Chip Somodevilla

Berkshire Hathaway’s (NYSE:BRK.A)(NYSE:BRK.B) operating results for Q2 2022 were spectacular while Buffett’s actions provided insight about the market as a whole and Berkshire itself. As is often the case, both actions taken and actions not taken communicate eloquently. But first, the actual reported earnings need to be unpacked with a bit of detail.

Why Operating Earnings Are Important And Fluctuations In Berkshire’s Portfolio Mostly Aren’t

Berkshire’s Q2 earnings report generated contradictory headlines such as (1) Berkshire Hathaway Posts $43.8 Billion Loss As Stock Holdings Tumble (Fidelity) and (2) Berkshire Beats Estimates for Second Quarter Profits (Barron’s). Bloomberg’s headline was “Buffett’s Berkshire Pounces on Market Slump To Buy Equities” – this despite the fact that equity purchases dropped from about $41 billion net purchases in Q1 2022 to under $4 billion in Q2. By my calculation that’s about a 90% decline. It’s important to go beyond the headlines to get a clear picture.

As I wrote in this recent piece entitled “Berkshire Hathaway: Hit To Book Value Could Be Drastic But A Buying Opportunity Comes With It”, Berkshire’s earnings are virtually assured of being somewhat lumpy because of Accounting Standards Update (ASU) 2016-1 which went into effect in 2017. The new rule required the inclusion of “unrealized investment gains and losses” in reporting net income. Buffett pointed out in Berkshire’s 2017 Shareholder Letter that the inclusion of unrealized gains and losses had the effect of creating “wild” and “capricious” numbers which had to be included in all net income figures and thus made the bottom line number “useless.”

In practical terms the rule impacted very few companies in a significant way. Most of the companies affected are insurance companies which set aside means to pay for future claims with portfolios of fixed income securities and in some cases such as Berkshire publicly traded stocks. For these companies investors must look at reported earnings with a discerning eye and decide whether to simply dismiss the part of earnings resulting from the fluctuating prices of stocks and bonds. An important fact neither the headlines nor the initial stories have mentioned is that what happens on the income statement drops immediately to the Balance Sheet where it lands on the company’s Book Value. This quarter for Berk and most insurance companies it landed with a thud.

Does the drop in book value really matter? The short answer is no. Buffett himself suggests ignoring the distortion in both earnings and book value. His view is that investors understood the reality better in the 100 years or so before ASU 2016-1. For Buffett the proper measure of a portfolio is either the income it produces or, for more sophisticated investors and analysts, a “look through” to the operating numbers of the companies owned.

Recent examples show clearly that many investors don’t look at it this way. Markel (MKL), a P&C insurance company similar in structure to Berkshire, reported earnings last week with the same situation in which temporary securities losses overwhelmed operating results. The stock immediately dropped 4%. This was despite the fact that a part of the loss creating a drop in book value was in fixed income securities for which the loss would be routinely recaptured at the maturity of the bonds. I will simply say that while some Markel owners sold I personally took the opportunity to add to my position.

The longer version here is that parts of the Berkshire portfolio may be a bit pricey – Apple (AAPL), I have suggested elsewhere – that doesn’t matter much for Berkshire’s purposes as long as its business continues to thrive. Yes, if it falls in price reported earnings may be down a bit again and pull down book value, but it really doesn’t matter when it comes to the growing cash stream returned to Berkshire Hathaway.

Operating Earnings Included Very Positive Information

The current inflationary environment has impacted Berkshire in the same way it has impacted the majority of companies. Berk’s 10Q filing mentioned “materials, freight, labor, and other input costs.” The sub-head above is the right one, however, as Berkshire has managed to compensate for those costs as well as for the somewhat punk results for GEICO, which suffered from increasing claims frequencies and severity. Reinsurance underwriting earnings increased, however, demonstrating the defensive nature of P&C insurance companies in inflationary times. What stands out is the performance of the BNSF railroad and Berkshire Hathaway Energy subsidiaries as well as the Manufacturing, service, and retailing segment as reported in this SA News story:

Operating earnings by segment vs. prior quarter and a year ago:

- Insurance underwriting — $581M vs. $47M in Q1 and $376M in Q2 2021.

- Insurance – investment income — $1.91B vs. $1.17B and $1.22B

- Railroad — $1.66B vs. $1.37B and $1.52B

- Utilities and energy — $766M vs. $750M and $740M

- Manufacturing, service and retailing — $3.25B vs. $3.03B and $3.00B

- Other — $1.12Bvs. $677M and -$169M

At the onset of high inflation Buffett told shareholders in attendance at the Berkshire annual meeting that costs had risen but Berkshire had raised prices to compensate and customers had accepted it. The above results suggest that to this point Berkshire continues to do well despite the inflationary environment.

What Buybacks And Other Buffett Actions Have Revealed About Buffett’s Views On Valuation

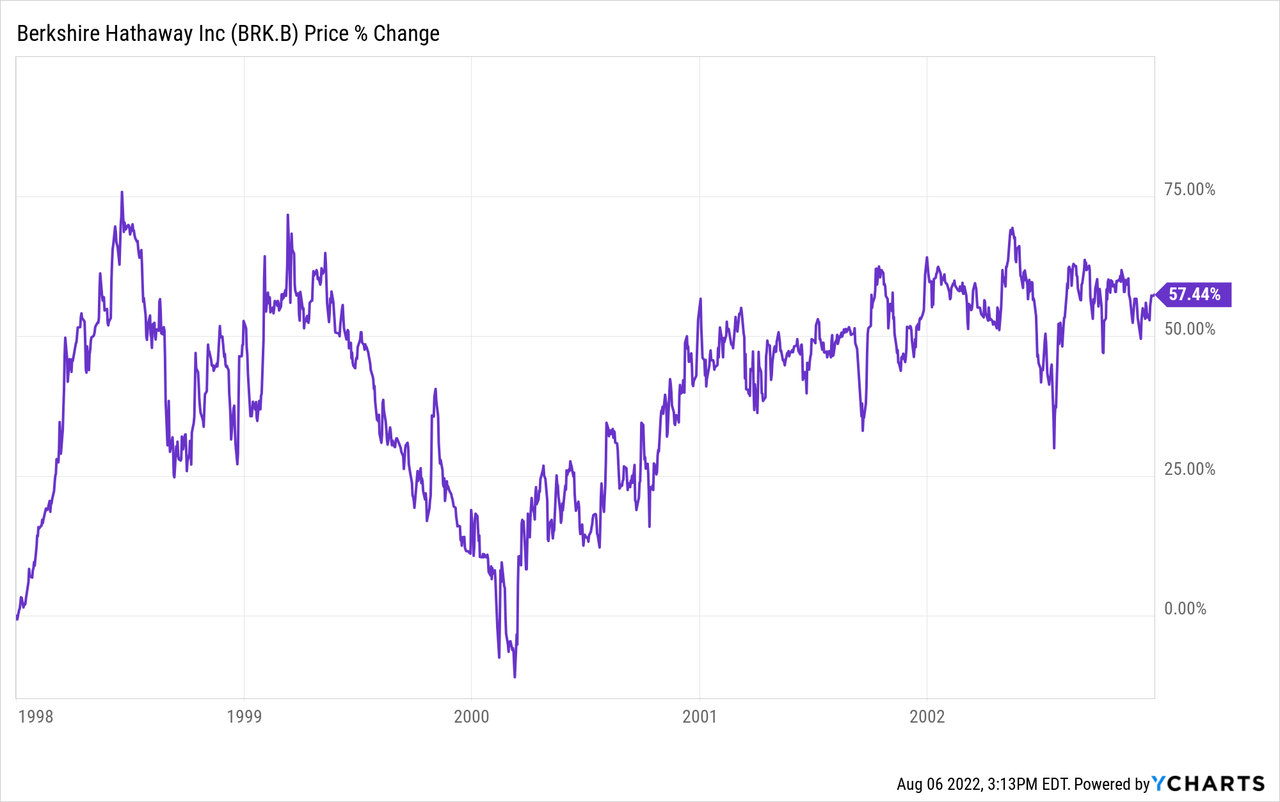

How would you like to have Buffett whisper in your ear when to buy and not buy Berkshire Hathaway stock? He has actually done that from time to time in the past, sometimes directly and sometimes through his actions. In 1998 he said outright that Berkshire Hathaway was overvalued (it was then selling at 2 times book value) and shouldn’t be bought. Here’s a chart of that era showing how you would have done at that point to hold off buying Berkshire for a couple of years.

On a long term chart it looks like you should buy Berkshire on any day the market is open and just forget about it, but as Buffett’s public remarks in the late 1990s show, you would have done a lot better to hold your horses on buying Berkshire until March 2000 when Berkshire bottomed on the very day that the NASDAQ 100 (QQQ) topped out. So what does Buffett think right now? He hasn’t said it outright, but analyzing the implications of his actions can tell you quite a bit.

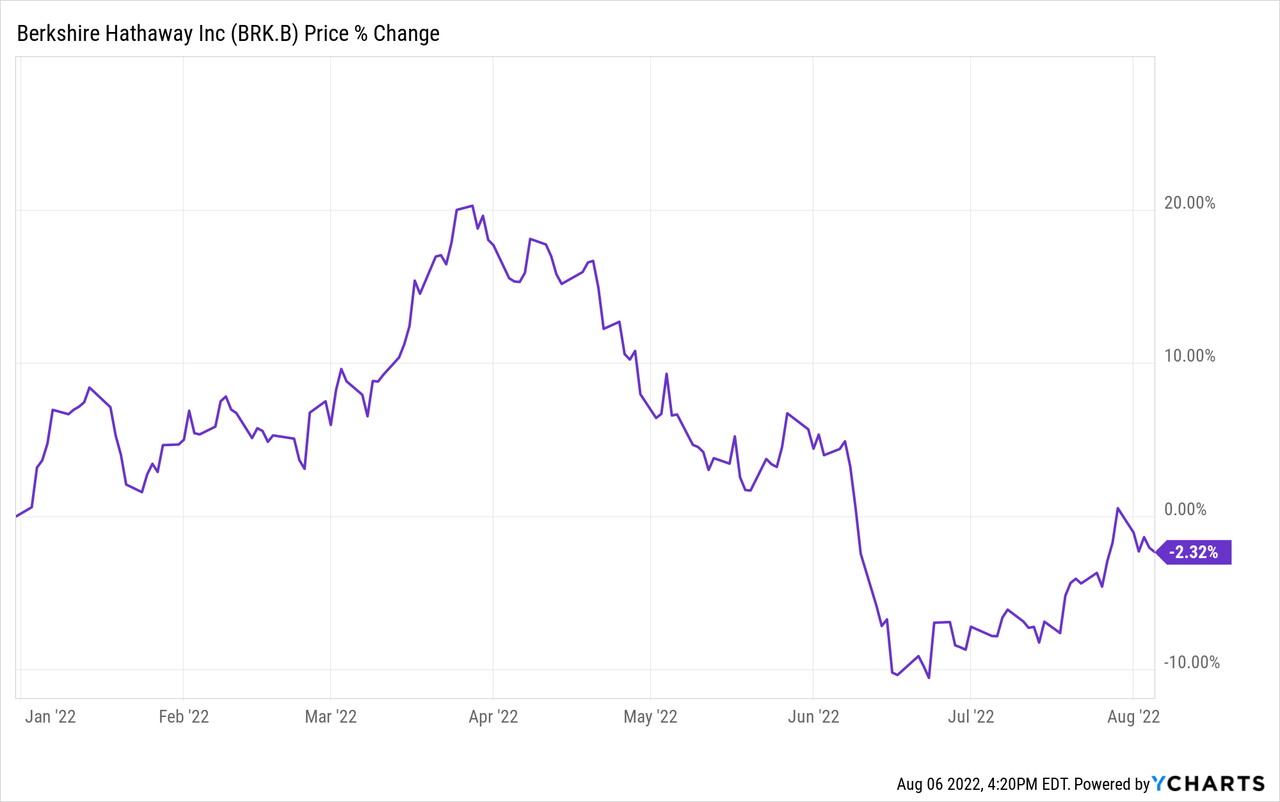

Buffett bought back about $3.3 billion of Berkshire shares in Q! but only $1 billion in Q2. He did not repurchase Berk shares in April and May, but resumed in June. From looking at the chart of Berkshire year to date it is possible that he bought back some shares at a price as high as $310 or so but no shares at a price higher than $320 – prices always given in B shares. None of his purchases were close to the scale of his buybacks in 2021. The peak on the following YTD chart clearly defines a price at which he did not buy.

Does the fact that Buffett apparently didn’t buy from around $320 to the $362.10 peak mean that he felt Berk was overpriced in that range? Not necessarily. We have to remember that Buffett follows the discipline of buying with a margin of safety, and one might guess that the margin of safety is at least the 12.5% from $320 to $360.

It’s further worth noting that Buffett bought very little of anything over that period with the exception of his continuing purchases of Occidental Petroleum (OXY) which were promptly reported on Form 4 reports. Late March was a turning point in the market as value stocks in general topped out at least for the time being, both in absolute terms and in comparison to growth stocks. With the exception of Apple, Buffett tends to buy value stocks, and he may well have seen Apple also as a value stock in many respects. The short message (the Bloomberg headline to the contrary) was that Buffett wasn’t buying anything heavily except OXY, which he clearly views as a special situation. The total of Berkshire buybacks ($1 billion) and net stock purchases around $4 billion is roughly the $5 billion of Berkshire free cash flow for the period.

The fact that OXY was his major stock purchase for the quarter also comes with a nuance from which it is possible to tease out important information. The obvious message is that Buffett continues to prefer OXY to other stocks and also to Berkshire buybacks. It’s worth noting, however, that $60 per share appears to be the ceiling above which he won’t buy more OXY. It will be interesting to see if that continues. A little more OXY, which he may have bought last week when it dipped below $60 (and not yet reported) would take Berkshire’s OXY position over the 20% line which enables Berkshire to consolidate its operational results as Berkshire now does with Kraft Heinz (KHC). Doing so significantly reduces taxes paid on OXY dividends.

It’s reasonable to consider that 20% level Buffett’s major target, and it’s also reasonable to believe that $60 per share may be his buy limit right now because it presents the necessary margin of safety. It does, on the other hand, make it seem less likely that Buffett aspires to buy the whole company (a subject I addressed here). My reasoning is that buying all of OXY would eventually require offering a premium to its price at the time, so that if that were Buffett’s intention he would likely want to continue building his position at a higher price. A price above $60 per share would in all likelihood be lower than the price he would have to bid for the shares Berkshire didn’t yet own.

Conclusion

We may or may not have seen the bottom in the market. While there are strong views among CNBC talking heads, we don’t really know, and the market direction will be the major factor as to whether Berkshire’s stock portfolio recovers quickly or declines further. At this point, it has recovered somewhat from its level as of June 30 which is the level reported for Q2 earnings. The good news is that like the market the Berkshire portfolio will eventually recover. Its temporary ups and downs have not ultimately mattered in the past and will not likely matter in the future.

The important part of the Q2 earnings report is that operating results were great. This suggests that Berkshire will continue to do well even if the economic situation worsens in any of the possible scenarios including further inflation, recession, or some odd mix of both. Nobody can forecast what is going to happen in the economy, not you, not me, not WEB. There are strong opinions on all sides, but nobody knows. What we do know about Berkshire Hathaway is that its present continues to make it likely that its success will continue in the future. The important job for analysts and investors is to pay attention to the important things in the earnings report, while paying much less attention to the things that have little importance to long term success. For the long term, especially at prices below $300 per B share, Berkshire continues to look like a Buy.

Be the first to comment