pixelfit/E+ via Getty Images

This monthly article series shows a dashboard with aggregate subsector metrics in Consumer Discretionary. It is also a top-down analysis of sector ETFs like the Consumer Discretionary Select Sector SPDR ETF (XLY) and the Fidelity MSCI Consumer Discretionary Index ETF (FDIS), whose largest holdings are used to calculate these metrics.

Shortcut

The next two paragraphs in italic describe the dashboard methodology. They are necessary for new readers to understand the metrics. If you are used to this series or if you are short of time, you can skip them and go to the charts.

Base Metrics

I calculate the median value of five fundamental ratios for each subsector: Earnings Yield (“EY”), Sales Yield (“SY”), Free Cash Flow Yield (“FY”), Return on Equity (“ROE”), Gross Margin (“GM”). The reference universe includes large companies in the U.S. stock market. The five base metrics are calculated on trailing 12 months. For all of them, higher is better. EY, SY and FY are medians of the inverse of Price/Earnings, Price/Sales and Price/Free Cash Flow. They are better for statistical studies than price-to-something ratios, which are unusable or non-available when the “something” is close to zero or negative (for example, companies with negative earnings). I also look at two momentum metrics for each group: the median monthly return (RetM) and the median annual return (RetY).

I prefer medians to averages because a median splits a set in a good half and a bad half. A capital-weighted average is skewed by extreme values and the largest companies. My metrics are designed for stock-picking rather than index investing.

Value And Quality Scores

I calculate historical baselines for all metrics. They are noted respectively EYh, SYh, FYh, ROEh, GMh, and they are calculated as the averages on a look-back period of 11 years. For example, the value of EYh for retailing in the table below is the 11-year average of the median Earnings Yield in retail companies.

The Value Score (“VS”) is defined as the average difference in % between the three valuation ratios (EY, SY, FY) and their baselines (EYh, SYh, FYh). The same way, the Quality Score (“QS”) is the average difference between the two quality ratios (ROE, GM) and their baselines (ROEh, GMh).

The scores are in percentage points. VS may be interpreted as the percentage of undervaluation or overvaluation relative to the baseline (positive is good, negative is bad). This interpretation must be taken with caution: the baseline is an arbitrary reference, not a supposed fair value. The formula assumes that the three valuation metrics are of equal importance. A floor of -100 is set for VS and QS when the calculation goes below this value. It may happen when metrics in a subsector are very bad.

Current Data

The next table shows the metrics and scores as of last week’s closing. Columns stand for all the data named and defined above.

|

VS |

QS |

EY |

SY |

FY |

ROE |

GM |

EYh |

SYh |

FYh |

ROEh |

GMh |

RetM |

RetY |

|

|

Auto + Components |

-30.81 |

19.60 |

0.0482 |

0.8519 |

0.0306 |

20.58 |

28.83 |

0.0601 |

1.6560 |

0.0403 |

19.19 |

21.85 |

-0.35% |

1.11% |

|

Durables + Apparel |

24.63 |

22.99 |

0.0519 |

0.5886 |

0.0598 |

27.36 |

42.95 |

0.0501 |

0.7007 |

0.0321 |

17.57 |

47.57 |

-6.75% |

4.00% |

|

Retailing |

-20.72 |

13.20 |

0.0471 |

0.5653 |

0.0337 |

31.25 |

34.88 |

0.0503 |

0.9178 |

0.0408 |

23.87 |

36.52 |

-7.11% |

2.91% |

|

Services |

-62.26 |

-86.85 |

0.0037 |

0.1686 |

0.0144 |

-9.83 |

32.74 |

0.0360 |

0.4239 |

0.0228 |

15.17 |

35.93 |

-0.64% |

11.73% |

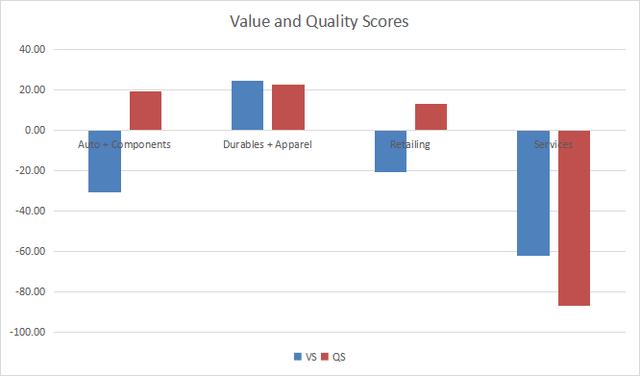

Value And Quality chart

The next chart plots the Value and Quality Scores by subsector (higher is better).

Value and quality in consumer discretionary Chart: author; data: Portfolio123

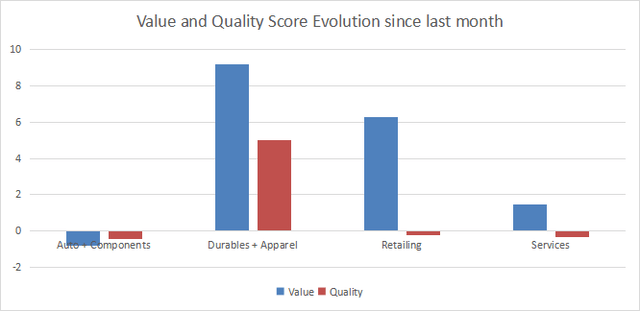

Evolution Since Last Month

The value score has significantly improved in the durables/apparel subsector and retailing. The former also shows an improvement in quality score.

Variations in value and quality Chart: author; data: Portfolio123

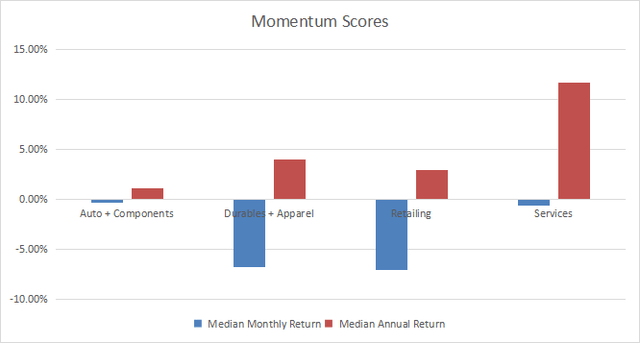

Momentum

The next chart plots momentum data.

Momentum in consumer discretionary Chart: author; data: Portfolio123

Interpretation

Durables and apparel is the only undervalued subsector relative to 11-year averages. It is also above the quality baseline: combining both scores, it is the most attractive group of industries in consumer cyclicals. It includes household equipment, leisure products, textile, apparel and luxury goods. Retail and auto/components are moderately overvalued relative to historical averages (by about 20% to 30%). It may be partly justified by a good quality score. The services subsector, which includes hotels, restaurants, leisure and diversified services, has bad fundamental metrics. The median 12-month return-on-equity is in negative territory, meaning a majority of companies is unprofitable regarding this ratio. Many of them have taken additional debt to survive lockdowns and travel bans, and some consumers may have changed their habits in a lasting way.

FDIS Fast Facts

The Fidelity MSCI Consumer Discretionary Index ETF has been tracking the MSCI USA IMI Consumer Discretionary 25/50 Index since 10/21/2013. It has a total expense ratio of 0.08%, which is lower than XLY (0.12%).

The fund has 329 holdings as of writing. The next table shows the top 10 names with basic ratios and dividend yields. Their aggregate weight is over 59%, with almost 36% in the top two companies. Amazon and Tesla represent 21.5% and 14.4% of the fund’s asset value.

|

Ticker |

Name |

Weight |

EPS growth %TTM |

P/E TTM |

P/E fwd |

Yield% |

|

Amazon.com Inc. |

21.51% |

49.77 |

59.31 |

73.83 |

0 |

|

|

Tesla Inc. |

14.31% |

517.21 |

322.57 |

155.34 |

0 |

|

|

Home Depot Inc. |

6.70% |

29.24 |

23.38 |

22.61 |

1.89 |

|

|

McDonald’s Corp. |

3.32% |

47.87 |

26.13 |

26.91 |

2.18 |

|

|

Nike Inc. |

3.26% |

117.41 |

37.42 |

38.71 |

0.85 |

|

|

Lowe’s Cos. Inc. |

2.91% |

62.65 |

19.44 |

18.68 |

1.43 |

|

|

Starbucks Corp. |

2.05% |

357.28 |

27.04 |

27.80 |

2.05 |

|

|

Target Corp. |

1.88% |

80.00 |

16.32 |

16.76 |

1.62 |

|

|

Booking Holdings Inc. |

1.76% |

-72.41 |

265.66 |

55.87 |

0 |

|

|

Ford Motor Co. |

1.75% |

1992.17 |

29.87 |

11.44 |

1.85 |

Ratios: Portfolio123

FDIS has beaten XLY by about 60 bps in annualized return since inception. It is also a bit more volatile.

|

Since 10/30/2013 |

Total Return |

Annual Return |

Drawdown |

Sharpe |

Volatility |

|

FDIS |

241.37% |

16.09% |

-36.29% |

0.97 |

17.67% |

|

XLY |

226.61% |

15.47% |

-33.91% |

0.99 |

16.57% |

Data calculated with Portfolio123

In summary, FDIS is a good product with cheap management fees for investors seeking capital-weighted exposure in consumer cyclicals. It holds 300+ stocks including large, mid- and small caps, whereas XLY has only 62 holdings in large companies. It has outperformed XLY by a short margin since 2013. FDIS looks a good choice for long-term investors, but XLY liquidity makes it a better instrument for tactical allocation and trading. Investors who are concerned by the weights of Amazon and Tesla may prefer the Invesco S&P 500 Equal Weight Consumer Discretionary ETF (RCD).

Dashboard List

I use the first table to calculate value and quality scores. It may also be used in a stock-picking process to check how companies stand among their peers. For example, the EY column tells us that a retail company with an Earnings Yield above 0.0471 (or price/earnings below 21.23) is in the better half of the industry regarding this metric. A Dashboard List is sent every month to Quantitative Risk & Value subscribers with the most profitable companies standing in the better half among their peers regarding the three valuation metrics at the same time. The list below was sent to subscribers several weeks ago based on data available at this time.

|

Boyd Gaming Corp. |

|

|

Bloomin’ Brands Inc. |

|

|

Sally Beauty Holdings Inc. |

|

|

Group 1 Automotive Inc. |

|

|

AutoNation Inc. |

|

|

Asbury Automotive Group Inc. |

|

|

Sonic Automotive Inc. |

|

|

Whirlpool Corp. |

|

|

Williams-Sonoma Inc. |

|

|

Patrick Industries Inc. |

It is a rotating list with a statistical bias toward excess returns on the long-term, not the result of an analysis of each stock.

Be the first to comment