BackyardProduction

The Federal Open Market Committee meets again next week, the dates are September 20 and 21.

The expectation is that the FOMC will raise the range for its policy rate of interest by at least 75 basis points.

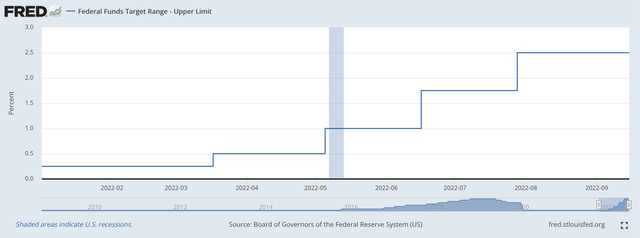

So, add that to the work already done this year…

Federal Funds Rate – Upper Limit (Federal Reserve)

…and you get 3.25.

If you add 75 basis points on top of the current effective Federal Funds rate, the average rate paid, which now stands at 2.33 percent, you get an effective Federal Funds rate of 3.08 percent.

Then, finishing out the year, you have meetings of the FOMC taking place on November 1 and 2 and then again on December 13 and 14.

The expectation is that the Fed will raise its policy rate of interest at both of these meetings. If the rate is raised by only 50 basis points at each of these meetings, you have an effective Federal Funds rate of just over 4.00 percent by the end of this year.

Next year, you have four FOMC meetings in the first half of 2023, in January, March, April, and June.

Just how far do you think the Fed will move its policy rate of interest if it is really serious about combating inflation?

Excess Reserves In The Banking System

The crucial element in raising the Fed’s policy rate of interest is the excess reserves in the commercial banking system. These excess reserves give some indication of how “liquid” the commercial banking system is, and, therefore, represent a picture of the pressure that is on the banking system to raise interest rates.

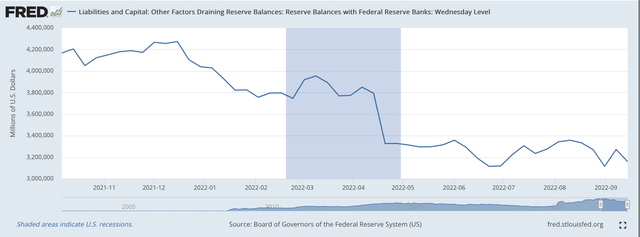

A “proxy” for the excess reserves in the commercial banking system is the line item coming from the H.4.1 statistical release of the Federal Reserve, Factors Affecting Reserve Balances of Depository Institutions, titled Reserve Balances with Commercial Banks.

This line item is closely related to the line item “cash assets” found on the Fed’s H.8 statistical release “Assets and Liabilities of Commercial Banks in the United States.”

Looking at the Reserve Balances with Commercial Banks on the Fed’s H.4.1 statistical release we find the following numbers.

Since March 16, 2022, the time when the Fed began to raise its policy rate of interest, reserve balances with commercial banks have declined by $662.1 billion.

As these reserve balances have declined, bank liquidity declines and this helps to put pressure on interest rates to rise.

So, it appears that the Fed has overseen a reduction in “excess reserves” that has contributed to the rise in the Fed’s policy rate of interest.

Reserve Balances With Commercial Banks (Federal Reserve)

Notice two things here.

First, the “peak” of reserve balances came on December 15, 2021. On that date, reserve balances with commercial banks totaled $4,273.6 billion. This is around the time that the Fed ceased its program of quantitative easing where it bought $120.0 billion in securities every month.

Second, note that the big drop in reserve balances came in the March-April time frame, just when the Fed started to raise its policy rate of interest.

The big drop in reserve balances came in the banking week ending April 20, 2022. Since then, these excess reserves have continued to decline, but not at a very rapid pace.

The Decline In Excess Reserves

The decline in excess reserves can come from several different sources.

The reduction in the portfolio of securities held outright is the most obvious way the decline can take place.

Since March 16, 2022, the Fed’s securities portfolio has declined by $82.6 billion.

But, big contributors to the decline can come from the liability side of the Fed’s balance sheet.

The three primary sources for these declines are movements in and out of the U.S. Treasury’s General Account, the account the Treasury Department writes checks from; the movement of currency into circulation; and the rise in reverse repurchase agreements.

Since March 16, 2022, $17.0 billion of currency has left the commercial banking system and flowed into the hands of the public.

Also, since March 16, 2022, deposits with Federal Reserve Banks have actually declined by $62.1 billion, as the Treasury Department has actually been writing more checks than it has been taking money into its Federal Reserve accounts.

With Reverse Repurchase Agreements, the Federal Reserve sells securities and agrees to repurchase these securities within a matter of a few short days.

Since March 16, 2022, reverse repurchase agreements have risen by $662.1 billion, which has accounted for most of the decline in the excess reserves of the commercial banking system.

So, these are the major factors that have impacted the Fed’s balance sheet in the past few months to support the Fed’s efforts to cause short-term interest rates to rise.

Market Responses

Perhaps the most interesting market response to these actions of the Federal Reserve has been the volatility of the stock markets.

During the past twelve years or so, stock prices have been very responsive to what the Federal Reserve is doing. This relationship was encouraged by the policy actions of the Fed under the leadership of Ben Bernanke.

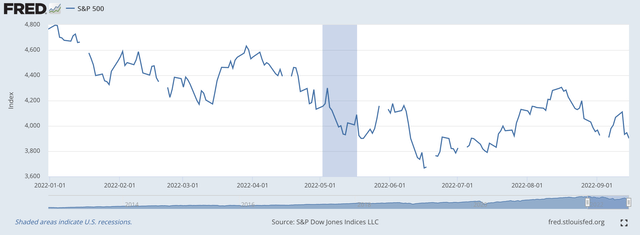

Consequently, the relationship between Fed actions and the stock market has been closely watched in the past two years or so. Here we see the movement of the S&P 500 Stock Index since the end of last year.

S&P 500 Stock Index (Federal Reserve)

Note that the S&P 500 hit its historical high on January 3, 2022.

Note also that the decline in stock prices since that date has been relatively choppy.

It seems as if investors have gone through periods when there has been a feeling that the Federal Reserve is not going to carry through on its efforts to bring inflation back down to its 2.0 percent target level.

Even after Fed Chairman Jerome Powell’s talk at Jackson Hole, Wyoming confirming the Fed’s intention to do what was necessary to bring inflation down, investors still hold to the idea that the Fed will not be able to follow through on its promise.

One reason there is concern relates to the “excess reserves” that still remain on the Fed’s balance sheet.

Commercial banks, as of Wednesday, September 14, held almost $3.2 trillion in reserve balances.

The proposals set out by the Fed only point to the Fed reducing the size of its securities portfolio by something over $2.0 trillion.

If the Fed achieves this, there will still be over $1.0 trillion in excess reserves in the banking system.

Is this “tight” money?

Will this bring inflation back down to the Fed’s target of 2.0 percent?

In other words, even with the Fed’s efforts to reduce the size of its securities portfolio, there will still be billions of dollars around in the financial markets for use here and there, wherever investors feel that they can profitably place the money.

The concern is now…does this really “tighten” up the monetary system?

Be the first to comment