spxChrome

Cyclical companies are often favorites among value investors because they can offer solid capital appreciation potential, so long as one buys closer to the bottom of the cycle than the top. It’s even better if these companies pay a stable dividend to investors while they wait for an eventual turnaround.

This brings me to Dow Inc. (NYSE:DOW), which appears to be much closer to a bottom than its top of $70 share price achieved as recently as May. In this article, I highlight what makes Dow a good buy on share price weakness for potentially strong gains, so let’s get started.

Why Dow?

Dow Inc. is among the three largest chemicals producers in the world, making plastics, chemicals and agricultural products across a broad set of use cases in consumer care, industrial, infrastructure, and farming. The company was formed in 2019 when its former parent, DowDuPont split into three publicly traded companies. It operates in 160 countries, has 54K employees, and generated $60 billion in total revenue over the trailing 12 months.

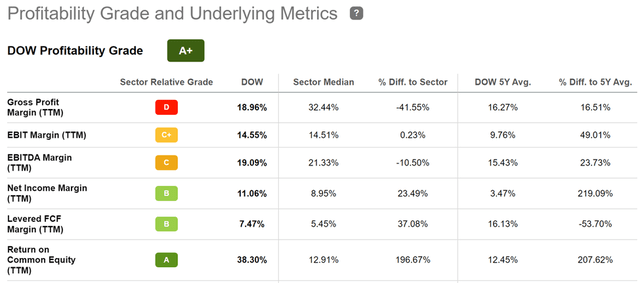

Dow recently released respectable results, with revenue growing by 13% YoY (up 3% sequentially) to $15.7 billion in the second quarter. This was driven by gains in all regions except for Asia Pacific, which was impacted by pandemic-related lockdowns in China. Notably, global volume declined by a slight 2%, but Dow was able to offset this with a 16% price increase, signaling pricing power. As shown below, Dow scores an A profitability rating with a sector-leading FCF margin of 7.5% and a 38% return on equity.

Dow Profitability (Seeking Alpha)

Also encouraging, management is being disciplined with its cash flow, as it redeemed $750 million of outstanding notes, which will lower its annual interest expense by $27 million. It also has no substantial long-term debt maturities until 2027.

It’s also aggressively returning cash to shareholders. This is reflected by the $1.3 billion in capital returns during the second quarter alone, comprised of an impressive $800 million share buybacks and $505 million in dividends.

While the quarterly dividend rate of $0.70 has remained flat, I give the company a pass, as it only recently initiated it in 2019, just before the global pandemic. Besides, the dividend is well covered by a low 29% payout ratio, giving ample room for raises down the line, especially after the reduced share count after repurchases.

Headwinds to Dow include its sensitivity to raw material costs, which could pressure margins. Moreover, the CEO recently warned of a slowdown in Europe should natural gas be curtained because of reduced Russian supplies. Gas rationing, in general, could hurt metal production and processing as well as the chemical and paper industries.

Nonetheless, Dow’s low-cost position makes it well positioned to face near-term headwinds. In addition, it’s seeing encouraging signs of normalization in industrial output from China, as noted in the recent conference call:

In Europe, the geopolitical and inflationary environment is driving moderation in consumer confidence and spending. However, PMI was still at expansionary levels at the end of the quarter. In China, economic activity began to recover at the end of the quarter, with manufacturing PMI expanding in June and Chinese output and new orders lifting to expansionary levels for the first time since February. And as the regional economy continues to reopen, we expect industrial output and consumer spending to benefit from easing supply chain constraints as well.

While the macroeconomic environment remains dynamic, we continue to see areas of underlying strength across our market verticals where demand and consumer spending have been resilient. Our unique competitive advantages including our global footprint, our industry-leading feedstock and derivative flexibility, combined with our chemistry toolkit and our innovation engine enabled Dow to remain agile to changing geographic energy and market conditions.

Importantly, oil-gas spreads continue to support our structurally advantaged feedstock positions along the U.S. Gulf Coast, Canada, Argentina, and the Middle East. These advantages enable us to mitigate the impacts of higher raw material and energy costs as we navigate the market dynamics around the world.

While analysts forecast an earnings decline next year, they largely expect for trends to normalize in the second half of next year before Dow returns to growing its bottom line. At the current price of $51.58 and a forward P/E of just 6.3, I see most of the headwinds have already having been baked in. Sell side analysts have an average price target of $60.68, equating to a potential one-year 23% total return including dividends.

Investor Takeaway

Dow is an intriguing value play at the current price. It’s a diversified chemical company with a global footprint, giving it an advantage over smaller players who are more subject to regional risks. Moreover, it boasts a solid free cash flow margin and return on equity.

Additionally, management is being disciplined with its cash flow and is returning cash to shareholders via share buybacks and dividends. While it has some headwinds in the near-term, it appears that most of the risks are already baked into the low valuation. Dow is a Buy for potentially strong total returns.

Be the first to comment