Justin Sullivan

PayPal Holdings, Inc. (NASDAQ:PYPL) is expected to submit its earnings card on August 2, and the company’s commercial performance in Q2’22 could either push shares of the financial services company into a new up-leg or a new down-leg, depending on whether or not PayPal will stick to its guidance for FY 2022. I expect PayPal, at this time, to confirm its full-year guidance for net revenues, free cash flow and net new account additions, but believe that risks have slightly risen due to growing concerns over the health of the U.S. economy. Better than expected results coming from buy now, pay later (“BNPL”) products and strong free cash flow could power shares of PayPal higher!

Quick review of PayPal’s last guidance change

Due to a deteriorating macro environment — which in Q2 included soaring inflation, the war in Ukraine as well as COVID-19 lockdowns in China — PayPal refreshed its guidance for FY 2022 in the first-quarter. The financial services company guided for net revenue growth of 11-13% instead of 15-17% (based on spot rates) for FY 2022 and, worst of all, cut its expectations for new account additions in half: PayPal expects that 10M new accounts will be created on the firm’s platforms as opposed to a previous projection of 15-20M. The downgrade in net new active accounts was especially concerning because the ability to attract new users into the PayPal ecosystem has been a driving force for free cash flow growth at the financial services company.

Why PayPal could beat low expectations

PayPal faces moderating growth prospects due to economic headwinds. Inflation is weighing on consumers’ willingness to stretch themselves financially and make purchases of consumer goods in both the real world as well as the digital economy. However, PayPal could surprise in August with a stronger-than-expected earnings sheet.

PayPal has guided for Q2’22 net revenues of approximately $6.8B, implying 9% year-over-year growth. Guidance implies a 1 PP improvement in the net revenue growth rate quarter over quarter. Earnings expectations are low after PayPal crushed hopes for stronger growth in Q1’22.

However, PayPal could out-perform in one specific area: buy now, pay later services. This category is seeing accelerating customer uptake and could have benefited greatly in Q2 as inflation continued to hurt consumers’ budgets. Inflation soared 9.1% last month which is making the use of buy now, pay later products so much more appealing. PayPal is chiefly monetizing this opportunity with PayPal’s “Pay with 4,” but is adding new products to capitalize on a strong growth opportunity. If PayPal announces an expansion of its buy now, pay later services in Q2’22, the stock could react positively to such an announcement.

I am also positive about PayPal’s ability to grow accounts and free cash flow. PayPal added 2.4M net new active accounts in Q1’22, chiefly due to momentum in Venmo sign-ups. I believe PayPal could add between 2.3-2.5M new accounts in Q2’22 on persistent Venmo momentum. Regarding free cash flow — for which PayPal has not submitted a Q2’22 projection — I expect a slight improvement quarter over quarter and estimate that PayPal will report free cash flow (“FCF”) in the range of $1.1-$1.2B. The outlook for FY 2022 free cash flow of $5B is likely going to get confirmed.

Market expectations, EPS estimate trend and P/E – P/FCF valuation

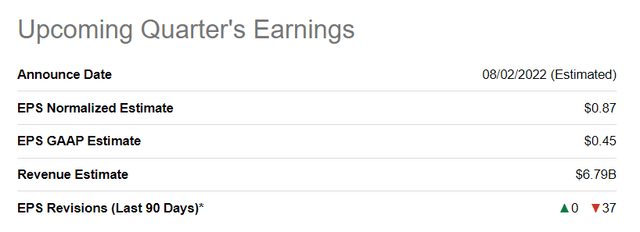

Earnings estimates for Q2’22 reports have trended down broadly in the market throughout the quarter, mostly because inflation has started to take a toll and companies see pricing pressures creep up in their businesses. The market expects PayPal to have generated adjusted EPS of $0.87 in Q2’22, which is slightly above PayPal’s expectation of $0.86 in non-GAAP EPS.

Seeking Alpha – PayPal Q3’22 Estimates

In the last 90 days, PayPal has seen 37 down-grades in EPS estimates and 0 up-grades which means that expectations heading into earnings week are very, very low. It will be easy for PayPal to exceed those expectations, and success on the buy now, pay later front as well as a better outlook for Q3’22 could push shares of PayPal back into a new up-leg.

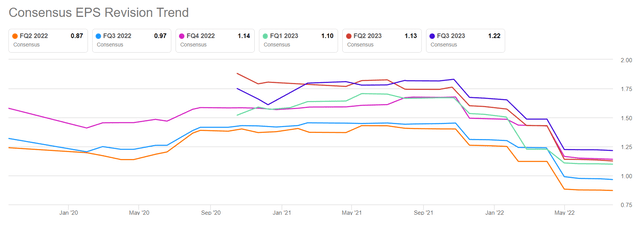

Seeking Alpha – PayPal EPS Revisions

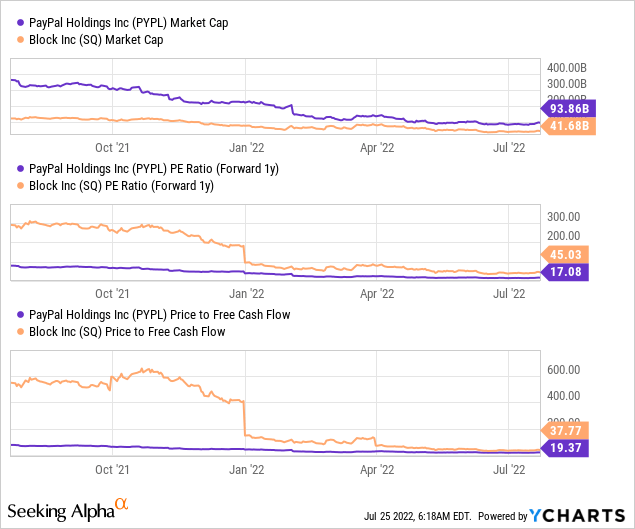

Turning to valuation

Fintechs have become significantly cheaper in 2022 and that’s largely because of slowing economic growth and high inflation in the U.S. economy pressuring financial businesses. Based off of EPS predictions for FY 2023, shares of PayPal have a price-to-earnings ratio of 17.1 X, while Block (SQ) is significantly more expensive, with a P/E ratio of 45.03 X. Block’s free cash flow is about twice as expensive as PayPal’s.

Risks with PayPal

The big risk heading into earnings is that PayPal could lower its FY 2022 guidance again if Q2 didn’t go well. PayPal’s trimmed outlook in the last quarter pushed shares of PayPal into a new down-leg from which the stock has not yet recovered. The biggest commercial risk for PayPal, as I see it, is a slowdown in net new active account growth which most certainly would translate to weaker revenue and free cash flow growth going forward.

Final thoughts

PayPal is going to submit its earnings card for Q2’22 in a week and it will be an important release after the firm trimmed its guidance in the previous quarter. PayPal has a good chance of beating low EPS predictions if the buy now, pay later category maintained its momentum and Venmo signups showed continual strength.

If Q2 earnings are better than expected, PayPal’s shares could break out of the down-trend and initiate a new up-leg. At this point in time, I expect PayPal to stick to its FY 2022 guidance. The EPS trend indicates that estimates have perhaps dropped too low, making it easier for PayPal to beat low expectations!

Be the first to comment