JHVEPhoto/iStock Editorial via Getty Images

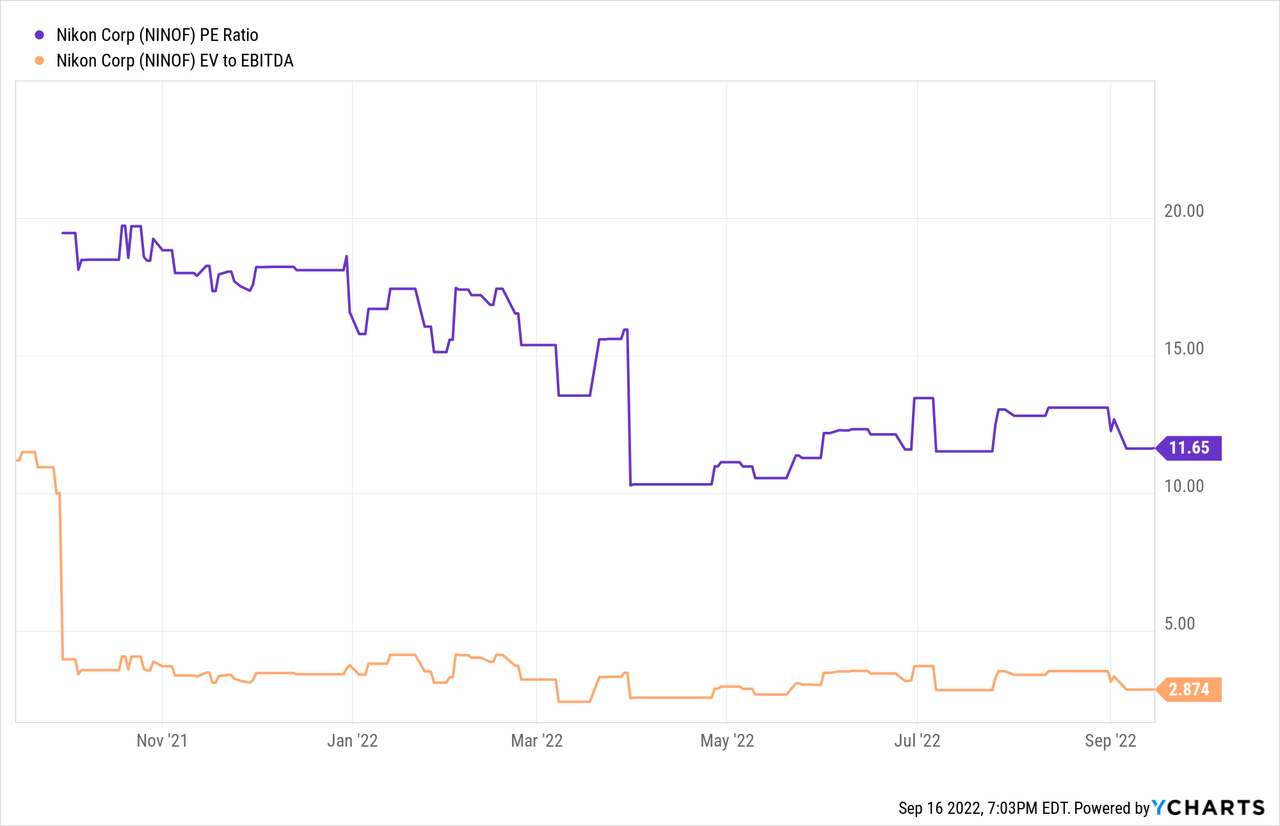

Nikon’s (OTCPK:NINOY) recent acquisition of metal 3D printer manufacturer SLM Solutions represents a key step in its Vision 2030 initiative, which features digital manufacturing as a key long-term growth driver. As the third-biggest player in the category and having just launched a new model that improves productivity for larger workpieces, the ~6x revenue price tag seems justified. While the company is currently loss-making at the EBITDA level, this should change over time, as it gains scale alongside the 3D printing momentum. SLM’s 12-laser NXG XII 600 product traction, in particular, will be worth watching, with adoption in the mass production of highly complex metal parts likely to drive incremental upside to current estimates. The stock currently trades at an undemanding 11-12x P/E, leaving ample room for a re-rating as its exposure to the industrial 3D printing theme grows over time.

All Clear on the SLM Solutions Acquisition

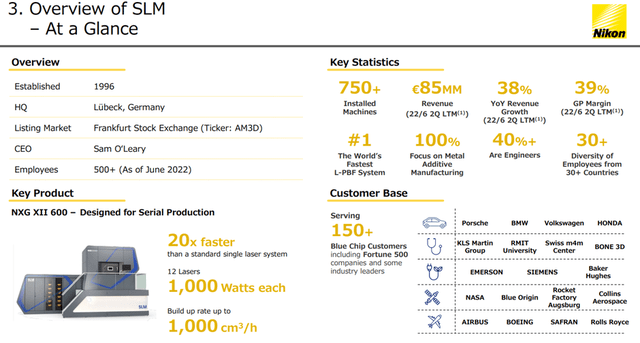

Nikon’s ~EUR622m acquisition of SLM Solutions was a positive surprise, coming in at a EUR20/share price tag or a ~75% premium to the stock’s pre-announcement closing price of EUR11.40. For context, SLM is a leading player and pioneer in selective laser melting systems for additive manufacturing (i.e., 3D printing), having invented the technology and achieving its first installation in 2003. The acquisition is an all-cash deal involving a three-step process and is expected to close in Q1/Q2 2023. The offer has already received approval from key shareholders, including Elliott and ENA Investment Capital, as well as Hans Idhe (SLM’s founder) and the key management team. In effect, Nikon has secured >60% of SLM’s total fully diluted shares and, assuming limited regulatory hurdles, is on track for a sooner-than-expected deal close.

Pricey Deal Justified by Growth Potential

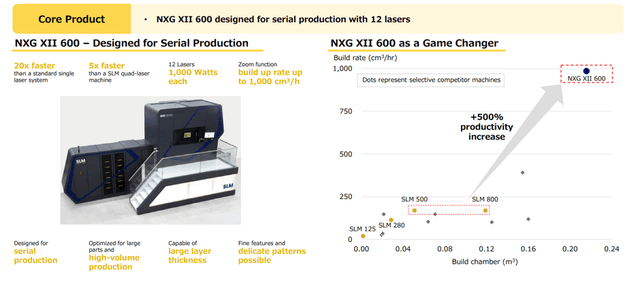

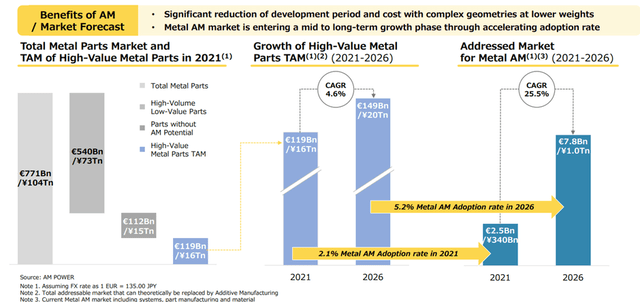

The EUR20/share offer price implies a valuation of ~EUR622m for SLM (fully diluted). Relative to the revenue guidance for the full year, this gets us to a ~6x revenue multiple – below the 9x revenue multiple of Velo3D (VLD) but well above 3D Systems (DDD) at ~2x revenue. Relative to prior transaction comps, the valuation is above the ~5x revenue multiple paid for ExOne in 2021 as well, so this isn’t the cheapest deal by any means. Fundamentally, SLM has some key advantages, though, including a more sophisticated manufacturing footprint and a superior growth outlook at ~5x through 2026 (per SLM targets). The latter target might seem optimistic but is supported by the pending 3D printing transition from prototyping to production, which will require more machines. Plus, the significantly improved economics offered by SLM’s higher-throughput next-generation systems (e.g., the 12-laser NXG XII 600) should accelerate adoption.

To be clear, the deal likely won’t be accretive in the immediate years. In the likely scenario that SLM hits or exceeds its revenue targets (helped by the structurally favorable growth outlook for the 3D printing industry), scale economies should drive a significant EBIT contribution over time. That said, the size of the deal (about half of Nikon’s net cash balance) and SLM’s funding needs will restrain Nikon’s M&A capacity in the near term, so don’t expect any major deals in the meantime. Nikon has more than enough room on the balance sheet to fund its existing shareholder return commitments (e.g., the JPY30bn buyback program), though, and selling non-core assets or divesting businesses to realize cash remain potential funding options.

A Positive Strategic Step to Rejuvenate the Business

From a strategic perspective, the acquisition of SLM is significant in that it moves Nikon closer toward its planned JPY200-300bn allocation to M&A and other strategic investments as part of its mid-term plan. To recap, the plan calls for a significant step up to >10% annualized revenue growth for the digital manufacturing business, including additive manufacturing (i.e., 3D printing), so the addition of high-growth assets like SLM is crucial. While management has yet to fully disclose the extent of the synergies here, there are low-hanging fruits to capitalize on – for one, SLM gains an extended growth runway from Nikon’s manufacturing and go-to-market scale, as well as its optical precision IP. Leveraging both networks will also be key – through SLM’s sales network (mostly within Europe and the US), Nikon adds distribution reach for its metal 3D printers, while SLM benefits from Nikon’s vast Japanese footprint.

More broadly, this transaction has positive read-throughs for the rest of the industry, affirming the growing interest and secular growth potential in additive manufacturing. Once the deal closes, Nikon will join the likes of HP (HPQ) and General Electric (GE) in manufacturing and selling metal 3D printers. Given current expectations for the 3D printing market to grow at a 25.5% CAGR through 2026, I suspect more industry consolidation ahead and perhaps accelerated innovation as key players enhance their IP portfolios via acquisitions. Backed by solid cash flow generation in its core business, Nikon remains one of the best positioned to capitalize on future consolidation opportunities.

‘Vision 2030’ Takes Shape with SLM Acquisition

Overall, I view the SLM deal as a positive one for Nikon – in spite of the relatively high valuation. Through SLM, Nikon accelerates its push into 3D printing and creates a thematically attractive long-term growth driver for the company. While the expectation is that this deal will take time to turn financially accretive, SLM’s NXG XII 600 (the world’s first twelve laser system) could surprise many, given its higher throughput and significant cost benefits to the manufacturing process. With the near-term core business outlook also bolstered by strong mirrorless camera demand, Nikon could well announce an upward revision with its upcoming quarterly results. Over the long run, a growing 3D printing contribution bodes well for the re-rating potential as well, particularly given the lack of thematic stocks in Japan. At an undemanding ~11-12x P/E and equipped with a net cash balance sheet, Nikon is worth a look, in my view.

Be the first to comment