Marti157900/iStock Editorial via Getty Images

FirstCash Holdings, Inc. (NASDAQ:FCFS) has a core pawn business that is counter-cyclical and can potentially benefit from the current economic slowdown. However, investors need to be mindful that the company recently acquired America First Finance business, which provides retail Lease-To-Own (“LTO”) loans. This is very cyclical and can expose FCFS to credit losses in a bad economic environment. I think, for now, the countercyclical tailwinds of the pawn business outweigh the risks from the payments business, and FirstCash is worth a speculative buy.

Company Overview

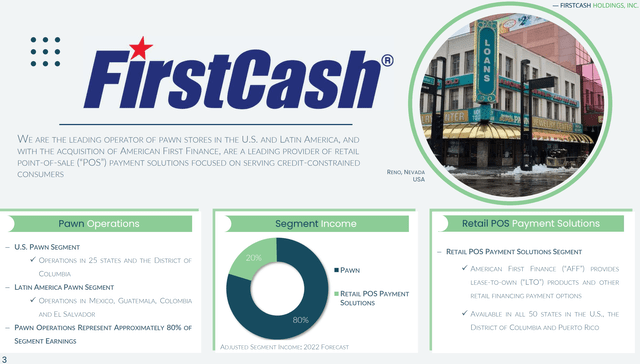

FirstCash Holdings, Inc. is a leading operator of pawn stores in the U.S. and Latin America, with over 2,800 retail locations. It also operates in the retail point-of-sale (“POS”) payment solutions business that provides credit-constrained consumers with LTO loans.

Approximately 80% of FCFS’s earnings come from the pawn segment, and 20% come from the newly acquired POS Payments business (Figure 1).

Figure 1 – FCFS overview (FCFS investor presentation)

Pawn Is A Counter-Cyclical Business

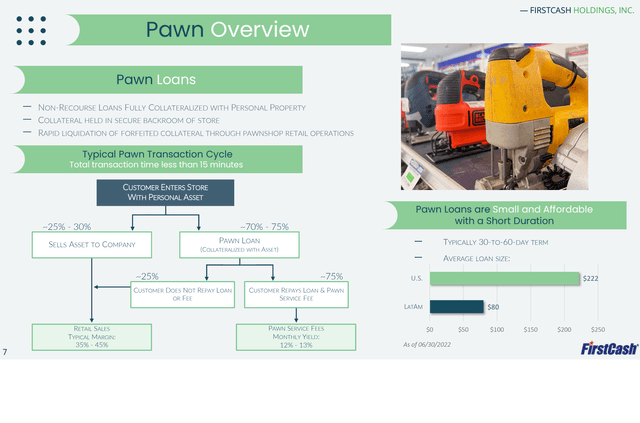

Pawn stores are local retail stores that buy and sell pre-owned consumer products like jewelry, electronics, tools, and sporting goods. Pawn stores provide a quick and convenient source of small ticket, secured, non-recourse loans to unbanked/underbanked/credit constrained consumers.

A typical customer enters the pawn store with their personal asset and about a quarter of the time, they sell the item directly to the store. Three-quarters of the time, they get a pawn loan, collateralized with their asset. Of the items pawned, about three-quarters are repaid, and the pawn store earns 12-13% monthly yields. A quarter of pawn loans default, and the pawn store takes possession of the asset. Assets that the pawn store takes possession of (either through direct purchase or defaulted loans) are resold to consumers at a 35-45% margin. Figure 2 shows an overview of the Pawn business.

Figure 2 – Pawn business overview (FCFS investor presentation)

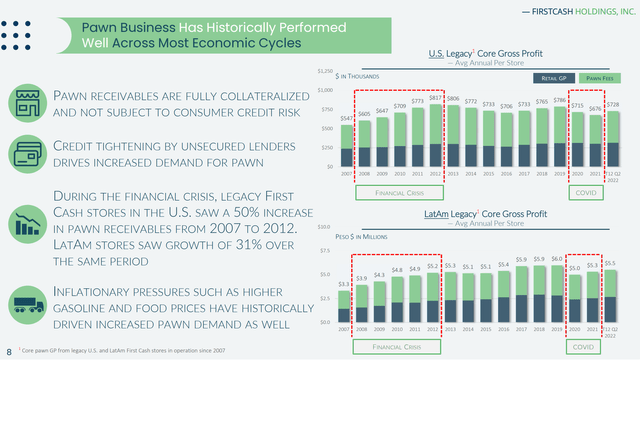

Historically, the pawn business has performed well across most economic cycles. In particular, the pawn business is countercyclical, as financially stretched consumers tend to utilize pawn services more during tough economic conditions. U.S. FirstCash Holdings stores actually saw a 50% increase in pawn receivables from 2007 to 2012 during the “Great Financial Crisis” (“GFC”), and receivables declined during COVID, as financially stretched consumers were buoyed by government stimulus cheques (Figure 3).

Figure 3 – Pawn business is counter-cyclical (FCFS investor presentation)

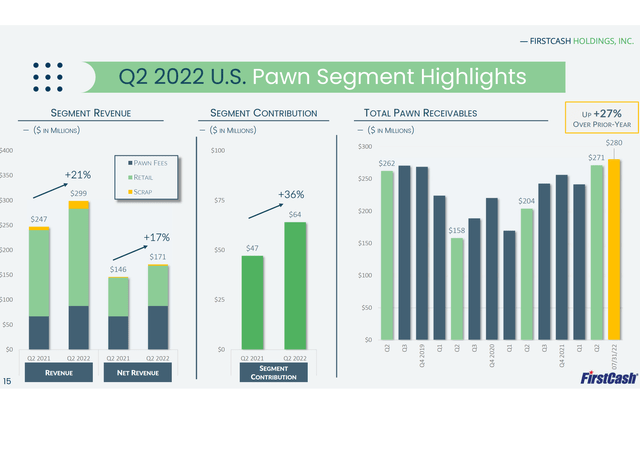

As government stimulus has ended and inflation eats into stretched household budgets, we can expect pawn store utilization to increase in the coming quarters. Already, we see U.S. pawn store receivables up 27% YoY as of July 31st (Figure 4).

Figure 4 – FCFS U.S. pawn store statistics (FCFS investor presentation)

Financials

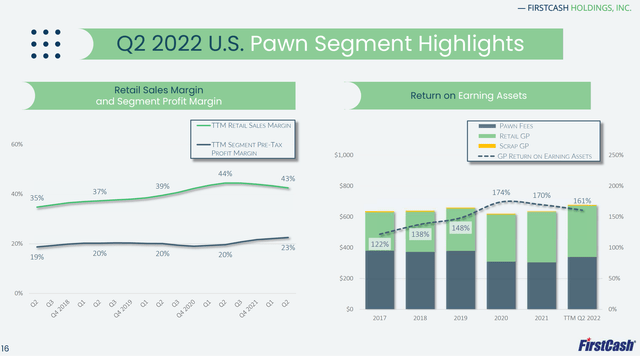

Financially, the pawn business model generates high returns. Unlike payday lending, which is banned in 12 states and has 36% interest rate caps in 18 other states, FirstCash’s pawn loans do not fall under those regulations. This has allowed FCFS to earn total returns of over 160% of earning assets in the last twelve months in its U.S. pawn segment (Figure 5). The rate of return in the Latin America segment is even higher at 190%.

Figure 5 – FCFS U.S. pawn returns (FCFS investor presentation)

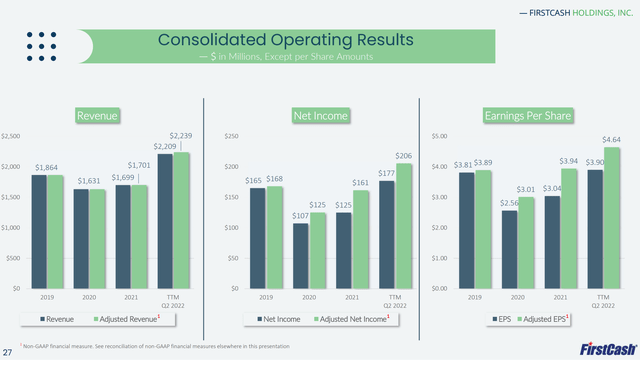

On a consolidated basis, this has translated into trailing twelve-month revenues of $2.2 billion, and $4.64 in adjusted EPS (Figure 6).

Figure 6 – FCFS consolidated financial results (FCFS investor presentation)

Note, while the pawn business generates fantastic cash returns, it does require a lot of operating expenses to maintain. After deducting operating expenses like employee compensation and occupancy costs, FirstCash has an LTM adj. net margin of 9.2%.

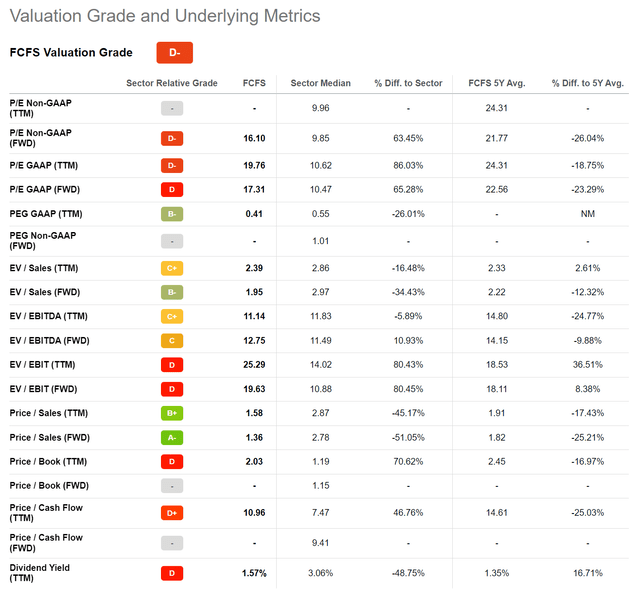

Valuation Is Rich

FirstCash is currently trading at an Fwd P/E of 17.3x, which is high, relative to the financial sector’s 10.5x Fwd P/E (Figure 7). However, we need to understand that FCFS’s business is counter-cyclical, so while investors may be wary of credit losses and thus awarding a lower multiple to banks and alternative lenders, FirstCash’s pawn business actually benefits from a weakening economy as its pawn loan receivables grow during tough times.

Figure 7 – FCFS valuation (Seeking Alpha)

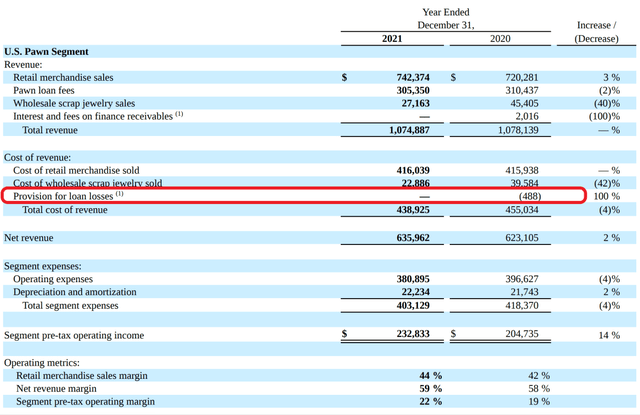

Importantly, even during the COVID pandemic, FirstCash had negligible loan losses, as FCFS typically lends only a fraction of an asset’s collateralized fair value (Figure 8).

Figure 8 – FCFS negligible pawn loan losses (FCFS 2021 10-K)

LTO Loans – Opportunity & Risk

While FirstCash’s core pawn business looks to benefit from tougher economic conditions, the recently acquired POS payments business does raise some questions and concerns.

In December 2017, FirstCash paid $1.17 billion (8 million shares plus $400 million cash) to acquire America First Finance (“AFF”), a rapidly growing retail Lease-To-Own finance provider. AFF’s payment solutions is available in over 7,600 retail merchant locations.

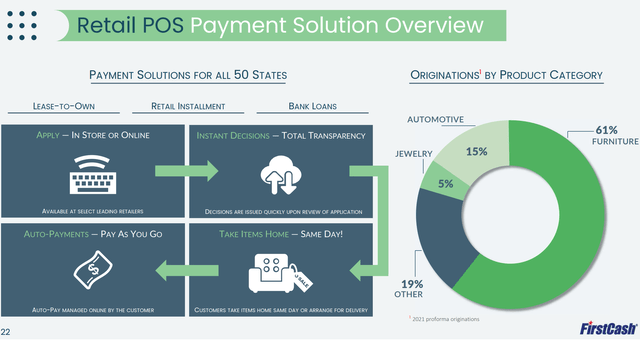

Similar to the increasingly popular BNPL business model, AFF’s POS payment solutions business allows consumers to apply for credit at the cash register. If credit is granted, they can take the items home and pay for the purchase over time through automated installment payments (Figure 9).

Figure 9 – FCFS LTO finance overview (FCFS investor presentation)

On the positive side, the LTO finance business is somewhat complementary to the core pawn business. It essentially targets the same consumer demographic (underbanked, credit constrained), and captures transactions where this consumer purchases new assets at other retail merchants. It is also much easier to grow the earning asset base, as the lever to toggle would be lending standards (one of the knocks against FCFS in the past had been its lack of growth during good economic times).

However, there are subtle and critical differences between the LTO and pawn businesses. First, recall that in a typical pawn loan transaction, the customer brings the pawn asset to the store, and the store keeps possession of the asset as collateral during the loan period. The loan is typically made at a fraction of the market value, so the pawn store is relatively protected from credit losses: in the worst case, the store takes ownership and sells the item.

In an LTO transaction, the customer applies for a loan at the point-of-sale and takes the item home. The lender does not take possession of the asset as collateral. Also, the loan is made on the retail ‘brand new’ value of the asset (most typically furniture), and the asset essentially depreciates as it goes out the door. Hence, LTO loans do have high credit risk, especially as the customer is credit constrained to begin with.

It could also be a hassle to retrieve defaulted LTO assets (having covered RCII and AAN in the past, I have read plenty of stories of angry LTO customers acting violently towards collection agents or destroying the assets on lease). FirstCash does allow LTO assets to be returned to the local pawn stores, however, I’m not sure how likely that is going to happen nor whether a piece of furniture like a large couch can be sold quickly in a small footprint pawn store.

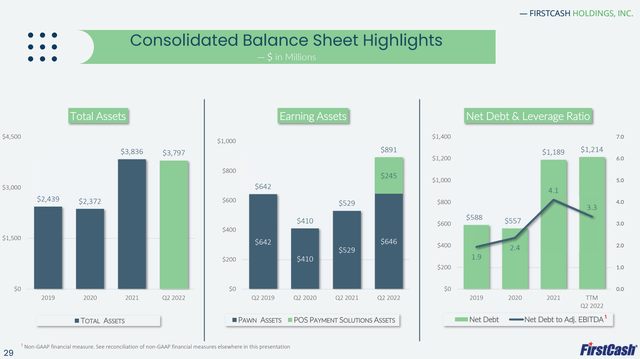

Balance Sheet Also A Risk

Another risk to FirstCash is that it took on significant amounts of debt to complete the AFF transaction. As shown in the Figure, net debt stood at $1.2 billion at the end of Q2 and is 3.3x LTM adj. EBITDA. High levels of debt could constrain management’s ability to react to various economic scenarios and business conditions.

Figure 10 – FCFS balance sheet (FCFS investor presentation)

Conclusion

In summary, FirstCash’s core pawn business is counter-cyclical and can potentially benefit from the current economic slowdown. However, investors need to be mindful that the recently acquired POS Payment Solutions business is very cyclical, and can expose FCFS to credit losses in a bad economic environment. I think that, for now, the countercyclical tailwinds of the pawn business outweigh the risks from the payments business, and FirstCash Holdings, Inc. is worth a speculative buy.

Be the first to comment