Fahroni

Europe found itself backed up against the wall when Russia invaded Ukraine earlier this year on the 24th of February. Natural gas from Russia had for so long flowed unimpeded and cheaply via pipelines to bring cheap energy from gas fields in Siberia to power the continent’s most industrial regions from Germany’s Lower Saxony and North Rhine-Westphalia to France’s Alsace. This old paradigm is over with energy now on the frontlines of the war.

Bloomberg

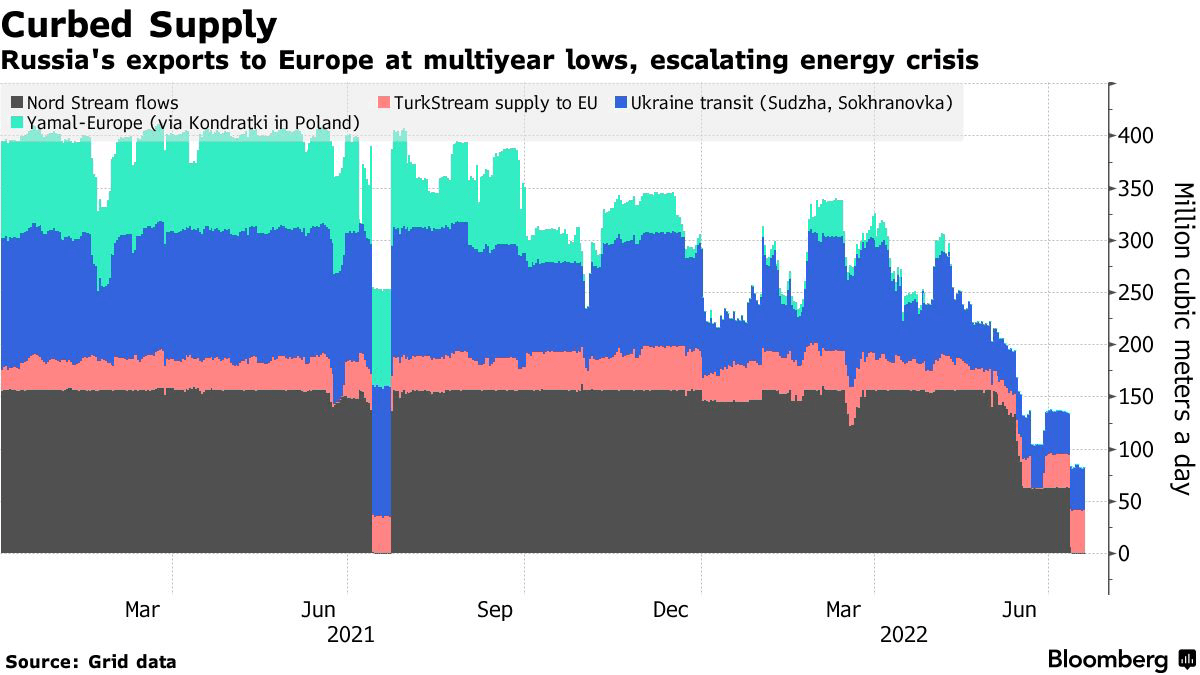

Energy is the lifeblood of modernity and the subsequent scramble for a replacement for piped Russian natural gas has upended the global energy markets and driven inflation. The situation is critical with the flows of natural gas from Nord Steam 1 and Yamal all but ended with the former actually blown up by a still unnamed state actor in September.

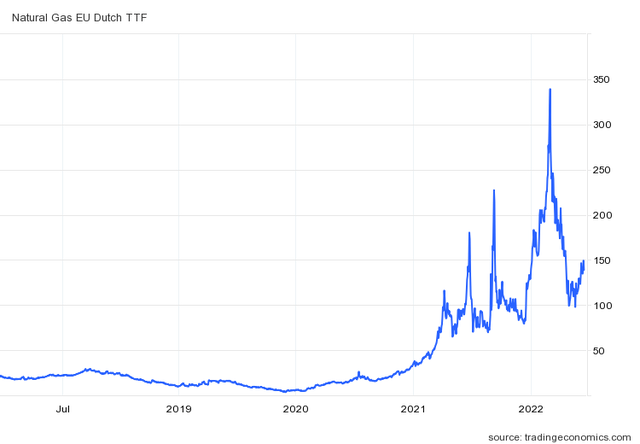

The 5-year chart of Dutch natural gas prices is dramatic and highlights the severity of the issue facing the continent. European governments have now collectively pledged around $536 billion to protect their citizens and businesses from soaring energy costs in 2022. This isn’t a one-off, the conditions that forced energy prices into crisis mode look set to remain unique features of the global energy landscape for the foreseeable future. Even if the war ends tomorrow, I think it’s unlikely the EU would be rushing to place itself in the exact vulnerable position of Russian dependency that preceded February 24th.

Germany’s Energiewende, the country’s planned transition to a low-carbon and nuclear-free economy, is now in reverse with a strange renaissance of coal in the continent’s largest economy. The relevance to Houston, Texas-based Tellurian (NYSE:TELL) is that the era of European trade with Russia is likely to be over for a generation and liquefied natural gas represents the future of energy for Europe and most of the world. With the Canadian government unwilling to U-turn on its anti-LNG export terminal policy, the US will take on a central role along with Qatar and with some notable contributions from some emerging African nations like Mozambique and Tanzania in exporting LNG in the decade ahead.

The Macro Case For Tellurian’s Driftwood

Energy Information Administration

Cheniere Energy (LNG), founded by the Chairman of Tellurian’s Board Charif Souki, was the first US company to export LNG from its Sabine Pass terminal in February 2016. US LNG export capacity has since grown rapidly to reach 11.1 billion cubic feet per day during the first half of 2022. But apart from Calcasieu Pass LNG, there is no further capacity coming online until 2024. From 2025, a further 5.7 Bcf/d in LNG export capacity will be available from three projects.

This is broadly the same story around the world. But a lot more capacity is needed to replace Russian piped gas and meet growing global energy demand. Japan, for example, is set to build around 6 GW in gas-fired powered plant capacity by 2030. Critically, a rising global middle class, population growth, and electrification in developed countries will form the secular growth factors that will require a significant enlargement of US LNG export capacity.

Tellurian is looking to build Driftwood, a $30 billion LNG export terminal project in Louisiana. Once complete the terminal will be able to export up to 27.6 million tonnes of LNG per year to Europe and other markets around the world. The construction of the $13.6 billion Phase one of Driftwood started earlier this year with Bechtel heading the works. Raising the required capital has been difficult for Tellurian with the company recently cancelling a $1 billion bond offering. Further, commitments by Shell (SHEL) and Vitol to buy LNG from the project were also cancelled. This reduced Driftwood’s overall sales volumes by two-thirds.

Tellurian Could Still Become An Important Player

However, these inherent killing blows do not mean the company should be written off. Tellurian has pursued an integrated model which would see the company almost operate like an integrated oil company to produce, transport, and liquefy its own natural gas. This would then be broadly sold at spot prices being set by the global markets. Current LNG exporters have been built around long-term 15 or 20-year contracts with buyers paying a fixed price. Tellurian’s proposed business model exposes the company to more risk but also the likelihood of substantially higher profits. This is especially as the spread between US and Dutch natural gas prices will likely remain material in the years ahead.

However, Tellurian already owns significant natural gas-producing assets in the Haynesville basin. This generated revenue of $81.1 million for its fiscal 2022 third quarter, growth that came on the back of a 25% sequential increase in gas production. The near-term objective is to fund ongoing Phase 1 development with money it could make from selling gas produced from Haynesville.

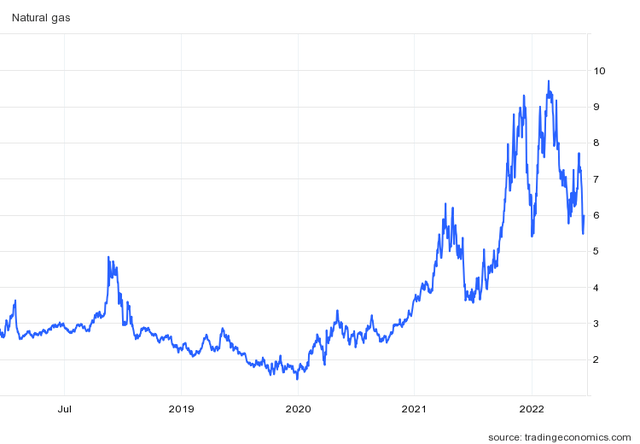

US natural gas prices have pulled back from their peak but are still trading at elevated levels. Further, with the Freeport LNG terminal set to come back online by the end of 2022, there could be some upward pressure on US natural gas prices. The terminal went offline in June after an explosion and fire, an event which has helped to keep US natural gas prices somewhat depressed.

Bears have stated that the perfect window to secure financing has been missed with the near-term outlook for the crisis likely not as bad as initially expected. The continent was able to cut down on its gas use by 25% in October with mild weather and behavioural changes being leading factors for the reduction. France’s nuclear outages are also expected to be fixed by the spring of 2023 to bring back much-needed electricity generation capacity.

This winter of course forms the core test for Europe. Large-scale blackouts would be a political failure and would push the continent to find more long-term solutions. Hence, there might be a small albeit extremely unlikely chance for a financing salvo. Tellurian as it currently stands remains a company with immense geopolitical implications with a story still being written. This is a hold.

Be the first to comment