BalkansCat

HP Inc. (NYSE:HPQ) is a legacy technology company that focuses on selling Personal Computers and Printers. The company is facing headwinds from the cyclical decline in the personal computing market. However, long term the business is poised to benefit from growth trends such as remote working (after its acquisition of Poly, discussed later) and 3D printing. The global 3D printing market was valued at $13.8 billion in 2021 and is forecasted to grow at a rapid 20.8% compounded annual growth rate up 2030. In this post I’m going to dive into the latest financial results for HP, then reveal its valuation, so let’s dive in.

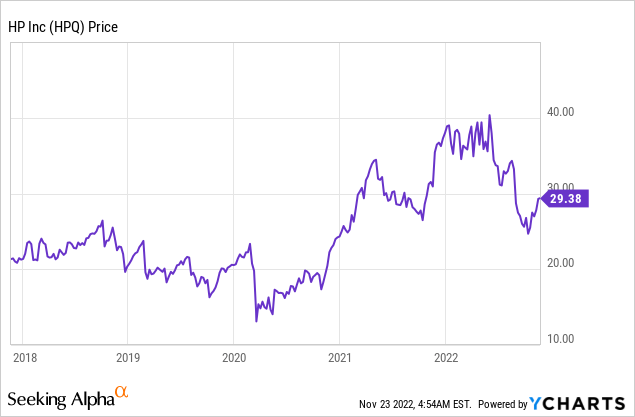

Fourth Quarter Financial Results

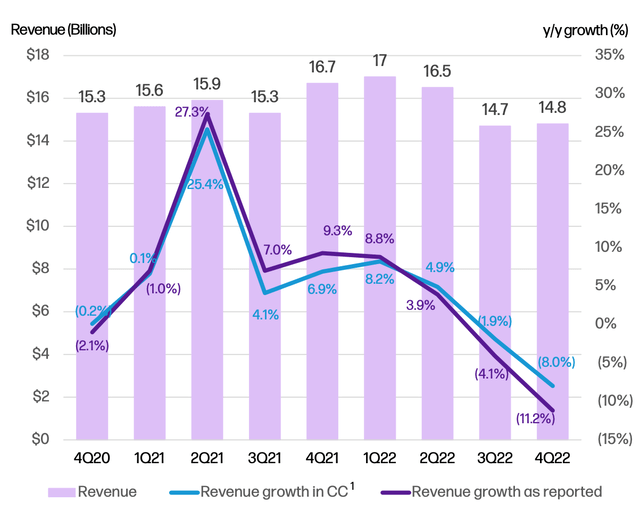

HP generated solid financial results for the fourth quarter of fiscal year 2022. Revenue was $14.8 billion, which beat analyst expectations by $124 million. However, revenue did decline by 11% year-over-year, or 8% on a constant-currency basis. This was driven by macro headwinds and was expected by management.

Revenue HPQ (Q4 Earnings Report)

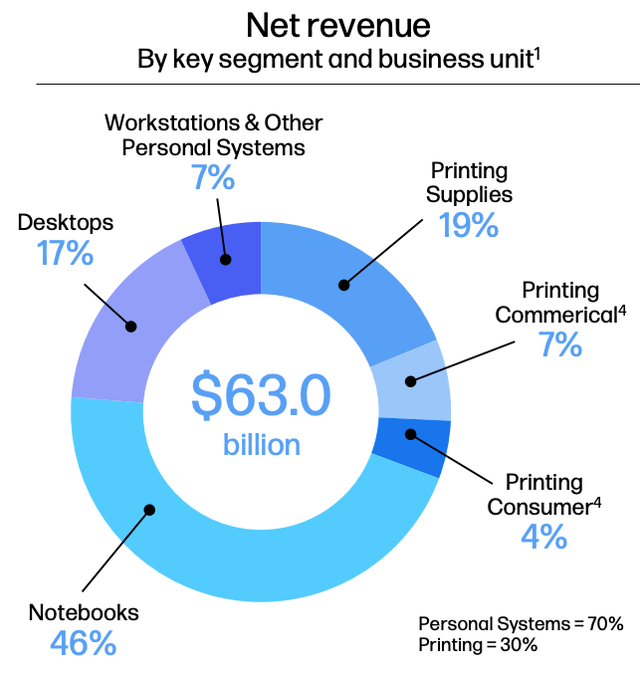

HP makes the majority of its revenue (~70%) from Personal Systems Revenue and ~30% from its Printing revenue. Personal Systems revenue was $10.3 billion in Q4, F22 which declined by 9% year-over-year, but up 4% sequentially on a constant currency basis. The Personal Systems segment can be further broken down into Notebooks (46% of revenue), Desktops (17%), and Workstation & Other systems (7%).

Demand for consumer PCs has been low in 2022, as the market is going through a cyclical downturn. This has been driven by a few factors. Firstly, gaming and computers as a whole had a major surge in sales during the lockdown of 2020. This is because many people were stuck at home and the trend towards building out home offices for remote working was popular. Many people were also “cash rich” thanks to stimulus check schemes throughout the world.

However, the environment is completely different in 2022. We have high inflation and a rising interest rate environment which is squeezing both businesses and consumers alike with higher input costs. Despite the macroeconomic environment, HP has continued to innovate and announced a new series of lightweight notebooks and gaming PCs at the CES Event in 2022.

The company has also closed the $3.3 billion acquisition of Poly, a video conference solution provider which provides cameras, headsets, microphones, and software. The fourth quarter results include two months of Poly-derived financials, which management has stated is performing “better than expected.” This makes sense given the rise of hybrid working and the solutions necessary to make this work efficient. According to one study, hybrid workforce models are used by 63% of high-revenue growth companies.

A positive trend with HP’s Personal Systems unit is a favorable move towards more commercial business, which makes up over 75% of revenue for this segment. Commercial businesses tend to have a higher average order volume and are more consistent with repeat orders, which is great to see.

Net Revenue by Segment (Q4 2022)

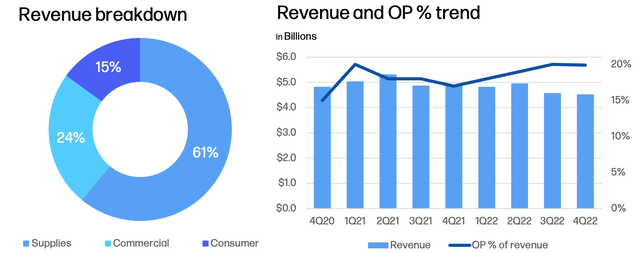

In the Print segment, revenue was $4.5 billion which declined by 7% year over year or 6% on a constant currency basis. This decline was driven by softness in the Consumer market. Given the rise of digital technology and Esign (electronic signature) services, the need for a physical printer is not the same as it was 10 or 20 years ago.

From my personal experience, I own an HP printer which I purchased 5 years ago, and only really use this for postage labels. However, I find the user experience of this to be poor and I much prefer to use QR code-based postage labels. The good news for HP is commercial business has made a solid recovery since the pandemic, with hardware recovery revenue growing at double digits year-over-year.

55% of HP’s Print sales are derived from its HP+ and Big Tank printers. 3D printing also had a strong quarter, as did Industrial graphics, all growing sales year-over-year.

Print Segment Revenue (Q4, F22 Earnings Report)

Profitability and Expenses

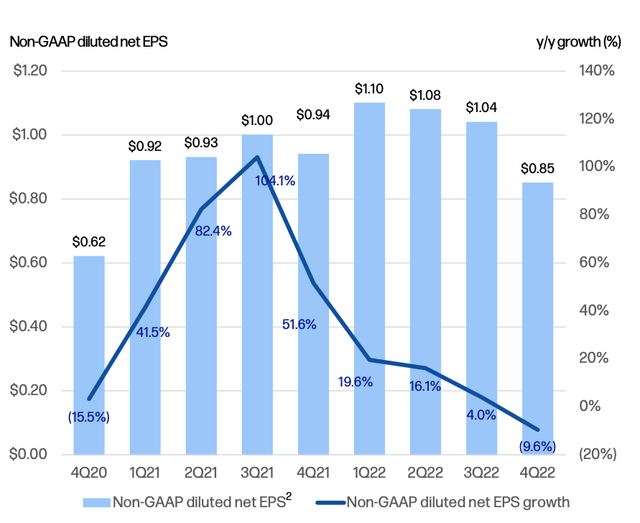

HP generated Non-GAAP operating profit of $1.1 billion, which declined by 15% year-over-year. Non-GAAP earnings per share was $0.85 which declined from the $0.94 in the prior year. However, this still beat analyst expectations $0.01. Keep in mind the “Non GAAP” results excludes net expenses of $855 million which were primarily related to one-time acquisition costs, restructuring costs and tax adjustments. For the full year of 2022, Non-GAAP EPS was $4.08 which increased by 8% year-over-year.

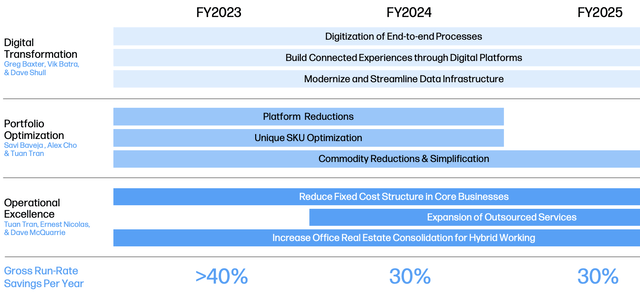

HP’s management has developed a range of cost-cutting initiatives designed to streamline the business. This includes Digitization of the companies end to end processes, inventory optimization, and reduced fixed cost structure for the business. Through these activities and more, the company is expecting to achieve $1.4 billion in Annualized Run Rate Savings by the end of Fiscal year 2023. The company has made a great start to this plan and reduced OpEx spending by ~$350 million year-over-year.

Cost Saving Plan (Q4,FY22 report)

The company generated strong free cash flow of $3.9 billion over the year and returned $5.3 billion to shareholders via stock buybacks and dividends. HP pays a healthy 3.4% dividend, which has grown over the past 11 years.

The company has a solid balance sheet, with $3.145 billion in cash and cash equivalents and short-term investments of $17 million. HP does have fairly high long term debt of $10.8 billion, but just $218 million of this is current debt.

Advanced Valuation

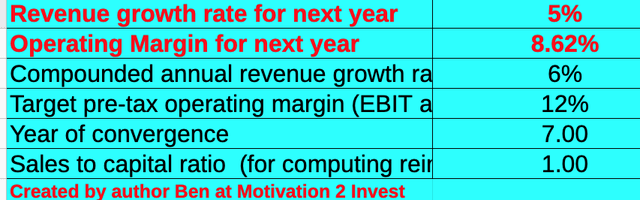

In order to value HP, I have plugged the latest financials into my advanced valuation model which uses the discounted cash flow (“DCF”) method of valuation. I have forecasted a conservative 5% revenue growth for next year and 6% revenue growth over the next 2 to 5 years as the business’s personal computing segment rebounds.

HP stock valuation (created by author Ben at Motivation 2 Invest)

To increase the accuracy of the valuation I have capitalized R&D expenses, which has lifted the operating margin. I expect the operating margin to increase to 12% at least, over the next 7 years given the company’s rigorous cost-cutting plan.

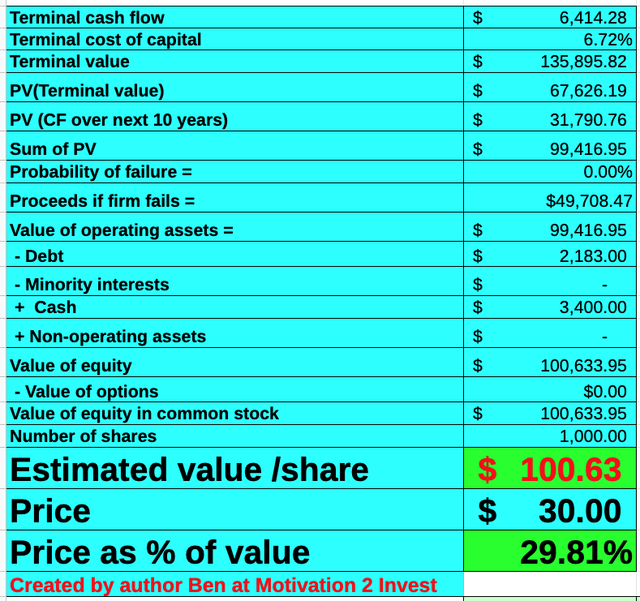

HPQ stock valuation 1 (created by author Ben at Motivation 2 Invest)

Given these factors, I get a fair value of $100 per share. HP stock is trading at $30 per share at the time of writing and thus is 70% undervalued.

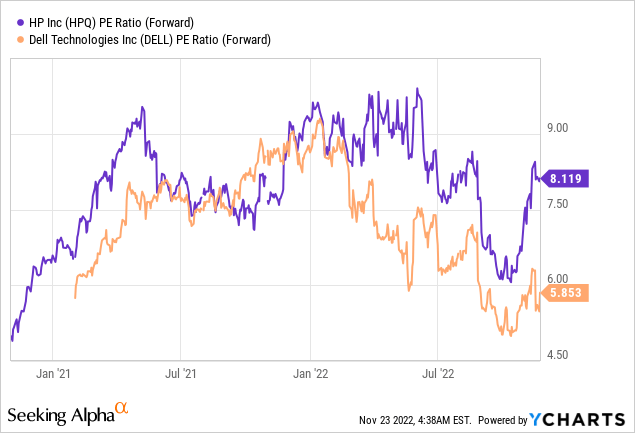

HP trades at a forward Price to Earnings ratio = 8.4 which is 10% cheaper than its 5 year average. As a comparison, HP trades at a higher valuation than Dell (DELL), which is an interesting datapoint.

Risks

Recession/Cyclical PC Demand

As mentioned previously, the high inflation and rising interest rate environment has caused many analysts to forecast a recession. A recessionary environment is not great for most companies, especially those in the business of selling personal computers which are going through a cyclical downturn. I personally believe HP’s smaller segment Print (30% of revenue) is in a declining industry, as I believe the need to print physical paper is just not as necessary as it was 10 years ago, for the reasons mentioned prior (e-signatures, etc.). Then of course we have the environmental impact of printing lots of paper. The good news is that 3D printing is a growth industry, so that could help HP keep its crown.

Final Thoughts

HP Inc. is a legacy technology company that is currently facing a number of short-term headwinds from the cyclical decline in computing to unfavorable FX exchange rates. However, HP management is extremely proactive, and its bold cost-cutting play should pay dividends over the long term. Given these factors and the stock’s undervaluation, I believe HP Inc. could be a great long-term investment.

Be the first to comment