coldsnowstorm/iStock via Getty Images

Midwest refinery fire shuts down 2% of total U.S. refining capacity

The 6th largest refinery in the U.S. is mostly shut down after a fire on August 24th with no schedule for restarting operations available. The refinery located in Whiting, Indiana and operated by BP has a 435,000 bbl/day capacity. The refinery is the largest in the Midwest and BP’s largest in the world.

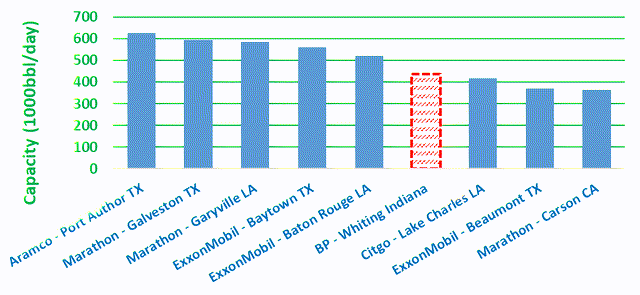

Top 10 US Refineries by Capacity

The shutdown BP refinery, represented by the red column, accounts for 2% of total U.S. refining capacity. Currently, U.S. refineries are running at 93% of total capacity, according to EIA.

The reactions of federal and state government underscore a regional crisis

The U.S. Department of Transportation has declared a regional emergency for Illinois, Indiana, Michigan, and Wisconsin, temporarily lifting Federal Motor Carrier Safety Administration regulations. The declaration is meant facilitate immediate transportation of gasoline, diesel and jet fuel to Illinois, Indiana, Michigan, and Wisconsin by easing regulations on maximum truck drivers’ time behind the wheel between breaks.

Governor Gretchen Whitmer has declared an energy emergency in Michigan with similar provisions. Whitmer said in a statement:

The impacts of the outage at the Whiting facility will be widespread across our region, and I am taking proactive steps to help Michiganders get the fuel they need to drive their cars and help businesses keep their products moving.

The federal EPA has also stepped in lifting a Clean Air Act provision that requires lower volatility gasoline during summer months to limit ozone pollution. The waiver is in effect until September 15.

10.4% of Midwest refining capacity is shut down

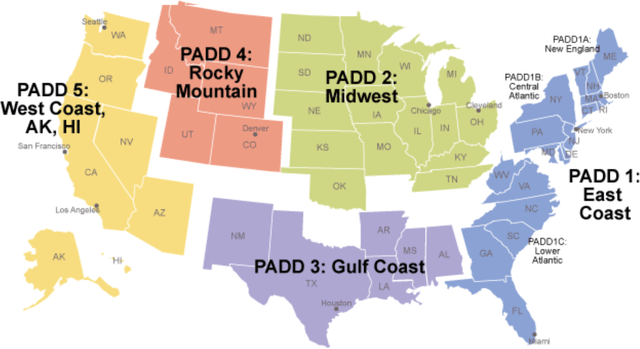

The impact will be most severe in the Midwest EIA PADD 2 region where the shutdown BP refinery accounts for 10.4% of total capacity. The PADD districts (Petroleum Administration for Defense Districts) were first established in World War II in order to ration fuel and remain a useful tool for analysts and markets today.

US PADD Districts

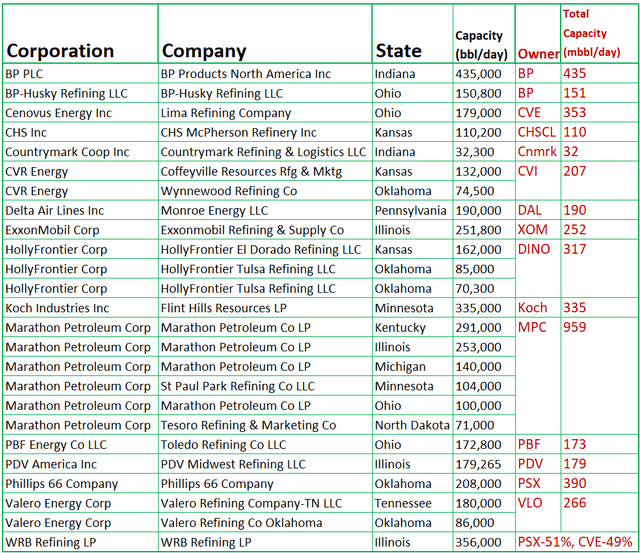

The following chart was aggregated from data within EIA’s Refinery Capacity Report published in June 2022.

PADD 2: Midwest Refineries

All EIA listed refineries in Midwest PADD 2 are shown in the chart above; red notes are by author and represent total ownership by company.

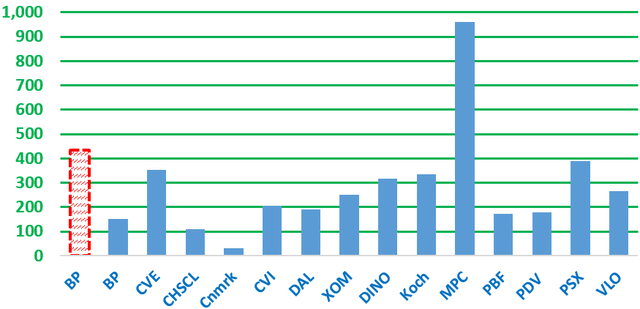

Padd 2 Refining Capacity – (1000/bbl/day)

Refining capacity in the Midwest is operated by publicly traded companies with the exception of Country Coop Inc and Koch Industries. BP is represented by two columns; a red dashed column representing its shutdown refinery and another operating one in blue. The rest of the companies are represented by a single blue column representing that company’s total refining capacity in the region.

The publicly traded companies are of the most interest here, with Marathon Petroleum (MPC) operating more than twice the refining capacity in the region than its next largest regional competitor, Phillips 66 (PSX). Cenovus (CVE), HF Sinclair (DINO), and Valero (VLO) also have significant capacity in the region. Exxon (XOM), CVR Energy (CVI), PDV America (PDV.TO), PBF Energy (PBF), are also regional players. Notably, Delta Air Lines (DAL) also has significant refining capacity in the region.

Those refiners with the most regional capacity have the most possible upside in the disrupted market. The shutdown has already driven up fuel prices in the local market; Chicago CBOB gasoline gained 30.5 cents per gallon while Chicago ultra-low sulfur diesel gained 17 cents. Presumably, regional refiners (excluding BP) will benefit from increased retail fuel prices.

The BP fire may smolder across broader energy markets

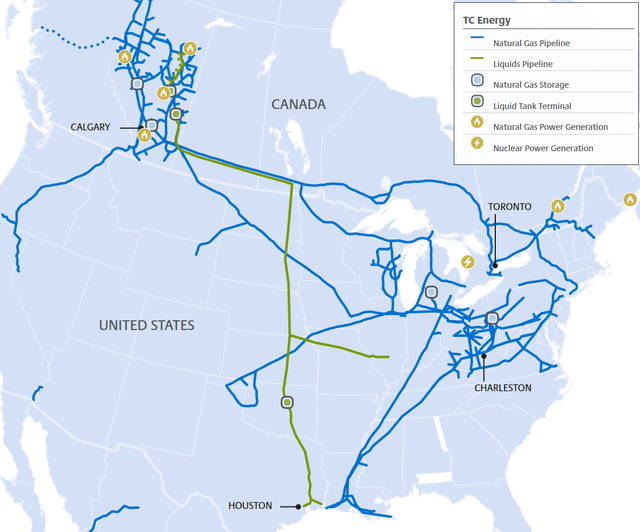

In addition to BP, other possible losers and winners in this disrupted market may include TC Energy (TRP), the operator of the existing Keystone Pipeline, shown in green on the map below, and a diverse group of energy companies served by the pipeline. Even a small change in demand or supply at any point along the pipeline could cause a large spike or dip in an already volatile regional energy market.

Keystone Pipeline

The Keystone Pipeline system begins in the Western Canadian Sedimentary Basin and transports Western Canadian Select to refineries in Illinois and Texas where a blend of the heavy Canadian oil and light crude from U.S. tight oil basins, including the Bakken, is a feedstock for refineries. The disruption in Midwest refining capacity could upset the delicate balance between heavy Western Canadian Select and light U.S. oil.

Demand and price of Western Canadian Select (WCE1) and light U.S. crude may experience volatility next week. Only 4 E&Ps produce WCS: Canadian Natural Resources (CNQ), Suncor Energy (SU), Cenovus Energy (CVE), and Repsol (OTCQX:REPYY, OTCQX:REPYF). However, other regional crude blends are priced based on WCS, such that its market influence is disproportionate to its average volume of around 0.5 million bbl/day.

Political backdrop and more volatility in energy sector

Late last week, Biden Administration officials urged domestic refiners to limit fuel exports to in order to build up domestic fuel inventories. A letter from U.S. Energy Secretary Jennifer Granholm, obtained by The Wall Street Journal, was sent to seven large domestic refiners:

Given the historic level of U.S. refined product exports, I again urge you to focus in the near term on building inventories in the United States, rather than selling down current stocks and further increasing exports.

The BP shutdown and temporary loss of refining capacity can only drive U.S. inventories lower, cause further volatility, and invite further government demands or even more direct intervention. The Biden administration has not been friendly to the energy industry. The release of inventory from the strategic petroleum reserve demonstrates that the administration could directly intervene in energy markets again.

It is absolutely impossible to determine how energy markets will react next week to the loss of refining capacity in the Midwest. Energy commodities and equities could move in either direction on the BP fire and government reactions. Cautious traders may want to add to current positions in refiners while trimming exposure to BP, Western Canadian Select (WCE1), and Canadian E&Ps. More aggressive swing traders may want to initiate new positions in MPC, PSX, CVE, DINO, or VLO in order to sell an anticipated spike. Some investors may see an opportunity in DAL.

The man who has anticipated the coming of troubles takes away their power when they arrive. – Seneca

Be the first to comment