Sezeryadigar/E+ via Getty Images

Elevator Pitch

I upgrade my investment rating for Federated Hermes’ (NYSE:FHI) shares from a Hold to a Buy. My prior update written on August 27, 2021 discussed about “short-term headwinds (for FHI) linked to fee waivers.”

Looking ahead, fee waivers are expected to be much less of a drag on Federated Hermes’ earnings in the short term, thanks to expectations of a rising interest rate environment. In the intermediate to long term, Federated Hermes’ alternatives/private markets business has a long growth runway ahead considering that the asset type’s or strategy’s current AUM (Assets Under Management) is only a low single-digit percentage of FHI’s total AUM.

Rate Hikes Should Translate Into Lower Fee Waivers And Higher Earnings

The Fed “lifted the federal funds rate target range by 25 basis points” last month as highlighted in a Seeking Alpha News article published on March 16, 2022.

Prior to the mid-March 2022 rate hike, Federated Hermes had highlighted at the RBC Capital Markets Financial Institutions Conference on March 8, 2022 that the hit to its pre-tax earnings as a result of fee waivers for money market funds should drop substantially from -$22 million (estimated) in Q1 FY 2022 to -$2 million in Q2 FY 2022 based on the assumption of a 0.25% rate hike in March 2022 which did materialize.

FHI had earlier disclosed in the company’s Q4 2021 earnings press release that fee waivers relating to money market funds had a “net negative pre-tax impact” of -$143.2 million for the company in full-year fiscal 2021. This was the key factor that led to a -16% decline in earnings before tax for Federated Hermes from $446.1 million in FY 2020 to $376.3 million in FY 2021. In a low-interest rate environment, FHI had been offering fee waivers so as to allow its money market funds to maintain positive (or at least zero) net yields, and this has hurt the company’s financial performance in 2021.

The sell-side analysts expect Federated Hermes to turn around from a -15% decrease in earnings per share for FY 2021 to deliver a +11% EPS growth for the current fiscal year as per financial data sourced from S&P Capital IQ. I think that the consensus FY 2022 financial forecast for FHI is reasonable considering the expected reduction in fee waivers for the company this year.

Separately, Jerome Powell has recently mentioned that “50 basis-point hikes are ‘on the table’ particularly for the May meeting” according to an April 21, 2022 Seeking Alpha News article. The rising interest rate environment also tends to drive an increase in AUM (Assets Under Management) for money market funds, which would be favorable for FHI. At the earlier RBC Capital Markets Financial Institutions Conference in March, Federated Hermes confirmed that “our history is that when there are rising rates, we do better on the (money market funds) AUM side” as “it’s a cash management service.”

In a nutshell, I have a favorable view of Federated Hermes’ 2022 financial outlook.

Long-Term Growth Opportunity For Alternatives/Private Markets

Looking beyond the short-term earnings uplift driven by rate hikes as discussed in the preceding section, it is worth spending time to understand about the long-term growth potential of Federated Hermes’ alternatives/private markets business. FHI’s alternatives/private markets business comprises of property, private equity, infrastructure and direct lending.

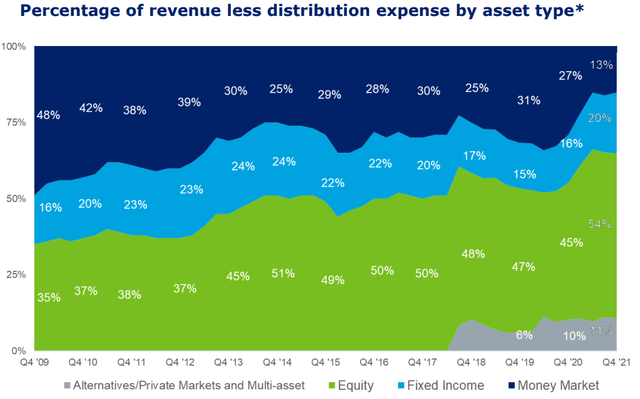

Federated Hermes’ Revenue Mix By Asset Type

FHI’s 2021 Earnings Presentation

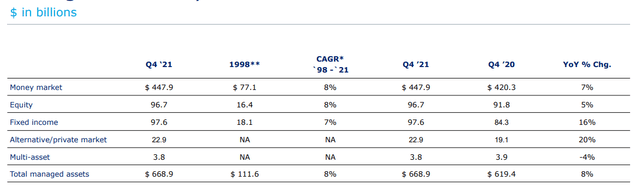

FHI’s AUM Split By Asset Type

FHI’s 2021 Earnings Presentation

The two charts presented above show that FHI’s alternatives/private markets business is growing fast but it still only represents a small part of the company’s total AUM. FHI had only started earning significant revenue from this business in the past three to four years as per the first chart. The second chart indicates that AUM for Federated Hermes’ alternatives/private markets segment grew by +20% YoY in the fourth quarter of 2021, which makes it the fastest-growing asset type or strategy for the company.

Federated Hermes had stressed at the RBC Capital Markets Financial Institutions Conference held in early March 2022 that its “alternatives business could easily become that big” similar to “fixed income and equity”. As of December 31, 2021, Federated Hermes’ AUM for alternatives/private markets was only $22.9 billion (3% of overall AUM) or less than a quarter of the AUM for both equity and fixed income.

Share Buybacks And Valuations

FHI has an impressive track record of returning excess capital to shareholders. Federated Hermes has generated approximately $4,700 million in net profit between 1998 (the year of listing) and 2021, of which $4.1 billion was distributed in the form of either share buybacks or dividends over this period as highlighted in its Q4 2021 results presentation slides. Specifically, Federated Hermes has reduced the company’s shares outstanding by more than a quarter from around 128 million as of end-1998 to 93.4 million as of December 31, 2021.

Notably, FHI has continued to buy back its own shares in Q4 2021 and Q1 2022. In its FY 2021 10-K filing, Federated Hermes revealed that it repurchased approximately 4 million of the company’s shares at an average price of $35.81 in the fourth quarter of last year. At the end of 2021, FHI still has the capacity to buy back another 6.065 million shares as part of its remaining share buyback authorization. Federated Hermes disclosed at the March 2022 RBC Capital Markets Financial Institutions Conference that “we’ve remained active here in the first part of the year on share buybacks”, which implies that the company has done a fair bit of share repurchases in the first quarter of this year too.

FHI hinted at the RBC Capital Markets Financial Institutions Conference that it is still actively engaged in share buybacks now because the stock’s valuations are still reasonably attractive. Federated Hermes commented at the investor conference that the “type of analysis as against the share price of FHI” is what “gets us into a little bit of share buybacks.”

Indeed, Federated Hermes’ current valuations appear to be attractive. FHI trades at 10.3 times forward fiscal 2022 normalized P/E according to S&P Capital IQ data and its last done share price of $31.34 as of April 21, 2022. This is much lower than FHI’s 10-year mean forward P/E multiple of 13.7 times.

Concluding Thoughts

Federated Hermes is deemed as a Buy now. The recent rate hike in March 2022 and further rate hikes expected in the coming months are positive for FHI’s core money markets business in the near term. In the long run, Federated Hermes’ alternatives/private markets business ($23 million AUM) has the potential to grow as large as fixed income or equity (both are close to $100 million AUM each).

Be the first to comment