with interest rate hikes and a good sign for MPW. In fact, the same Bank of America rating upgrade (to “Buy”) that we discussed earlier, also cites “a pivot to a more dovish Fed is a positive for this high yielding REIT.”

We could offer up a litany of subjective arguments as to why the Fed’s continuing interest rate hike trajectory is not believable anyway (such as (1) they cannot raise rates much further because it will crush the US economy under the weight of the interest rate payments on its own treasuries, and (2) they’ve already gone way too far (and too fast) with rate hikes considering the impacts are always lagged by 6-18 months anyway). Also noteworthy, fed fund futures are already predicting the first fed interest rate decrease before the end of 2023. Slowing rate increases (and eventually an interest rate decrease) bodes well for MPW.

4. Industry-Specific Risks: Hospitals are important

Industry-specific risks are another critical factor. For example, hospitals are heavily regulated and rely on government funding through a variety of sources, such as Medicare and Medicaid. And as the government is constantly pressured to reduce the growth rate in these costs, regulatory changes pose a significant risk for MPW. Additionally, if any hospital operator ceases operations for financial reasons, it may be difficult for MPW to find a replacement. For example, MPW has been successful in attracting private-equity capital in the past, but there is no guarantee they will have similar success in the future.

However, an important factor is simply that the hospitals MPW owns are strategically important to the communities in which they exists. Specifically, there is incentive from the communities, governments and MPW to enable the hospitals to remain a going concern. For example, here is what CFO Steve Hamner had to say on the Q2 earnings call:

…the absolute certainty that governments and people are going to support their infrastructure like hospitals. And so all of that has led to a very high level of interest in the private area, and that’s with sovereigns and pension funds and asset managers and people like you just mentioned KKR.

This is further evidence of the value of MPWs assets.

Dividend Safety

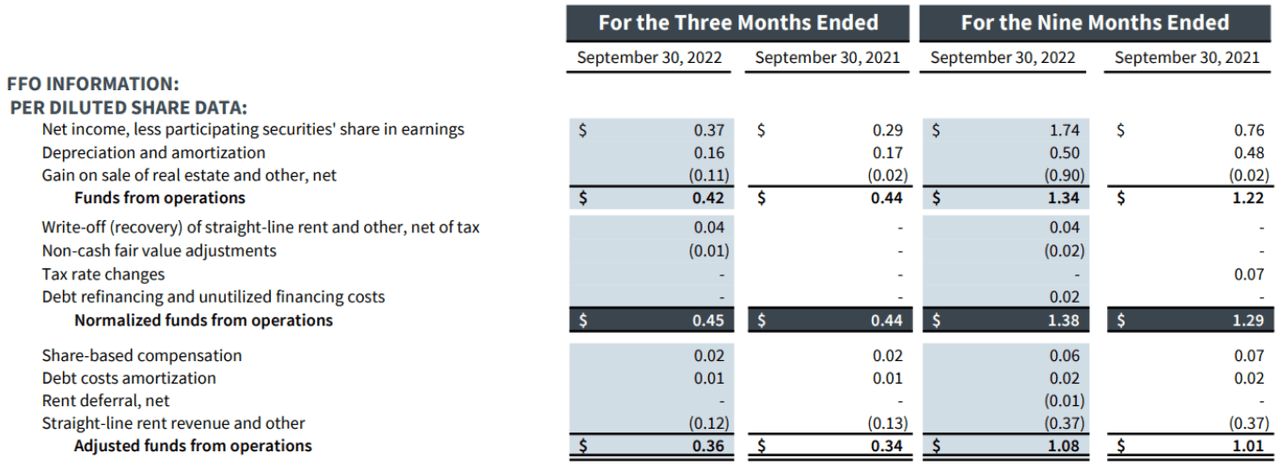

An important consideration for MPW investors is simply that the annual dividend has increased for nine years straight and it continues to be well covered by funds from operations. For example, you can see in the following chart that company’s adjusted funds from operations (“AFFO”) of $0.36 and $1.08, respectively, exceeds the dividend amount for these periods of $0.29 and $0.87, respectively.

MPW Investor Presentation

Also encouraging, the company’s fundamentals are improving, as described earlier.

Valuation:

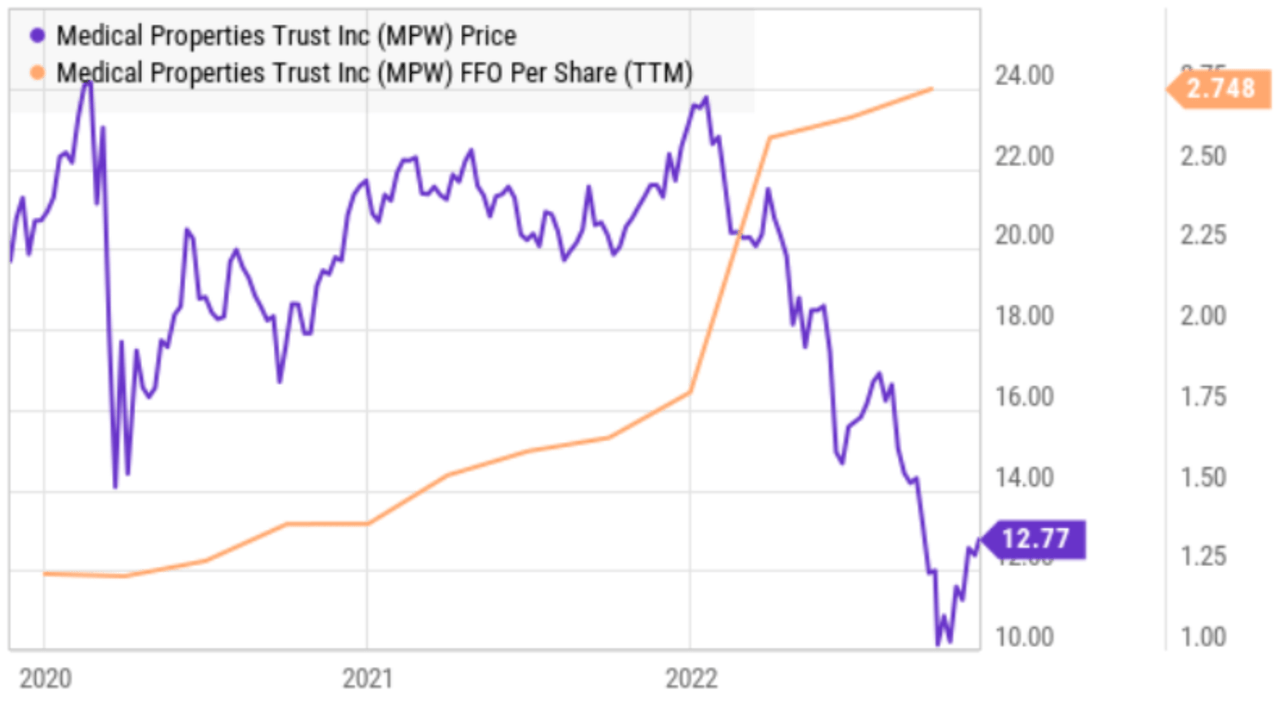

MPW’s valuation has fallen because there are significant risks, as described above. However, it has arguably fallen significantly too far. For starters, here is a look at MPW’s share price versus its Funds from Operations (“FFO”).

YCharts

As you can see above, FFO has held up well over the past 12 months, while the share price has fallen in anticipation of potential risks as described above. However, it now trades at a forward P/AFFO ratio (~9.0x) that is very low as compared to peers, and the fallout from potential risks may not be nearly as extreme as feared.

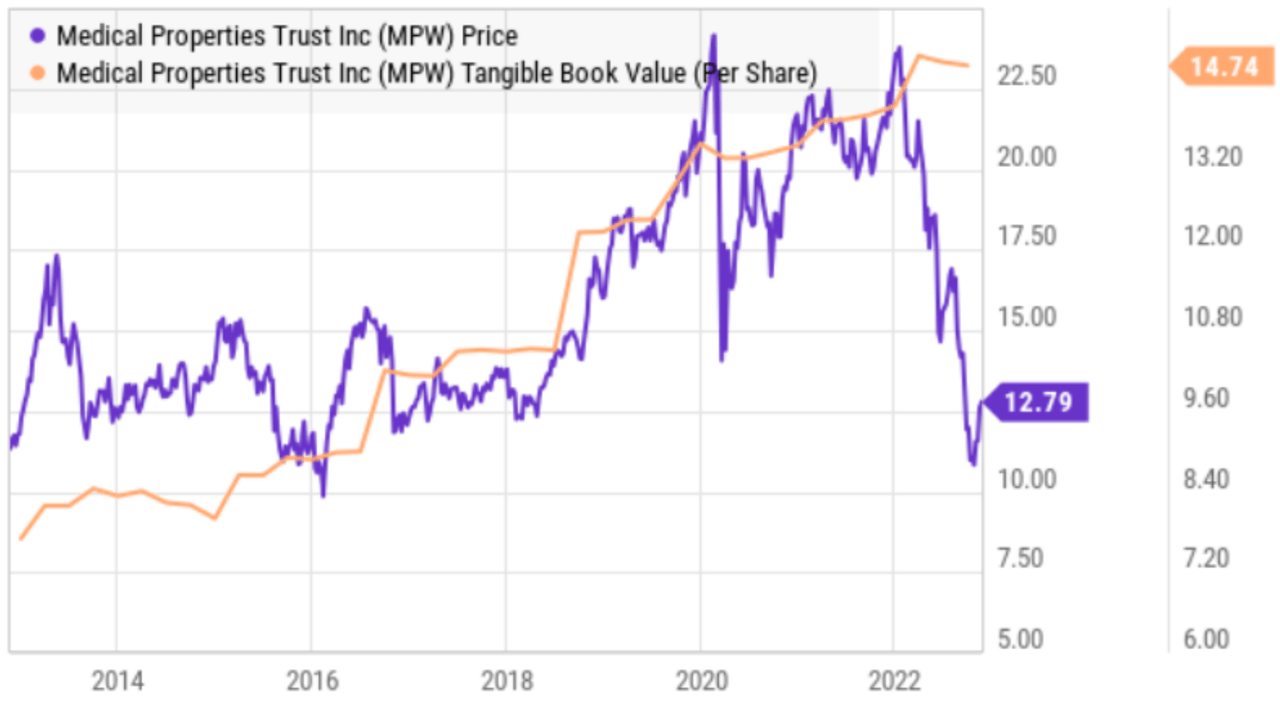

Next, here is a look at MPW’s share price versus its book value per share.

YCharts

And again, the book value has held up very well versus the share price—an indication the shares are undervalued. Granted, if any operators cease to be a going concern (which is unlikely considering their strategic importance to the communities in which they exists) that will create challenges, but those challenges appear less severe than the market fears, in our view.

Also worth noting, Medical Properties Trust recently announced its board authorized the repurchase of up to $500M of stock before October 2023, perhaps a strong indication of value.

Medical Properties Trust Bottom Line:

MPW is not appropriate for the most risk averse investors. However, MPW may be worth considering if you can tolerate the volatility and if you hold it within the constructs of a prudently-diversified long-term portfolio. In our opinion, the shares are particularly compelling if you consider the improving fundamentals combined with the potential for a massive short-squeeze (i.e. short-sellers may be forced to cover as conditions improve—which would drive shares higher) and quite possibly an epic fed pivot (as inflation slows, so too may the interest rate hikes that have been hampering MPW). We currently have a small position in MPW shares within our Income Equity Portfolio and look forward to receiving large dividends combined with the potential for significant share price appreciation.

Simon Property Group (SPG), Yield: 6.0%

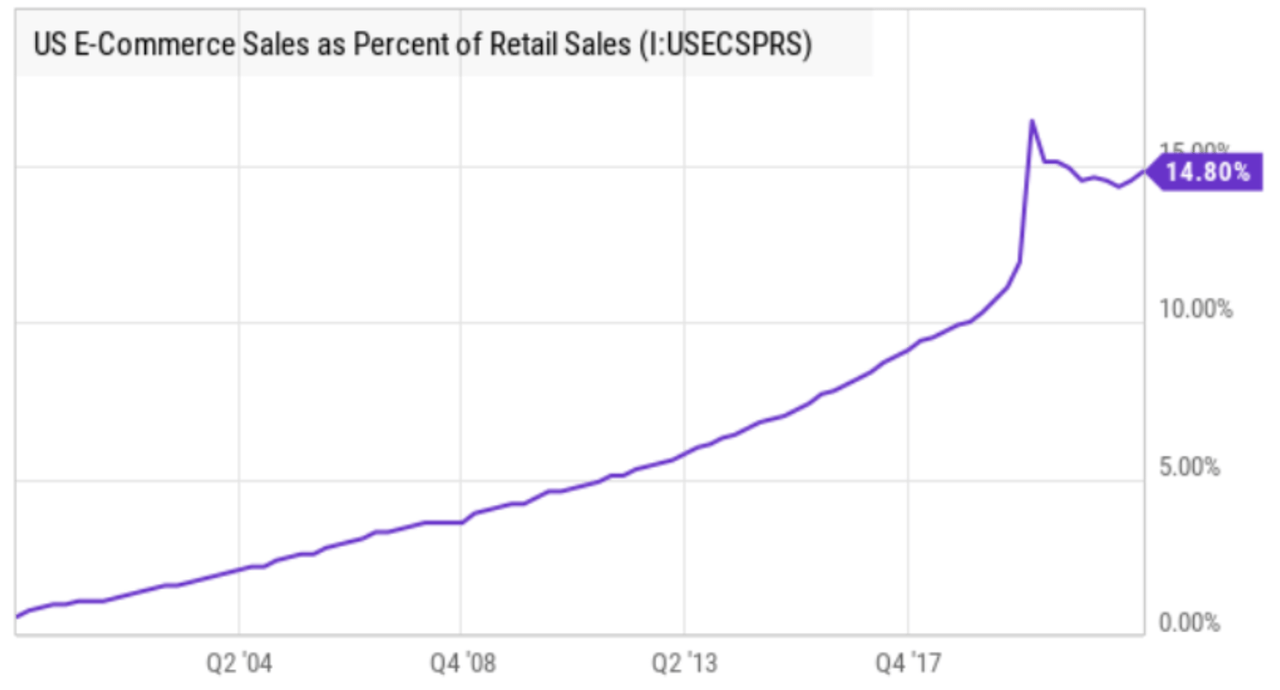

Switching gears, and as you can see in our earlier table on retail REITs, most of them (such as Simon Property Group) have also been ugly this year, and over the past few years as well. The very high-level oversimplified explanation for the weak performance for retail REITs in general is that online shopping is destroying demand for retail properties, as you might infer from the chart below.

YCharts

And while there is some truth to the “death-of-brick-and-mortar-real-estate” narrative, not all retail real estate is actually dying. In fact, A-class retail properties will continue to grow over time as the old adage “location, location, location” matters just as much now as it ever has. As we will explain below, our expectation is that poorly-located retail real estate is entering a “death spiral,” but select prime location properties will continue to grow over time (and keep paying big growing dividends).

Simon Property Group is the largest retail mall REIT (shopping malls and premium outlets) in the US. It is focused mainly on A-class properties (more than 80% of operating income), whereas B-class constitutes ~15% of NOI and C-class (and below) less than 1.0%. Without doubt, the ongoing growth of online shopping is disrupting the retail industry, but it is our view that A-class properties will not only survive, but also thrive, whereas C-class and lower will become largely extinct over the next decade.

Simon Property Group

We recently wrote up Simon in detail for our members, but the basic thesis is that despite the market’s hatred for retail REITs, Simon has a very strong “investment grade” balance sheet, an extremely well-covered dividend (that will likely keep growing as the payout ratio is still overly conservative following the pandemic, see table above), a compelling low valuation multiple (forward P/AFFO is below 11x), and its properties are located in highly sought after locations (based on foot traffic and the need for prime retail locations for companies to market to their omni-channel customers). If you are looking for an attractive long-term contrarian opportunity, Simon Property Group is worth considering.

Digital Realty Trust (DLR), Yield: 4.4%

Next, and as you can see in our earlier table on specialty REITs, the specialty REIT industry is diverse. However, one interesting subset of the group is data centers. Data centers basically house servers to support data that is “in the cloud.” And considering the massive secular trend by enterprises around the globe to digitize everything and then migrate it to the cloud for better access, data center REITs (such as Digital Realty (DLR), Equinix (EQIX) and now even Iron Mountain (IRM) to some extent) stand to benefit.

Like the entire real estate sector, most data center REITs have sold off hard this year. And one common negative viewpoint is that they are becoming increasingly obsolete faster than they can build out (or acquire) properties to meet demand. For example, according to Morningstar analyst, Matthew Dolgin, who has a “buy rating” on data center REIT, Digital Realty:

“Virtualization and other technological advances could allow Digital’s tenants to do more with less space and fewer connections, reducing their data center needs.”

Digital Realty shares in particular have sold off way too hard this year as it’s gotten caught up in the tech sell off (i.e. tech stocks are down more than the market averages this year). However, DLR has low debt, a very reasonable valuation and a dividend (that has been growing every year for 10+ years) that is well covered by FFO. In our view, the selloff is overdone, and DLR currently represents an attractive value. Simply put, if you are looking for a steady big-dividend with some reasonable share price appreciation potential, Digital Realty is a blue chip REIT worth considering.

Takeaways:

In our view, Medical Properties Trust, Simon Property Group and Digital Realty have fallen too far out-of-favor with the market, thereby making them attractive long-term contrarian opportunities (based on their ongoing value creation and dividend distributions). And if you appreciate these ideas and the data tables in this report, we share a few more in our newest article: Top 10 REITs (Big Dividends, Discounted Prices). Just know that long-term income-focused value investing can be volatile, and it is not right for everyone (for example, you may prefer the higher safety high-income opportunities we wrote about in this new report: Top 10 Big-Yield Bonds). At the end of the day, it’s critically important to know your own personal goals as an investor, and then to stick to a disciplined strategy that works for you.

Be the first to comment