ablokhin

Last quarter, we said that Five Below becomes a needs-based retailer during the holiday season, and we are beginning to see that play out with improved transactions.

Joel Anderson, Five Below’s CEO, during the Q3 2022 earnings Call

Introduction

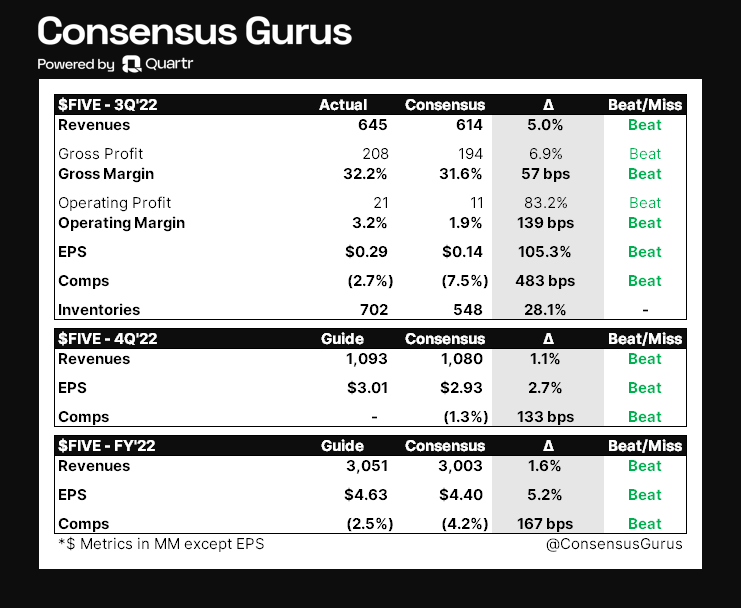

Five Below (NASDAQ:FIVE) reported very strong Q3 earnings on Wednesday last week. It was basically a beat on all fronts. Inventories were up more than expected, but we’ll explain why this isn’t worrying later on:

Consensus Gurus

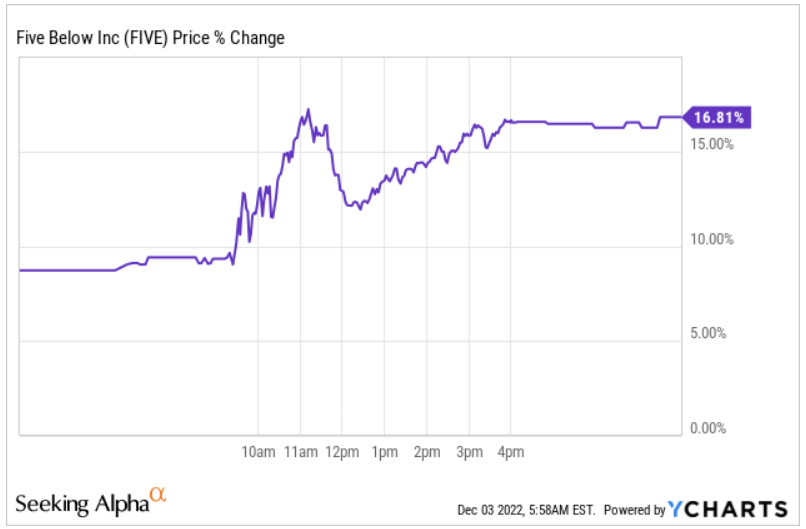

These numbers surprised the market, and Five Below’s stock increased the following day substantially. One doesn’t always see a 17% daily increase.

YCharts

Management claimed last quarter that they expected the consumer to go out of “freeze mode” as the year progressed and Five Below to benefit enormously from this trend. The thesis seems to be playing out just as management outlined, which is excellent news for investors for two reasons:

-

It should help investors trust management even more as they evidently understand the drivers of their business.

-

It should make investors more comfortable holding Five Below into a deteriorating macro environment.

So, without further ado, let’s get started.

The numbers

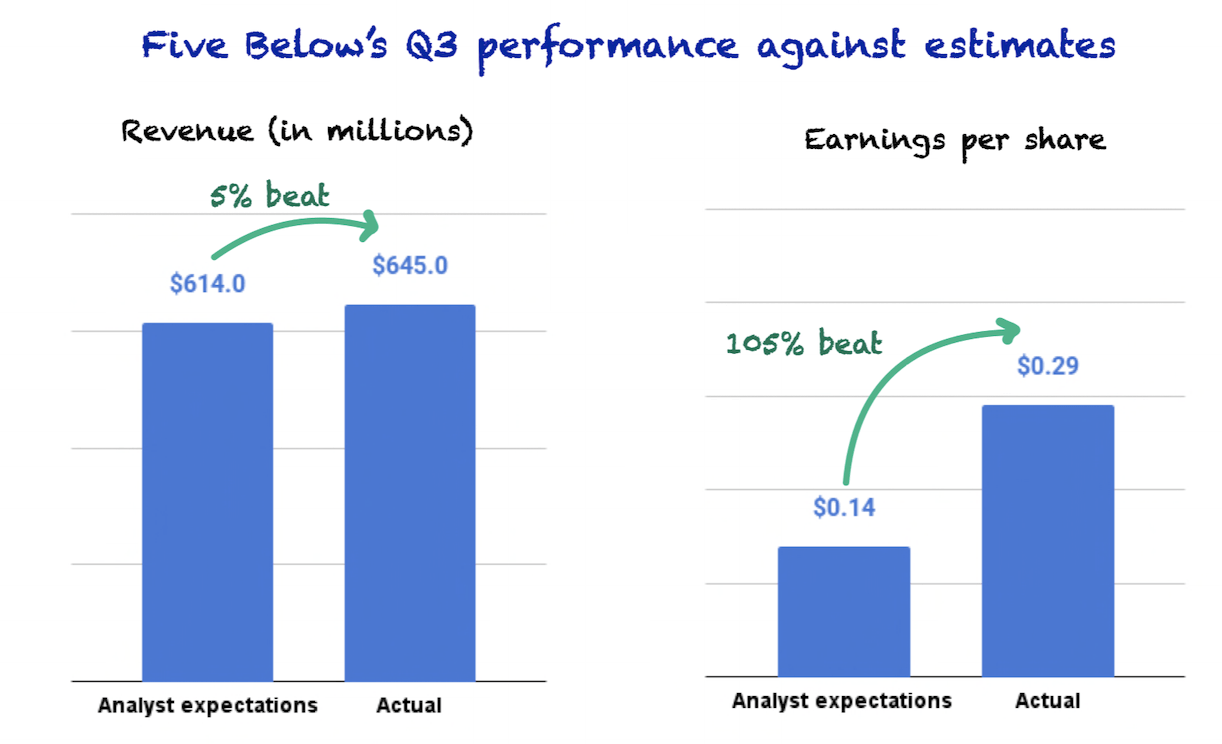

As discussed above, Five Below’s Q3 numbers were very strong. However, the most impressive thing was probably the outperformance on the bottom line, considering Five Below is a value retailer and, intuitively, should have fewer options to defend margins.

The headline numbers

Q3 sales came in at $645 million, up 6.2% year over year and significantly beating analysts’ expectations. Regarding EPS, they came in at $0.29, compared to the expected $0.14:

Made by Best Anchor Stocks

It seems like very few people trusted management’s cost-cutting initiatives to play out amidst high inflation. We believe the bottom line outperformance simply underscores the flexibility of the operating model despite the company’s “low” margins.

Contrary to Q3, Q2 headline numbers had not been great because management didn’t expect customers to go into freeze mode. Instead, the company expected customers to automatically shift to lower-priced goods amidst high inflation. This effect took longer than expected and was “deferred” to Q3.

The top line and its drivers: Comparable sales and store growth

Five Below has two main drivers of its top line: comparable sales and new store openings. Comparable sales refer to the increase or decrease in sales from stores that were already open in the comparable period. So, for example, comparable sales for Q3 2022 will be a calculation using only the changes in sales from those stores that were already open during Q3 2021. New store openings are pretty much self explanatory.

This quarter’s top-line outperformance was driven by comparable sales, as the company fell short of its store openings expectations once again.

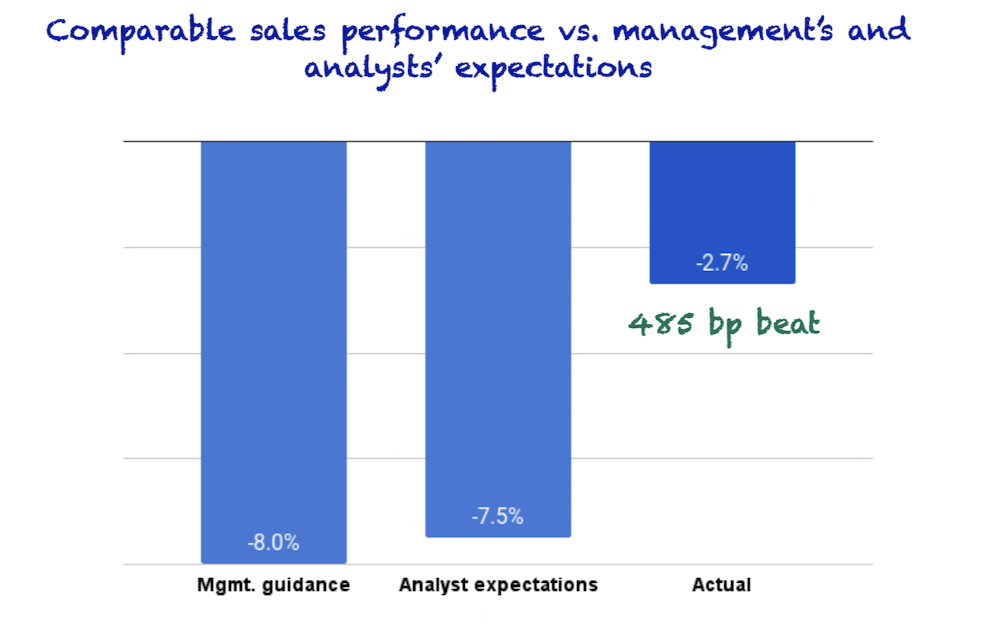

Comparable sales: Better-than-expected ticket and transactions

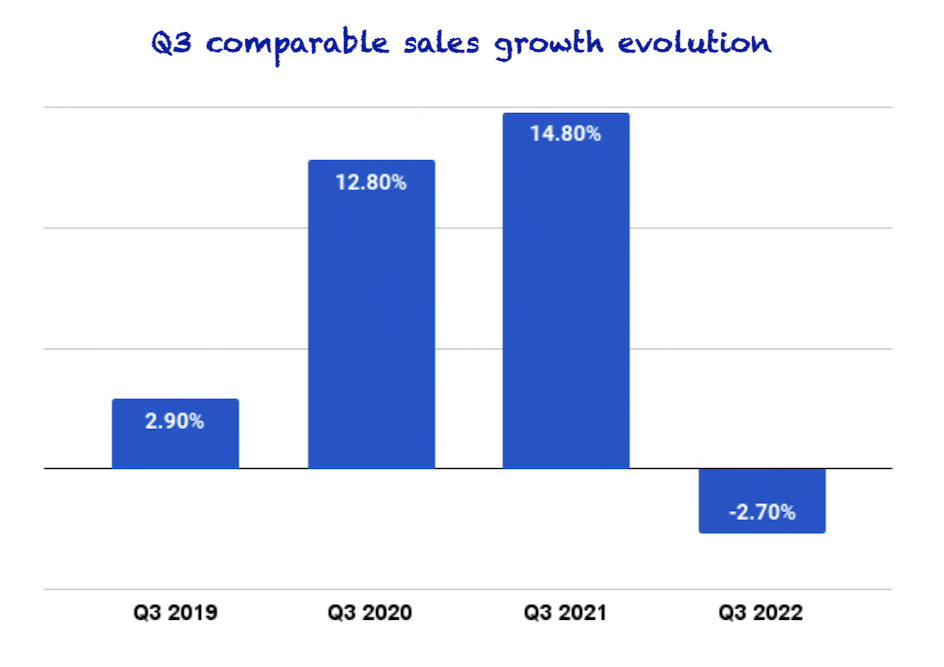

Despite the top-line outperformance, comparable sales fell 2.7% in the quarter. It’s indeed negative growth, but it significantly outperformed management’s and analysts’ expectations:

Made by Best Anchor Stocks

Like the last couple of quarters, a negative growth rate here might look worrying, but this is far from the truth. Five Below benefited enormously from the post-pandemic period due to government stimulus, helping comparable sales outperform. Now that times are more “normal,” comparable sales are “coming back to earth.” With the pandemic already behind us, we should see a return to more normal comparable sales growth in the coming years.

For some context of what we’re saying, take a look at the graph below with the Q3 comparable sales growth rates during the last few years. It’s quite evident there was a pull forward during the pandemic:

Made by Best Anchor Stocks

Comparable sales also have two underlying growth drivers: Average ticket and number of transactions. Average ticket can be understood as the price in the demand equation, whereas the number of transactions can be understood as the quantity side of the equation. Both helped Five Below outperform in comparable sales this quarter.

Average ticket decreased by 1.8%, and transactions decreased by 0.9%. Seeing the comparable sales decrease being driven more by average ticket than transactions is good because it shows that the decrease comes more from macro factors than Five Below-specific factors. The company can work on initiatives to drive average ticket, but these will prove meaningless if traffic slumps. One of these initiatives is Five Beyond:

We continued to see customers who purchased Five Beyond products spend about twice as much as those who did not.

Source: Joel Anderson, Five Below’s CEO, during the Q3 2022 earnings call

Of course, traffic also is in management’s control, but impacting a consumer’s behavior once already in the store is simpler and cheaper than gaining a new customer. The good thing about Five Below is that its diversified nature allows it to do well in varying economic environments. For example, amidst a troubling economy, the company’s need-based and consumables categories outperformed:

On product, the trends we mentioned last quarter continued, with our version of consumables or needs-based products resonating with customers.

Source: Joel Anderson, Five Below’s CEO, during the Q3 2022 earnings call

New store openings come out below expectations

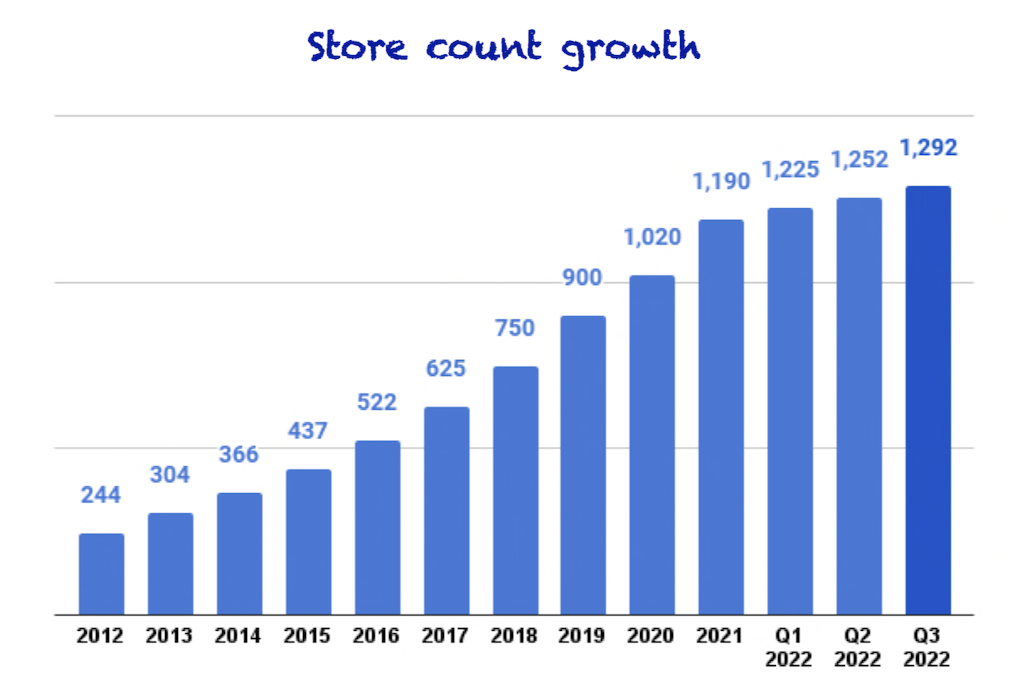

For the second consecutive quarter, Five Below came below its expectations of store openings. The company opened 40 stores, while management expected to open 45 stores.

These stores were opened across 20 states and helped the company end the quarter with 1,292 stores:

Made by Best Anchor Stocks

As usual with Five Below, there were no store closures during the quarter despite the worsening macro (other retail companies can’t say the same). Last quarter the company ended with 1,252 stores, and this quarter, it ended with 1,292. A simple calculation lets us see that it only opened stores (1,292 – 1,252 = 40).

The company has opened 102 stores year-to-date and expects to end the year with 150 store openings. This means that we should see around 48 store openings in Q4. Last quarter management expected to end the year with 160 store openings, so they will fall short of that. However, when it comes to store openings, all eyes should be on next year when the company expects to open a record 200 stores, taking advantage of increased real estate opportunities.

There was some good news on the store front, though. First, some store openings were very successful:

Three of these new stores ranked in the top 25 fall grand openings of all time.

Source: Joel Anderson, Five Below’s CEO, during the Q3 2022 earnings call

New store openings going into the top grand openings is something that we should see recur in the future. As Five Below opens more stores, its brand image improves, attracting consumers to new stores. This is especially true for non-densified markets. Imagine seeing the first opening of an Apple store in your neighborhood; you’ll most likely go to that! Of course, we don’t believe Five Below has the same brand equity as Apple, but driving traffic to a store becomes evidently easier as the brand gets stronger.

Secondly, the company continues to shift the store base to the Beyond model:

In addition, we have already converted approximately 250 stores this year to the new Five Beyond prototype. We are very pleased with the pace and execution of this rollout as well as the customer response, which is driving higher sales and traffic to these stores.

Source: Joel Anderson, Five Below’s CEO, during the Q3 2022 earnings call

We should not count this as “store growth” because it’s only a remodel, but it will definitely be essential to drive comparable sales going forward. Each store converted to the Beyond model is expected to enjoy better economics.

Digging into profitability

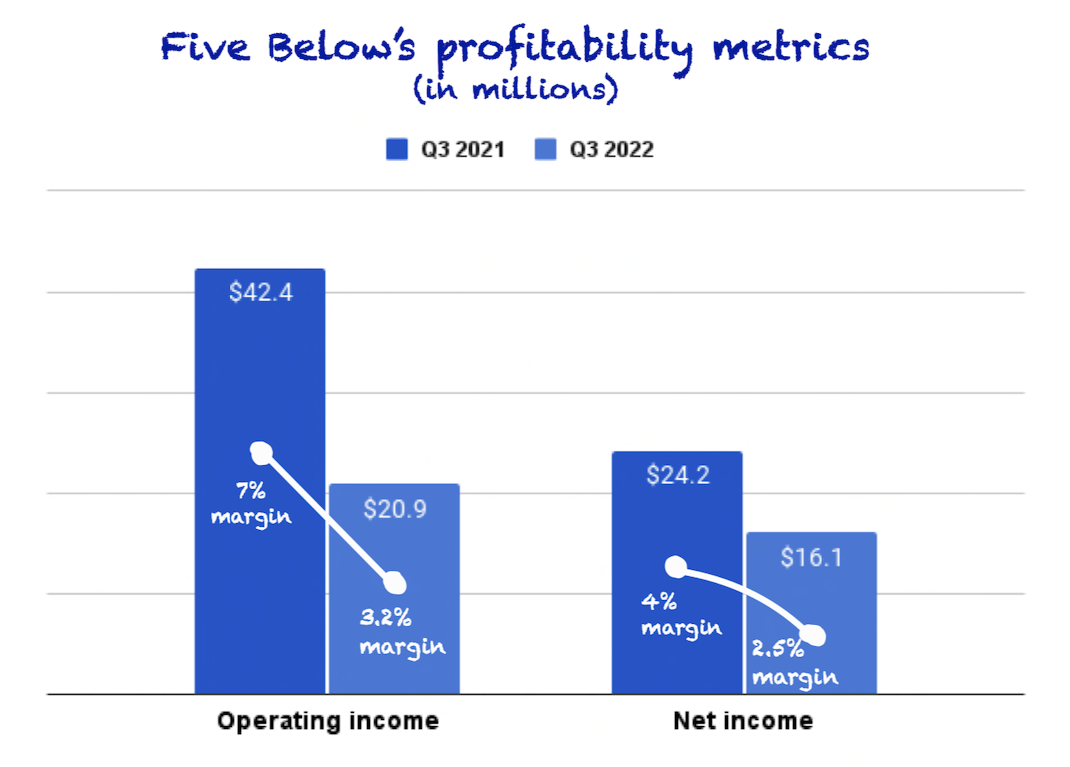

For yet another quarter, Five Below continued to show impressive cost control. Many companies are seeing margin contraction, and Five Below is no exception, but we need some context to understand why it isn’t worrying.

Five Below’s operating and net income margins contracted significantly in Q3:

Made by Best Anchor Stocks

Margins were down due to several reasons. The most important one was deleveraging. Last year, sales grew faster than expenses due to government benefits, creating an “artificial” rise in margins. This year we have the opposite picture where sales are not growing as fast, and thus expenses are “catching up.” This deleveraging impacted operating margins quite substantially:

As a result, operating income decreased 50.7% to $20.9 million versus $42.4 million in the third quarter last year, with operating margin deleveraging year-over-year by approximately 375 basis points.

Source: Ken Bull, Five Below’s CFO, during the Q3 2022 earnings call

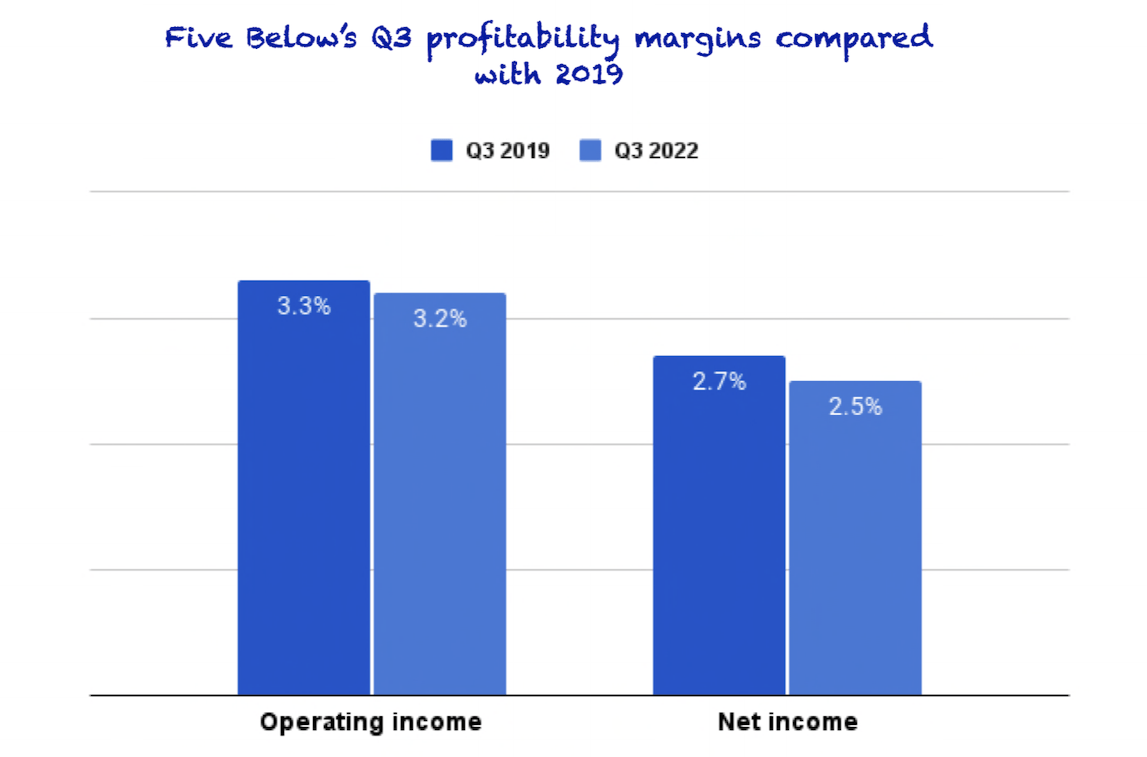

The 375 basis points impact from the deleverage explains most of the decrease. I think it’s better to compare this quarter’s margins with what we saw in 2019, before the pre-pandemic period, which introduced substantial volatility to the numbers:

Made by Best Anchor Stocks

There’s no denying that 2020 to 2022 has not been a normal period for Five Below, so we should zoom out to really understand and interpret the numbers. Despite high inflation, Five Below reported similar margins to those of 2019.

Cash flow and balance sheet

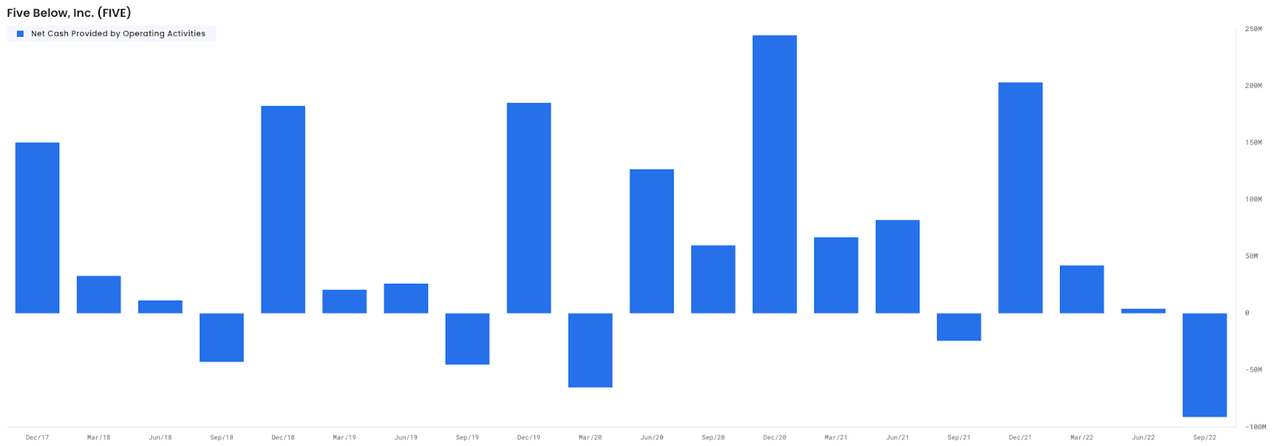

Looking at cash flows every quarter might be tricky because there’s significant volatility. The company posted a negative operating cash flow of $91.1 million in Q3, compared to a negative $24.1 million in the comparable period.

Is this worrying? Well, let us explain a bit. Five Below exhibits the highest cash flows in Q4 due to the holiday season. However, this highest quarterly cash flow is typically preceded by the lowest as the company prepares for the holiday season by stocking up on inventory:

Stratosphere

This explains the negative operating cash flow, but why did it decrease so much compared to Q3 2021? The thing is that 2021 came with muted seasonality, which made comparables very tough. Additionally, Five Below’s management regretted not having more inventory last year, and they don’t want to repeat the same mistake. I’ll talk a bit more about inventories later on.

Regarding the balance sheet, Five Below reported a solid financial position with $117 million in cash and no debt. Of course, the company has no debt, but it has significant contractual obligations from the store leases.

Qualitative highlights

Inventories: Much better than the retail industry in general

Five Below came ahead of expectations on inventories (which is not typically good), but the inventory increase did not signal anything worrying.

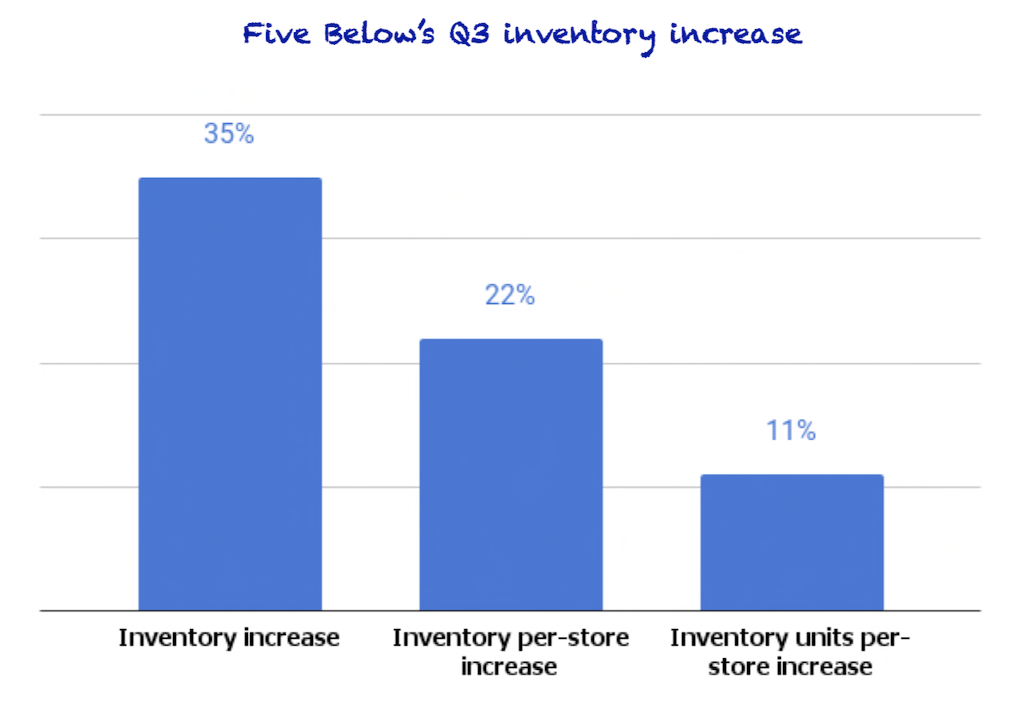

Inventories increased 35% year over year. However, it’s not entirely fair to look at this number directly because Five Below has added plenty of stores since last year, causing inventories to increase just because more stores need to be serviced.

On a per-store basis, inventory was up 22%, half of which comes from units and the other half from inflation and maybe a higher mix of Five Beyond products (we can’t know for sure):

In line with our expectations, average inventory on a per store basis increased approximately 22% versus the third quarter last year. Approximately half of this increase comes from unit growth.

Source: Ken Bull, Five Below’s CFO, during the Q3 2022 earnings call

Seeing units on a per-store basis up around 11% year over year is nothing worrying, especially since management directly targeted such an increase to avoid falling short during the holiday season’s increased demand:

We strategically accelerated inventory receipts to ensure a great in-stock position for the holiday season.

Source: Joel Anderson, Five Below’s CEO, during the Q3 2022 earnings call

During Q4, the company will most likely work its way through this inventory:

We continue to expect the growth in average year-over-year inventory per store to moderate significantly by the end of the fourth quarter.

Source: Ken Bull, Five Below’s CFO, during the Q3 2022 earnings call

Made by Best Anchor Stocks

Five Beyond: more products and higher price points

Management talked about Five Beyond quite a bit. The company added around 200 new products to the category during the quarter. Five Below also continued to go “up market” and introduced more $25 items than last year:

We have more $25 items than we did last year. For now, I think that’s the high end of where we’ll go.

Source: Joel Anderson, Five Below’s CEO, during the Q3 2022 earnings call

Five Below wants to remain true to its name, so it’s also introducing a good deal of $1 and $2 products. It’s all about value at Five Below, and this value can be achieved both at high and low price points:

We’re still Five Below. And more than ever this year, we really focused on that. $1, $2 price points and really try to screen value in the stores. And at the same time, strategically, we are very excited about Five Beyond.

Source: Joel Anderson, Five Below’s CEO, during the Q3 2022 earnings call

We don’t believe Five Beyond changes the value proposition of Five Below at all, and it will be an integral part of the company’s long-term growth. According to management, a remodel of a Five Below store to the Beyond model is creating plus mid-single-digits comps:

We expected the first full year post remodel to run in plus mid-single digits. And we haven’t seen any signs that they’re not going to perform at that kind of level.

Source: Joel Anderson, Five Below’s CEO, during the Q3 2022 earnings call

Self-checkout still has a long way to go

Another lever that will help the company grow profits is self-checkout. The company has included self-checkout in 70% of the store base, with an objective of getting to around 90%:

For all intents purposes, that number will continue to float up. It will never be 100%, but it’s probably not going to be less than 85%. So somewhere in that range, 85% to 90%.

Source: Joel Anderson, Five Below’s CEO, during the Q3 2022 earnings call

Self-checkout not only allows the company to save on personnel costs but should also improve the customer’s experience. The rationale is that the checkout is faster, and there will be more employees available to attend to customers throughout the store.

Leveraging data through tokenization in the absence of a loyalty program

Joel Anderson claimed that Five Below uses tokenization to collect and act on customer data. Through tokenization, the company can save the credit card data (encrypted) from transactions, which helps it understand how the same customer behaves across periods. November was the first month where the company had year-over-year comparisons:

But short of having a loyalty or a credit card, our tokenization work which started November last year, that which then therefore means this is the first year I’ve got year-over-year trends.

Source: Joel Anderson, Five Below’s CEO, during the Q3 2022 earnings call

A loyalty program would be ideal, not only for the data but also to drive repeat purchases and create a loyal customer base. We honestly hope that comes sometime in the near future, but for the moment, tokenization seems like a great choice.

Guidance – Back to positive comps and margin expansion?

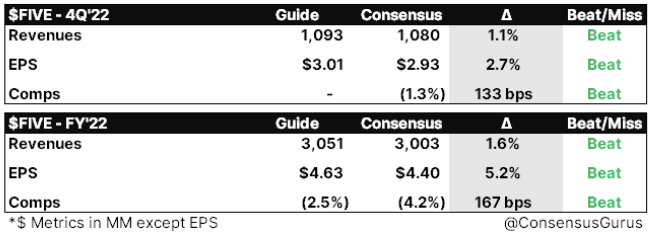

Guidance was also a highlight for Five Below, as it came above expectations:

Consensus Gurus

Once again, the company expects to outperform significantly in the bottom line as the cost-cutting initiatives continue in Q4. The above expectations for Q4 translate into a 9% growth in sales and 19% EPS growth.

With tough comps starting to be a thing of the past, growth is accelerating at Five Below, which is nothing short of impressive considering the macro environment. In one of our public articles, we remember writing that a tough economy would benefit Five Below. Some people told us we were close to crazy to believe this would happen, but we are seeing it play out.

Comparable sales will also face easier comps in Q4, and we might see the first positive comparable sales data for quite a while. The company expects comparable sales to fall somewhere between -1% and 1%.

At the yearly level, the company’s guidance translates into 6% top-line growth and negative 9% EPS growth. The negative EPS growth comes from the same deleveraging impact we saw this quarter.

Looking to next year, despite not giving any specific guidance, management believes that operating margins will expand and the company will go back to positive comps after a “challenging” year:

Ken gave you a 3% scenario, but I don’t think the scenario everyone on this call should be thinking about is a flat comp. I think clearly, as we get to March and if the world changes again, I’d unwind that comment.

But I think with all the initiatives we’ve got focused on what we told you all at the Investor Day, we’re pushing ahead with all those, and we outlined 3% to 5% the next 3 years. We’re working our way into that for next year. And I think the 3% is still the right way to think about it.

Source: Joel Anderson, Five Below’s CEO, during the Q3 2022 earnings call

Growth at Five Below seems far from over, and it’s great to see that we’ll soon be going into less volatile times, leaving the pandemic period behind.

Conclusion

Five Below’s Q3 report was strong on all fronts. Management has prepared the company for what appears to be a strong Q4, where the company might even go back to positive comps. With the pandemic period behind us, we should start seeing growth rates and margins normalize, which will make tracking the company’s performance easier.

In the meantime, keep growing!

Be the first to comment