ipopba

Investment Summary

Investors awoke to PerkinElmer, Inc. (NYSE:PKI)’s Q2 FY22 earnings this morning. The company posted upsides from top to bottom and secured a strong non-GAAP set of results. To add further validity to the company’s fundamental momentum, it declared a $0.07 dividend and raised its FY22 guidance.

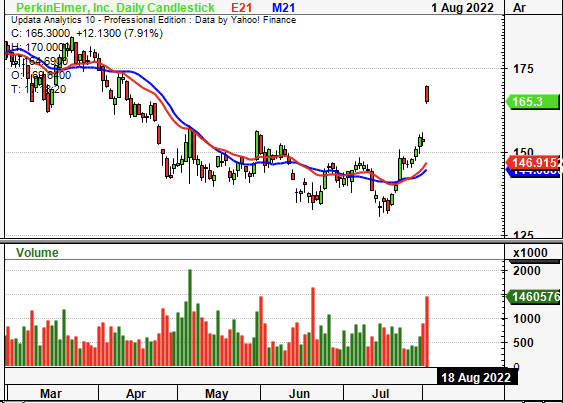

Exhibit 1. PKI 6-month price action

Data: Updata

Aside from that, PKI also advised today that it will sell its carved-out Applied, Food and Enterprise Services businesses off to an alternative asset manager for a $2.45 billion consideration. We believe this to be a key catalyst to move the needle and the company projects ~$2 billion in net earnings from the transaction. For investors to make the most informed investment reasoning possible, we discuss the moving parts of the PKI investment debate. We give a buy rating to shares, with a PT of $179-$180.

PerkinElmer’s Q2 earnings momentum illustrates turning point

Second quarter turnover was flat YoY coming in at $1.23 billion at the top, ahead of consensus by ~$30 million. GAAP gross margin on this revenue lifted by ~110bps YoY to 58.9% whilst the company saw ~100bps of headwind at the SG&A line primarily from non-cash amortization costs. As such, operating income reached $251 million from the quarter, a 24% YoY decrease, pushing operating margin down by ~670bps to 20.4% for the period. Adjusting for one-off items on the income statement and operating income leveled off at ~$402 million or ~33% margin. Non-GAAP earnings came in strong at $2.32 whilst GAAP EPS was $1.42. Each of these are down considerably YoY from $2.83 and $2.19 respectively.

Segmentally, performance was mixed. PKI printed ~$660 million in its discovery and analytical solutions (“D&A”) business, a 29% YoY growth schedule that lifted organically. This came through to quarterly operating income of $70 million, up 9.3% YoY. Meanwhile, in its diagnostics segment, turnover came in ~20% lower YoY to ~$570 million, down from $716 million. Of this slide, around 19–20% was an organic decline.

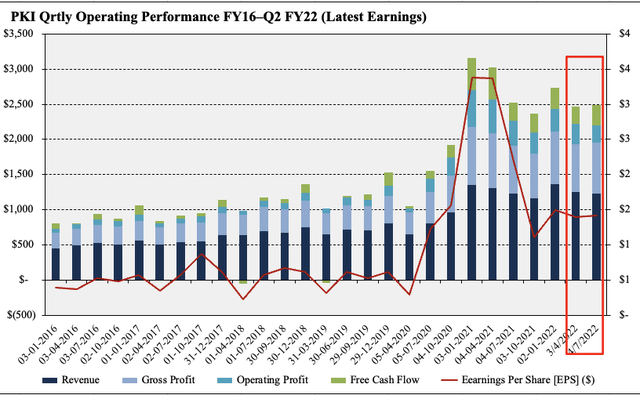

Consequently it printed quarterly operating income of $201 million in diagnostics, down from $286 million the year prior. As seen in the chart below, operating performance has been flat the past two quarters, and has pulled back substantially from FY21. However, comparing to pre-Covid, profitability and operating credentials put a strong case forward for the fundamental momentum available to harvest in this name.

Exhibit 2. PKI’s operating performance has plateaued last 2x quarters, but is substantially beyond pre-pandemic levels

As a result of the fundamental momentum earned through the quarter, management initiated Q3 FY22 guidance and raised full-year guidance at the same time. It now calls for $4.64 billion at the top for FY22 full-year on earnings of $7.90 both at the upper end. For the coming quarter, it envisions ~$1.02–$1.03 billion at the top and this to carry down to $1.40–$1.45 in earnings.

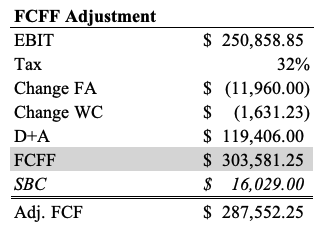

In addition, the company also doubled its expense to stock-based compensation YoY, with $16.02 million allocated vs. $7.2 million in Q2 FY21. PKI fed ~$303 million below the bottom line in FCF last quarter and when adjusting for SBC this levels off to $287 million, as seen in Exhibit 3. We advocate to treat SBC as an expense vs. conventionally adding back SBC to the FCFF calculation, as it could lead to us overshooting our estimate of corporate value, and, SBC represents a clear economic cost to equity holders.

Exhibit 3. FCFF adjustment for Q2 FY22 stock-based compensation expense; [$000′]

Data: HB Insights, PKI SEC Filings

New Mountain Capital Offer

Perhaps the bigger point on the earnings call was PKI’s announcement that private equity manager New Mountal Capital (“NMC”) entered into a definitive agreement to acquire PKI’s Applied, Food and Enterprise Services businesses (“AFES”). This looks to be a key catalyst to move the needle and we estimate this news alone will draw buyers to the stock. We encourage investors to pay a close eye on developments around this as any unexpected outcome to the downside is likely to be reflected as such in the stock price. Similarly, there’s potential for upsides from announcements in this region. Not to mention, when the proceeds are realized it will create a tailwind via the earnings accretion, by our estimates.

The AFES division is actually a carve-out of the D&A, whilst the deal is understood to be valued up to $2.45 billion. NMC has ~$37 billion in AUM, however there’s no talk of how the transaction will be financed, or even more importantly, if finance has been obtained in the first place.

Under the agreement, NMC will acquire PKI’s OneSource laboratory and field services business, alongside the portfolio of assets comprised of instruments, consumables and reagents that serve the biopharma, food, environmental & safety and applied end markets. Noteworthy it that the PerkinElmer brand will be transferred with the business.

The deal could be accretive to PKI shareholders and offers a decent length of tail on the sale. PKI expects post-tax proceeds of ~$2 billion ($15.87/share) in cash and ~$150 million ($1.19/share) in future considerations from the same. Management notes it has folded around ~$1.3 billion in FY22 revenue estimates. With this to come through PKI will free up additional liquidity and be able to put its balance sheet to effective use. The timing of the payments also creates a tail of returns yet to be realized.

On the rational front, PKI notes it reduces the cyclicality of its business model and frees up the balance sheet to deploy additional capital in new and emerging end-markets. The deal is expected to close in Q1 FY23.

PKI Stock Valuation

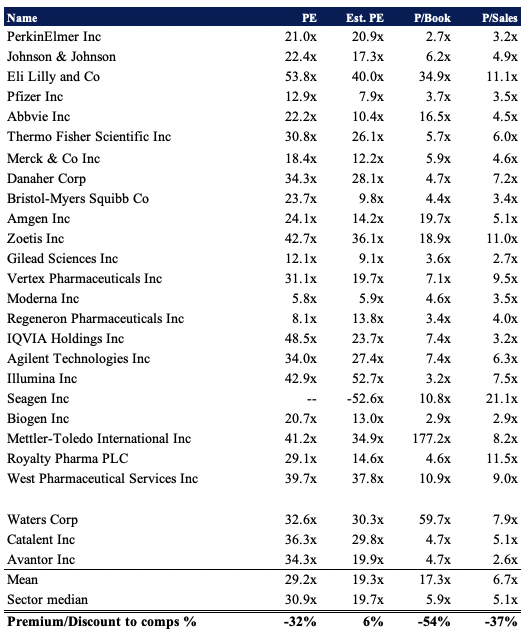

Shares are priced at a 21x P/E and ~67x Q3 FY22 free cash flow and are trading at 2.7x book value. On TTM values the figures begin to level out somewhat. PKI is trading at 3.1x TTM sales, 5.6x gross profit and ~14x FCF, and is trading at a respective discount across key multiples used within the analysis.

Exhibit 4. Multiples and Comps

Data: HB Insights

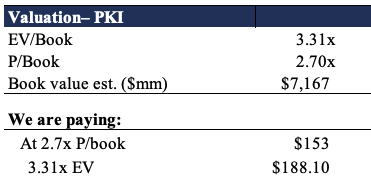

At ~2.7x book value we are also paying ~3.3x enterprise value (“EV”) to book value. In other words, we’d theoretically be paying $153 at 2.7x book and $188 at 3.3x book. Taking the lower bound, at 2.7x, PKI is undervalued by ~8.4%, whereas using the more clean measure of corporate value in EV, shares are overvalued by 13%. The arithmetic mean of the pair is $170, implying the stock may revert to the dislocation in market price to its book value, and is therefore an opportunistic play on a valuation front.

At 14x FCF we see PKI valued at $132, whereas 3-year normalized quarterly EPS for PKI lands at ~$1.20 – $3.92 annualized. Assigning the 4-year normalized P/E of 21x to the normalized EPS lands us at a valuation of just $102. In that sense, there’s a risk to our thesis that the market has in fact over-inflated the PKI share price relative to its valuation.

Exhibit 5.

Data: HB Insights Estimates

In short

PKI has caught a bid in July and we note another robust quarter from the company. It fed ~$287 million in FCFF below the bottom line and saw non-GAAP earnings of $2.42, ahead of normalized estimates. We believe there’s upside potential for the stock to appreciate towards ~$180, however note that there is also an additional catalyst with the New Mountain Capital offer.

There is substantial upside potential from this transaction yet to be priced in, and with the additional $2 billion in post-tax earnings it could potentially be worth ~$15.80/share in value to shareholders. The market has yet to reflect this into the stock price by any real measure, we estimate. With the culmination of these factors, we rate PKI as a speculative buy with a PT of $180.

Be the first to comment