MoMo Productions/DigitalVision via Getty Images

Thesis

Fiverr International Ltd. (NYSE:FVRR) stock has rightly been sold off amidst these difficult market conditions. However, management’s response combined with broader industry tailwinds makes Fiverr a great long-term investment. Still, its valuation presents a low margin of safety, and I don’t advise starting a position for short to medium-term gains.

Background

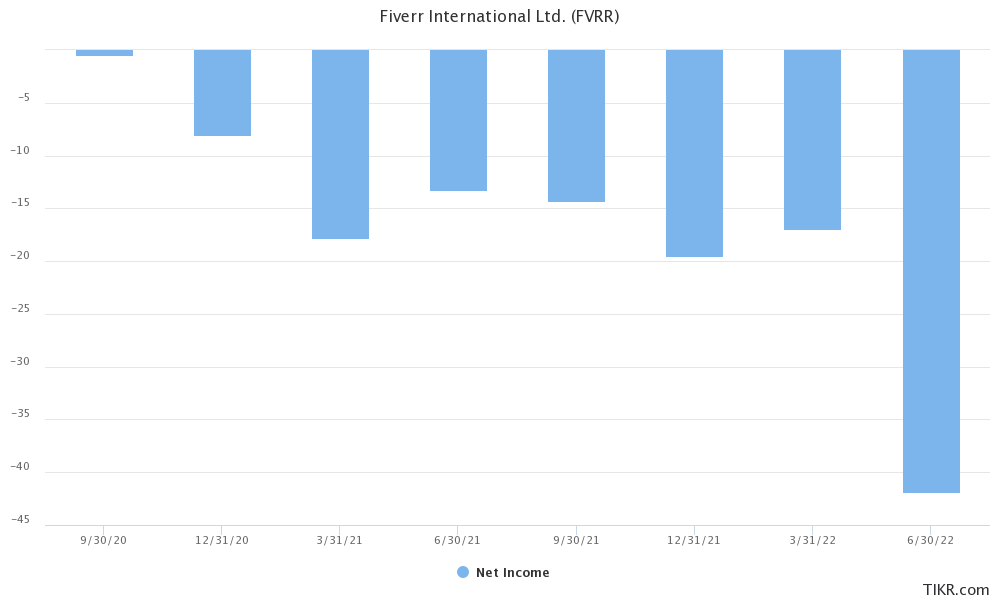

Fiverr’s stock has fallen over 70% YTD and over 90% from its peak. On a broader scope, this isn’t surprising given we are in a bear market. Rising interest rates – and the Fed’s determination to continue until inflationary targets are met–have only exacerbated the selloff of tech stocks. It doesn’t help that Fiverr has had a trend of losses, with earnings continuing to decline quarter after quarter. As the company continued to lower expectations, the stock followed with waves of selloffs.

TIKR Terminal

In their Q2 earnings call, management blames the decline on the broader macro conditions, saying that it impacted consumer spending power. I would expect this problem to be exacerbated, as Europe faces a harsh winter and over 25% of revenue came from Europe in FY 2021.

Q2 2022

In Q2 of 2022, Fiverr reported revenue of $85M, with a growth of about 12.9% YoY. It missed the analysts’ estimations by $1.71M. Despite revenue not meeting expectations, the company’s EPS was about $0.13, beating expectations by $0.04. For FY 2022, management’s outlook remains positive and expects revenue to be between $332M to $340.0M, with a YoY growth between 12% to 14%.

Management’s response

Recognizing these challenges, the company is making changes accordingly.

First, they are investing in moving revenue upstream, and that has paid off. They’ve been investing in Fiverr Business, which is a segment of their business that serves larger customers. As a result, the number of buyers who spent over $10,000 per year increased by over 60% YoY, and Fiverr Business already represents 5% of total marketplace GMV despite launching only 2 years ago. With this initiative, Fiverr will be able to enjoy a steady stream of cash flow as it endures the recession.

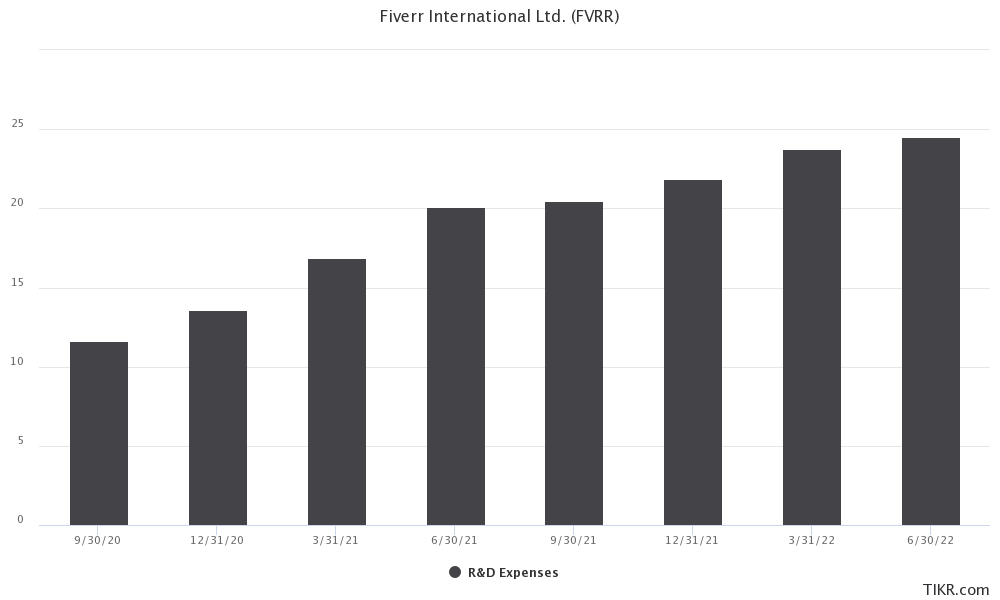

Second, they are cutting costs, improving their balance sheet, and waiting for better opportunities to invest in growth. Operating expenses have decreased from $86.8M to $82.5M QoQ while cash has increased from $346.2M to $417.2M QoQ. They also have a healthy current ratio of 2.7x. However, Fiverr’s growth story is not over. R&D expenses have continued to increase despite the tough macro environment. Rather than focusing on short-term growth, the company has its eyes set on the long run and plans to double down on growth once market conditions improve.

TIKR Terminal

Tailwinds for Fiverr in the Long Term

Firstly, Fiverr benefits from the secular shift towards freelance work. The global Freelance market size is projected to reach 9.2B USD by 2027, with a 15.3% CAGR. As workers experience better flexibility, employers benefit as well. Even if economic conditions worsen, companies will be forced to cut costs–one of which includes switching to freelancers in order to avoid the overhead costs of a traditional workforce. Surveys indicate that “78% of business leaders are more likely to hire freelancers rather than full-time employees while economic conditions remain uncertain.”

In addition, customers have shown that they value freelancers and the service that Fiverr provides. Management reported in their Q2 earnings call that even older pre-COVID cohorts continue to spend more today than they did pre-COVID.

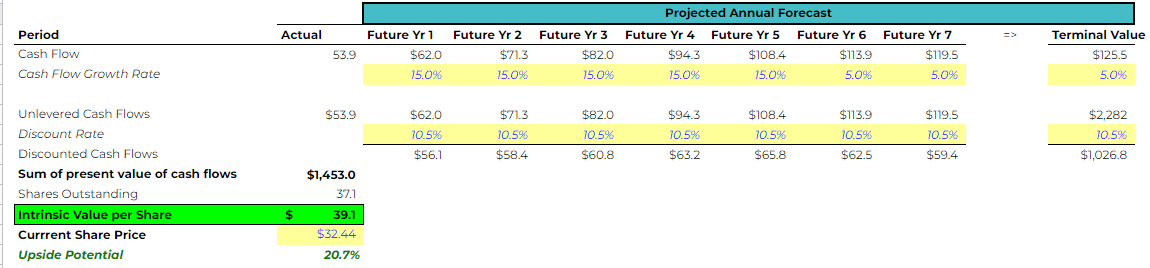

Valuation

To value Fiverr, I performed a discounted cash flow (“DCF”) analysis. Because the company is in its decelerated growth phase, I used a terminal growth rate of 5%. I also used a discount rate of 10.5% and a conservative growth rate of 15%. This yielded a price target of $39.1, or a 20% upside, and is in line with targets from Wall Street.

Excel Yahoo Finance

Risk

However, I personally will not be getting in on Fiverr at these prices for two reasons. Number one, the company is still in a cost-cutting phase where it’s trying to maintain its balance sheet; this means slower growth in the short to medium term. The Fed’s continued interest hikes combined with the company’s unprofitability could likely lead to further declines in its stock. Not to mention, Europe currently presents a huge uncertainty for the company because of the energy crisis and its representation in the company’s revenue.

Consequently, the second reason I’m waiting for better opportunities is that I see a low margin for safety to buy at current prices. I believe that the stock could go down further amidst this bear market and that it hasn’t dropped enough to constitute a sufficient margin of safety.

Conclusion

I believe in the long-term prospects of Fiverr as the company benefits from secular growth. In the short to medium terms, however, I believe it is very difficult to predict its movements. Thus, I would caution against starting a position for investors with a shorter time horizon–especially given the low margin of safety. Personally, I will remain on the sidelines and continue to monitor the stock for developments and better buying opportunities.

Be the first to comment