gremlin/iStock via Getty Images

Thesis

Leading automotive and industrial semi company ON Semiconductor Corporation (NASDAQ:ON), or onsemi, has seen its stock recover remarkably from its post-earnings selloff.

Buyers returned to stanch further downside, but the momentum has stalled again at a critical juncture. Despite that, ON’s valuation remains below its closest and broad semi peers, likely helping sustain its buying sentiments.

Also, the company is confident that its leadership in the automotive image sensors market and its ramp in silicon carbide (SiC) should improve its competitive edge against its peers. Coupled with the underlying growth drivers in EVs and renewable energy, it should help mitigate the near-term slowdown in industrial applications and the malaise in consumer electronics.

However, we urge investors to remain wary, given the expected normalization in ON’s growth momentum through FY24. Therefore, we assess that the reward/risk profile at the current levels is not constructive for adding more exposure.

ON’s price action suggests that the market has not re-rated it to a higher level relative to its peers’ valuation. As such, we believe the market remains concerned about its potential medium-term growth, given more challenging comps reflected against its performances in FY21/22.

Coupled with the massive downturn in tech and other semi stocks recently, we assess that investors should consider cutting exposure from ON and rotating.

Maintain Sell.

Auto Chips Supply Is Expected To Remain Tight Through 2024

onsemi has weathered the broad semi downturn incredibly well, even though its Q3 performance suggested that normalization should continue. Given onsemi’s remarkable FY21/22 performances, we believe ON bulls need to be more cautious about expecting the company to continue posting such significant gains moving ahead.

Furthermore, the company has maintained its FY25 model guidance (implying a 5Y revenue CAGR of 7-9%). Therefore, we believe it’s reasonable for investors to be cautious about expecting a material re-rating, even though the auto supply chain is expected to remain tight through 2024.

The question is whether sufficient visibility from 2024 could lift onsemi’s revenue and profitability growth, helping drive a material re-rating in ON.

onsemi Should Benefit From ADAS Growth

There’s little doubt that onsemi’s leadership position in the advanced driving assistance systems (ADAS) platform should continue to benefit its automotive business.

CEO Hassane El-Khoury also telegraphed his confidence in a recent conference, as he articulated:

We’re the market leader today. We have [an] 80% share, as I mentioned, for ADAS, specifically 60% in automotive. Unless you design the imager for automotive, you’re not going to be able to solve the automotive use case. What does that mean? If you’re in a tunnel, the sun is in your face. And if the camera is blinded, it’s not really ADAS or you don’t want it to be ADAS. That’s called technically high dynamic range. Bright is bright, and dark is dark. Our cameras are able to do that with, obviously, no shading, nothing, just normal same camera, same technology. That’s important. That’s why we win. (NASDAQ 47th Investor Conference)

We think onsemi is indeed onto something massive here. BloombergNEF estimates suggest that Level 2 and Level 3 ADAS will continue to proliferate. As such, onsemi, as the market leader, is in a prime position to leverage its ADAS market leadership to drive growth further. Bloomberg accentuated:

The uptake of ADAS will create a large market for suppliers. By 2026, we expect Level 2 ADAS sales to reach $70 billion annually. While Level 2 vehicles will remain a sizable market, Level 3 vehicles could be even bigger as soon as 2027, with sales of Level 2 and 3 vehicles approaching a combined $150 billion. – BloombergNEF

Is ON Stock A Buy, Sell, Or Hold?

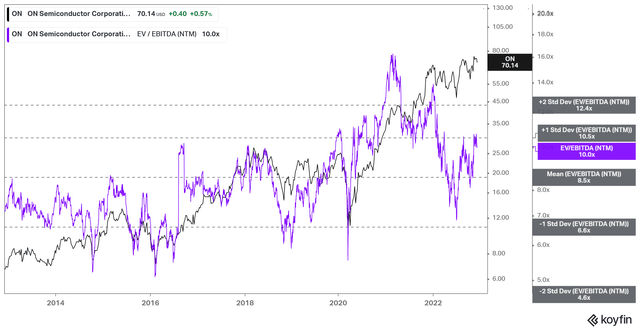

ON NTM EBITDA multiples valuation trend (koyfin)

ON last traded at an NTM EBITDA multiple of 10x, above its 10Y average of 8.5x. Relative to its peers’ median of 11.3x (according to S&P Cap IQ data), it’s not aggressively configured. Moreover, its NTM P/E of 15.1x is below the de-rated semi industry forward P/E of 19.5x.

Hence, we can understand why ON buyers believe that ON remains an attractive proposition, as it outperformed the semi industry with a YTD total return of 2.7%.

However, we also urge investors to be cautious, as the market has clearly de-rated ON’s valuation, even as it surged toward its 2022 highs. We believe the market could be pricing in a slower growth cadence moving ahead, which could impact its revenue and profitability.

But does it show up in ON’s price action?

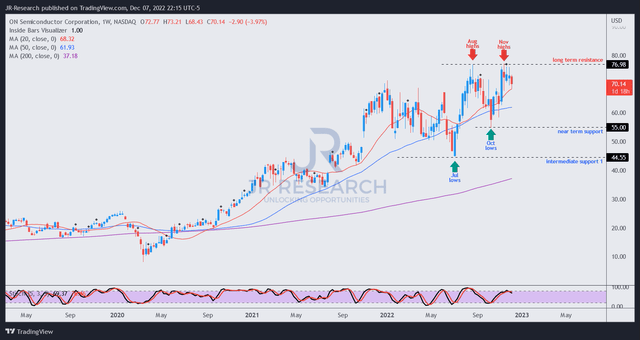

ON price chart (weekly) (TradingView)

Yes, it does. As seen above, ON’s buying momentum failed at its previous August highs as it recovered from its October lows. Hence, sellers have patiently waited for ON bulls to “buy the dip” in October but refused to allow ON to break decisively into higher highs.

Therefore, we believe the market’s message to ON bulls is that a material re-rating is unlikely unless management revises its FY25 model significantly higher, driving much more robust growth momentum ahead.

Hence, we parse the reward/risk upside remains skewed to the downside at the current levels. Accordingly, ON buyers are encouraged to wait patiently for the market to force a steeper selloff to re-test its October/July lows before adding more exposure.

Maintain Sell.

Be the first to comment