RHJ/iStock via Getty Images

Investment Thesis

FirstCash Holdings, Inc (NASDAQ:FCFS) specializes in financing distressed borrowers, so amid the economic slowdown and deteriorating global financial conditions, the company shows attractive dynamics. In addition, the recent acquisition of American First Finance (“AFF”) will be a strong driver of the holding’s growth in the medium term. Nevertheless, we see the problems with the group’s profit margin looming due to the poor quality of the loan portfolio and reduced efficiency of the pawn stores in the long term, so the current market prices are fair and even somewhat optimistic. We give the company a HOLD status and will wait for more attractive entry points.

Pawnshops performance outlook

Pawn stores as an alternative source of financing for retail consumption have historically shown high operational efficiency in almost any economic condition. Even though such a business is a financial institution, it depends little on global environment and monetary policy – the target audience tends to remain stable and has to agree on unfavorable terms of financing.

FirstCash Holdings, Inc is the leading conglomerate in the pawnshop segment. While other sectors, including finance, are showing deteriorating financial results, the company’s operating performance is very optimistic, but we believe the trend will be limited in time.

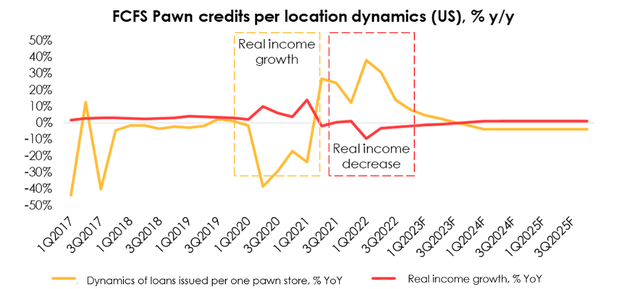

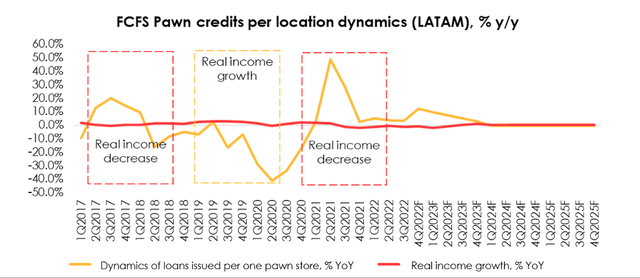

In our revenue forecast, we use two main metrics – the number of open stores and loans per pawnshop. Historically, loan volume grew in years when real incomes fell, with business sensitivity to real income being higher in the U.S. than in Latin America (on average, a 1% drop in real income caused the average volume of loans per pawn store to increase by 3.7% in the U.S., and by 2.3% in Latin America).

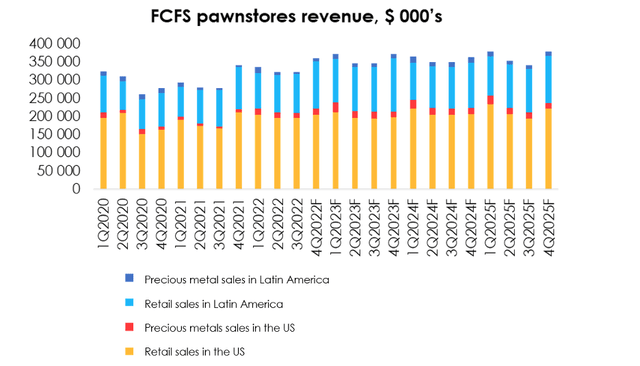

The current macroeconomic challenges are a good driver for FirstCash Holdings, Inc – the efficiency of the company’s pawnshops is increasing with the volume of loans issued and retail sales, but we expect that the situation in the economy will gradually begin to stabilize, demand for short-term expensive loans will fall, and the generated revenue of the company per pawn store will decline, given the company’s modest plans for expansive growth.

AFF acquisition will be a far-looking driver

Despite the modest expected growth rate of the pawnshop network business, FirstCash Holdings, Inc still has a clear development plan. In Q4 2021, the company absorbed the point-of-sale (“POS”) system of American First Finance, which is focused on issuing loans to distressed borrowers (retail loans, leasing, sub-loans with partner banks), who are denied by conventional banks.

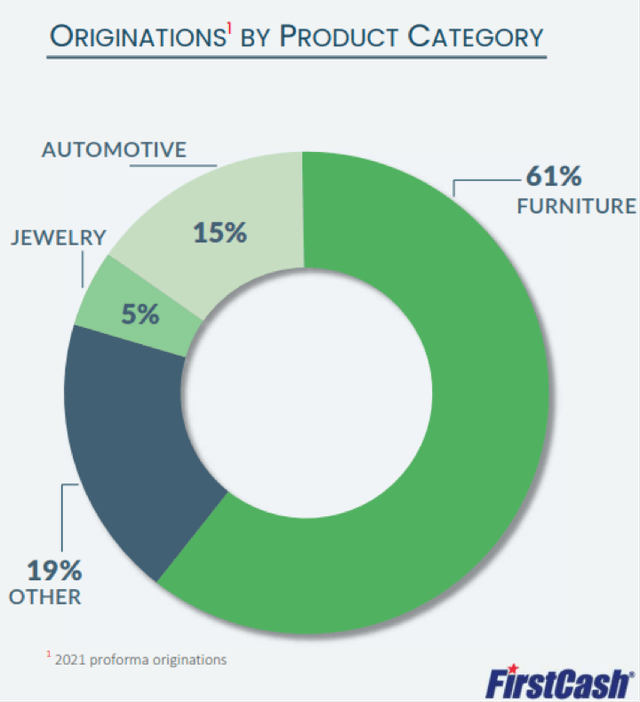

The main market of interest for the acquired company is the furniture retail market. More than 60% of partners’ stores GMV are concentrated directly in the home furnishings segment, and we believe that GMV structure will remain stable in the future.

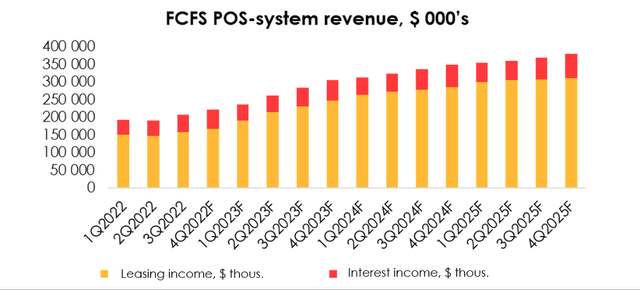

After the takeover, the segment demonstrates high growth rates of revenue and market share of POS systems. At the time of the takeover, the company had ~6500 partner stores, and as of the end of Q3 the figure had increased to 8600. Meanwhile, GMV of active partners grew from $185 mln to $221 mln over the same period.

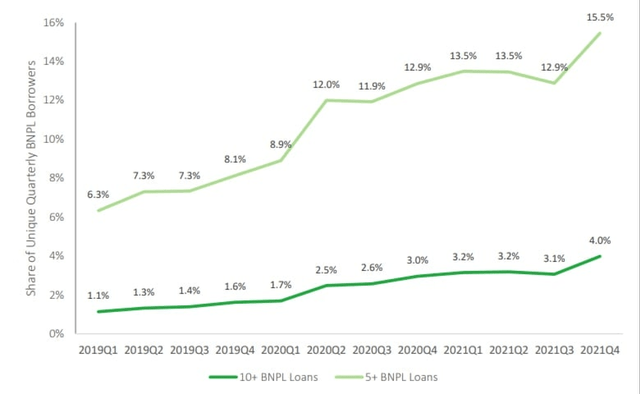

The POS and BNPL (Buy Now, Pay Later) systems market, in turn, is showing growth and consolidation in the consumer behavior model. According to the CFPB, having resorted to this type of alternative loan, consumers tend to redeem dets. Only ~6.3% of total BNPL users in the U.S. had 5 or more installments in early 2019, but that number increased to 15.5 by the end of 2021%.

Consumer Financial Protection Bureau

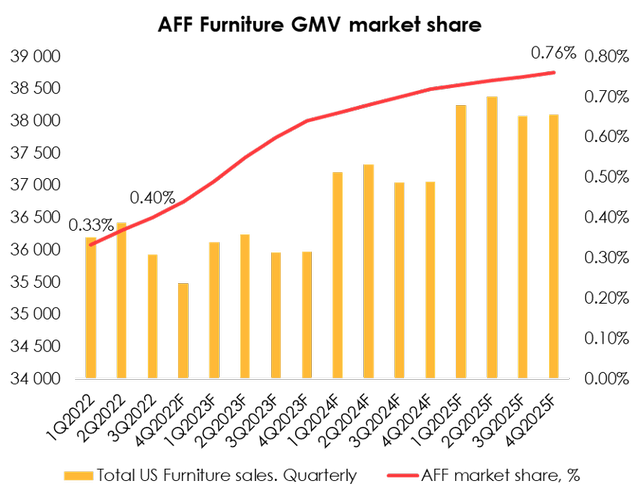

Assuming the same GMV structure, according to the U.S. Census Bureau, the company’s share of the payments market in the furniture segment increased from 0.33% to 0.40% in 2022. We expect the company to take ~0.76% by the end of 2025, which will be provided by the persistent trend of overall growth in demand for POS payment systems and active development of AFF in the FirstCash Holdings, Inc holding structure.

Thus, we expect segment revenue to grow at an average rate of 21.66% per year till 2025, which will be the strongest revenue driver of the entire conglomerate.

Profitability will shift

The company’s profit margin remains the major problem with FirstCash Holdings, Inc’s valuation. We have reasons to believe that after the AFF acquisition we are unlikely to see gross margin of ~55%, which was a stable indicator over the last 5 years.

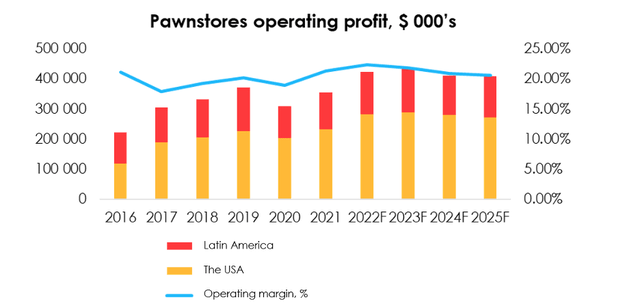

First, as the demand for pawnshops declines, the revenue per store will also decline, resulting in a slight reduction in operating margin of the core business line. According to our estimate, the operating margin of pawn stores will decline from 22.8% in 2022 to 21.1% by 2025.

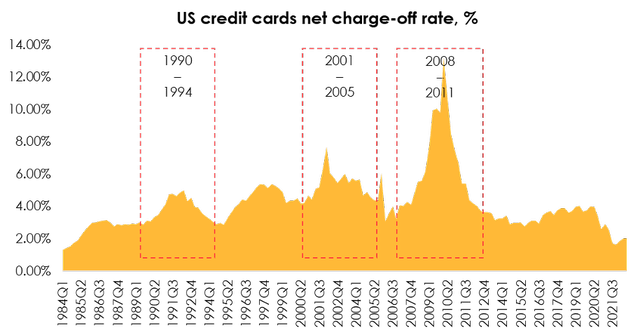

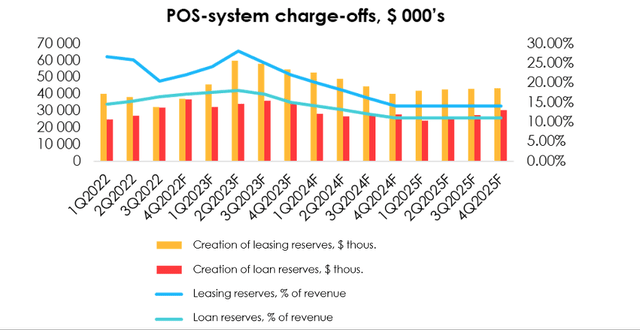

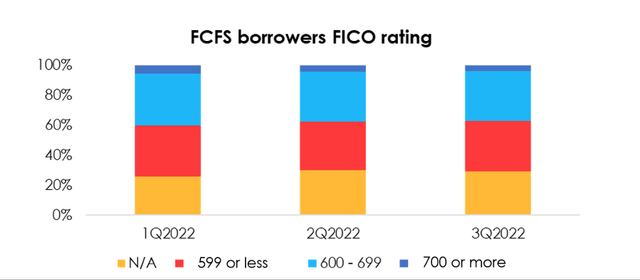

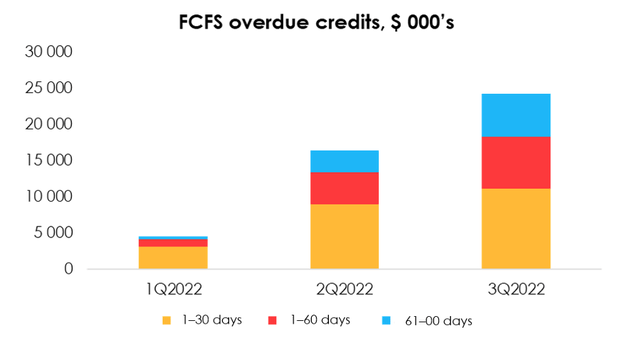

However, the low credit quality of borrowers in the AFF POS segment remains the main problem for FirstCash. The company must create high reserves for losses, which affects the company’s profit. The 2022 results already show the deterioration of the AFF loan portfolio quality – the share of borrowers with low credit scores has surged (in 2021, the average credit score across the country was 714), and the number of overdue loans has significantly increased.

We believe that it will be a long-lasting trend. Historically, spikes in reserve growth during the recession took place over a span of 3-4 years. Although we do not suggest that the current crisis will be protracted, we expect the company to return to historical levels of AFF reserve creation prior to the acquisition only by the end of 2024.

Federal Deposit Insurance Corporation Invest Heroes

Valuation

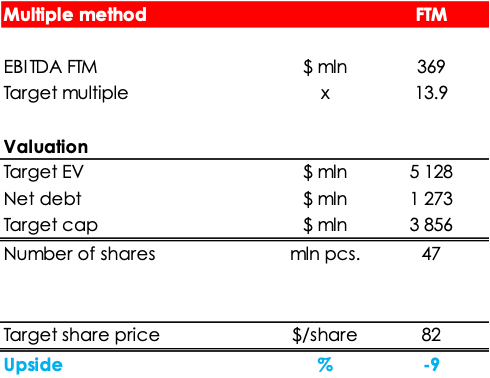

We are evaluating FCFS fair value price based on a FTM EV/EBITDA multiple.

We are setting the fair value price for the shares at $82/share.

Based on our assumptions, we are setting the FirstCash Holdings, Inc rating at HOLD. The downside is -9%.

Invest Heroes

Conclusion

Even though FirstCash Holdings, Inc is now demonstrating good operating results dynamics, we do not see potential in the company’s shares at current prices. Being the core business, pawnshops will not show significant growth, their efficiency will decline as the economy recovers, and the new segment (POS system of AFF) will have to create high loan and leasing reserves in the medium-term, putting pressure on the company’s margin.

To manage the position, we recommend keeping an eye on FirstCash Holdings, Inc financial statements, lending, and banking sector statistics, as well as the U.S. retail sales figures.

Be the first to comment