Samuel Corum/Getty Images News

The Federal Reserve is moving, more and more, into a restrictive monetary stance.

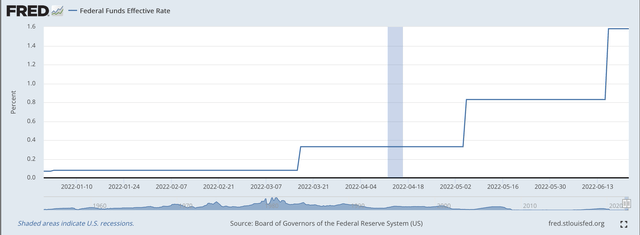

The most obvious sign of the Fed’s moves is an increase in the Fed’s policy rate of interest.

On Wednesday, June 15, 2022, the Federal Open Market Committee approved an increase in the target rate for the Federal Funds rate of 75 basis points.

Beginning June 16, the effective Federal Funds rate moved to 1.58 percent, exactly 75 basis points above the previous setting of the effective Federal Funds rate of 0.83 percent.

Effective Federal Runds Rate (Federal Reserve)

The Federal Reserve is expected to raise the range for its policy rate of interest again in July, when the FOMC meets again on July 26 and 27.

The FOMC does not meet again until September 20 and 21. Investors believe that the Fed will move the rate again at this time.

Expectations are that the upper limit of the policy range could be somewhere between 2.50 percent and 3.00 percent after the September meeting.

Federal Reserve Balance Sheet

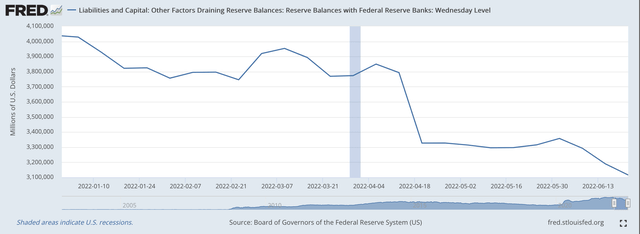

In order to support this rise in the Fed’s policy rate of interest, there has been some reduction in the liquidity of the commercial banking industry.

The balance sheet item on the Fed’s H.4.1 statistical release labeled “Reserve Balances With Federal Reserve Banks” is often looked at as a proxy for the excess reserves that exist within the banking system.

On June 22, 2022, Reserve Balances with Federal Reserve Banks amounted to $3,115.6 billion.

Note, this amount is $777.1 billion less than the total for Reserve Balances on Mach 16, 2022, the date that the Fed made its first increase in the range of the Federal Funds rate.

One can certainly argue that, during this time period, the Federal Reserve has reduced the amount of liquidity in the banking system. Here is the chart of the series.

Reserve Balances With Federal Reserve Banks (Federal Reserve)

Note the big drop that took place in the banking week ending April 20, 2022. Reserve balances with Federal Reserve banks dropped by $466.4 billion that banking week as the U.S. Treasury moved a large amount of funds from the commercial banks to its General Account at the Federal Reserve. Note that this was right around the time that people made their tax payments.

Also, note, however, that Reserve Balances with Federal Reserve banks have continued to decline since April 20.

This raises the point that the Federal Reserve was overseeing the decline in Reserve Balances, not by selling securities and reducing the size of its securities portfolio.

Since March 16, 2022, the size of the Fed’s securities portfolio actually increased, but only by $4.0 billion.

The reduction in Reserve Balances, therefore, came from other sources, like the reduction in the balances of the U.S. Treasury Department’s General Account at the Fed.

What To Look For Next

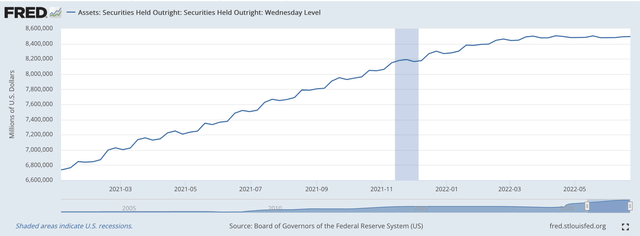

The next thing to look for is for the Federal Reserve to begin to reduce the size of its securities portfolio.

Remember that the Fed is not going to be selling off securities to reduce the size of its portfolio.

The plans are for the Fed to allow securities to mature off of its balance sheet without being replaced. The plan right now is for the Fed to allow $47.5 billion to run off in its securities portfolio for June, July, and August. Then in September, the amount of runoff will rise to $95.0 billion.

This runoff is projected to last through the middle of 2024. Approximately, $2. trillion will runoff from the Fed’s balance sheet if this plan is followed.

Here is how the securities portfolio has increased since the end of December 2020. Note, the Fed was acquiring, outright, $120.0 billion in securities every month.

Securities Held Outright (Federal Reserve)

On June 22, 2022, the Fed’s securities portfolio amounted to $8.5 trillion.

So, we need to keep an eye on what the Fed is doing to this portfolio to see how the reduction in the securities held outright relates to the continued rise in the Fed’s effort to raise its policy rate of interest.

A Final Question

There seems to be one final concern analysts have about the program Fed Chair Jerome Powell and the Fed has set up.

The concern is Jerome Powell, himself.

The Question: Can Chairman Powell actually carry out this program?

Mr. Powell has been accused over and over again about how he has handled his first term in office.

He is accused of being weak, of always erring on the side of monetary ease, of always focusing on the “less severe” path to take.

Right now, a lot of people are comparing Mr. Powell with former Fed Chairman Paul Volcker.

Paul Volker stood up to the forces-that-be in the late 1970s and early 1980s, and fought off both the economic conditions and the political pressures to bring down inflation.

People are questioning whether or not Mr. Powell has what it takes to stick with the battle against inflation and bring inflation under control.

These people are saying that the first four years as Chairman of the Board of Governors of the Federal Reserve System have only given us evidence that Mr. Powell will not stand up to the pressures of combatting the current severe bout of rising prices.

Let’s hope that the answer to this question is, “Yes, Mr. Powell can carry out this program.”

Be the first to comment