SvetaZi

We covered the good management behind your real estate investment trust (“REIT”) money. We covered the great management, too.

Now, we’re switching gears to the negative side of the CEO story: the companies that aren’t so sharp because their leaders aren’t as on top of their games.

I’m not saying that to be mean. I’m saying it because it’s true. Not everyone is cut out for executive positions. Or sometimes they are, only to lose their way at some point.

In full fairness, running a corporation can be a tough position. Believe it or not, it’s not all fun and games, jet-setting to exotic destinations and staying in five-star hotels.

The biggest companies can indeed see their CEOs enjoy pretty nice perks. For instance, I can’t exactly see Tim Cook staying in a Holiday Inn. And I would imagine that Elon Musk has seen a few $10,000 bottles of wine in his day.

Being the world’s richest man (at last check, anyway), he may have even seen a $100,000+ bottle or two.

But would you really want to be in his shoes?

Really think about it for a moment.

Would you be able to take the pressure of running a publicly traded company? Keep in mind that means taking the hits and criticism that comes your way from customers, employees, and shareholders alike.

Could you cut it?

Bad Management on Display

Now, some might acknowledge that they couldn’t cut it; then again, that’s why they never applied for any such job.

Which is a fair point.

For my part, I’m not even defending some of these managers. I’m just trying to stay realistic.

In that same light, I’ll easily admit there are truly some ridiculous “C-suiters” who have no business occupying the positions they’re in.

I’ll mention one in a moment. And I already have two names in mind for the next installment in this series: “The Awful Management Behind Your REIT Money.”

But that’s another story for another day. For now, we’re just talking about the incompetent, ignorant, or uncaring. Not the close to or downright criminal.

Naturally, this article – and article series – is about real estate investment trusts and who runs them. But before I get to those, a “bad management” name automatically comes to mind.

That would be the team leading the real estate heavy Kohl’s Corporation (KSS), a company I actually did write about before. That was back in July, when the company was making the headlines every other day – for all the wrong reasons – prompting me to write:

“As of December 31, [Kohl’s] had assets at cost of more than $20 billion against borrowings and other obligations of approximately $7.4 billion. That made its equity at cost equal to roughly $13.2 billion.

“We’re using Kohl’s December year-end financial statement because it contains greater asset detail. (Its equity at cost wasn’t materially different at the end of Q1-22.) Given a current equity capitalization approximating $3.2 billion, Kohl’s has lost approximately 75% of the cost of its deployed equity.”

As I went on to ask, “How does a company light that much money on fire?”

At least some of that answer comes down to bad management.

Kohl’s Continued, and Another Bad Management Example

To be fair, here’s the longer response to that question:

“Answer: By realizing equity rates of return from its business model that are well below shareholder expectations.

“Some of this lack-of-return-driven loss has no doubt been from competitive pressures and management decisions. But a great deal of it was due to Kohl’s misguided decision to become an investment-grade company with so much real estate.”

So it was a series of bad decisions made by multiple bad – i.e., incompetent, ignorant, or uncaring – managers and board members.

Unfortunately, there are several other companies with similar woes. Though I’ll only mention one more: Bed Bath & Beyond (BBBY). CNN reported late last month that it was:

“… losing shoppers and money at a rapid clip, and the company will need to quickly reverse course to avoid bankruptcy.

“The struggling chain announced Thursday that sales at stores open for at least a year plunged 26% during its latest quarter ending August 27. The company also lost $366 million in that period, and profits fell as the chain discounted merchandise to clear shelves.”

You can only blame interim CEO Sue Gove so much. She just took over in June after her predecessor, Mark Tritton, was ousted.

The article continued with:

“Sales dropped last quarter because Bed Bath & Beyond has been offering too much merchandise that customers don’t want and was out of stock on items in higher demand, according to the company.”

To rectify that, it’s removing a third of its signature brands and returning many well-known names to its shelves – refuting Tritton’s belief that copycatting Target’s (TGT) niche inventory ideas was the way to go.

He either didn’t understand his customers or didn’t implement the strategy well enough. Because the results speak for themselves.

They always eventually do.

Some Bad REIT Managers

Back in July 2022 Dane Bowler wrote,

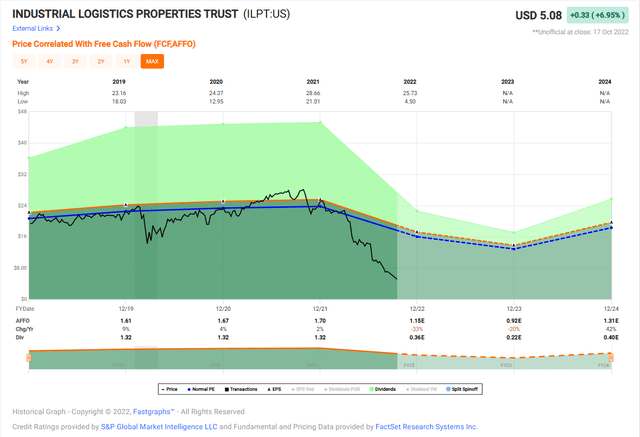

“Industrial Logistics Properties Trust (ILPT) external manager, RMR Group (RMR), is so incredibly misaligned with shareholder interest that over time it will erode enough value so as to overcome the discount.”

Bowler and I agree on that topic, and also his explanation of external management:

“[T]here is a big difference between external management that is executed well and that which is executed for the purpose of enriching management. I believe that ILPT falls into the latter category.”

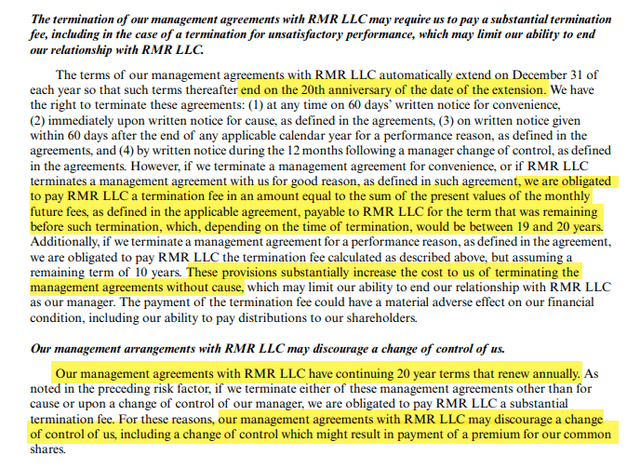

As noted in the 10-K, RMR’s management contract automatically renews such that it is perpetually 20 years in remaining duration.

“The terms of our management agreements with RMR LLC automatically extend on December 31 of each year so that such terms thereafter end on the 20th anniversary of the date of the extension.”

Who would want to own such nonsense.

Besides that, ILPT is drowning in debt, with over $4 Billion of debt sitting on its balance sheet and an equity market cap of just $300 million.

Don’t worry, though, ILPT can’t be called a sucker yield because the company is barely paying a dividend, the yield is sub 1%.

Fortunately, I have always avoided any REIT that has the RMR name associated with it, and that has allowed me to avoid a lot of trouble. I have a feeling that Sam Zell and Barry Sternlicht – two prominent REIT billionaires – will be watching ILPT closely, waiting on the right time to pounce.

I’m tempted to short ILPT, but Bowler is right: “I don’t think shorting would be wise here given the magnitude of discount.”

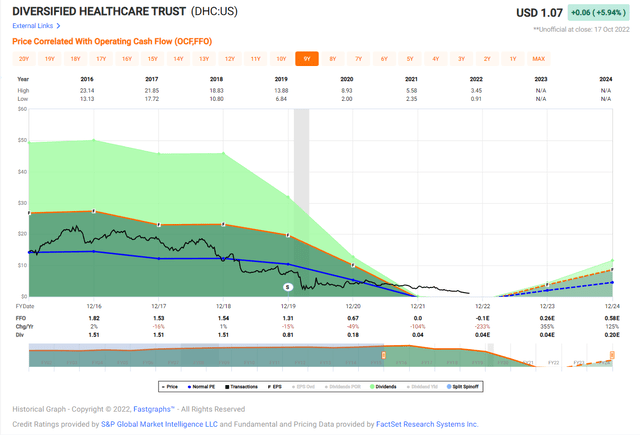

Another toxic REIT to avoid is Diversified Healthcare Trust (DHC) that is also managed by no other than RMR. The company was called Senior Housing Properties in a prior life, and back in 2019 I wrote,

“I am becoming increasingly skeptical of the conflicts of interest between the various RMR-managed entities and the cozy lease arrangements between Senior Housing and Five Star.”

Hopefully you read my article, in which I said,

“I don’t know about you, but I don’t think Mr. Market has priced in a dividend cut yet… and I would be careful jumping into that frying pan when you know that it’s gonna most likely burn you.”

Back then, DHC was trading at $13.41 per share with a 11.6% dividend yield and now shares are trading at $1.07 and a 3.7% dividend yield.

How could that be?

Answer: Bad Management

Similar to ILPT, DHC has a long-term management contract with RMR that clearly is not aligned with shareholders:

This is why it’s important to always read the fine print and to fully understand who’s running the REIT. The properties may be terrific, but if they’re managed externally there’s a very good chance that your interests are not aligned with management.

I Saved the Best for Last

In my next article, the last in the series on REIT management, I will tackle the “awful” management teams, and I can assure you that I will not pull any punches.

Over the years, I’ve found that I’m pretty good at smelling skunks, partly because I lost millions of dollars due to corrupt managers. In other words, there’s simply no time to sugar coat this topic when an investor’s hard-earned capital is at risk.

I have absolutely no desire to take losses due to unscrupulous management, and I’m sure you would agree. As an old friend once told me, “When you lay down with dogs, you wake up with fleas.”

Be the first to comment