Daleta/iStock via Getty Images

The FOMC minutes delivered a massive surprise to markets because rates increased dramatically following its release. Additionally, the Fed Fund futures market began to reprice the path of future rate hikes immediately.

Most people would look at the equity market and think the Fed minutes were not crucial because stocks have managed to rally some. But equities aren’t the smartest when it comes to the path of monetary policy and, at this point, are dictated by changes in implied volatility levels. Fear not – the equity market will come around soon enough.

Fed Is Targeting Inflation

Perhaps the most surprising piece of evidence of what the Fed is thinking about wasn’t new. The difference could be seen in the last FOMC statement. But the thought process was highlighted and again reiterated in the minutes. It was noted in the minutes:

Members judged that, with high and widespread inflation pressures and some measures of longer-term inflation expectations moving up somewhat, it would be appropriate for the post-meeting statement to note that the Committee was strongly committed to returning inflation to its 2% objective. As the further firming in the policy stance would likely result in some slowing in economic growth and tempering in labor market conditions, members also agreed to remove the previous statement language that had indicated an expectation that appropriate policy would result in a return of inflation to 2% and a strong labor market.

This paragraph may be the loudest message of all to the markets. The Fed will not blink because of some slowing in economic growth and is willing to let the unemployment rate rise to achieve its 2% inflation target. It’s critical because markets had started to reprice future rate hikes lower on the idea the Fed would slowly alter its path due to an economic slowdown.

Rates Repricing

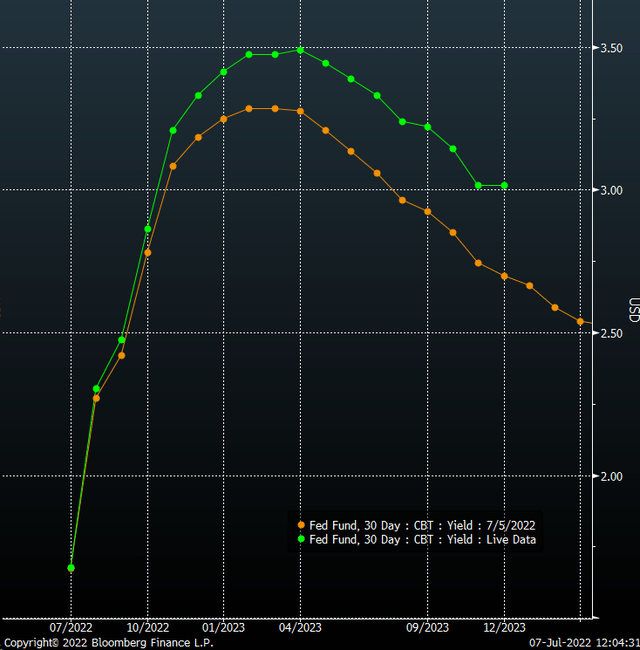

As a result, the Fed Fund Futures have seen a significant move higher following the Fed minutes and have repriced higher. The peak rate is now trading at 3.5%, expected in April 2023. It’s a significant shift from where rates stood on July 5, peaking at 3.28% in March.

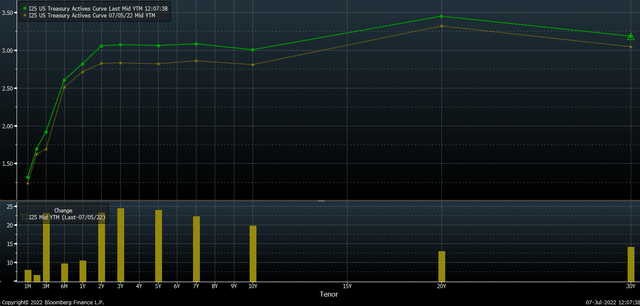

Additionally, the yield curve has shifted dramatically higher since July 5. The biggest changes in rates have come in the belly of the curve, with the 2-Yr, 3-Yr, 5-Yr, and 7-Yr rates all moving higher by 20 bps or more. Additionally, there has been a significant move higher in the three-month rate, which has also shifted higher by 20 bps.

Stocks Are In Fantasy Land

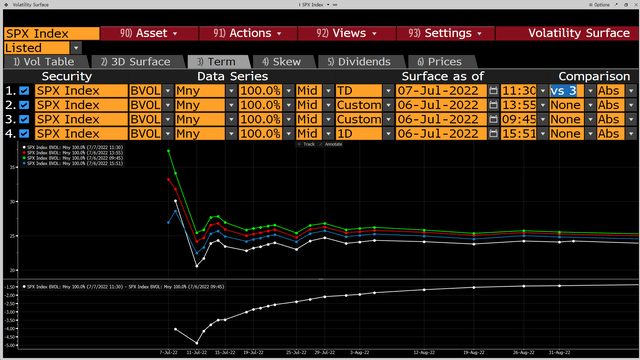

Meanwhile, stock investors are living in a fantasy land for the moment, thinking all is good with the Fed minutes. They aren’t. The stock market is rising because implied volatility is falling following the release of the Fed minutes. Implied volatility for the S&P 500 has dropped dramatically from the time of yesterday’s opening at 25.4% for a July 11 at the money option to 20.5% as of 11:30 AM today.

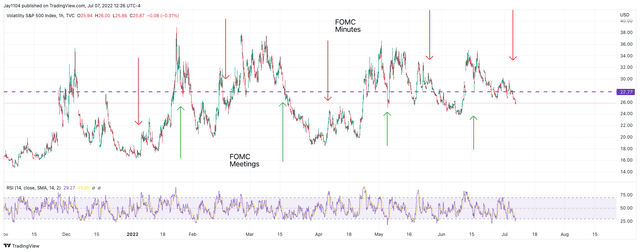

This change in implied volatility is also reflected in the VIX index which has fallen to around 25.8, down from a peak of 30 on July 5. That decline in VIX is normal following the release of the FOMC minutes. But that decline in the VIX typically doesn’t last very long, and eventually, the VIX begins to turn higher.

That’s why the FOMC minutes have generally served as a sell the news event for the S&P 500 over the last several months. After the release of the minutes, event risk is removed from the market. This results in the VIX falling and the S&P 500 rising. But after the minutes are digested, the market begins the cycle of looking to hedge the risk of the upcoming FOMC meeting. Implied volatility levels start to trend higher, pushing the VIX higher and stock prices down.

The move higher in rates and the projected path of the Fed Funds Futures tells you that the equity market rally is inaccurate and is primarily due to short-covering due to implied volatility levels declining.

Join Reading The Markets Risk-Free With A Two-Week Trial!

Investing today is more complex than ever. With stocks rising and falling on very little news while doing the opposite of what seems logical. Reading the Markets helps readers cut through all the noise delivering stock ideas and market updates, looking for opportunities.

We use a repeated and detailed process of watching the fundamental trends, technical charts, and options trading data. The process helps isolate and determine where a stock, sector, or market may be heading over various time frames.

Be the first to comment