PM Images

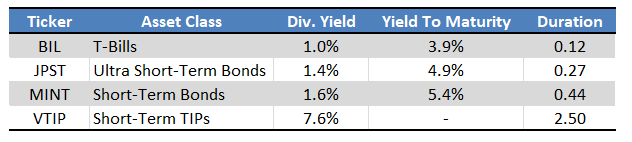

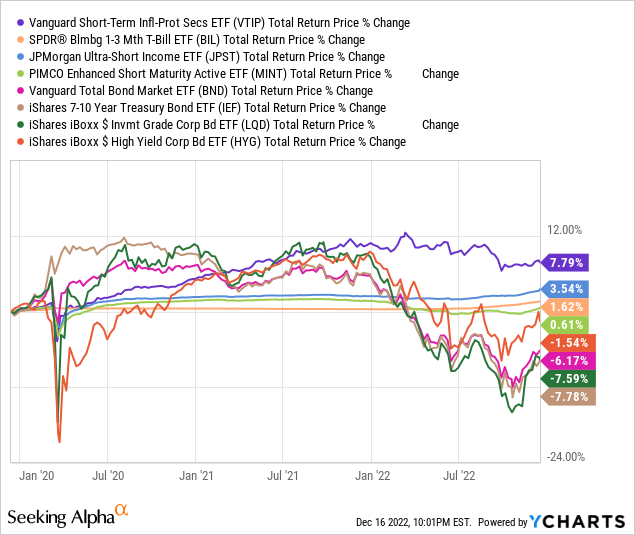

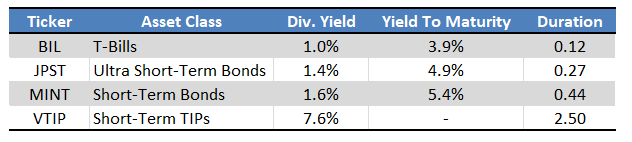

I’ve covered several cash replacement ETFs in the recent past, including those focused on T-bills, short-term bonds, and short-term TIPs. Due to reader interest, thought to do a quick article summarizing some of these ETFs, and detailing their most important characteristics and advantages. All funds have low credit and interest rate risk, but also have relatively low forward yields and expected returns. Specifics differ.

The SPDR Bloomberg Barclays 1-3 Month T-Bill ETF (BIL) invests in T-bills, and has the lowest 3.9% yield to maturity / forward yield of the bunch. It is also the lowest risk, most stable fund in its peer group.

The JPMorgan Ultra-Short Income ETF (JPST) invests in ultra short-term bonds, is slightly riskier than BIL, but has a higher 4.9% yield to maturity / forward yield.

The PIMCO Enhanced Short Maturity Active Exchange-Traded Fund (MINT) invests in very short-term bonds, is slightly riskier than JPST, but has a higher 5.4% yield to maturity / forward yield.

The Vanguard Short-Term Inflation-Protected Securities ETF (VTIP) invests in short-term inflation-protected treasuries, or TIPs. VTIP is the riskiest of the bunch, but sports a massive, inflation-protected 7.6% dividend yield. VTIP’s dividends are strongly dependent on inflation rates, should decline as inflation normalizes, but could increase if inflation picks up again. VTIP is the riskiest of the bunch, but is still a broadly low-risk, stable, fund, and particularly appropriate for those wishing to safeguard their portfolios against inflation.

Finally, a quick table with pertinent information for each fund. I’ve included both backward-looking dividend yields, and more forward-looking yield to maturities. The latter are much more indicative of the dividends investors can expect moving forward.

Fund Filings – Chart by author

BIL – Treasury Bills

BIL is a simple T-Bill ETF. It invests in all publicly issued U.S. Treasury Bills with a remaining maturity of between 1 and 3 months, subject to a basic set of inclusion criteria.

BIL’s holdings are all treasuries, issued by the U.S. Treasury, and backed by the full faith and credit of the U.S. government. Credit risk is effectively nil, barring an unprecedented U.S. government default. As such, investors in BIL can be (almost) certain that their investment and capital is safe.

BIL’s holdings are all short-term securities, with an average remaining maturity of just 5 weeks. Short-term securities have very little interest rate risk, as their duration is quite low, and as they can quickly be replaced for newer securities as the need arises (you are not stuck with low yields for long if rates rise).

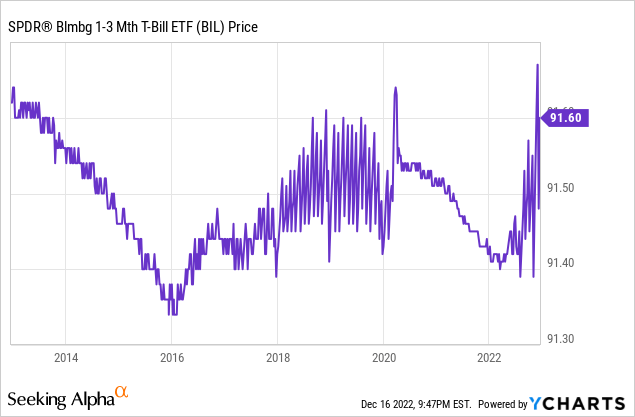

BIL’s holdings have low credit and interest rate risk, which ensures incredibly stable share prices and capital levels. The fund almost always trades in a very tight range, of between $91.30 and $91.60, equivalent to fluctuations of, at most, 0.30%. The fund suffered negligible losses during the most recent recession, early 2020, and during the most recent hiking cycle, all of 2022.

BIL’s low-risk holdings and stable share price make it a reasonably strong cash replacement ETF, albeit one with relatively low dividends and expected returns. BIL currently sports a trailing twelve-month yield of only 1.0%. Said yield does not fully account for recent dividend and interest rate hikes, so is not an accurate indicator of the dividends investors should expect moving forward.

Yield to maturity metrics are a forwards-looking measure of expected returns which, for bond funds, mostly consist of dividends. BIL currently sports a yield to maturity of 3.9%, a figure which is much more reflective of expected fund dividends. BIL’s dividend yield should increase to around 3.9% in the coming months. Yields should increase a bit more than that, contingent on further Federal Reserve hikes.

BIL’s dividends are reasonably good for its level of risk, but are lower than those of its peers. As such, the fund seems like a more compelling investment opportunity for more conservative, short-term investors, for whom capital stability and preservation is key. In my opinion at least. For investors looking for a bit more yield, JPST is a compelling choice. Let’s have a look.

JPST – Ultra Short-Term Bonds

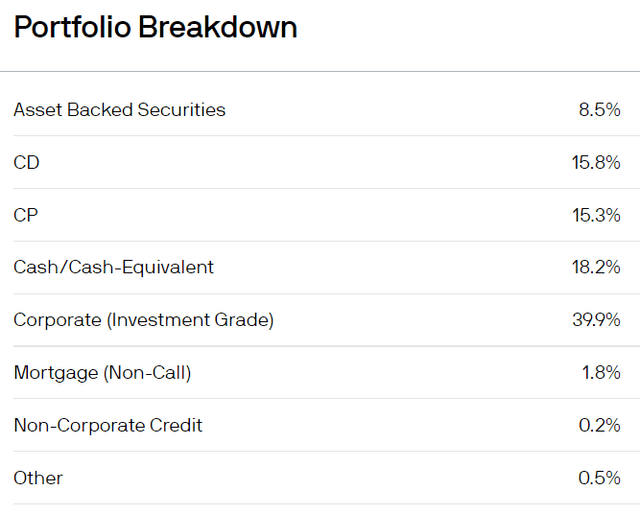

JPST is a simple, actively-managed ultra short-term bond ETF.

JPST’s holdings are reasonably well-diversified, with investments in over 600 securities, and with exposure to several sub-asset classes.

JPST exclusively invests in investment-grade securities, with an average rating of AA, and a modal rating of AAA. These are strong credit ratings, indicative of relatively safe, low-risk securities with low default rates. JPST’s underlying holdings should be paid back, in full, at maturity, with extremely few exceptions.

JPST focuses on ultra short-term bonds, with an average remaining maturity of 6 months, and an average duration of 3 months. Both are incredibly low figures, but about twice as high relative to BIL. Expect some losses when interest rates increase, but these should be relatively low, and short-lived.

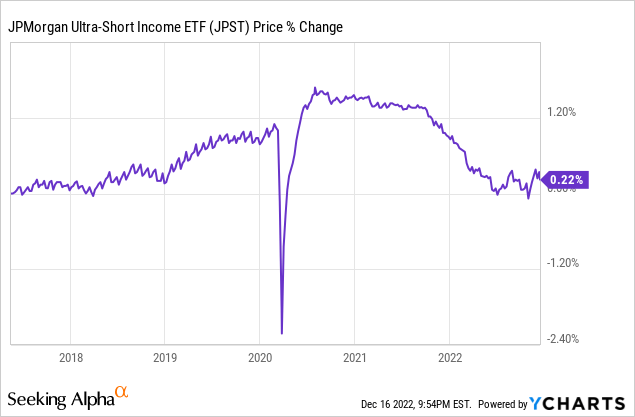

JPST’s low credit and interest rate risk serve to stabilize the fund’s share price, but to a lesser extent than BIL. The fund’s share price tends to oscillate between $50.00 and $50.60, with yearly movements of around 1.0% being common. JPST suffered losses of around 3.0% in early 2020, during the depths of the coronavirus pandemic, but these were mostly due to liquidity issues, and were extremely short-lived.

In my opinion, and if the past is any indication, the fund should suffer losses of around 1.0% during future recessions and interest rate hike cycles. These are very low losses, all things considered, but higher than those experienced by BIL (which were effectively zero).

JPST currently sports a dividend yield of 1.4%. As with BIL, this is a backwards-looking metric, and not indicative of the dividends investors can expect moving forward. JPST sports a yield to maturity of 4.9%, quite a bit higher than its dividend yield. Said metric is much more reflective of the dividends that JPST’s investors should expect moving forward. Dividends could be even higher, contingent on further Federal Reserve hikes.

JPST is a bit riskier than BIL, but also yields a bit more. Both funds are fine, but some might find JPST’s overall value proposition a bit more compelling. For investors looking for a bit more in yield, MINT might be an interesting choice.

MINT- Short-Term Bonds

MINT is a simple, actively-managed short-term bond ETF.

MINT’s holdings are reasonably well-diversified, with investments in over 600 securities, and with exposure to several sub-asset classes. MINT is more or less as diversified as JPST.

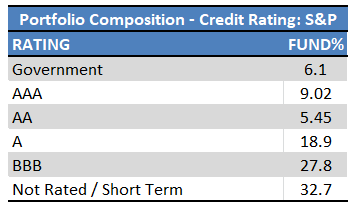

MINT exclusively invests in investment-grade bonds, with an average credit rating of A. These are strong credit ratings, indicative of relatively safe, low-risk securities with low default rates. MINT’s credit ratings are, on average, one notch lower than JPST’s ratings, so risks are slightly higher as well.

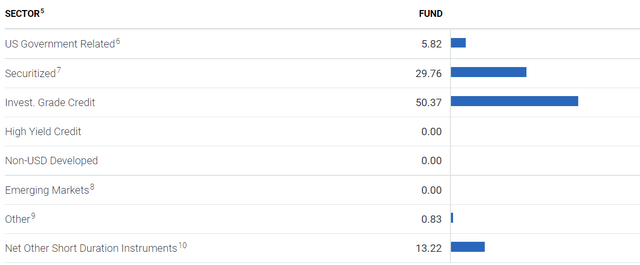

MINT – Chart by author

MINT focuses on short-term bonds, with an average maturity and duration of 6 months. MINT’s interest rate risk is quite low, but materially higher than BIL / JPST’s risk.

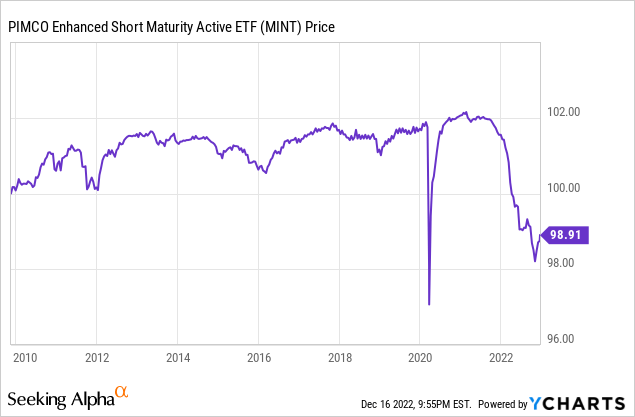

MINT has low credit and interest rate risk, which helps ensure a relatively stable share price. MINT’s share price oscillates between $98 and $102, a relatively tight range, although wider than BIL or JPST’s normal trading range.

MINT currently sports a dividend yield of 1.6%. As with its peers, the fund’s dividend yield is backwards-looking, and not reflective of the dividends that investors can expect moving forward. MINT sports a 5.4% yield to maturity, a more forwards-looking yield metric, and much more reflective of the fund’s expected future dividends. MINT should yield 5.4% in the coming months and years, perhaps a bit more if the Federal Reserve continues to hike rates.

MINT is a bit riskier than JPST, but yields a bit more as well. Both funds are reasonable, but some might find MINT’s value proposition to be a bit more compelling.

VTIP – Short-Term TIPs

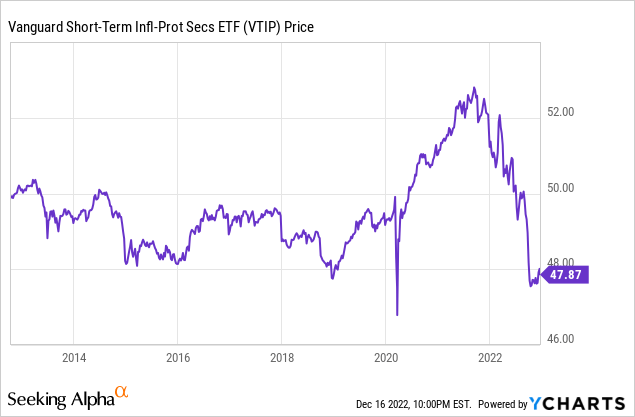

VTIP is a simple short-term TIPs index ETF.

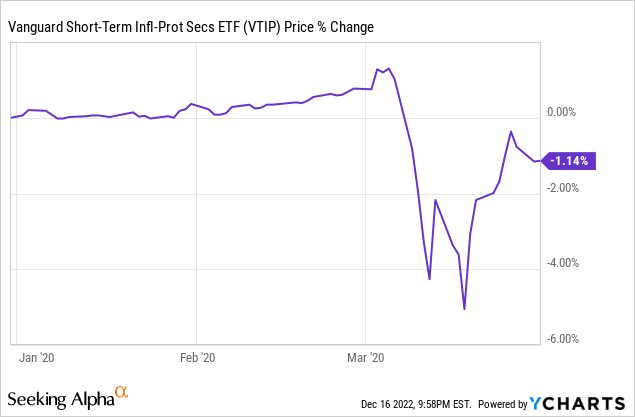

VTIP’s holdings are all treasuries, same as BIL. Credit risk is effectively nil, barring an unprecedented U.S. government default. As such, investors in VTIP can be (almost) certain that their investment and capital is safe. Losses during downturns and recessions should be very low / non-existent. As an example, VTIP suffered losses of around 1.1% in 1Q2020, the onset of the coronavirus pandemic.

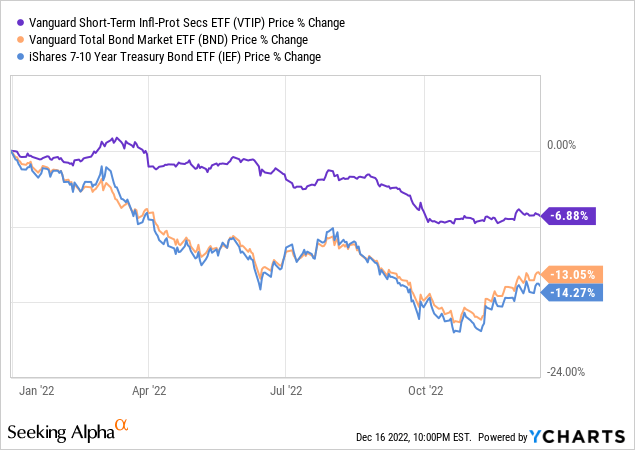

VTIP’s holdings are all short-term securities, with an average maturity and duration of 2.5 years. Although these are low figures on absolute terms, and lower than average for a bond index fund, all three other funds have significantly lower duration and interest rate risk. Expect below-average losses for VTIP when interest rates increase, but losses should still be material, and bite. As an example, VTIP’s share price has decreased by 6.9% YTD.

VTIP’s share price is reasonably stable, oscillating between $47 and $53 since inception. Reasonably tight range, but wider than for its peer funds.

In my opinion, VTIP is an incredibly safe, stable, fund, but too volatile as a replacement for cash. Still, some short-term investors might find the fund to be a reasonable choice for their needs and investment horizons.

VTIP’s underlying holdings are indexed against inflation, and so see rising dividends and strong returns when inflation is high and rising. Inflation has skyrocketed these past few months, causing VTIP’s dividend yield to balloon to 7.6%. It is a strong yield on absolute terms, higher than its peers, and higher than most broad-based index bond funds. Skyrocketing inflation has also led the fund to outperform relative to its peers for the past three years, and by quite a large margin.

VTIP’s inflation-protected holdings are a significant benefit for the fund and its shareholders, and its key advantage relative to its peers. VTIP seems like the clear choice for short-term investors concerned about inflation, in my opinion at least.

As a final point, as per fund and treasury date, VTIP currently yields around 1.0% plus inflation. Inflation averaged 7.1% in November, so VTIP returns would average 8.1% per year moving forward, contingent on inflation remaining as is. Inflation will very likely decrease, as it is significantly above target, and as the Federal Reserve is intent on reducing inflation through rate hikes. In my opinion, a yield of 1.0% plus inflation seems reasonably good, although obviously much will depend on how inflation evolves from here on out.

Conclusion

Short-term bond funds offer investors reasonably safe, good yields. The four funds mentioned here are all good short-term bond funds, and might be interesting opportunities for investors.

Fund Filings – Chart by Author

Be the first to comment