Olemedia

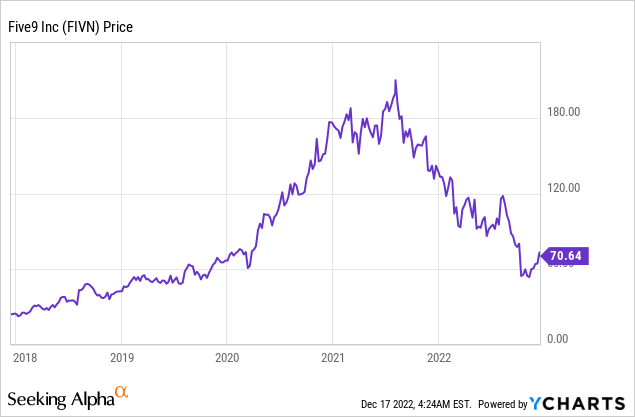

Five9 (NASDAQ:FIVN) is a leading provider of cloud software for contact centers. The company offers a great technology solution that is poised to benefit from the digital transformation of organizations. This industry was valued at $609 billion in 2021 and is forecasted to grow at a 23% compounded annual growth rate up until 2030. In the third quarter of 2022, Five9 reported strong financial results, that beat analyst estimates for revenue, and the company improved its adjusted EBITDA significantly. In this post, I’m going to break down the company’s business model, financials, and valuation, let’s dive in.

Business model

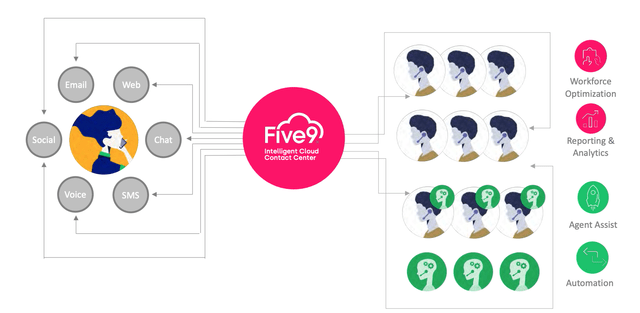

Five9 is a leading provider of virtual contact centers. Traditional contact or call centers generally consist of expensive office space with high overheads and offer limited flexibility for reduction or expansion with demand. Cloud contact centers solve this problem as they effectively utilize a series of data centers and software which can be used remotely by any employee around the world. This means companies don’t need to rent out expensive office space and can also flexibly scale the software with new employees easily. The graphic below shows the global footprint of data centers Five9 has globally.

Data Centers (Five9 Investor Presentation)

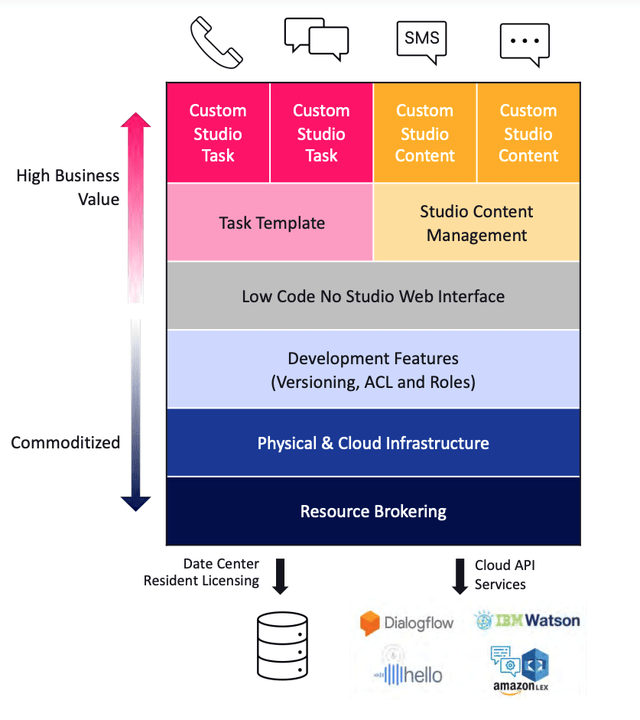

The “Virtual” contact center platform also has many extra benefits such as the ability to utilize AI-powered assistants and Automation. The technology can also be used to run natural language processing [NLP] on calls in order to gauge sentiment, as positive or negative. Businesses can also see analytics such as the average time per call for each caller and further optimize their operations.

Five9 setup (Investor Presentation)

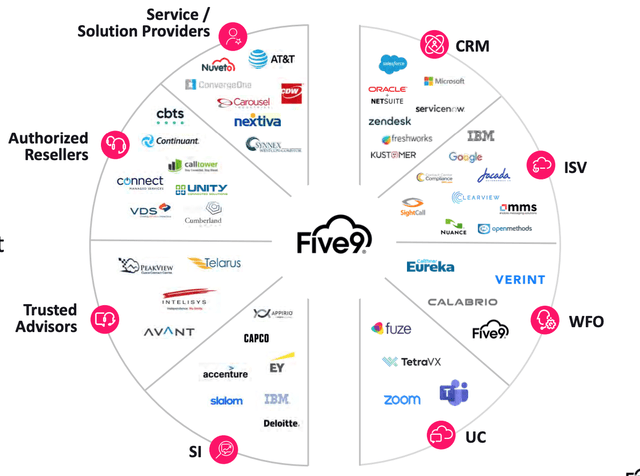

The company also offers a series of API integrations with popular CRM (Customer Relationship Management) tools such as Salesforce and ServiceNow in order to automatically update interrogations. Various “Studio tasks” can be created via an intuitive low-code solution which makes it easy to customize.

Five9 has 4.5 out of 5 stars on Gartner and competes with products such as Amazon Connect by Amazon Web Services, Talkdesk, and 8×8.

Third Quarter Financials

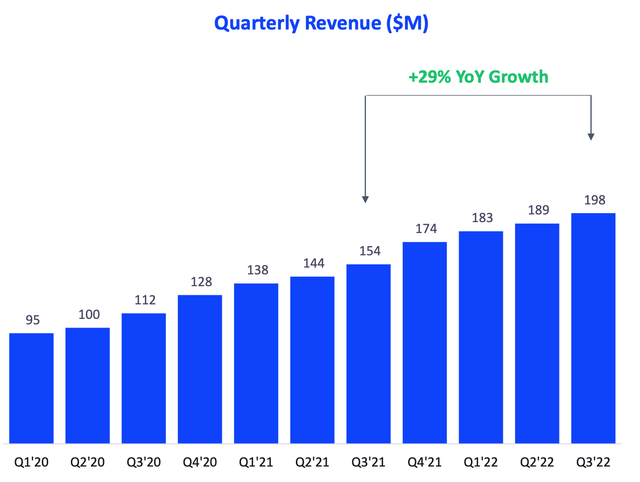

Five9 reported solid financial results for the third quarter of 2022. Revenue was $198.34 million which increased by a rapid 29% year over year and beat analyst expectations by $2.65 million.

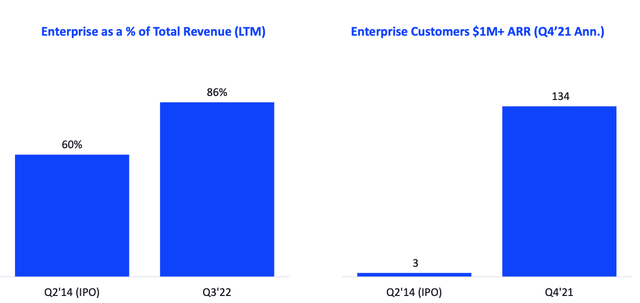

Five9’s “upmarket” strategy was the main driver of its successful business results. The company increased its enterprise subscription revenue by 37% year over year in the last twelve months. Enterprise sales as a portion of total revenue has also increased to 86%, compared to just 60% at its IPO. Its largest customers with over $1 million in Annual Recurring Revenue [ARR] also increased to 134, from just 3 customers in 2014 at its IPO.

Enterprise Revenue (Q3,22 report)

Notable customer wins in the third quarter include a Fortune 200 global leader in heating, ventilation, and air conditioning [HVAC] which signed a $4.7 million ARR deal with Five9. This company chose Five9 as its competitor products required extensive software development for customizations, and Five9 was more of a plug-and-play solution. Another example is a large U.S. medical practice with over 350 locations across the northeast. Booking appointments with a doctor is a key use case for a contact center. Five9 offered greater flexibility and security than their legacy solution.

Five9 also reported strong expansion in its existing customer accounts. For example, a parcel delivery service customer increased their ARR by $5 million as they expanded into the APAC region. A regional bank also opted to expand its usage of Five9 following a merger with another bank that had a legacy on-premises system by Cisco. This new contract will result in an ARR increase from $600,000 to $1.6 million.

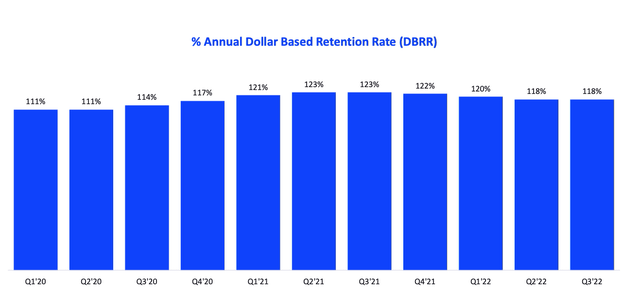

Strong expansion metrics mean it is no surprise that Five9 has a dollar-based retention rate of 118%. This is fantastic as it means customers are staying with the platform and spending more.

A key growth driver for Five9 has also been its vast partner network and connections with ISV [Independent Software Vendors]. This has acted as a “force multiplier” which has helped to scale the solution.

Partner Network (Q3,22 report)

Five9 has also been aggressively expanding its operations outside of the U.S, with a series of investments. These investments have paid off, as the company increased its international bookings by a fantastic 78% year over year.

Profitability and Cash Flow

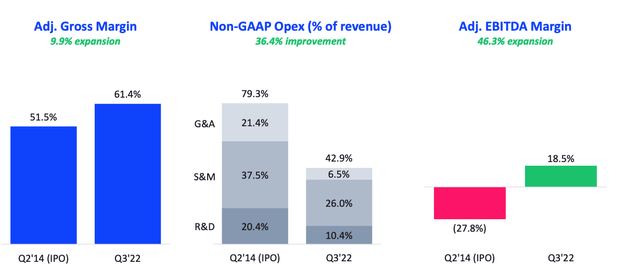

As a software company, Five9 has a high adjusted gross margin of 61.4%. This did decline by 270 basis points year over year, but it has improved 70 basis points versus the prior quarter. The company has also driven down its operating expenses [Non-GAAP] from 79.3% to 42.9% of revenue, which is a substantial improvement. This has resulted in its Adjusted EBITDA margin jumping from negative 27.8% to a fantastic 18.5%. Non-GAAP earnings per share was $0.39, which beat analyst expectations by $0.04.

Adjusted Gross Margin (Q3,22 report)

Five9 has a strong balance sheet with $577.1 million in cash and short-term investments. The company does have $790 million in total debt but just $200,000 of this is short-term debt and thus manageable.

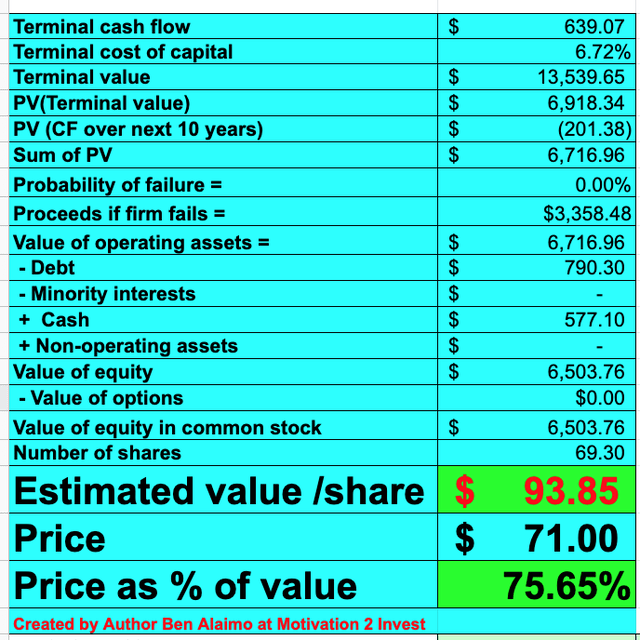

Advanced Valuation

To value Five9 I have plugged the latest financials into my advanced valuation model which uses the discounted cash flow method of valuation. I have forecasted 16% revenue growth for next year, which is based on management’s conservative guidance, given the macroeconomic environment. In years 2 to 5, I have forecasted revenue growth to increase to 30% per year as I believe economic the situation will improve. In addition, the guided 2022 growth rate for the full year is 27%, so a 30% growth rate is not out of the question.

Five9 stock valuation 2 (Q3,22 report)

To increase the accuracy of the valuation I have capitalized R&D expenses, which has lifted net income. In addition, I have forecasted its pre-tax operating margin to increase to 24% over the next 8 years, as the company continues to drive down its operating expenses.

Five9 stock valuation (Created by author at Motivation 2 Invest)

Given these factors I get a fair value of $94 per share, the stock is trading at $71 per share at the time of writing and thus is ~24% undervalued.

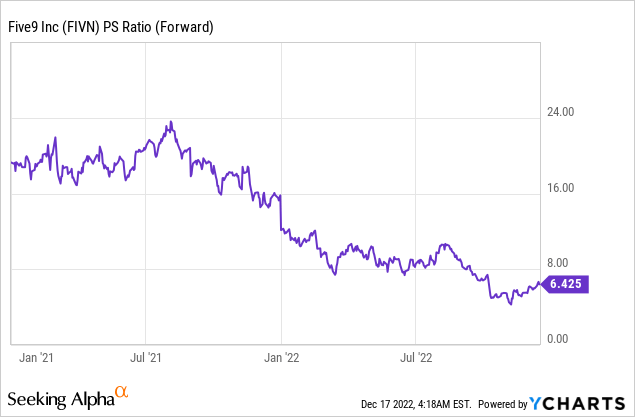

As an extra data point, Five9 trades at a Price to Sales ratio = 6.5, which is 55% cheaper than its 5-year average.

Risks

Recession/competition

Management noted that the company has seen some weakness in demand from its medium-sized business customers. I suspect this is due to economic uncertainty and delayed spending which is likely, at least in the short term. The company also faces a lot of competition in the Cloud contact space from the aforementioned products such as Connect by AWS and 8×8.

Final Thoughts

Five9 has developed a leading cloud contact center solution and has executed its enterprise growth strategy to a tee. The business is expanding internationally extremely well and benefits from high customer account expansion. Its stock is undervalued intrinsically at the time of writing and relative to historic multiples. Therefore, it could be a great long-term investment opportunity.

Be the first to comment