dszc

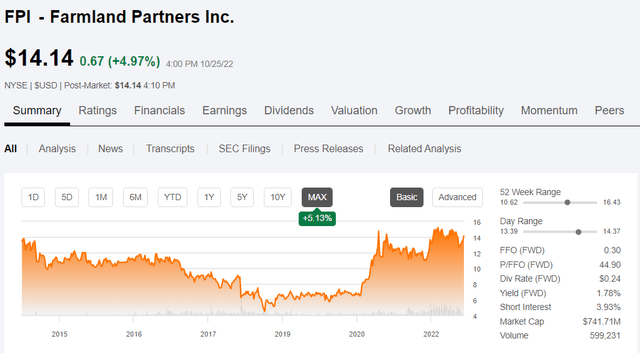

Third quarter earnings of 2022 marked an inflection point in Farmland Partners (NYSE:FPI). This is the start of their growth engine in which scale and per share AFFO accretion work in harmony.

To understand what I mean by this, allow me to go on a bit of a tangent about the process by which young REITs attain scale.

A balancing act – Size versus value

Most REITs start off subscale and FPI is no exception. In navigating the situation REITs are forced to balance their decisions between 2 objectives which are usually opposing.

- Scaling up to ideal size

- Accretion to earnings/NAV on a per share basis

Scaling up is enhanced by equity issuance but equity issuance is often dilutive which makes it counterproductive to objective #2.

The skill with which a REIT navigates this balance is a huge determinant of their future success. Most fledgling REITs lean heavily toward scaling up, issuing equity recklessly. This does accomplish the mission of getting to an efficient scale which for most property sectors is around $1B-$2B. However, it comes at a tremendous dilutive cost.

Original shareholders are left with a fraction of their value and it can take many years of successful business operations to recover original per share value on a NAV basis or AFFO/share basis.

As a REIT dedicated analyst with an emphasis on the small-cap space I have seen dozens of REITs dilute themselves to oblivion, but I have also seen some success stories. There are generally 4 pathways in which REITs successfully achieve scale in a shareholder-friendly way.

- IPO at a time when the market is favorable. This facilitates issuing equity above NAV and thereby allows scaling without dilution. Examples of this include Essential Properties (EPRT) and Broadstone Net Lease (BNL).

- Be in a sector with tremendous fundamental growth such that the dilution of share issuance can be overwhelmed by NOI growth such that FFO/share is maintained or grown despite the dilution. Plymouth REIT (PLYM) is a good example.

- Slow calculated equity issuance paired with asset acquisitions at cap rates that exceed the WACC. Gladstone Commercial (GOOD) has done this for years and still remains somewhat small.

- Patient organic growth. Allow asset value and NOI to rise via strong properties and eventually that intrinsic value pulls market price up to a point where equity issuance can be accretive. NexPoint Residential (NXRT) and Farmland Partners used this path.

REITs will often time their IPOs with intent to scale using the first path. I believe this is what FPI did as they came out of the gate with a strong farm economy in 2014 and the market was interested in the asset class. They came out firing, pairing issuance with acquisitions. Unfortunately, this pathway requires a bit of luck because it involves the market having a sustained level of enthusiasm.

Not long after going public, the farm economy went into recession and FPI’s market price quickly sank to a level that would have made further issuance dilutive.

This is the inflection point that differentiates responsible REITs from greedy REITs. What does the REIT do when scaling pathway #1 gets closed down?

Pathways #2 and #3 were also closed to FPI. Farmland has long-term growth, but not the kind of explosive growth that quickly overcomes dilutions. Cap rates in the sector are generally low, so there was no real opportunity to grow via cap rates above WACC when share price is low.

Farmland Partners went into hibernation. Despite the downturn in the farm economy, farmland as an asset is quite stable which provides an opportunity for unlimited dormancy. Like a turtle in its shell, FPI hunkered down and chugged along reasonably profitably while they waited out the weak market pricing.

Eventually, market pricing got so absurdly low that FPI was faced with a difficult decision of actually shrinking when already subscale so as to benefit value on a per share basis.

FPI executed a massive share buyback (relative to the size of the company).

This catapulted NAV/share up into the mid-teens and will eventually result in significantly higher AFFO/share.

That is how FPI remains far below ideal size, even after more than 8 years in the public domain.

3Q22 marks an inflection point for Farmland Partners

Today, FPI has the ability to pursue both goals in harmony: Scaling AND per share growth.

There were a few notable aspects to this quarter that facilitate greater market interest which I believe will allow FPI to continually issue equity at accretive levels that not only scale the company but improve AFFO/share. From the 3Q22 earnings press release:

- renewed approximately 60% of leases expiring in 2022 at average rent increases in excess of 15%; and

- increased the bottom and top end of 2022 AFFO guidance range to $0.27 to $0.31 from $0.26 to $.30.

- increased AFFO by $5.7 million to $2.5 million, or $0.05 per share, from $(3.2) million, or $(0.09) per share, for the same period in 2021;

Operating numbers came in above expectations allowing FPI to raise its full year guidance. I think the bigger deal, however, is how it will help align public market perceptions with what was already known in private farmland investment.

Delta between public and private perception of farmland asset class

Farmland is one of the oldest assets and the private market understands how the cycle works. Land tends to stagnate in value during farm recession and then bumps up in value during the good times. It is the ultimate slow and steady sort of asset class.

The public market, however, has historically had very little access to farmland and as such is less familiar with how the cycle works. When the recent farm recessions hit, public markets panicked; they saw news reports of farmers going out of business and thought this meant disaster for farmland REITs. Public markets are not aware of the history of farmland occupancy consistently sitting basically at 100%.

Also eluding public markets has been the idea that farmland returns come in 2 forms:

- AFFO

- NAV accretion with no capex input

REIT investors know how to track AFFO and generally for REITs that is a good approximation of profit levels.

Farmland is a low cashflow asset class, getting a large portion of its return from asset appreciation. So while over the past 8 years FPI has actually been highly profitable when you consider both sources of return, the myopic focus of the market on AFFO has made it seem spotty at best. Seasonality of specialty crops generating most of their crop-share revenue in 4Q has furthered the perception gap as it made FPI only AFFO positive in 4Q with other quarters being negative.

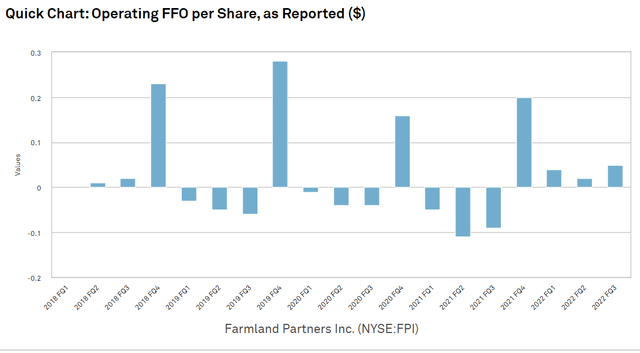

S&P Global Market Intelligence

That is not a chart the typical REIT investor likes to see and that is why I think the 3Q22 report will be so impactful.

AFFO/share is now solidly in the green even in the seasonally weak quarters. Rental rates have risen enough on the row crop land that the run-rate now exceeds expenses by a decent margin. Further, the cessation of legal expenses allows that operating cash flow to shine through.

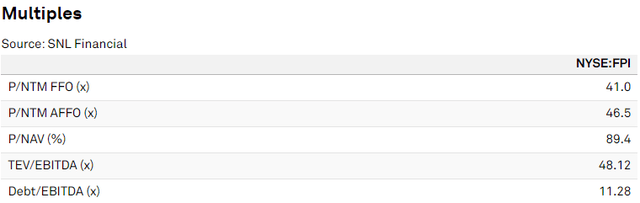

This report along with other recent fundamental success has brought FPI’s market price up to a level where they can comfortably issue equity to acquire more farmland and it is clearly accretive to shareholders. FPI is still slightly below NAV (89.4%), so there is a bit of NAV dilution.

S&P Global Market Intelligence

However, that is more than made up for by the benefits of scale and the AFFO/share accretion. The AFFO math is quite simple. Issuing at a multiple in the 40X range is a cost of equity capital in the 2s. Cap rates on farmland are well north of that.

It is also quite satisfying as a shareholder to have shares issued in the $14s after those same shares were bought back in the ~$6-7 range.

Benefits of scale

Given how large of an asset class farmland is, FPI is still far from achieving what I would consider full scale, but there are benefits to shareholders that will accrue along the way.

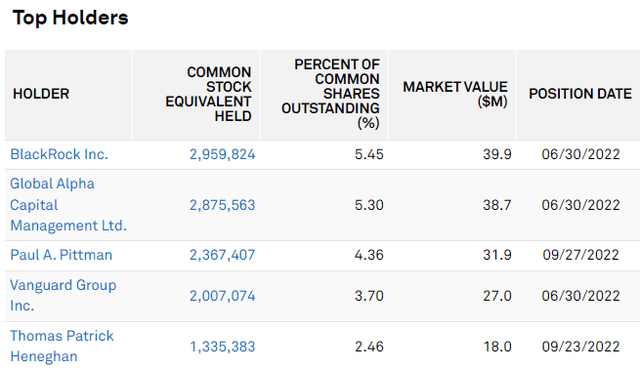

At roughly the $650-$800 million market cap level FPI will be added to the index underlying the Vanguard Real Estate ETF (VNQ).

Upon addition, Vanguard will increase its ownership of FPI from about 3.7% of shares outstanding to around 15%.

S&P Global Market Intelligence

As FPI gets bigger its pooled purchasing becomes more valuable to both shareholders and its tenant farmers.

Small farmers get pushed around by producers of farm equipment and fertilizers. An individual simply doesn’t have the negotiating power to get bulk discounts, but FPI has a pooled purchasing program in which its tenants can essentially band together to get better input prices. FPI and the tenants share the savings. Some benefit to pooled purchasing already exists, but as FPI gets bigger the discounts achieved will be greater.

Think along the lines of Starbucks (SBUX) buying coffee beans at absurdly low prices due to its scale except instead of possibly abusing poor coffee farmers in disadvantaged nations, FPI will be leveling the playing field against the major fertilizer companies.

The building of a major investment class

There is such an obvious lack of public investment in farmland. It is a multi-trillion dollar asset class yet the only ways to invest in it as a public investor are FPI, Gladstone Land (LAND) and a few semi-public vehicles like FarmTogether.

That is a massive disconnect and I think there is huge opportunity for FPI to step in as an institutionally accessible vehicle. It is just a matter of scale and as discussed in the bulk of this article, accretive scaling has been unlocked.

Just as real estate is now considered an important part of a portfolio with general diversification guidelines now calling for significant allocation to real estate, farmland will someday be considered a basic building block of a diversified portfolio.

Whether that generally recommended portion ends up being 5%, 10% or 15% I have no idea, but it is coming from a state of being basically 0% in most people’s portfolios. When it becomes an institutional asset class there will be huge inflows. I don’t know if it’s FPI, Gladstone Land or something else entirely catching those inflows, but the opportunity is there.

Be the first to comment