undefined undefined

Thesis

FedEx Corporation (NYSE:FDX) stock crashed hard after the company warned that Q3 results are likely to be worse than expected. During the extended trading hours (pre-market reference), FDX stock lost as much as 22%. FedEx weak preliminary results come at a very difficult time for stocks – and further highlight the dangerous possibility of a serious EPS contraction, which the market has arguably yet to price.

Personally, after the selloff, I believe FedEx stock trades fairly and gives a balanced risk/reward for investors. However, I would advise investors to remain cautious buying the dip at this point, given that the global economy and investor sentiment remain very weak.

The FedEx Profit Warning

Preliminary Results

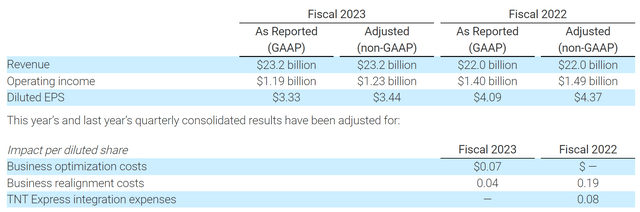

According to preliminary result, FedEx expects a $500 million revenue shortfall ($23.2 billion versus analyst consensus of $23.7 billion). Furthermore, the company expects earnings per share of $3.33, which implies a 19% year-over-year decline and a $1.81 shortfall versus consensus estimates at $5.14.

Raj Subramaniam commented (emphasis added):

Global volumes declined as macroeconomic trends significantly worsened later in the quarter, both internationally and in the US …

… We are swiftly addressing these headwinds, but given the speed at which conditions shifted, first-quarter results are below our expectations.

Weak Guidance

FedEx also added a weak guidance for the following quarter, expecting macroeconomic conditions to deteriorate even further. Revenue is expected to fall between $23.5 billion to $24 billion and earnings are estimated at $2.65. Notably, analysts had anchored expectations at $24.9 billion for revenues and $5.39 for earnings. FedEx will officially report results for the Q3 quarter on September 22.

Steps To Manage Headwinds

As a response to the weak quarter, management said it will freeze hiring, close about 90 FedEx locations, and temporarily reduce business activity in line with demand (reduce flights, park aircraft, etc.). The company also said it would reduce capital spending for FY 2023 by about $500 million, down to $6.3 billion.

A Buying Opportunity?

Supported by strong e-commerce growth, FedEx enjoyed an attractive structural tailwind during the past few years. From FY 2019 to FY 2022, the company’s revenues increased at a 3-year CAGR of about 10%, growing from $69.7 billion to $93.5 billion. Over the same period, EBITDA expanded from $8.6 to $13.9 and net income from $4.1 billion to $5.5 billion respectively.

Accordingly, investors might be tempted to regard the current share price weakness as a buying opportunity and argue to “be greedy when others are fearful.” For reference, FDX stock is down by about 38% YTD, versus a loss of almost 20% for the S&P 500 (SPX).

However, I do not think FedEx is cheap. In fact, I argue FedEx is now trading more/less in line with fair valuation. True, the company’s year historical average P/E of about 15 (Source Bloomberg) is approximately 15% higher than the company’s current one-year forward P/E of about 12. But, investors should consider that analyst estimates for FedEx’s 2023 earnings has yet to incorporate an EPS – which should take the implied P/E closer to the FDX historical ratio.

Profit Warning Implication

Although I am bullish on FedEx long-term, as I believe e-commerce and express shipping services will continue to take share in consumers’ disposable income, I am cautious for the near-term outlook. Investors should consider that the transportation industry is highly sensitive to the macroeconomy. And the macroeconomy is clearly under-pressure, with high inflation, rising interest rates, falling asset prices, and a challenging backdrop for China and Europe. As a consequence, FedEx is exposed to significant margin pressure. Reflecting on slowing consumer confidence and compressing freight rates, FedEx topline will inevitably contract. At the same time, inflation and higher fuel costs increase the company’s cost and reduce the company’s profitability.

Investor Recommendation

FedEx profit warning is a very negative primer for investor confidence in the U.S./global economy and comes at a very unfortunate time – shortly after a risk-sentiment-crushing CPI report for August. In my opinion, signs of a recession are now too obvious to ignore. And accordingly, investors are well-advised to avoid investing in companies that are highly sensitive to the strength and weakness of the macroeconomy – companies such as FedEx. In other words: not the time to buy the dip.

There could be an interesting trade opportunity for investors who are comfortable trading options and seeking to accumulate FedEx stock despite the macroeconomic concerns. Specifically, given the elevated volatility levels, investors could write January 20th dated $140 Strike PUTs and collect an $8.10 premium (about 5.7%). Selling PUTs at a 10% OTM strike would lower the purchasing price and thus support investors with a margin of safety, which is strongly needed in light of the current market conditions.

Be the first to comment