Stefonlinton

FedEx Offers Investors a Flexible Investment Despite Bull or Bear Market Conditions

FedEx Corporation (NYSE:FDX) is a U.S. multinational delivery services company with its headquarters in Memphis, Tennessee. The company is the world’s second-largest package delivery company (after United Parcel Service (UPS)) and operates in more than 220 countries and territories.

The company’s stock price has been under pressure in recent months as the global economy has slowed down and trade tensions have increased with the war in Ukraine. The stock is down more than 30% from its 52-week high of $267 and is currently trading near its 52-week low of $175 due to potential for slowing growth this holiday season.

Despite the recent sell-off, we believe that FedEx stock is a buy for low-risk investors near 52-week lows. The company is a market leader in the global package delivery industry and is well-positioned to benefit from the continued growth of e-commerce. Moreover, the stock is currently trading at a significant discount to its 52-week-high. With the market turning, FedEx offers investors the opportunity to build a position in a versatile stock that has the potential to rise in both bull & bear market conditions.

Valuing FedEx

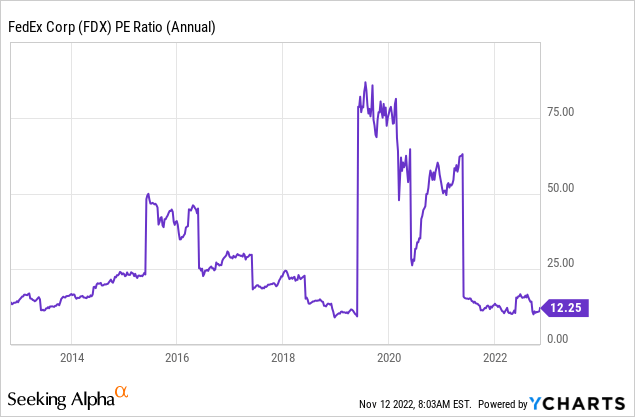

FedEx stock in our opinion is a buy near 52-week lows. The stock is down sharply from recent highs, and is now trading at a significant discount to 5 year averages. Given the historically strong fundamentals of the company, and the recent slowdown in the economy, we believe that the stock is a bargain at current levels for investors looking for fairly safe returns on a potential macroeconomic easing in coming months.

Here are a few reasons why we believe that FedEx stock is a good value buy near 52-week lows despite recent headwinds:

1) The company has strong fundamentals, and is well-positioned to weather an economic slowdown (A+ Profitability score on Seeking Alpha).

2) The stock is trading at a significant discount to recent highs (30%+ pullback & -30% plus from 5 year historical trading averages) not seen since the start of the pandemic.

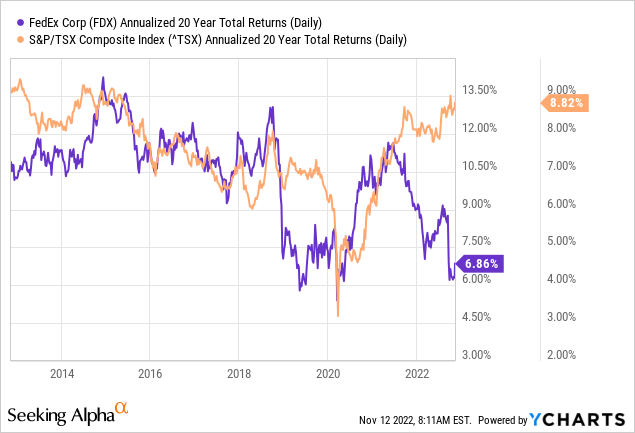

3) The company has a strong track record of delivering shareholder value in line with S&P growth, neglecting recent variation due to dips.

4) The company has a strong dividend yield (2.6%), which makes it an attractive income investment.

This combination of factors above presents nearly 30% upside for FedEx stock if they can navigate current headwinds. There will be many better returners out there in our opinion to invest in over the next 6-10 months, but FedEx offers a good amount of low risk upside along with a decent dividend that would be respectable in just about any portfolio looking to diversify beyond tech with more traditional blue chip names. Therefore, we believe FDX falls somewhere between a neutral hold and a buy for the right investor with lower propensity for risk.

Risks

Investing in stocks comes with a certain amount of risk. This is especially true for FedEx, which is currently facing several challenges that could impact its stock price. These challenges include the delivering following the COVID-19 pandemic, increasing competition from giants such as UPS & Amazon (AMZN), and the potential for volume slowdowns with shoppers beginning to slowly return to brick and mortar options. The company’s debt stands around $37 billion. Cash stand around $7 billion and flows in heavily through operations, so the balance sheet appears healthy as long as management and investors monitor these metrics going forward quarter to quarter.

Despite these aforementioned risks, FedEx stock is still worth considering for potential investors. The company has a strong history of profitability and growth, and it is one of the leading global logistics providers. FedEx also has a large customer base and a large network of warehouses and distribution centers. We believe it is extremely unlikely FedEx stock dips below the $120 range where it traded at the lows of the pandemic, hinting at worst ~28% downside. This equates to a nearly asymmetrical risk vs. reward, although the upside story appears considerably more likely in our opinion, which is why we feel the stock is somewhere between a hold to a buy.

Overall Summary

Overall, FedEx stock is a hold if it continues to appreciate, but offers a low risk buying opportunity at sub $170 levels in our opinion. The company’s strong history of dividend growth, combined with its recent share price decline, makes it an attractive investment at current prices. While the company faces some challenges in the coming years, its strong financial position and growth potential make it a stock worth considering for medium to long-term dividend investors.

We like FedEx more than UPS heading into the holidays based on current valuations. Over the past five years, FedEx stock has underperformed the market. However, at current prices, the stock is trading at a discount to 5 year averages. Based on this analysis, we recommend that investors do not overlook FedEx stock, but keep it in mind to diversify for the asymmetrical risk vs. reward opportunity available.

Be the first to comment