Sundry Photography

MongoDB’s (NASDAQ:MDB) stock has been under pressure for the past 12 months due to the combination of decelerating revenue growth and higher interest rates. The drawdown is likely overdone though, as most of MongoDB’s current struggles can be attributed to macroeconomic weakness and a post-COVID hangover. With the transition to web scale databases only just beginning, and the capabilities of MongoDB’s platform continuing to expand, the company has a long growth runway ahead of it.

Market

Companies are continuing to embed software into their value propositions, leading to growth in the number of custom software applications. More modern data platforms are needed to enable these companies to innovate quickly though. Legacy tech stacks are expensive and brittle, and the current macro environment could be a catalyst to move away from these platforms.

Legacy relational databases are expensive and don’t scale to meet the needs of modern applications. It is also difficult to add new features to relational databases, which slows down the pace of innovation over time. There has been a proliferation of point solution databases to address these limitations, but this has created a disjointed experience for developers and resulted in complex architectures, with data silos and high costs.

MongoDB abstracts away all that complexity through an architecture that is designed to address the vast majority of use cases. The document model could be considered a superset of other database models, enabling MongoDB to consolidate the database market. They are doing this by adding capabilities like time series, search and analytics. MongoDB’s document model aligns with the way developers code, providing a simpler experience for developers. The distributed architecture also delivers the highest levels of performance and scale.

MongoDB believes they can demonstrate over 40 percent cost savings relative to the existing tech stack. Examples of these cost savings include:

- A financial services company utilized MongoDB to decommission eight legacy trading systems and realize cost savings of almost 50 million USD annually.

- A security provider migrated its IoT and AI security platform to Atlas and reduced their database spend by 60%.

- A Fortune 500 consumer technology company used MongoDB to replace its existing compliance platform. This improved performance and lowered costs by 70%.

MongoDB believes their current market opportunity is approximately 85 billion USD and that this opportunity will grow to $138 billion in 2026. MongoDB’s current revenue only implies something like a 1% market share, providing plenty of future upside.

MongoDB

MongoDB measures customer penetration based on the number of applications or workloads. Customers generally shift to MongoDB in a gradual process, leading to expansion over time. Even amongst existing customers, MongoDB is generally fractionally penetrated relative to their potential. This is also an expanding opportunity set as customers continue to build new applications and increase the number of workloads over time.

MongoDB is supporting this expansion by adding to the capabilities of their platform, like support for search, time series and streaming, with potential use cases in operational intelligence and real-time analytics. The addition of these types of capabilities supports the use of MongoDB as an all purpose data platform. Customer feedback on the concept of a unified seamless platform has been positive.

MongoDB’s search efforts are focused on applications, whereas Elasticsearch also addresses logging and security, which MongoDB is not pursuing. MongoDB’s unified platform saves developers from investing in tooling to move data between their OLTP platform and their search database or vice versa.

MongoDB has also introduced Queryable Encryption, which allows customers to query data while it remains encrypted, helping customers to meet stringent security and compliance requirements. This ensures that data remains secure in-transit, at-rest, in memory, in logs, and in backups. MongoDB is the only database provider that enables processing of expressive queries on randomly encrypted data.

MongoDB is also focused on removing friction in acquiring workloads from new and existing customers. Relational Migrator simplifies the process of migrating workloads off relational databases and on to MongoDB by allowing customers to quickly model what the schema would look like in MongoDB, versus the existing schema on a relational database. The Relational Migrator early access program is oversubscribed, and MongoDB is receiving positive feedback.

MongoDB is also reducing friction by supporting serverless architectures as part of their efforts to free developers to focus on business problems rather than infrastructure. Serverless architecture is a way of building applications without needing to think about the underlying infrastructure that supports it. Serverless abstracts away the need to do capacity planning. A serverless architecture for a cloud database means that developers can simply set up a database and not worry about how it scales. MongoDB Atlas allows developers to deploy a serverless database via serverless instances and early feedback has been positive.

MongoDB’s analytics initiatives are also advancing. Atlas Data Federation and Atlas Data Lake storage are seeing healthy early adoption in use cases related to the extraction of insights from applications on Atlas. Atlas Data Federation is a distributed query engine that allows customers to natively query, transform, and move data across various sources inside and outside of MongoDB Atlas. Data Federation reduces the effort, time, and complexity of pipelines and ETL tools when working with data in different formats. Atlas Data Lake is a fully managed storage solution that is optimized for analytical queries while maintaining the economics of cloud object storage. Customers can automatically extract and optimize data into a fully managed data lake store to isolate analytical workloads and perform large-scale analytics.

Despite moving into the analytics space, MongoDB does not see Snowflake (SNOW) in any of their deals. There is potentially some overlap between analytic and operational databases but MongoDB believes the future of analytics will be powering intelligent applications. Snowflake’s efforts to enable transactional workloads on their platform and enable the development of an application platform may increase the amount of overlap between the two companies.

In the past there has been a large amount of concern regarding MongoDB’s ability to compete with the hyperscalers, in part due to their open-source background. MongoDB made the software open source to drive adoption, but they retain the intellectual rights and have the technical acumen.

SSPL prevented the cloud providers from offering a competing version of MongoDB as a service. The hyperscalers were instead forced to emulate MongoDB’s features by building a clone service. Microsoft (MSFT) and Amazon (AMZN) did this by building on a relational back end, causing feature and performance trade-offs. Customers may also prefer MongoDB to the hyperscalers so that they can maintain platform independence. MongoDB has stated that their win rates against the hyperscalers are very high.

Financial Analysis

MongoDB has pointed towards a record increase in direct sales account as evidence that the business environment remains robust. Innovation remains a top priority for MongoDB customers and they continue to invest in modern technologies in support of this. MongoDB has strong engagement with the C-suite and so far their deal cycles are in line with normal patterns.

Despite this, MongoDB is likely to experience a significant growth slowdown in coming quarters due to their reliance on customer activity. This should not be a particular cause for concern for long term investors though. MongoDB’s growth has exhibited volatility in the past, but has so far shown little evidence of being in terminal decline.

MongoDB still expects full fiscal year 2023 revenue to be $1.196-$1.206 billion, representing 37% annual growth at the midpoint. Implied growth in the fourth quarter is only in the mid-teens though, which has likely concerned investors, although some of this is due to a difficult comparable period in the previous year. It also appears concerning given the dramatic decline in growth since the January quarter, where strong growth was driven in part by exceptionally high in-quarter expansion of existing Atlas customers.

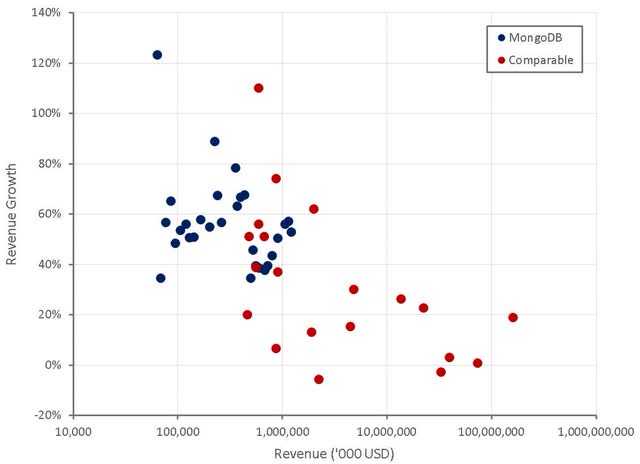

Figure 1: MongoDB Revenue Growth (source: Created by author using data from company reports)

Expansion rates also remain strong, which is evidence that MongoDB is a non-discretionary expense for customers. The macro environment is weighing on the growth of Atlas consumption though. The root cause of slower expansion is slower growth in usage of the underlying applications, which is consistent with a macro slowdown. This pattern is similar to the early days of COVID, although the impact so far is neither as ubiquitous, nor as severe. MongoDB’s ARR expansion rate has generally been above 120%.

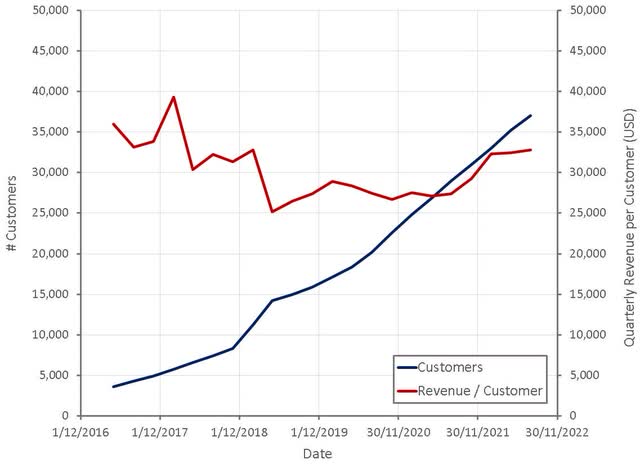

The growth in MongoDB’s total customer count is currently being driven in large part by Atlas, which had over 31,500 customers at the end of the most recent quarter, compared to over 23,300 in the year ago period.

Figure 2: MongoDB Customers (source: Created by author using data from MongoDB)

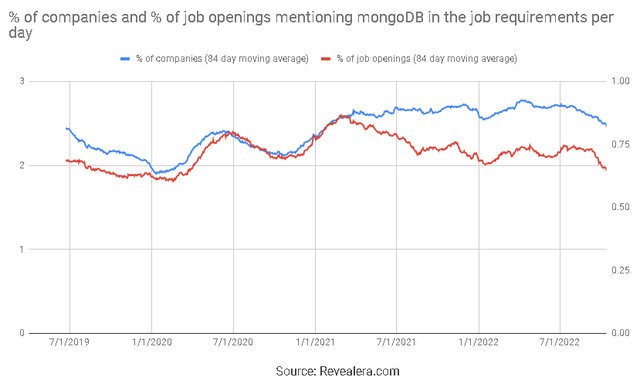

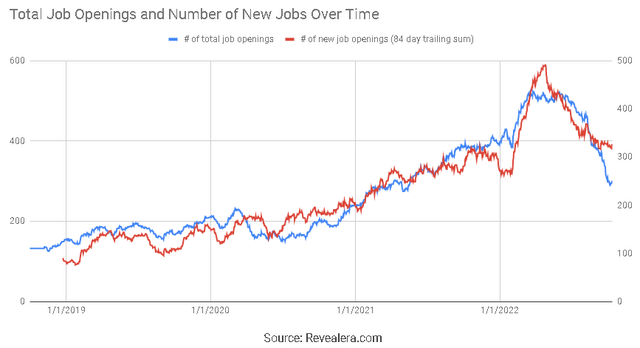

The number of job openings mentioning MongoDB in the requirements has been fairly stable over the last few years. Job openings may not be increasing due to the fact that MongoDB is already fairly ubiquitous at this point. The number of job openings has declined somewhat in recent months though, which could be indicative of a softening of demand going forward.

Figure 3: Job Openings Mentioning MongoDB in the Requirements (source: Revealera.com)

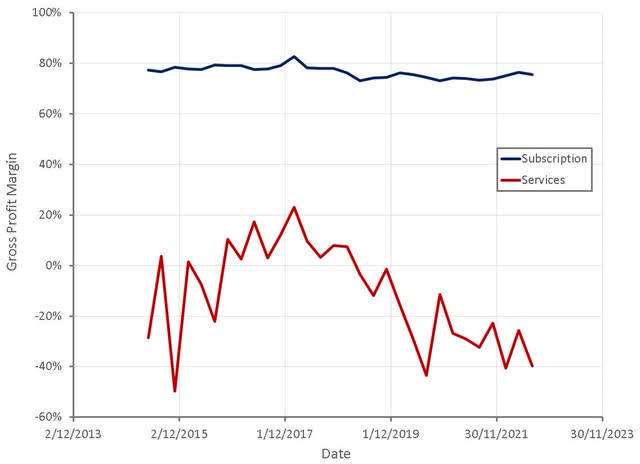

MongoDB’s gross margins continue to be relatively stable. Services are being used as a customer acquisition/retention tool and hence are a loss leader.

Figure 4: MongoDB Gross Profit Margins (source: Created by author using data from MongoDB)

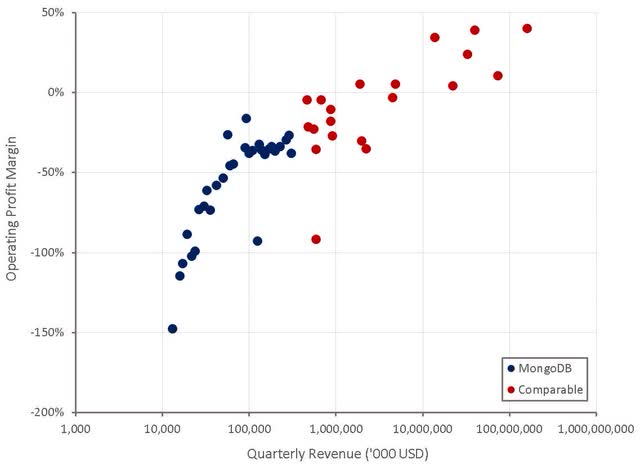

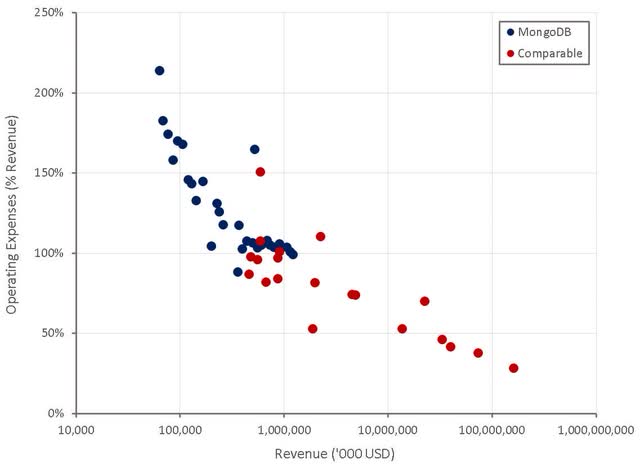

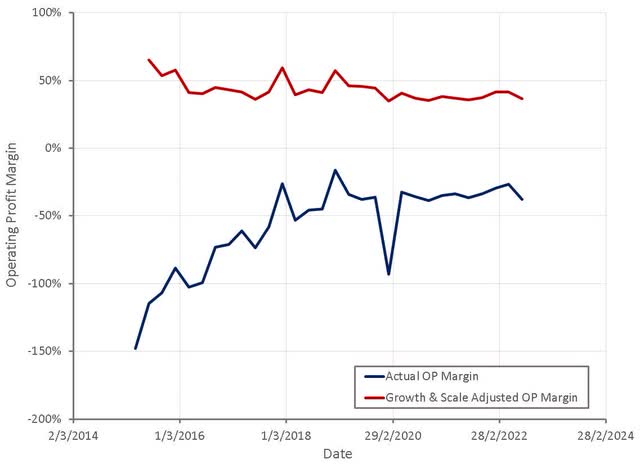

MongoDB continues to exhibit modest operating leverage and is slowly moving towards profitability as the business scales. Margins are likely to deteriorate in coming quarters though as the company continues to invest for the long term, and near term growth is unlikely to be sufficient to cover these investments.

Figure 5: MongoDB Operating Profit Margins (source: Created by author using data from company reports)

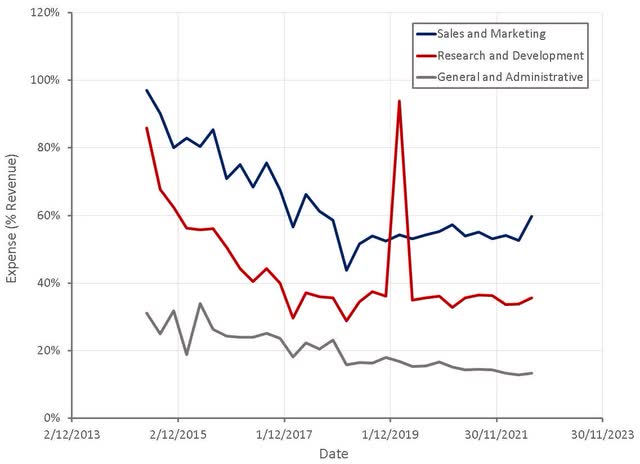

In particular, MongoDB’s sales and marketing expenses are rising relative to revenue, consistent with management’s statement that they are building out a bigger salesforce to capitalize on the large market opportunity. High sales and marketing expenses are acceptable given the stickiness of databases, MongoDB’s high gross margins and the expanding product portfolio provide upsell opportunities.

Figure 6: MongoDB Operating Expenses (source: Created by author using data from MongoDB)

Figure 7: MongoDB Operating Leverage (source: Created by author using data from company reports)

Figure 8: MongoDB Adjusted Operating Profit Margins (source: Created by author using data from MongoDB)

MongoDB has around 37,000 customers, of which approximately 12% are direct sales customers. To support the growing number of direct sales customers, MongoDB is growing its salesforce. Their quota carrying headcount is still small relative to competitors though (hundreds of reps versus thousands).

Despite macroeconomic weakness, MongoDB remains confident in the long-term opportunity and their competitive position in the market, and hence is continuing to rapidly scale their sales organization. MongoDB has stated that they have exceptionally high win rates. Their main concern seems to be ensuring their sales force is large enough to cover the market opportunity.

Figure 9: MongoDB Hiring Trend (source: Revealera.com)

Valuation

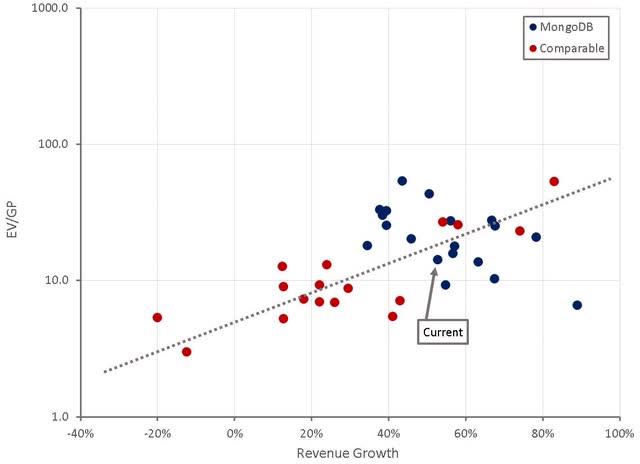

After a significant pullback this year, MongoDB now trades on relatively low revenue multiples relative to its peers and its own history, given its growth and margin potential. This may be because the market is pricing in short-term downside based on MongoDB’s dependence on customer activity. Based on a discounted cash flow analysis I estimate that MongoDB’s stock is worth approximately $375 per share. Despite this, the stock is unlikely to move higher until interest rate volatility declines and macroeconomic conditions stabilize.

Figure 10: MongoDB Relative Valuation (source: Created by author using data from Seeking Alpha)

Conclusion

Macroeconomic weakness and high interest rates are providing investors with an opportunity to buy MongoDB at depressed levels relative to recent history. Given MongoDB’s current losses, and the fact that margins are likely to deteriorate going forward, the stock could still move lower. For long-term investors, the focus should be on the large and growing market opportunity and MongoDB’s competitive position.

Be the first to comment