Oksana Kuznetsova/iStock via Getty Images

Since my last article on the Vanguard FTSE Emerging Markets ETF (NYSEARCA:VWO) in September, the ETF has declined by 12%, entirely due to the weakness seen in Chinese stocks. The decline in price in the VWO has contrasted with stable earnings and dividend expectations, at least according to Bloomberg analyst estimates. The forward P/E ratio on the underlying index has therefore fallen to 11.9x, while the forward dividend yield has risen to 3.3%. Despite this fall in valuations, I am not adding to my long positions as the opportunity cost has also risen thanks to the surge in U.S. bond yields over the past 7 months. Furthermore, the Communist Party’s increasingly unhinged COVID response poses increased risks to Chinese economic growth and minority shareholders.

The VWO ETF

The VWO offers exposure to large-cap EM stocks with a very low expense ratio of 0.1%, which compares favorably to the 0.7% charge for the iShares MSCI Emerging Markets ETF (EEM). China’s higher weighting in the VWO largely reflects the absence of Korean stocks in the index, which contrasts with the EEM’s 12% weighting. The absence of Korean tech giant Samsung also means a slightly lower weighting towards Technology. The VWO’s current distribution yield is currently 3.1% versus the EEM’s 1.7%.

VWO Top 10 Holdings (Bloomberg)

Almost half of the decline in the VWO since my September update has been due to the crash Chinese tech giants Alibaba and Tencent. Chinese stocks continue to dominate the index, with a weighting of 31%, although this is down from 37% in September. Interestingly, the VWO has actually outperformed its rival ETF the EEM despite its higher China weighting, due in large part to the former’s higher weighting of Taiwanese stocks and exclusion of Korean stocks.

Increasingly Undervalued Relative To Developed Markets

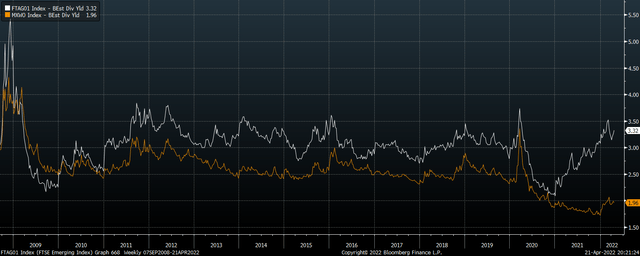

Recent weakness in the FTSE Emerging Markets index has seen the index valuation discount relative to developed market benchmarks rise even further. On a forward basis, the P/E ratio is below its long-term average at 11.9x, while the dividend yield has risen to 3.3%. This compares to 17.5x and 2.0% for the MSCI World.

FTSE EM Vs MSCI World Forward Dividend Yield (Bloomberg)

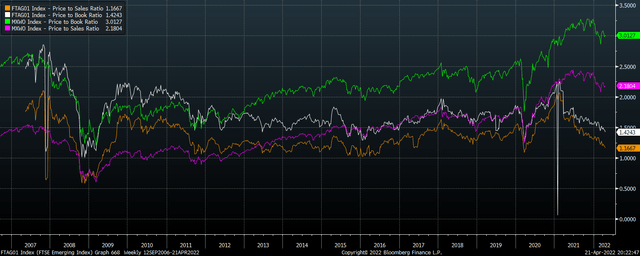

This valuation discount may even underestimate the true extent of the relative attractiveness of EM stocks. If we use price/book and price/sales ratios, which have historically tended to be better gauge of true valuation as they ignore temporary shifts in profit margins, the FTSE Emerging Markets index trades around 50% below the MSCI World. While EM stocks have almost always been cheaper on these metrics, the current discount is the most extreme it has been since the creation of the index in 2007.

FTSE EM Vs MSCI World P/B and P/S (Bloomberg)

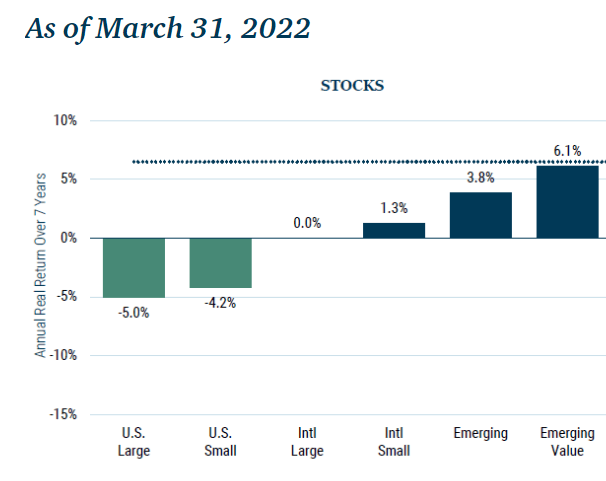

In large part this reflects the extreme level of overvaluation in U.S. stocks, but even if we compare EM to the MSCI World Ex-U.S. index, a huge valuation discount is observable. According to value-focused investment management firm GMO, this valuation discount should allow EM stocks to outperform the rest of the world handsomely over the next 7 years.

7-Year Real Return Forecasts (GMO)

Rise In U.S. Yields Has Raised The Opportunity Cost

Regular readers of my content will be well aware of my view that changes in interest rates have little impact on equity valuations. This is a view backed up by decades of data across both the U.S. and the rest of the world. That said, the surge in U.S. bond yields over the last has dramatically improved the relative outlook for bonds, particularly from a risk-adjusted perspective. The 5-year U.S. Treasury yield is now yield is now on par with the VWO’s dividend yield. Although the former does not rise with inflation, I am adding new capital to bond funds at this juncture instead of EM stocks.

China’s Lockdowns Are A Significant Threat To Growth And Stability

As Chinese lockdowns extend from Shanghai to other cities, near-term economic weakness is becoming almost inevitable. At least 44 Chinese cities are reportedly under either a full or partial lockdown. What poses a greater threat in terms of the country’s stock market is the long-term risks posed by increased economic and political control from Beijing in response to growing public discontent. With the rest of the world returning to normal after two years of restrictions, China’s zero-COVID policy is looking increasingly unhinged, and Chinese citizens appear to be growing weary of it. With the twice-a-decade Party Congress just months away, leader Xi Jinping will be under intense pressure to limit political unrest, and if history is any guide this is likely to mean further curtailment of economic freedom. For minority shareholders like ourselves, it is difficult to spin this in a positive light.

Summary

The VWO ETF offers exposure to a broad basket of emerging market stocks with a low expense ratio. It is trading at increasingly attractive valuations, particularly relative to its developed market peers. However, the surge in U.S. bond yields and risks posed by Chinese COVID lockdowns have undermined the case for adding to positions despite the decline in valuations.

Be the first to comment