Sundry Photography

Introduction

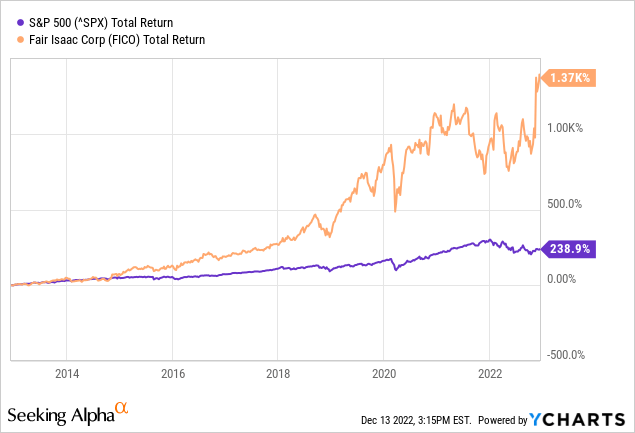

Fair Isaac (NYSE:FICO) is a stock that has generated amazing returns over the past decade, averaging 30.8% per year. The stock has a high price, as its P/E ratio is 32, much higher than the S&P 500’s P/E ratio of 21.

The company is interesting because its free cash flow margin is 37%, which is entirely returned to investors. The company repurchased shares, and the buyback yield from fiscal 2022 (fiscal 2022 ended September) was 11%, which drove the share price higher as demand increased and supply decreased.

Fair Isaac is a company that everyone should have in their portfolio, the company’s finances are in perfect shape and the company is growing strongly. Management is shareholder-friendly by buying back a lot of shares, which drives up the share price.

Company Overview

Fair Isaac is known for its FICO score, which is used by almost all major banks, mortgage lenders, credit card issuers and auto loan providers in most lending decisions in the US. The Scores segment accounted for 50% of total revenue. Revenue came primarily from business-to-business, but the segment also included business-to-consumer solutions, including the myfico.com subscription offering.

Another part of its revenue comes from the software segment. It includes preconfigured analytics and decision management solutions designed for business processes such as account origination, customer management, customer engagement, fraud detection, financial crime compliance, marketing and other business needs. The Software segment also includes the FICO platform, a software solution designed to support advanced analytics and decision-making applications. The Software segment accounted for 50% of total revenues.

Fourth Quarter Earnings Were Solid, Guidance Is Strong

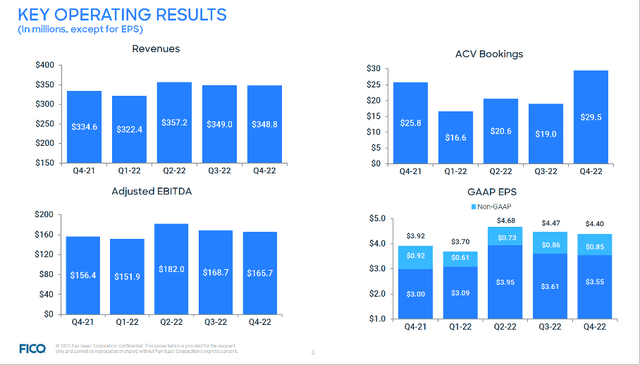

Key operating results (FICO Fiscal 4Q22 Investor Presentation)

Fourth quarter revenues didn’t increase as score revenues declined 3%, which was offset by an increase in software revenues. Software ACV bookings came in strong with a 55% increase compared to the same period last year. Adjusted EBITDA and adjusted earnings per share declined 2% year over year, but free cash flow rose sharply by 60%.

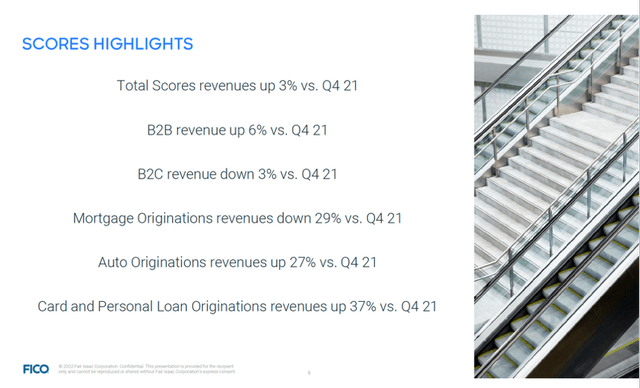

Mortgage originations declined in the fourth quarter, accounting for only 11% of the Scores segment’s revenue. Auto contract revenues were up 27% from the same period last year, mainly due to pricing. Card and personal loan sales rose sharply, with 37% more revenue than last year.

Scores segment highlights (FICO fiscal 4Q22 Investor Presentation)

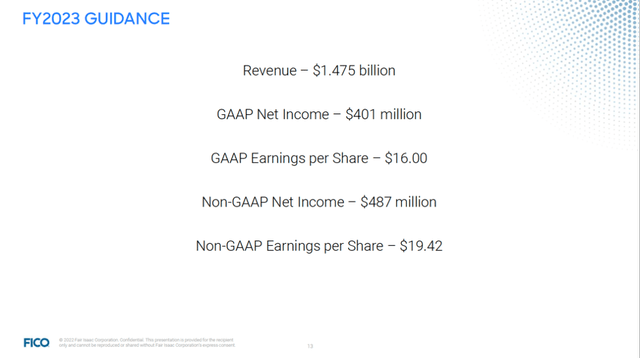

The company announced a strong outlook for fiscal year 2023, with revenue expected to increase 7%. Adjusted earnings per share are expected to increase 13%. The strong results are expected due to special pricing initiatives and growth rates, which will be introduced next year. The Scores business offers risk management products that are especially critical in uncertain economic times.

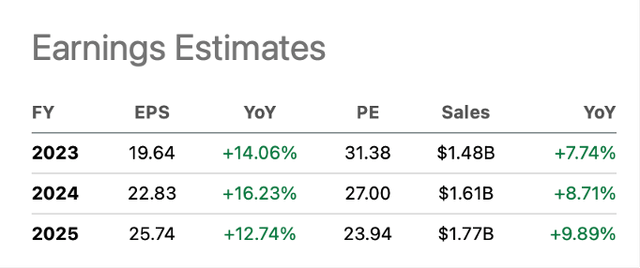

According to the Seeking Alpha FICO ticker page, 5 analysts have revised earnings per share upward. The analysts expect earnings per share growth of at least 15% over the next few years. The P/E ratio for fiscal year 2025 looks attractive at 24 with its strong growth prospects.

FY2023 guidance (FICO fiscal 4Q22 investor presentation)

Massive Share Repurchases

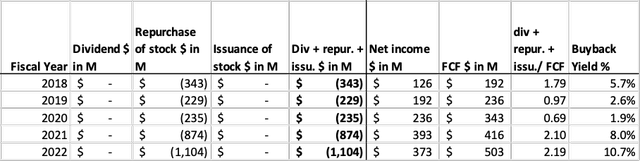

The company does not pay a dividend, but repurchases shares because it is a tax-efficient way to return cash to shareholders. The company rewards its shareholders generously, as the share buyback was 219% of free cash flow for fiscal year 2022, indicating that the company used cash from its balance sheet to finance the share buyback.

FICO Cash flow highlights (SEC and author’s own calculation)

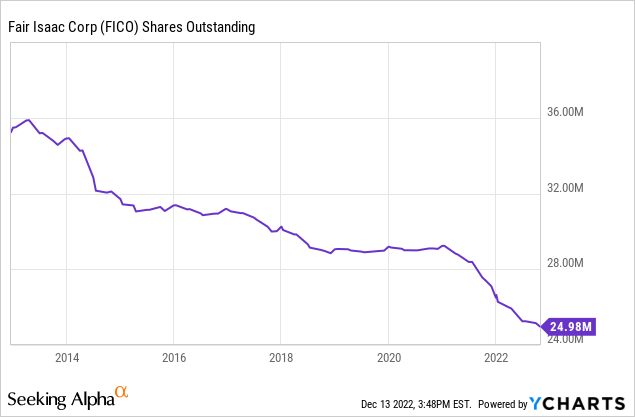

Due to share repurchases, shares outstanding decreased by an average of 3.3% over the past decade. Especially from 2021, shares outstanding decreased at a rapid pace. Share repurchases reduce the supply of shares; the company buys shares in the open market which increases demand, allowing the share price to rise. Share repurchases have proven their worth, as the share price has risen sharply in recent years; 30.8% per year on average.

Valuation

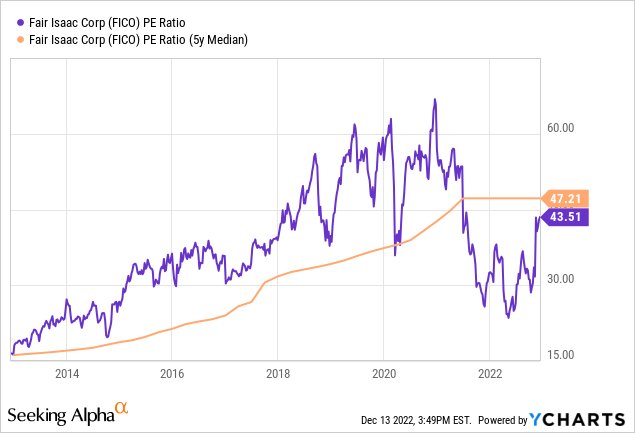

The stock rose sharply over the years, peaking at a P/E ratio of over 60 before the corona crisis in 2020. The stock entered a strong bear market in 2020 after which the price rebounded. As of late 2020, the stock price moved somewhat sideways as valuation metrics were still on the high side. Fourth-quarter earnings were strong, and the outlook was revised upward, causing the share price to rise sharply.

The current P/E ratio of 44 is on the high side, but still lower than the average P/E ratio of 47. The P/E ratio has gradually increased over the years as the company has performed strongly.

According to the Seeking Alpha FICO Ticker Page, 5 analysts expect single-digit revenue growth and double-digit earnings per share growth. For fiscal year 2025, earnings per share is expected to be $25.74 and the forward P/E ratio is 24.

Although the current P/E ratio is overvalued according to historical aspects, the stock offers value. The forward stock valuation looks favorable because earnings per share is expected to rise sharply, and the share buyback should boost the share price.

Earnings estimates (Seeking Alpha FICO ticker page)

Key Takeaway

Fair Isaac is a company known for the FICO score. Financial companies use the FICO score to gain insight in the creditworthiness of customers. Fair Isaac has grown rapidly over the past decade, with its stock price increasing an average of 31% annually. The company is highly profitable, generating a very high free cash flow margin of as much as 37%. This free cash flow is returned in full to shareholders each year. In its fourth-quarter results, the company expects strong earnings per share and revenue growth for fiscal 2023. Fair Isaac rewards shareholders generously: share repurchases amounted to 219% of free cash flow for fiscal 2022. The share repurchases have proven their value, as the share price has risen sharply over the past decade. The P/E ratio indicates that the company is currently overvalued, but given strong earnings per share expectations, the company is reasonably valued. The stock is worth buying because of its strong growth prospects, high free cash flow margin (which flows back to shareholders) and the company’s competitive advantage.

Be the first to comment