NoDerog/iStock Unreleased via Getty Images

By Brian Nelson, CFA

From where we stand, bellwethers in the consumer staples sector (VDC) can’t price successfully ahead of inflationary headwinds to drive operating profit expansion, and many are experiencing tremendous gross margin pressure. Not only this, but in many cases, we think branded staples are experiencing demand (volume) destruction as consumers balk at price increases that still fall short of offsetting the heightened cost environment.

In Kimberly-Clark’s (NYSE:KMB) first quarter results, released April 22, organic sales increased 10% thanks to a 6% increase in net selling prices, but that wasn’t enough to offset inflationary headwinds. First-quarter adjusted operating profit fell to $629 million in 2022 from $804 million in 2021, despite the strong top-line performance and price increases. The company’s quarterly diluted earnings per share also fell to $1.35 from $1.80 in the year ago period, a roughly 25% drop.

It’s clear that, while consumer staples entities are raising prices, it’s just not enough to keep operating profit moving in the right direction, and many investors are growing concerned that the type of price increases that are needed to just hold the line with operating profit may cause tangible demand destruction and create a whole host of other problems with respect to volumes. Kimberly-Clark, for example, was “impacted by $470 million of higher input costs, driven by pulp and polymer-based materials, distribution and energy costs” in its first quarter of 2022.

It not only looks like inflationary headwinds will put a damper on Kimberly-Clark’s earnings performance for some time, but the company has an $8.6 billion net debt position, as of the end of March 2022. With shares trading at a lofty 19.6x expected 2023 consensus earnings, according to Yahoo Finance, downside risks to its share price are mounting given these important valuation considerations. Furthermore, Kimberly-Clark’s ~3.5% dividend yield may not offer sufficient price support to stem a valuation re-adjustment, should earnings really start to take a hit from input cost inflation.

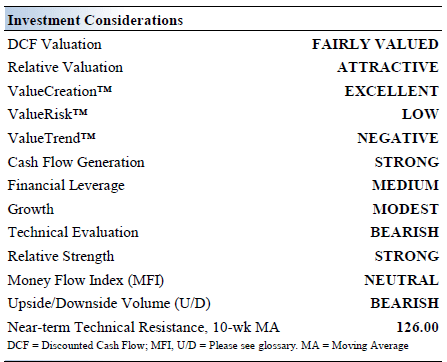

Kimberly-Clark‘s Investment Considerations

Image source: Valuentum. The key investment considerations we look at with respect to Kimberly-Clark. (Image source: Valuentum)

Kimberly-Clark is best known for its personal care and consumer tissue brands (‘Personal Care’ products represent half its revenues). Key brands include Huggies, Kleenex, Scott, Kotex, Cottonelle, Depend, Pull-Ups, and WypAll. Its products have #1 or #2 position in ~80 countries. Kimberly-Clark was founded in 1872 and is based in Dallas, Texas.

Kimberly-Clark is a Dividend Aristocrat that as of 2022 had increased its annual payout over the past 50 consecutive years. The firm is a tremendous free cash flow generator, though its net debt load is quite sizable. Share buyback programs are common.

Kimberly-Clark is using acquisitions, its brand strength, scale, and digital marketing campaigns to grow its presence in developing and emerging markets while maintaining its strength in established markets. Inflationary pressures have been significant of late, and Kimberly-Clark is turning to pricing increases and cost structure improvements to offset those hurdles.

Kimberly-Clark closed its ~$1.2 billion acquisition of Softex Indonesia, which generated ~80% of its revenues from diaper sales under brands such as Sweety and Happy Nappy, in October 2020 through an all-cash deal. The company views its growth runway in Indonesia quite favorably.

Kimberly-Clark recently completed its ‘2018 Global Restructuring Program’ which involved exiting some low-margin businesses. Looking ahead, its ‘Focused On Reducing Costs Everywhere’ or FORCE program is expected to improve its cost structure over time.

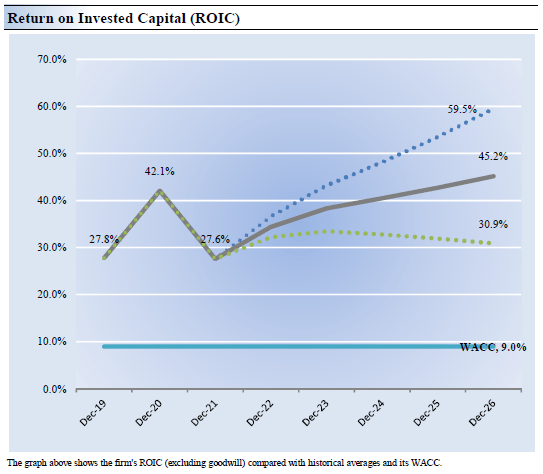

Kimberly-Clark’s Economic Profit Analysis

The best measure of a company’s ability to create value for shareholders is expressed by comparing its return on invested capital with its weighted average cost of capital. The gap or difference between ROIC and WACC is called the firm’s economic profit spread. Kimberly-Clark’s 3-year historical return on invested capital (without goodwill) is 32.5%, which is above the estimate of its cost of capital of 9%.

As such, we assign Kimberly-Clark a ValueCreation rating of EXCELLENT. In the chart below, we show the probable path of ROIC in the years ahead based on the estimated volatility of key drivers behind the measure. The solid grey line reflects the most likely outcome, in our opinion, and represents the scenario that results in our fair value estimate. Though we expect some rough sledding at Kimberly-Clark in the near term, we believe it will continue to generate economic profit for shareholders.

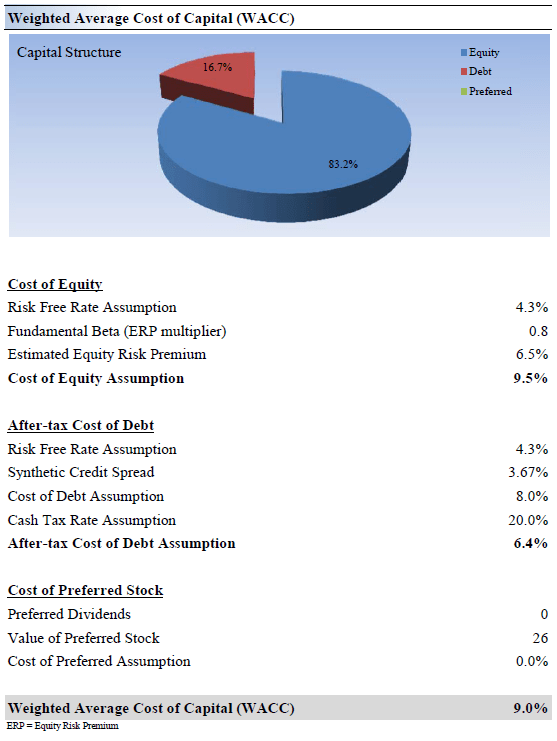

Image source: Valuentum. Our expectations for Kimberly-Clark’s economic profit stream in coming years. (Image source: Valuentum) Image source: Valuentum. How we calculate the firm’s weighted average cost of capital assumption. (Image source: Valuentum)

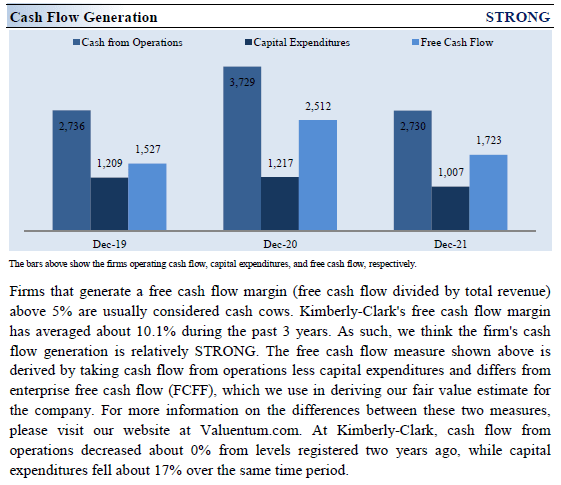

Kimberly-Clark’s Cash Flow and Valuation Analysis

Image source: Valuentum. Kimberly-Clark is a fantastic free cash flow generator. (Image source: Valuentum)

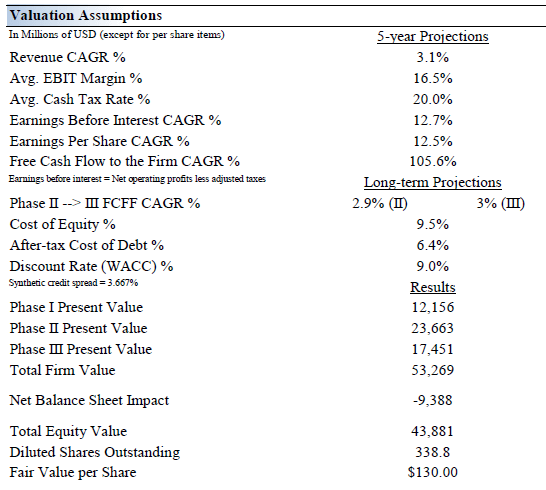

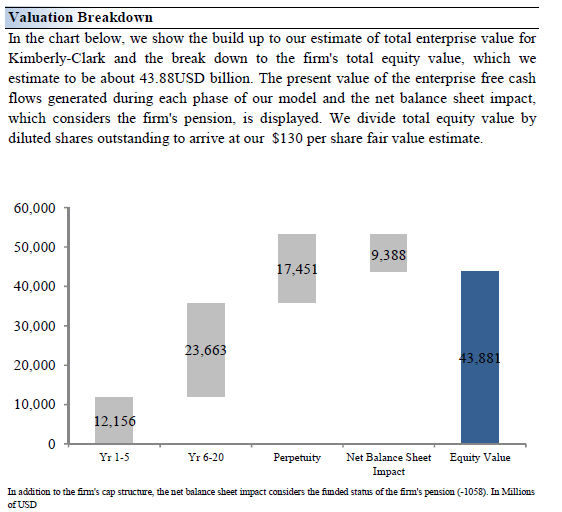

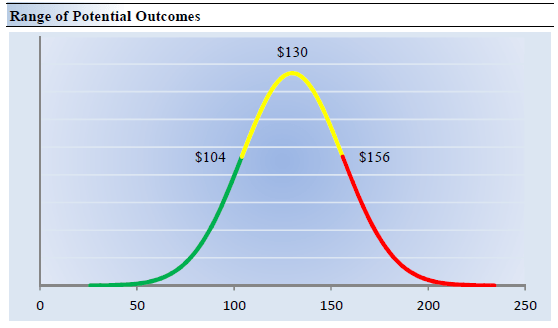

We think Kimberly-Clark is worth $130 per share with a fair value range of $104-$156.00. The margin of safety around our fair value estimate is driven by the firm’s LOW ValueRisk rating, which is derived from an evaluation of the historical volatility of key valuation drivers and a future assessment of them.

Our near-term operating forecasts, including revenue and earnings, do not differ much from consensus estimates or management guidance. Our model reflects a compound annual revenue growth rate of 3.1% during the next five years, a pace that is higher than the firm’s 3-year historical compound annual growth rate of 1.7%.

Our valuation model reflects a 5-year projected average operating margin of 16.5%, which is above Kimberly-Clark’s trailing 3-year average. Beyond year 5, we assume free cash flow will grow at an annual rate of 2.9% for the next 15 years and 3% in perpetuity. For Kimberly-Clark, we use a 9% weighted average cost of capital to discount future free cash flows.

Image source: Valuentum. The key valuation assumptions of our discounted cash flow model of Kimberly-Clark. (Image source: Valuentum) Image source: Valuentum. The duration of the value composition of Kimberly-Clark. (Image source: Valuentum)

Kimberly-Clark’s Margin of Safety Analysis

Image source: Valuentum. The fair value estimate distribution for Kimberly-Clark. Its most likely ‘true’ fair value rests at the highest point on the distribution. (Image source: Valuentum)

Our discounted cash flow process values each firm on the basis of the present value of all future free cash flows. Although we estimate the firm’s fair value at about $130 per share, every company has a range of probable fair values that’s created by the uncertainty of key valuation drivers (like future revenue or earnings, for example). After all, if the future were known with certainty, we wouldn’t see much volatility in the markets as stocks would trade precisely at their known fair values.

Our ValueRisk rating sets the margin of safety or the fair value range we assign to each stock. In the graph above, we show this probable range of fair values for Kimberly-Clark. We think the firm is attractive below $104 per share (the green line), but quite expensive above $156 per share (the red line). The prices that fall along the yellow line, which includes our fair value estimate, represent a reasonable valuation for the firm, in our opinion.

In light of the company’s outsize net debt position, pressures on operating profit that may come in greater-than-expected in coming years, and lofty earnings multiple implied by our fair value estimate, investors may look more specifically to the low end of the fair value estimate range $104-$130 for shares (the company trades for $130+ at the time of this writing). Caution may be in order.

Concluding Thoughts

Kimberly-Clark has both strong operating and dividend track records. Having been in business for 150 years and increasing its annual dividend payout for 50 consecutive years, the latter lands Kimberly-Clark on the coveted list of Dividend Aristocrats. Its products have #1 or #2 position in ~80 countries. It recently completed its ‘2018 Global Restructuring Program’ and is focused on its ‘FORCE’ cost savings program. Kimberly-Clark’s brand strength is undeniable with some of its key brands including Kotex, Scott, Depend, Kleenex, Huggies, Pull-Ups, Cottonelle, and WypAll. The company is a tremendous free cash flow generator.

Kimberly-Clark’s tremendous brand strength makes its business resilient, but slowing growth in the international population due to societal changes in countries such as China could pressure diaper sales, for example (‘Personal Care’ products represent about half of its annual sales). The firm is also subject to volatile currency exchange rates and commodity markets, which can pressure earnings at various points in the economic cycle. Competition and inflationary pressures have been intense of late, and we’re not particularly fond of its net debt position, though we expect Kimberly-Clark will continue to steadily grow its dividend going forward. Still, a 3.5% dividend yield may not offer sufficient support to Kimberly-Clark’s share price should inflationary pressures put a bigger damper on earnings expectations over the next couple years.

This article or report and any links within are for information purposes only and should not be considered a solicitation to buy or sell any security. Valuentum is not responsible for any errors or omissions or for results obtained from the use of this article and accepts no liability for how readers may choose to utilize the content. Assumptions, opinions, and estimates are based on our judgment as of the date of the article and are subject to change without notice.

Be the first to comment