inakiantonana

Main Thesis & Background

The purpose of this article is to evaluate the SPDR EURO STOXX 50 ETF (NYSEARCA:FEZ) as an investment option at its current market price. This is a fund that invests in large-cap European companies, and one I used to consider when looking for overseas exposure.

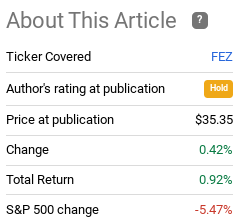

Throughout 2022 I have generally suggested investors avoid mainland Europe. The rationale was straightforward – war between Russia and Ukraine was a unique headwind that other regions did not face. This has amplified inflation, another macro-headwind that, while not unique to Europe, is worse there. This modest outlook has been proven correct over time – including since my last review in July:

Fund Performance (Seeking Alpha)

As I look ahead to the new year I continue to believe continental Europe is not the right place for my cash. While there is a potential value play, I think the risks outweigh this potential. I will be keeping this fund’s rating at a “hold” because I believe investors will be well served keeping minimal exposure to FEZ as other regions have a brighter economic outlook.

What’s The Buy Case? Valuation

To start, let us consider why investors would even be considering FEZ at this juncture. Europe certainly has a lot of problems – so why would anyone even want to buy here?

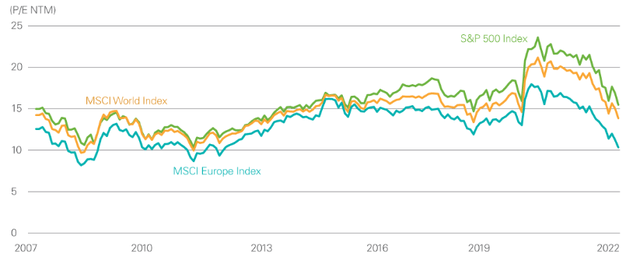

The simple reason is that buying during times or weakness or uncertainty often results in strong long-term returns. If we wait until the headwinds are all removed it is usually too late. In this vein, we see that European equities have been laggards in 2022. So perhaps it is time to consider this region as a relative value play compared to the rest of the world:

Relative Index Performance (World Bank)

Because of this, funds that are Europe-focused like FEZ are trading at marked discounts. Specifically, FEZ has a current P/E under 13. This contrasts with a U.S. stock market that is still a bit pricey with the S&P 500 holding a current P/E above 19.

What this tells me is that value-oriented investors could be drawn in here. Equities across Europe and the ones in FEZ’s portfolio are clearly cheaper than their developed world counterparts. However, I would caution against this simplistic conclusion because I see earnings continuing to come under pressure across the pond for a variety of reasons. I will get to those reasons in the following paragraphs and use them as a cautionary tale that readers should not get too optimistic on FEZ’s potential just because it looks “cheap”.

Earnings Estimates On The Decline

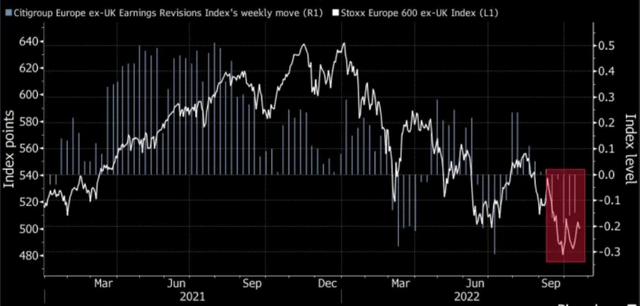

The primary reason why I don’t see FEZ as a compelling value is because I think the P/E ratio is a bit misleading at this juncture. Yes, it is lower, but whether or not that is an actual value depends on what happens to each the “P” and the “E” going forward. I think the “P” does have a chance to push higher if we see clarity in the Russia-Ukraine conflict and/or the winter is milder than expected which will ease the gas shortage. The problem is that neither of these scenarios is guaranteed to happen. That will limit how high investors are willing to bid up the “P” in the immediate future.

The other challenge is the “E” portion of that ratio is coming under pressure. If earnings disappoint, share prices could push lower and the relative value won’t improve. The P/E could stay steady (or even move higher) in that scenario, which is not what anyone buying in today would want to happen. The reason this concern is so valid is because earnings revisions for Europe have been net negative as the Fall got underway:

Corporate Earnings Net Revisions (Bloomberg)

The takeaway I have here is that if these forecasts are right then FEZ is going to see its P/E rise as earnings come in lower (all other things being equal). This means FEZ is less of a value play than it looks, supporting a more cautious view at the moment.

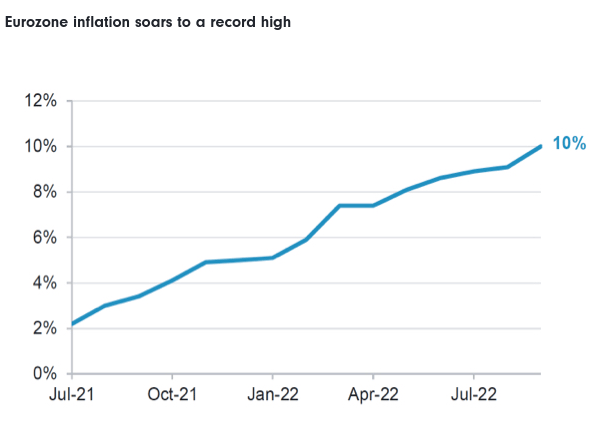

Inflation Remains A Challenge For FEZ

The next attribute I want to touch on is the energy crisis in Europe and how that is impacting inflation. As readers are surely aware, inflation is a global problem both here and abroad. So the fact that the Euro-zone is grappling with this issue is not a surprise. The problem here is the primary driver for rising prices in Europe is lack of oil and gas supplies, which shows no signs of abating. This has been amplified by the Russia-Ukraine conflict and the corresponding political fallout as the EU attempts to sanction Russia but also rely on them for their energy needs.

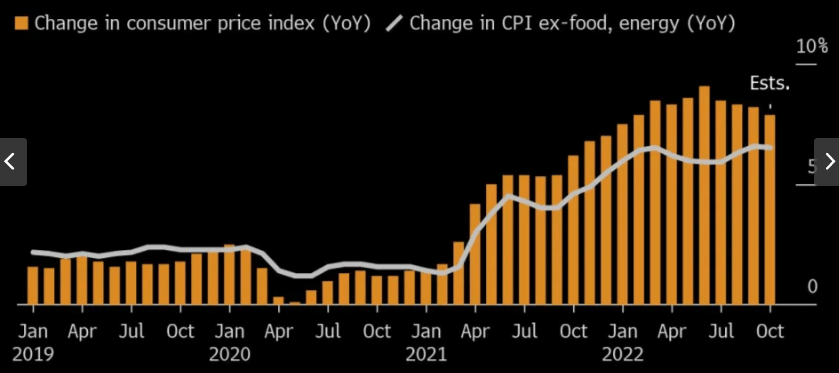

Just recently, we have seen the indefinite suspension of the NordStream One pipeline, keeping energy prices elevated there compared to other regions in the world. As a result, inflation remains at a record high and is not showing any signs of peaking:

Euro-zone Inflation (Fidelity)

This contrasts to inflation hopefully starting to peak in America, which gives U.S.-based companies (and stocks) a relative advantage on that front:

CPI (America) (Yahoo Finance)

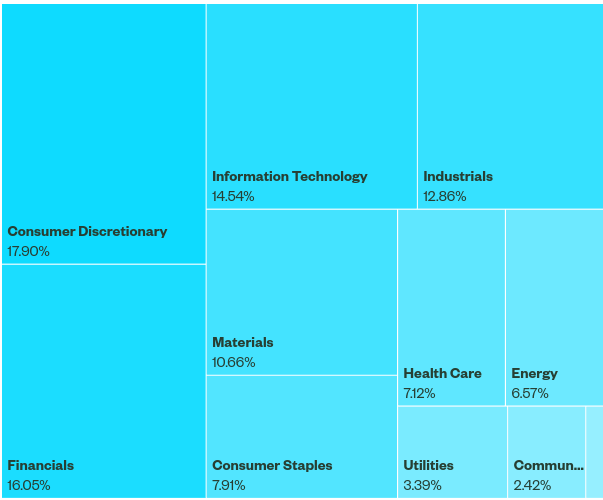

This is especially concerning for FEZ because the fund is heavily exposed to consumer-oriented sectors. The Consumer Discretionary sector happens to be the largest sector by weighting. And once Consumer Staples is factored in, we see the fund has almost 26% of its total assets tied directly to European consumers, as illustrated below:

FEZ’s Sector Weightings (State Street)

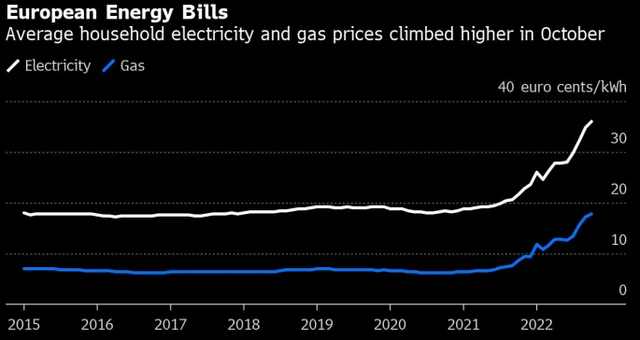

What this tells me is the FEZ is heavily reliant on how consumers are faring. Do they have money to spend and are they in confident enough to spend it. With inflation still accelerating and the winter energy crisis looming, I am more than a little worried going forward. We are still in the Fall season and already European households are seeing their budgets under pressure by rising electricity and gas prices:

Average Household Utility Prices (EU-zone) (European Central Bank)

The conclusion I draw here is that discretionary spend is going to decline measurably over the next quarter, perhaps the next two. It is simply hard for me to get bullish on a fund like FEZ that is overweight consumer sectors in this reality.

Russia Has Been Unwavering In Its Use Of Force

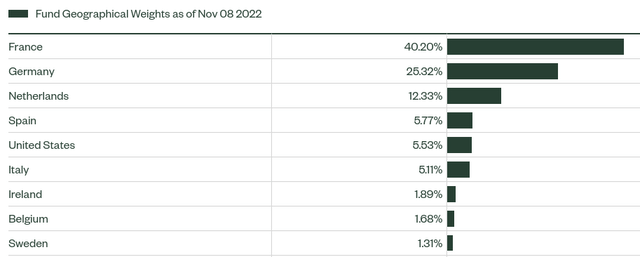

The next topic to focus on is the Russian-led military conflict taking part in Ukraine. This is again key to my rationale for avoiding mainland Europe throughout 2022. While I would have hoped for a different outlook in 2023, the truth is there is not much suggesting a peaceful resolution any time soon. While FEZ is not comprised of Russian or Eastern European companies directly, the fund focuses on continental Europe that is very near to the conflict:

FEZ’s Geographical Exposure (State Street)

Given Europe’s greater economic exposure to Russia – particularly through energy – this military conflict makes the region mostly univestable right now. To be fair, there is quite a bit of upside that could occur if we see substantial progress on that front. If the conflict does not spill over the borders and/or if Russia retreats and political relations and trade routes normalize, European equities will rally. This is critical to why I wouldn’t get “short” this investment theme. There is upside potential and that will be very painful on anyone going short this region right now.

However, I do not see rapid upside as the likely scenario, hence my reluctance to go long. The chances of a diplomatic solution remains low. This hurts trade routes, investor sentiment, and business opportunity in the eastern region of Europe. Worryingly, the conflict seems to be intensifying near the Black Sea that means there are consequences on world trade beyond just Russia and Ukraine (as we have seen throughout 2022 already):

Overview Of The Conflict (United Nation)

I recognize that FEZ avoids direct exposure in either Russia or Ukraine. But the implication of this war continues to have a disproportionate impact on the Euro-zone. While waiting for the conflict to resolve completely will be too late to make the most “alpha” of European equities, I don’t see any need to rush in at these levels as long as the conflict shows no signs of slowing down and may actually be escalating as Russia gets more desperate in the winter months.

Bottom-line

FEZ has been moving in-line with most of the market in 2022 – down. Europe has been under pressure for a variety of reasons, and investors may begin looking at this region as a value play. It does have a strong relative edge over U.S. equities and other developed markets and central and western Europe have also been lucky in that the Russia-Ukraine conflict has remained isolated for the time being. The residual impacts have been felt world-wide, but at least the worst of the conflict continues to be contained.

While one could argue a buy case here, inflation and rate hiking by the ECB tells me that cheaper share prices could be on the way. Considering consumers are already seeing home heating bills rise and we aren’t even in winter yet, I think Q1 2023 is going to be very challenging. I will wait for more clarity that economic growth in Europe has bottomed and is beginning to improve, before making a move back in to European equities. Therefore, I continue to believe a “hold” is the right call on FEZ at this juncture.

Be the first to comment