Peach_iStock

Fortis Inc. (NYSE:FTS) recently announced the expected completion of many energy projects from 2023 to 2026. With more than CAD19 billion in capital expenditures, the increase in free cash flow will most likely push the stock price up. With beneficial guidance and fantastic expectations from financial analysts, Fortis will likely surprise those investors who don’t follow the stock carefully. Under my discounted cash flow models, even considering potential issues from inflation, I believe that the current market valuation is too low. New projects undertaking low carbon technologies and sufficient support from investors could really push the stock valuation up.

Fortis

Fortis Inc., runs projects in the North American regulated electric and gas utility industry.

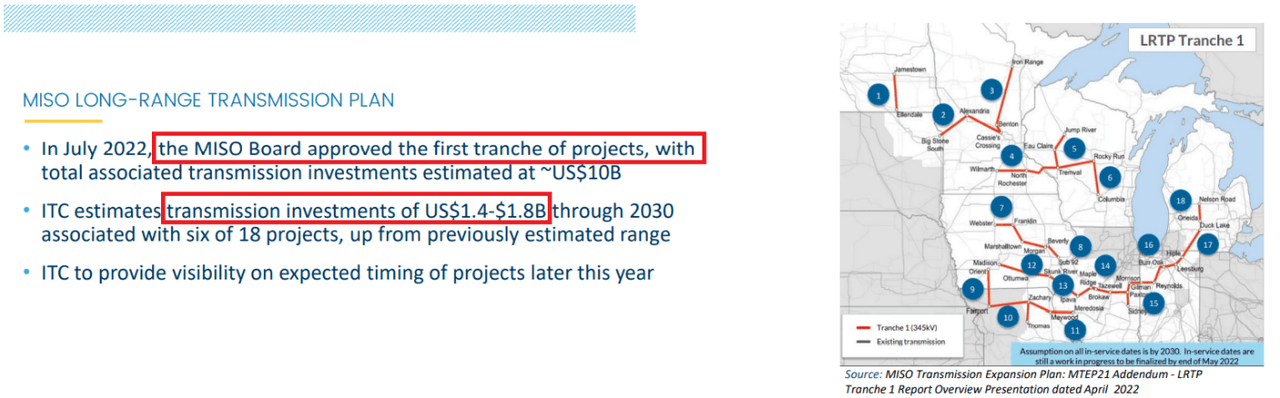

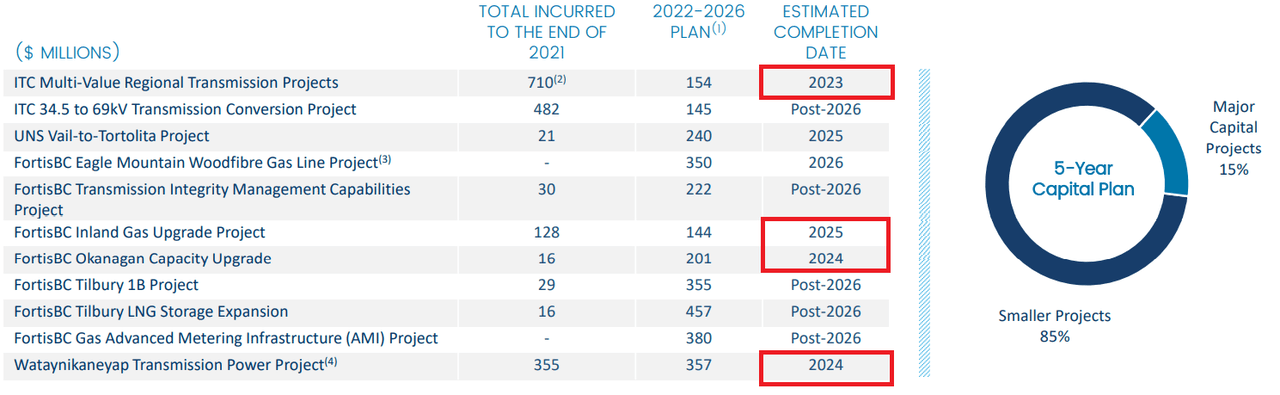

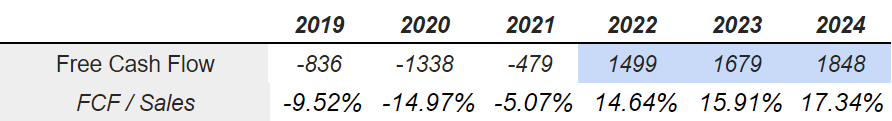

I believe that the company’s business model is quite interesting because of the incoming investments in capital expenditures and new projects. Considering the number of projects that may be completed through 2023, free cash flow will most likely trend north soon:

Presentation

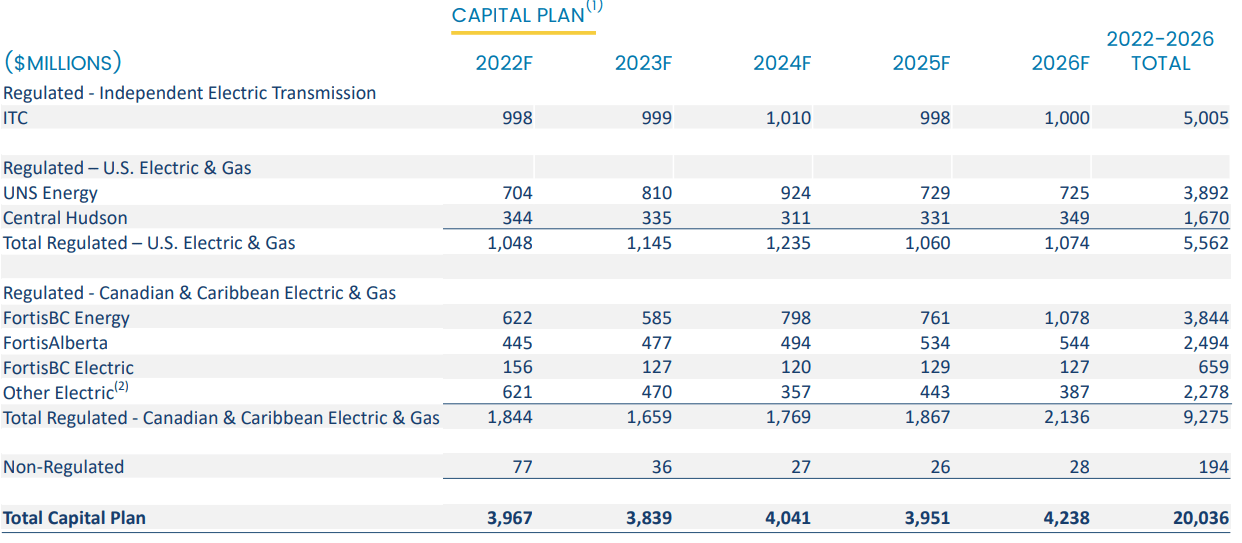

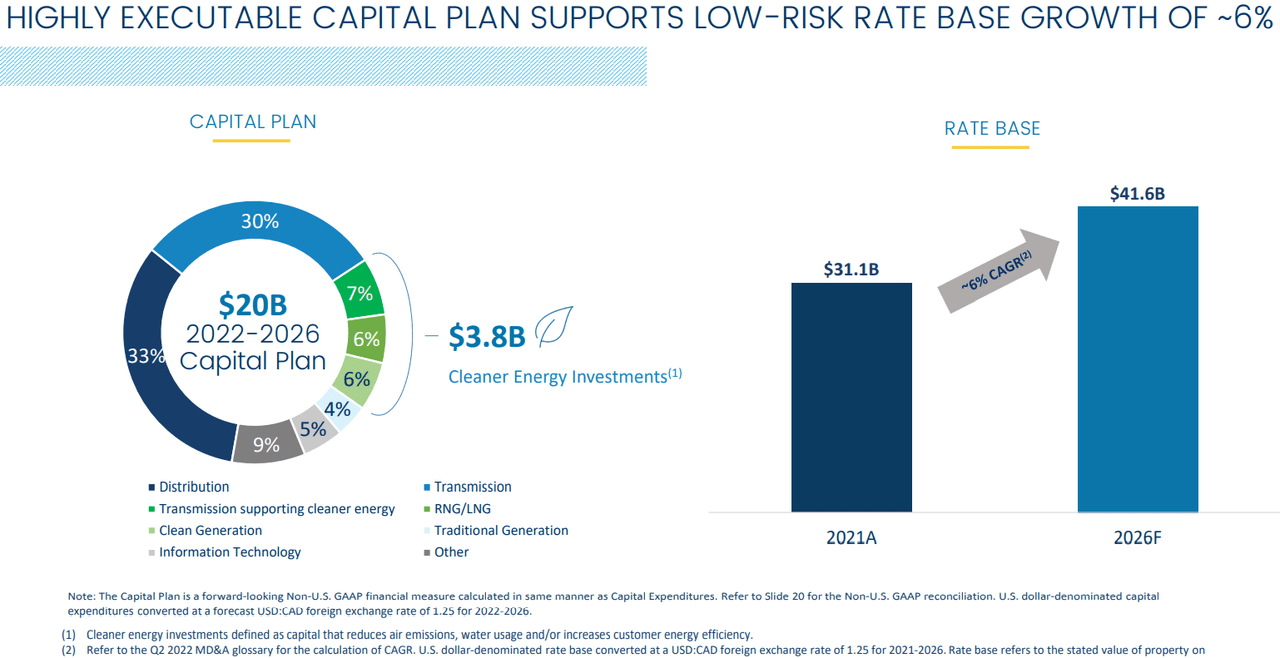

I counted one project to be finished in 2023, two in 2024, and many more from 2026. The total amount of money invested is quite impressive. The total capital plan includes as much as CAD20 billion.

Presentation Presentation

The guidance given by management is promising. Management did not only promise an annual growth rate of 6%, but also announced new additional energy infrastructure opportunities, which could enhance future sales growth.

The Corporation’s $20 billion five-year capital plan is expected to increase midyear rate base from $31.1 billion in 2021 to $41.6 billion by 2026, translating into a five-year compound annual growth rate of approximately 6%. Above and beyond the five-year capital plan, Fortis continues to pursue additional energy infrastructure opportunities. Source: Quarterly Report Q2 2022

Fortis continues to enhance shareholder value through the execution of its capital plan, the balance and strength of its diversified portfolio of utility businesses, and growth opportunities within and proximate to its service territories. Source: Quarterly Report Q2 2022

Other Analysts Are Quite Optimistic About Fortis

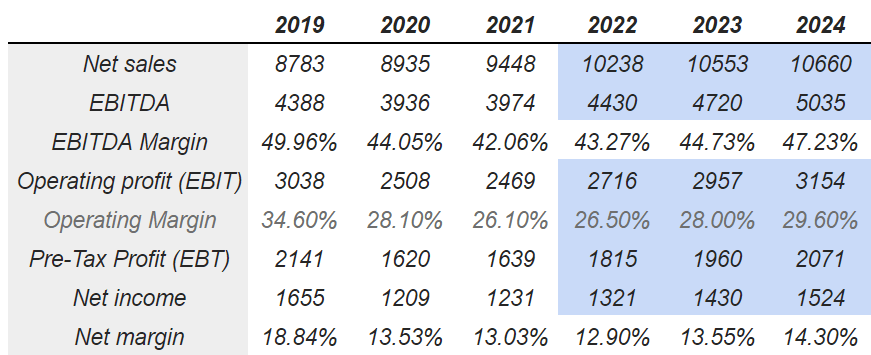

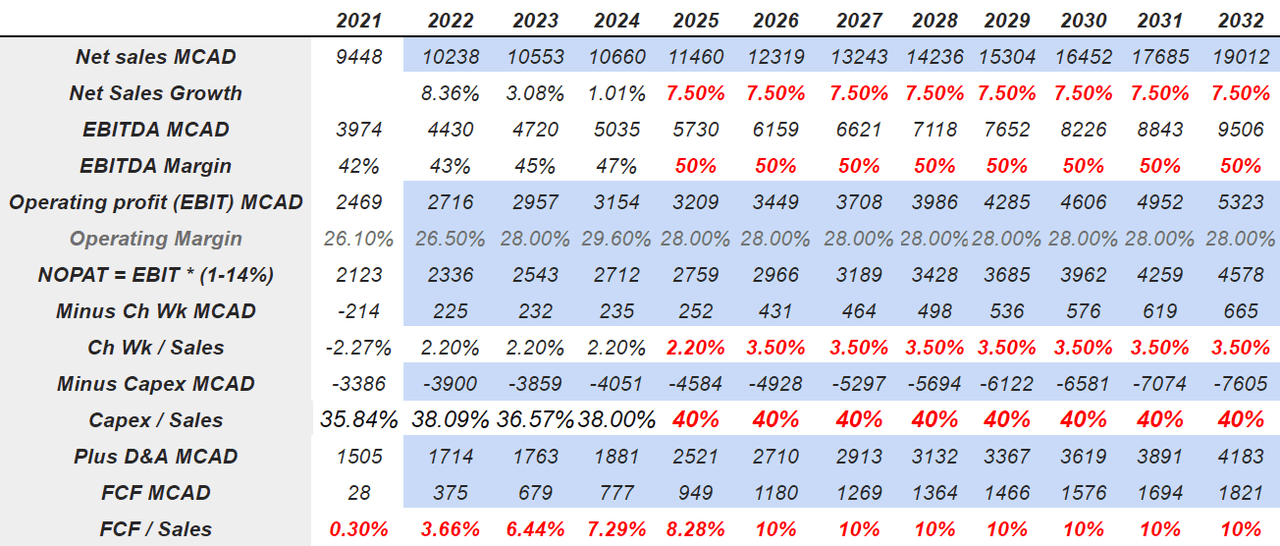

Other investment analysts are expecting a stable EBITDA margin around 44%. The net margin is also expected to remain positive. 2024 EBITDA would stand at CAD5.035 billion, more than 26% more than that in 2021.

Marketscreener.com

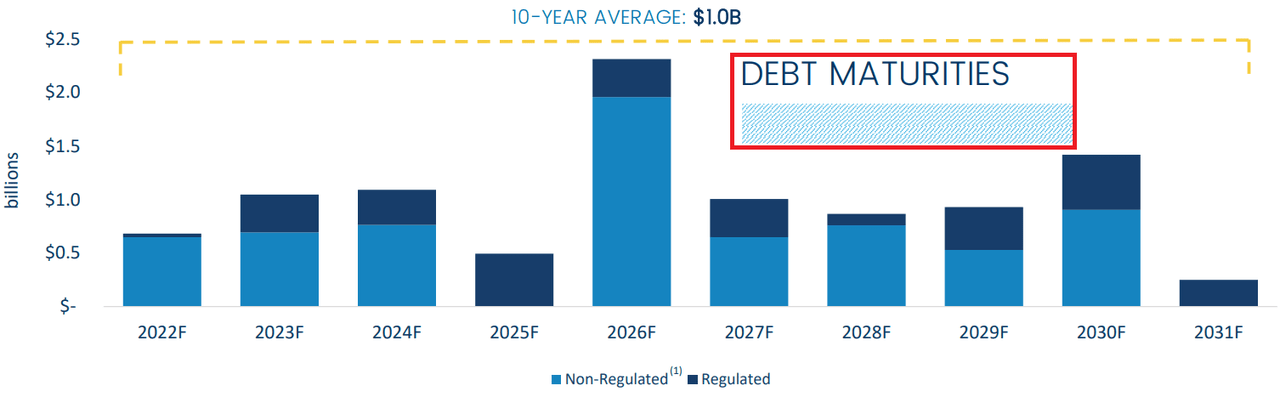

The free cash flow would turn positive from 2022, and the FCF/Sales would be close to 12%-14%. With these figures, I would expect an increase in the demand for the stock in the coming months.

Marketscreener.com

I Am Not Afraid Of The Total Amount Of Debt Because The Business Model Does Not Report Volatile Margins

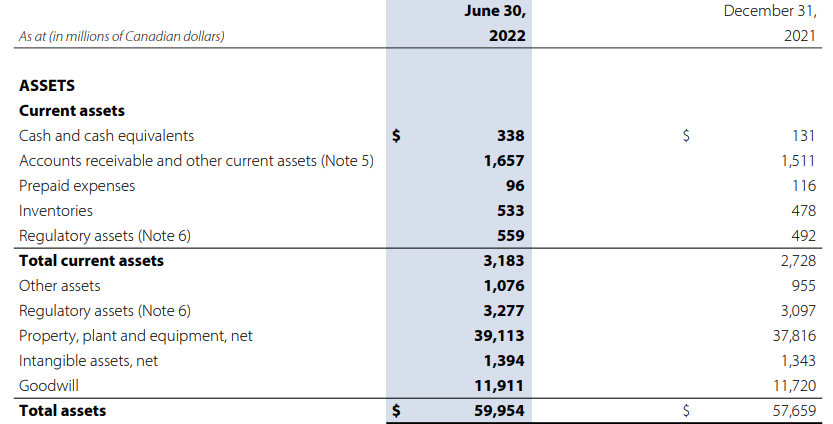

As of June 30, 2022, cash in hand stands at CAD338 million, with CAD59 billion in total assets and CAD38 billion in total liabilities. Considering that Fortis runs a model in which margins are easily forecasted, in my view, the balance sheet appears quite stable.

Quarterly Report Q2 2022

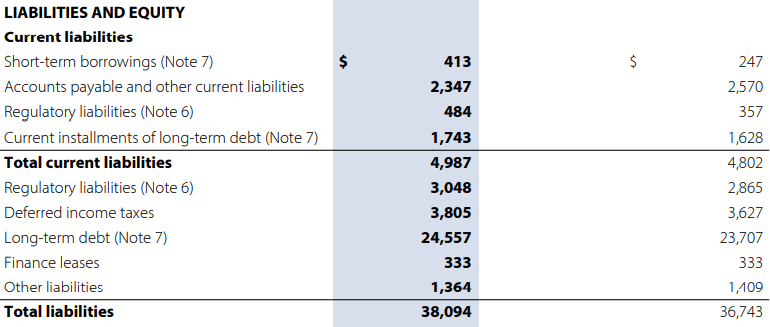

Yes, management reports long-term debt worth CAD24.5 billion and short-term debt worth CAD1.7 million. However, the payment of the debt is expected in the next ten years. I believe that Fortis will be able to pay its obligations after free cash flow increases in 2023.

Quarterly Report Q2 2022

Fortis has to pay more than CAD2 billion by 2026. I wouldn’t worry about future payments from 2022. In my view, management has sufficient time to either negotiate debt obligations or generate free cash flow to pay.

Presentation

My Base Scenario Implied A Stock Price Close To CAD83 Per Share

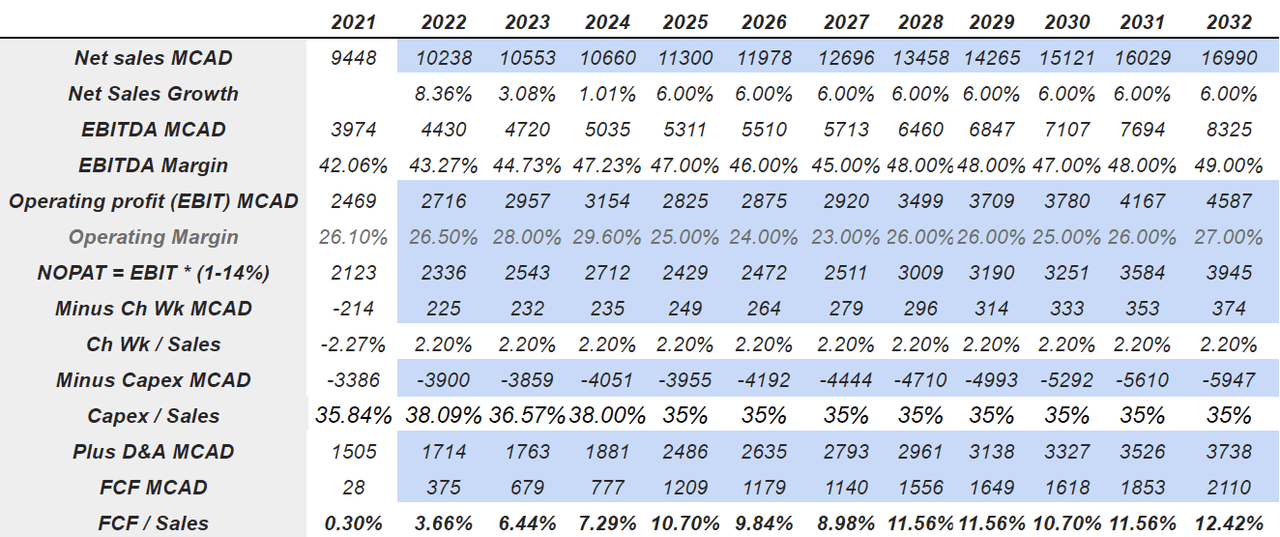

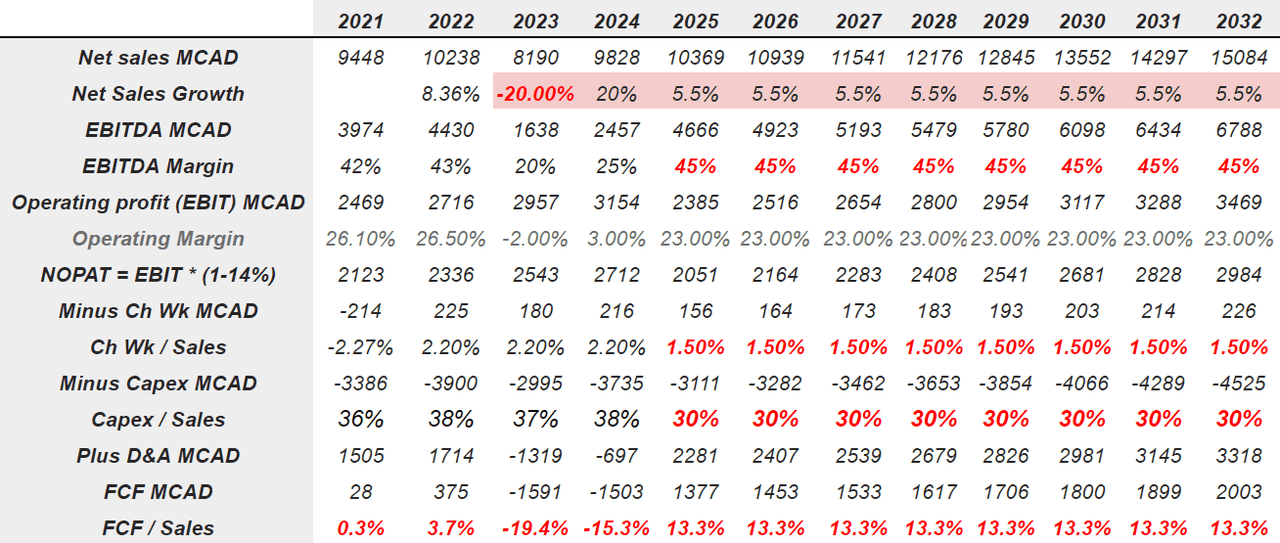

Following the guidance given by Fortis, I assumed sales growth close to 6% from 2026 to 2032, EBITDA/Sales close to 46%-49%, and operating margin close to 26%.

Presentation

With an effective tax of approximately 14%, changes in working capital/sales of 2%, and capex/sales close to 35%, 2032 FCF/Sales would stand at 12%. I also obtained 2032 FCF of CAD2 billion, which is significantly higher than what most investors expect for 2022.

Author’s Work

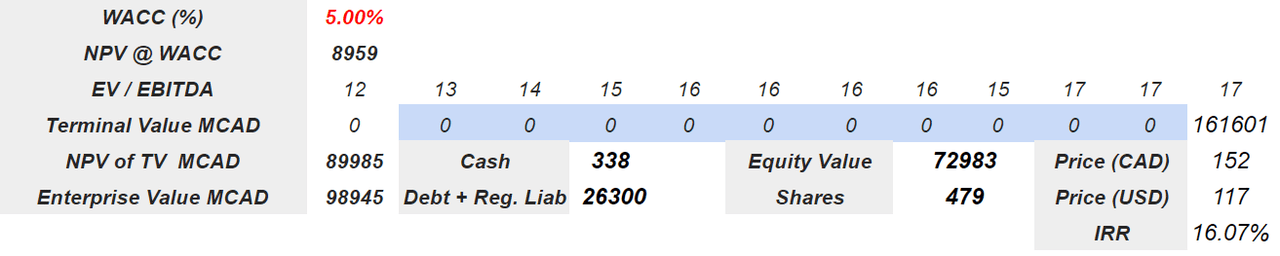

Like other investors, I included a weighted average cost of capital of 7.8%, which implied a net present value of future FCF of CAD7.84 billion. I also assumed that the company’s EV/EBITDA ratio would increase as both the EBITDA margin and revenue increase.

With an exit multiple of 17x, the net present value of the terminal value would be CAD57 billion. If we sum the terminal value and the NPV of future free cash flow, the enterprise value would be CAD65.3 billion. Finally, we would obtain CAD82-CAD83 per share and an IRR of 4%.

Author’s Work

Low Carbon Technologies And More Projects Could Lead To More Than CAD150 Per Share

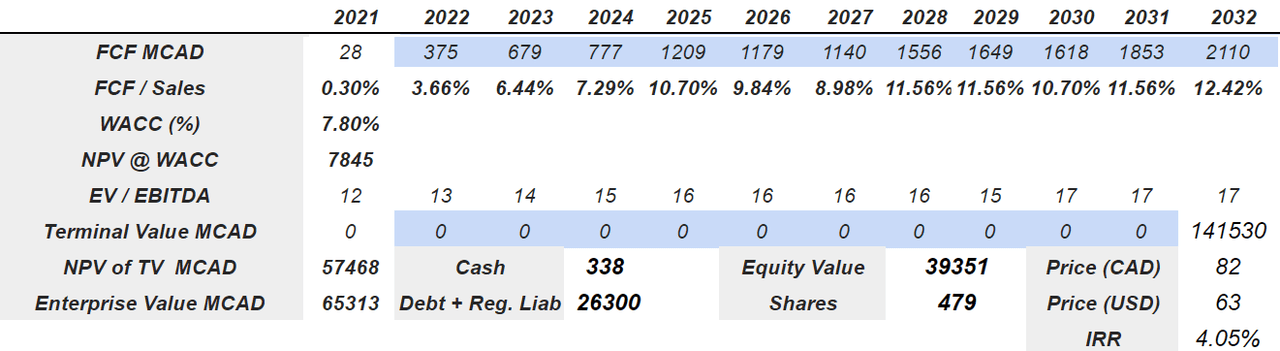

Under my most optimistic case scenario, I assumed that drastic reduction in emissions and investing in low carbon technologies will help Fortis. If management can find new projects and new investors, future sales growth may be larger than expected. With more scale, I believe that the company’s EBITDA margin could also grow more than that in previous case scenarios.

Our utilities are reducing emissions and investing in low carbon technologies. Last month we retired the coal-fired San Juan Generating Facility in Arizona and we now have several hydrogen pilot projects announced or underway in British Columbia. I’m proud of our strong governance practices and progress on diversity, equity and inclusion initiatives, and how we are moving forward by engaging with key stakeholders. Source: Quarterly Report Q2 2022

With sales growth around 7.5% from 2025 to 2032 and an EBITDA margin of 50%, I obtained 2032 EBITDA of CAD9.5 billion. I also assumed more free cash flow thanks to less changes in working capital, but also more capital expenditures. The results would include FCF/Sales of 10% and 2032 FCF of almost CAD1.85 billion.

Author’s Work

Finally, if we use a discount of 5% and an exit multiple of 17x, the implied enterprise value would be CAD98.945 billion, and the implied fair price would stand at around CAD150 per share.

Author’s Work

Failed Engineering Plans, Lower Productivity, Inflation, Or Changes In Energy Law Could Bring The Company’s Stock Price Down

Taking into account the number of projects to be completed, I believe that failures in the engineering plans could occur. If engineers fail to forecast capital expenditures, opex, or future FCF, the FCF/Sales margin may not be as expected. In the worst case scenario, the market may not appreciate the new earnings reported from 2023, which would lower the company’s market capitalization.

The ability to recover the actual cost of service and earn the approved ROE or ROA typically depends on achieving the forecasts established in the rate-setting process. Source: Annual Report

Inflation, lower productivity than expected, or changes in energy laws and governmental energy policies could destroy the company’s net margin. Keep in mind that Fortis warned about these issues in the last annual report:

While Fortis is well positioned to maintain constructive regulatory relationships through local management teams and boards comprised mostly of independent local members, it cannot predict future legislative or regulatory changes, whether caused by economic, political or other factors, or its ability to respond thereto in an effective and timely manner, or the resulting compliance costs. Source: Annual Report

For those utilities subject to PBR mechanisms, rates reflect assumed inflation rates and productivity improvement factors, and variances therefrom could have a Material Adverse Effect. Source: Annual Report

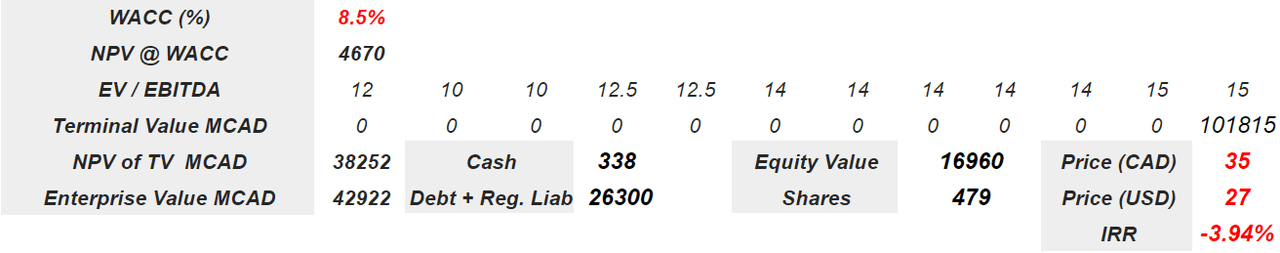

I also believe that the supply chain could represent a relevant risk for Fortis. Under my worst case scenario, I assumed -20% sales growth in 2023 and long-term sales growth of around 5.5% from 2025 to 2032. With an EBITDA margin of 45%, changes in working capital/sales of 1.5%, and capex/sales of 30%, I obtained 2032 FCF of $2 billion.

Author’s Work

I assumed a discount of 8.5%, which is a bit higher than that in previous case scenarios because the numbers are not that good. If traders decide to sell shares, the cost of equity and cost of debt could increase. I also assumed an exit multiple of 15x, which implied a valuation of CAD35 per share.

Author’s Work

My Takeaway

Fortis expects to deliver several projects in 2023, 2024, and 2025, which could accelerate both the free cash flow and the demand for the stock. Investment analysts and management are quite optimistic about the future financial figures. The upside potential in the FCF obtained from further projects targeting lower carbon technologies could be substantial. Even considering risks from inflation, changing energy laws, or failed forecasts, Fortis appears cheap at its current market value.

Be the first to comment