franckreporter

While the recent lifting of the iPath Series B S&P 50 VIX Short-Term Futures ETN (BATS:VXX)’s issuance halt is welcome news, investor enthusiasm for VXX may not return to the same levels prior to the halt. There are comparable products on the marketplace that do not have the issuance halt/short squeeze risk of VXX.

Brief Fund Overview

The iPath Series B S&P 500 VIX Short-Term Futures ETN (“VXX”) is an exchange traded note (“ETN”) offered by Barclays Bank PLC. It offers investors exposure to short-term VIX futures. The ETN currently has $550 million in assets.

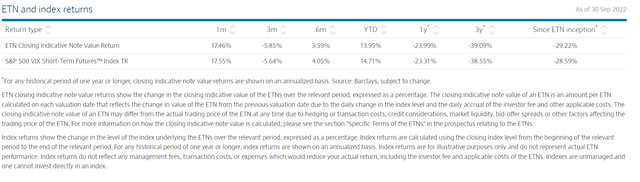

The VXX ETN achieves its investment objective by tracking the S&P 500 VIX Short-Term Futures Index, which holds the first and second month VIX futures in a 45/55 ratio (Figure 1).

Figure 1 – VXX Exposure (ipathetn.barclays)

VXX Was Popular Among Day Traders And Short-Vol Traders

Although VXX’s long-term performance has been very poor, with 3-Yr annualized returns of -39.1%, the VXX ETN was very popular among day traders who wanted to bet against the market (Figure 2).

Figure 2 – VXX Historical Performance (ipathetn.barclays)

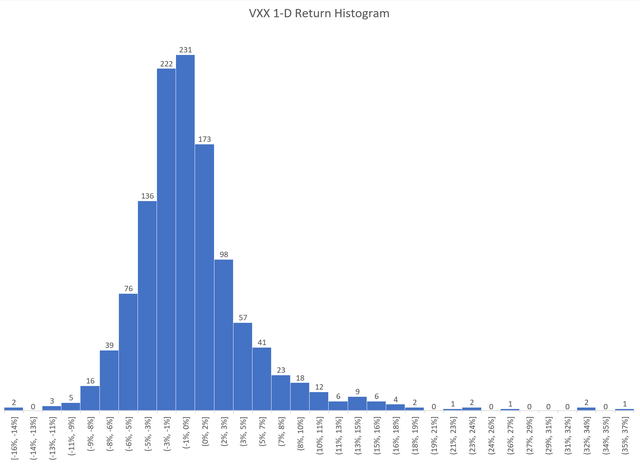

This is because the VXX ETN’s tracking of short-term VIX futures meant that over short periods of time, the returns of owning VXX can be extraordinary. Figure 3 shows the VXX ETN’s 1-Day return distribution. Although the median return is negative 0.73%, the distribution has some extreme positive returns during market drawdowns such as a 34% rally on February 5, 2018 (6.8 standard deviation) or a 37% rally on March 16, 2020 (7.5 standard deviation).

Figure 3 – VXX 1-Day Return Histogram (Author created with data from stockcharts.com)

Timed right, owning VXX during market drawdowns can produce some dramatic returns. Over the early days of COVID-19 pandemic, VXX went from $55 on February 18, 2020 to an intraday high of $315 on March 18, 2020!

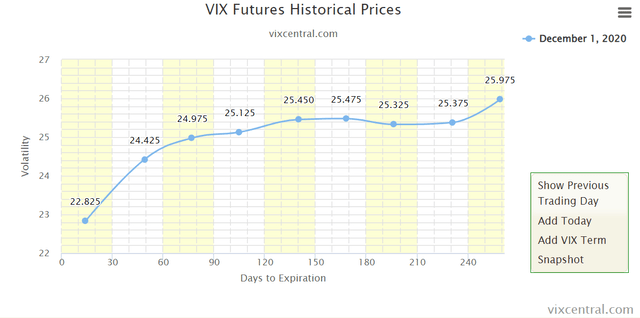

Traders also loved to short the VXX. This is because of how the ETN is set up and the nature of volatility. Normally, the VIX futures curve is upward sloping (contango), i.e. dates farther out in the future have higher volatilities (Figure 4).

Figure 4 – Illustrative VIX Futures Curve (vixcentral.com)

Since VXX provides exposure to the front two months on the VIX futures curve, it experiences negative roll expense each and every month. When the 1st month expires, assuming no shift in overall level of volatility, the 2nd month future that VXX owned will ‘roll’ down to be the 1st month and its value will decrease. VXX will also need to buy new 2nd month futures to replace the one that rolled.

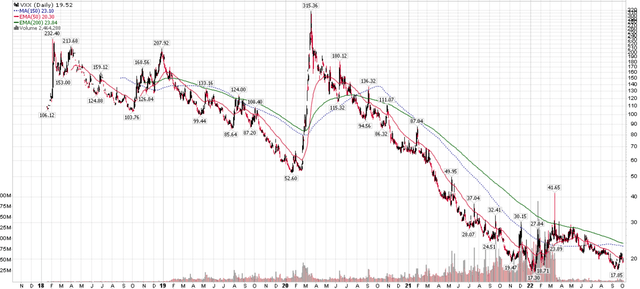

This negative roll expense pretty much guarantees VXX ETN holders to lose money over the long-term. Since the inception of VXX (note, the current iteration of VXX shows a start date in 2018, however, there was a prior iteration of the VXX ETN that used the same ticker and operated essentially in the same manner), the ETN has lost over 80% of its value, despite the volatile COVID-pandemic, which saw the ETN 6x in value in a matter of weeks (Figure 5).

Figure 5 – VXX has lost 80% of value since inception (stockcharts.com)

The push and pull from traders wanting to bet on the rise and fall of volatility made VXX one of the most traded securities in the market, regularly trading over $1 billion in value, despite its relatively small size. That dynamic came to an abrupt halt in March 2022.

Issuance Halt Wreaked Havoc On Unitholders

On March 14, 2022, Barclays abruptly announced it was halting the creation of new VXX ETN units. At first, nobody knew the reason behind the issuance halt, with some conspiracy theorists on reddit speculating the issuance halt was an intervention to prevent further market declines (the S&P 500 had fallen by approximately 10% YTD by early March).

In fact, there was a much simpler explanation. What actually happened was that the bankers in Barclays’ ETN unit thought they had an automatically renewing shelf prospectus, but due to a prior trading scandal, that license was revoked by the SEC and the bank only had a $20.8 billion shelf prospectus covering its ETN products. By March of 2022, Barclays had issued securities, including units of the VXX ETN, that exceeded its shelf prospectus limit by over $15 billion dollars. Hence, the SEC forced the bank to halt the issuance of new units and conduct a rescission offer to buyback the affected securities. Ultimately, Barclays was able to settle the issue by offering to pay $361 million in fines and penalties.

While Barclays was able to resolve the issue with a relatively minor slap on the wrist, the issuance halt severed the link between the market price of the VXX ETN and the underlying ‘value’ of the VIX futures. Without new VXX ETN units, investors who were short the VXX were ‘squeezed’ and had to pay a large premium to NAV to cover their shorts. In the months after the debacle, VXX’s premium to NAV traded as high as 30% (Figure 6).

Figure 6 – VXX Premium To NAV (ycharts.com)

Issuance Halt Resolved; Once Bitten, Twice Shy?

Recently, on September 19th, Barclays announced the resumption of ETN issuance, including the VXX. So far, investor reception has been lukewarm, as trading volumes of the VXX ETN is less than 10% of the volume prior to the March halt.

While VXX issuance was halted, a number of other VIX products took the mantle and became investor favorites. For example, the ProShares VIX Short-Term Futures ETF (VIXY) saw its trading volume explode from tens of millions dollars per day in 2021 to hundreds of millions of dollars per day in 2022 (Figure 7). Similarly, trading in ProShares Ultra VIX Short-Term Futures ETF (UVXY) also increased significantly.

Figure 7 – VIXY volumes traded increased dramatically in 2022 (stockcharts.com)

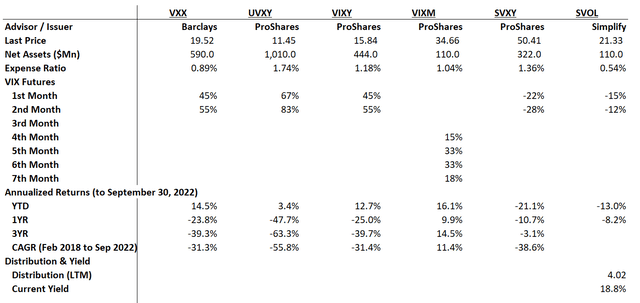

Comparing between the popular VIX products currently in the market, we can see the reasons why VXX may have lost some luster (Figure 8). First, in terms of exposure, the VXX provides the same VIX futures exposure as the VIXY. However, VIXY does not run into the capacity issue that affected VXX, as it is an ETF and not an ETN (which requires a shelf prospectus).

Figure 8 – Comparison of popular VIX products (Author created with returns data from Portfolio Visualizer and fundamental data from Seeking Alpha and company websites)

Second, for traders who want more exposure to VIX futures, UVXY provides more VIX futures exposure.

Finally, for those who want to short volatility, they can do so via the ProShares Short VIX Short-Term Futures ETF (SVXY) or the Simplify Volatility Premium ETF (SVOL), products that short VIX futures without running the risk of a short-squeeze. (Author’s note, I have written an article on the SVOL ETF that may be of interest to readers).

Conclusion

While the lifting of VXX’s issuance halt is welcome news for market participants, investor enthusiasm for VXX may not return to the same levels prior to the halt. There are comparable products on the marketplace that likely do not have the issuance halt/short squeeze risk of VXX.

Be the first to comment