Thaweesak Saengngoen

One of the biggest problems facing Americans today is the high inflation rate currently plaguing the country. This has gotten to the point of forcing many people to take on second jobs or go into debt simply to obtain the resources that they need to feed their families. Fortunately, as investors, we have other methods that we can use to obtain the extra money that we need to support ourselves. One of the best of these methods is by investing in a closed-end fund that specializes in the generation of income.

That’s because these assets provide easy access to a diversified portfolio that can, in many cases, provide a higher yield than any of the underlying assets. In this article, we will discuss the First Trust/Aberdeen Global Opportunity Income Fund (FAM), which is one fund in this category that investors can use. As of the time of writing, the fund yields a very attractive 9.41% and trades at a very reasonable valuation. I have discussed this fund before but more than a year has passed since that time so a great many things have changed. This article will therefore focus specifically on these changes as well as provide an updated analysis of the fund’s finances. Therefore, let us investigate and determine if this fund could be a worthy addition to your portfolio today.

About The Fund

According to the fund’s webpage, the First Trust/Aberdeen Global Opportunity Income Fund has the stated objective of providing a high level of current income. Although the fund’s name is not clear about this, the fund is a fixed-income fund so this objective seems fairly obvious. After all, virtually all fixed-income funds focus on the generation of income for their investors. This makes sense since capital gains tend to be very hard to come by in the fixed-income space.

This fund is somewhat unique though in that it invests its assets in the world bond markets. This is an asset class that can be a bit difficult for American investors to gain exposure to so it’s quite nice to have the opportunity. The diversification that we can gain by adding this asset class to our portfolios is particularly appealing considering the financial problems currently affecting the US economy.

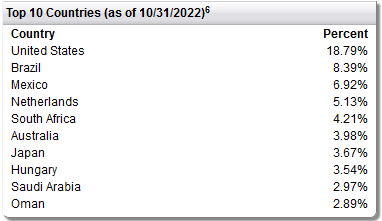

This fund does an excellent job at diversifying globally too, which we should somewhat expect from an Aberdeen fund. As we can see, only 18.79% of the fund’s portfolio is invested in American bonds:

First Trust

This represents a significant increase over the 9.28% American exposure that we saw when we last reviewed the fund but it’s still much better than peers. This is evident in the fact that most global funds have a 60% to 70% weighting to the United States. The lower percentage here is nice because it allows an investor to actually add this fund to a portfolio containing American bonds and reduce exposure to this country. Thus, it reduces our concentration risk somewhat.

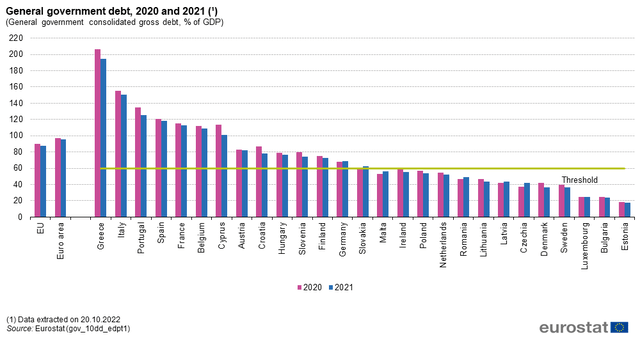

One thing that we do notice by looking at this portfolio is that the fund has completely dumped Russian and most other European bonds from its portfolio over the past year. In fact, the only European bonds that are still in the portfolio are those of The Netherlands. This is not particularly surprising, especially given the current political situation with respect to Russia. In the Eurozone, the finances of many governments have gotten considerably worse since the outbreak of the COVID-19 pandemic but they did make some headway in bringing down their national deficits in 2021:

Eurostat

We can still see though that many of the nations in the Eurozone still have debt-to-GDP ratios well above the 60% threshold dictated by the European Union and even those countries that are below the threshold are still fairly close to it. With that said though, the United States has a debt-to-GDP ratio of 124.9% so it’s higher than all but three countries in the Eurozone (Greece, Italy, and Portugal). The reason that this is important is that a high debt-to-GDP ratio has been associated with poor economic performance. In 2013, a study from the World Bank found that a nation’s economic growth slows down once the debt-to-GDP ratio exceeds 77%.

For every percentage point above that, gross domestic product growth slows by 0.017%. This is one reason why gross domestic product growth in the United States has been very meager for the past two decades. It’s also a reason why we want to be including bonds from less indebted countries in our portfolios. This fund is certainly doing that by including countries like Australia, Saudi Arabia, and The Netherlands that do have very low ratios. After all, the faster a country’s economy grows, the more easily it can afford to make its debt payments.

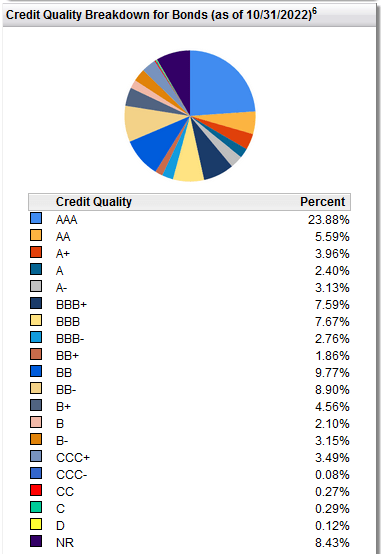

As any experienced investor can likely tell you, the major rating agencies issue letter-grade ratings alongside bonds. These ratings theoretically tell an investor how likely the issuer is to default on its bonds. Thus, we want to have a look at the ratings of the assets in the fund’s portfolio as part of our risk analysis. Here’s the basic summary:

First Trust

Mostly, we see high-quality bonds here. In particular, anything above a BBB- rating is considered to have minimal default risk and we can see that this is the majority of the portfolio. We also see that another sizable contingent is rated B or BB. According to the official bond rating scale, issuers whose bonds possess this rating are pretty unlikely to default outside of a severe economic shock. Thus, the overall default risk across the fund’s portfolio should be pretty low here. Risk-averse and other conservative investors do not really have much to worry about.

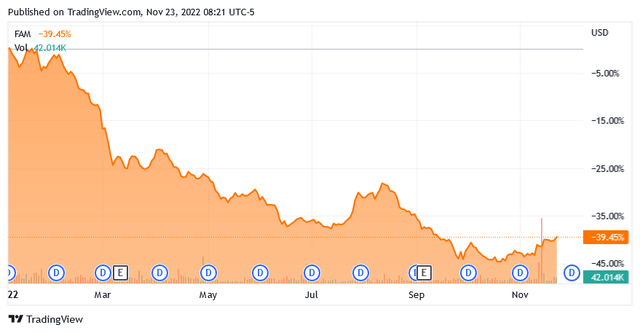

One thing that we have been seeing is that bond prices have been declining over the past several months. This has been caused by rising interest rates around the world in response to inflation. Most American investors are going to be most familiar with the Federal Reserve, which started to raise interest rates back in March, but in fact, most central banks around the world have been hiking rates due to the high inflation that we are all seeing. The First Trust/Aberdeen Global Opportunity Income Fund has certainly been affected by this in the market as its price is down 39.45% year-to-date:

Seeking Alpha

The reason why bond prices fall when interest rates rise is that investors want to earn a yield that’s in line with interest rates. Thus, when rates increase, older bonds with lower rates fall in price until they have the same yield-to-maturity as a newly-issued bond. As the fund is invested in bonds, its price will naturally decline to reflect the fact that the value of the assets in its portfolio is declining. However, one of the characteristics of bonds is that, barring a default, they still pay out their face value at maturity no matter what the current price is. Thus, unless the fund is actually selling its bonds after they decline in price, it’s not really suffering a loss.

With that said, the fund does actually sometimes sell bonds after they decline in price. We can see that with the fund’s disposition of its Russian Federation bonds as well as some of the European bonds that were previously in the fund. In fact, the fund has a 44.00% annual turnover, which is on the high side for a fixed-income fund. As I have explained in various previous articles, a high turnover creates a drag on the fund’s performance.

This is because trading stocks or other assets costs money, which is then billed to the fund’s investors. The fund’s management must then generate sufficient returns to both cover these added expenses and deliver a return that is acceptable to investors with the money that’s left over. This is a difficult task and it’s why very few funds consistently beat their benchmark indices. Admittedly, this fund does not officially have a benchmark index but it has underperformed the Vanguard Total World Bond ETF (BNDW) year-to-date.

That index fund is only down 12.94% over the period. The Vanguard fund is not a perfect comparison though since the First Trust/Aberdeen fund invests primarily in sovereign bonds and the Vanguard ETF includes both corporate and sovereign securities. We still see though that the performance of the closed-end fund has been disappointing. As interest rates are likely to keep rising in the short to medium term, it seems likely that this fund will continue to decline in price for a while.

Leverage

As mentioned in the introduction, closed-end funds like the First Trust/Aberdeen Global Opportunity Income Fund have the ability to deliver yields that are well in excess of those possessed by the underlying assets. One of the strategies that are used to accomplish that is the use of leverage. Basically, the fund borrows money and uses that borrowed money to purchase other bonds. As long as the interest rate that it pays on the borrowed funds is less than the interest rate that it receives from the purchased assets, this strategy works pretty well to boost the yield of the portfolio.

As the fund is able to borrow money at institutional rates, this will usually be the case. Unfortunately, the use of debt is a double-edged sword as leverage boosts both gains and losses. As such, we want to ensure that the fund is not using too much debt since that would expose us to an unacceptable level of risk. I do not typically like to see a fund’s leverage above a third as a percentage of assets for this reason. The fund currently has a leverage ratio of 32.40% of its assets so it fulfills this requirement. The fund thus appears to be maintaining a reasonable balance between risk and reward.

Distribution Analysis

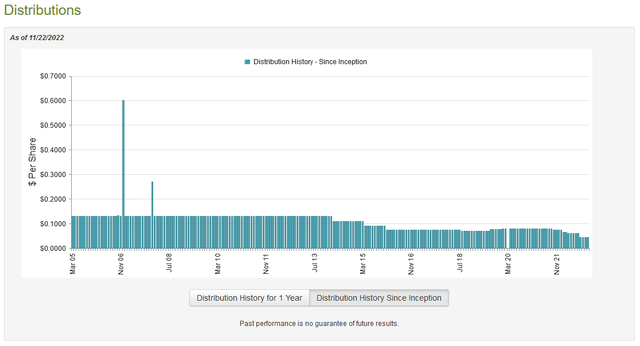

As mentioned earlier in this article, the First Trust/Aberdeen Global Opportunity Income Fund has the stated objective of providing its investors with a high level of current income. In addition, the fund invests in bonds using leverage to boost its effective yield. As such, we might assume that the fund will pay a very high distribution yield. This is indeed the case as the fund currently pays out a monthly distribution of $0.0450 per share ($0.54 per share annually), which gives it a 9.41% yield at the current price. Unfortunately, the fund has not been particularly consistent with this distribution and it has fluctuated quite a bit over the years:

CEF Connect

The fact that the fund has cut its distribution four times in the past 12 months is likely to be quite concerning to many investors. This is especially true because the rising rate environment has allowed several other fixed-income funds to boost their payouts. What’s probably happening here is that the rising rates are pinching the fund’s spread between the rate that it gets from its assets and the rate that it pays on its debt but that is by no means certain.

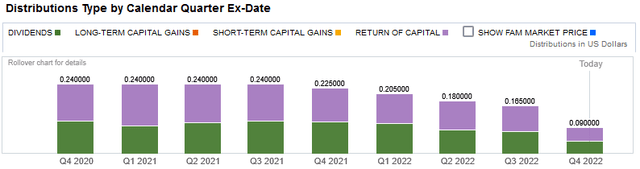

Either way, it’s concerning and it’s certain to be a bit of a turn-off to those investors that are looking for a stable and secure source of income to help cover their rising costs of living. These same investors may be concerned with the fact that a significant proportion of the fund’s distributions are classified as return of capital, which is quite rare for a bond fund:

Fidelity Investments

The reason that this can be concerning is that a return of capital distribution can be a sign that the fund is returning the investors’ own money back to them. This is obviously not sustainable over any sort of extended period. There are, of course, other things that can cause a distribution to be considered a return of capital distribution. However, most of these include things such as the distribution of unrealized capital gains or income from options strategies and are generally not relevant here, which is why we do not often see much return of capital from bond funds. As such, we should investigate to determine exactly how the fund is financing these distributions so that we can figure out how sustainable they are likely to be.

Fortunately, we do have a relatively recent report to consult for that purpose. The fund’s most recent financial report corresponds to the six-month period ending June 30, 2022. As such, it should give us a pretty good idea of how well the fund performed during the initial stages of the central banks’ tightening regime. During that six-month period, the First Trust/Aberdeen Global Opportunity Income Fund brought in $2,841,546 in interest from the assets from its portfolio.

When combined with a small amount of income from other sources, the fund had a total income of $2,846,223 during the period. The fund paid its expenses out of this amount, leaving it with $1,831,898 available for investors. This was not nearly enough to cover the $3,905,021 that the fund actually paid out in distributions, which is certainly concerning at first glance.

The fund does have other means to obtain the money that it needs to cover its distribution, however. Chief among these are capital gains, which are still possible for fixed-income funds even though bonds are not going to deliver the same sort of gains that we can get from the stock market. As might be expected from the rising rate regime though, the fund failed miserably in this task. In the first half of 2022, the fund had net realized losses of $7,338,131, which was amplified by net unrealized losses of $20,184,520.

Overall, the fund saw its assets under management decline by $29,579,809 after accounting for all inflows and outflows. This is obviously not the kind of thing that we like to see and it certainly explains the distribution cuts. The fund will need to work to turn this around and it may not be easy until rates begin to decline once again.

Valuation

It’s always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to generate a suboptimal return on that asset. In the case of a closed-end fund like the First Trust/Aberdeen Global Opportunity Fund, the usual way to value it is by looking at the fund’s net asset value. The net asset value of a fund is the total current market value of all the fund’s assets minus any outstanding debt. It’s therefore the amount that the investors would receive if the fund were immediately shut down and liquidated.

Ideally, we want to purchase shares of a fund when we can acquire them at a price that is less than the net asset value. That’s because such a scenario implies that we are acquiring the fund’s assets for less than they are actually worth. That’s fortunately the case with this fund. As of Nov. 22, 2022, (the most recent date for which data is currently available), the First Trust/Aberdeen Global Opportunity Income Fund had a net asset value of $6.54 per share but the shares actually trade for $5.74 per share. This gives the fund’s shares a 12.23% discount to net asset value at the current price. This is a very reasonable price that is only slightly worse than the 12.84% discount that the shares have traded at on average over the past 30 days.

Conclusion

In conclusion, the First Trust/Aberdeen Global Opportunity Income Fund has a lot to like and a lot not to like. The fund offers one of the most internationally diverse portfolios that can be found anywhere, a high distribution yield, and a very attractive price. However, it also seems likely that it will continue to decline in price until the various central banks around the world begin slashing interest rates again. The fund also will quite likely cut its distributions further. Overall, I want to like this fund but I cannot recommend buying it today, even with the large discount.

Be the first to comment