Henrik5000/iStock via Getty Images

Investment Thesis

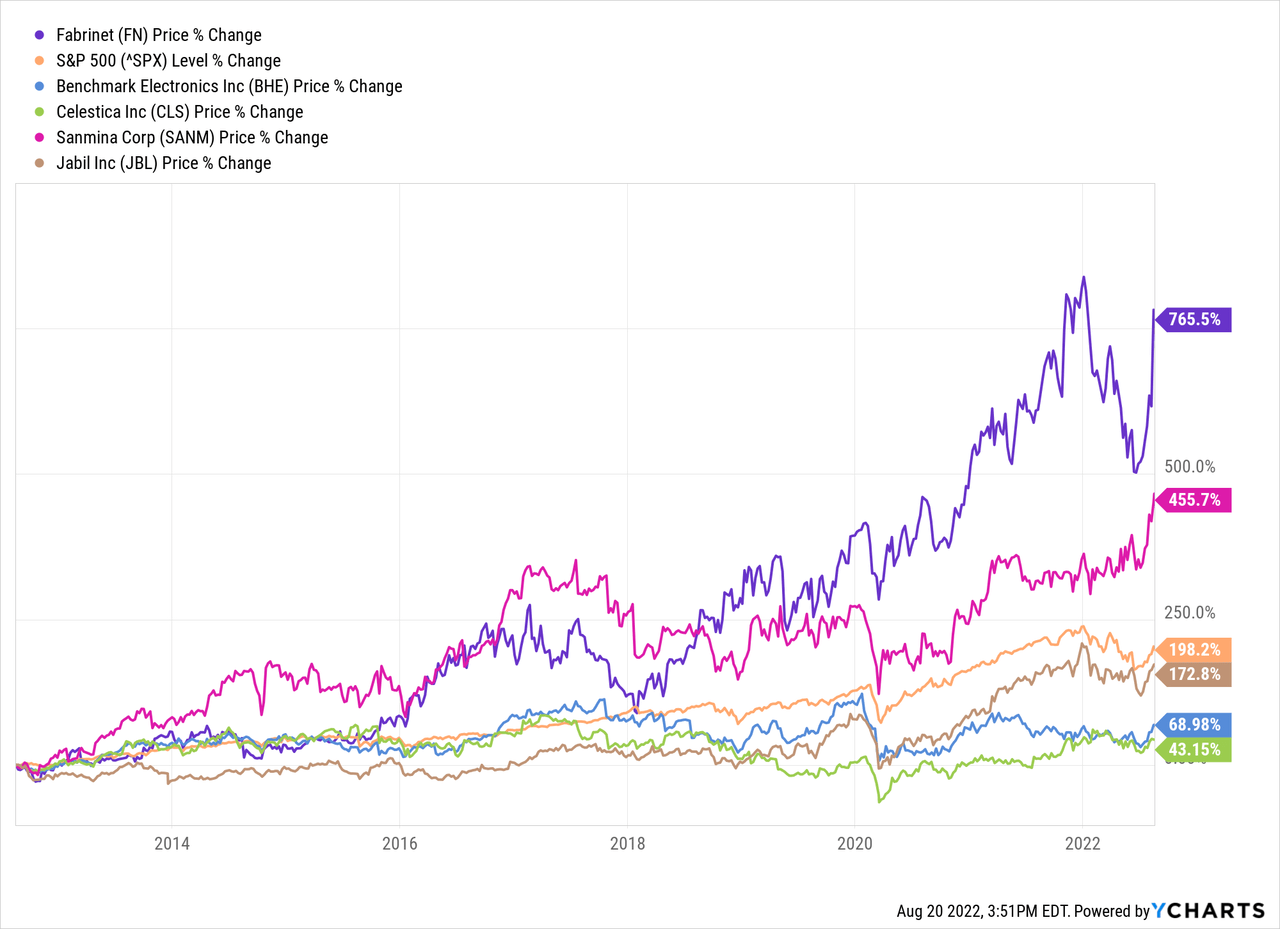

Fabrinet (NYSE:FN) stock has outperformed the market in all previous short and long-term markers with an over 40% surge since the start of this quarter. It has also outmatched its competitors in the long-term price returns, outpacing them at the 5- and 10-year mark.

The company has a fortified balance sheet with $478.2 million in liquid funds, about $30 million of total debt, and an Altman Z score of over 7. Its income statement has shown consistent sequential growth since the pandemic, beating all EPS targets since June 2020 with consistent margin expansions.

Despite its revenue originating from a relatively concentrated number of customers, it has a diverse end-user market and geographical footprint with significant growth opportunities and low-cost production facilities.

In the future, the high demand for the company’s products and services, its ability to translate this demand into top line growth, and convert this growth into profits down the line make me bullish on the stock.

The Company

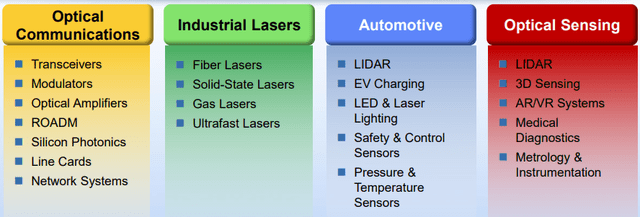

Fabrinet is a global leader that offers advanced optical packaging and precision optical, electro-mechanical, and electronic manufacturing services to complex product manufacturers, such as optical communication components, modules and sub-systems, industrial lasers, automotive components, medical devices, and sensor OEMs.

Fabrinet Investor Presentation

Its advanced optical and electro-mechanical capabilities include process design and engineering, supply chain management, manufacturing, complex printed circuit board assembly, advanced packaging, integration, final assembly, and testing. These services are provided across many industries like automotive, biotechnology, communications, materials processing, metrology, medical devices, semiconductor processing, etc.

Another differentiating aspect for the company is its provision of a customized software platform to its customers, allowing them to monitor all aspects of the manufacturing process and remotely access its databases to monitor yields, inventory positions, work-in-progress status, and vendor quality data in real-time.

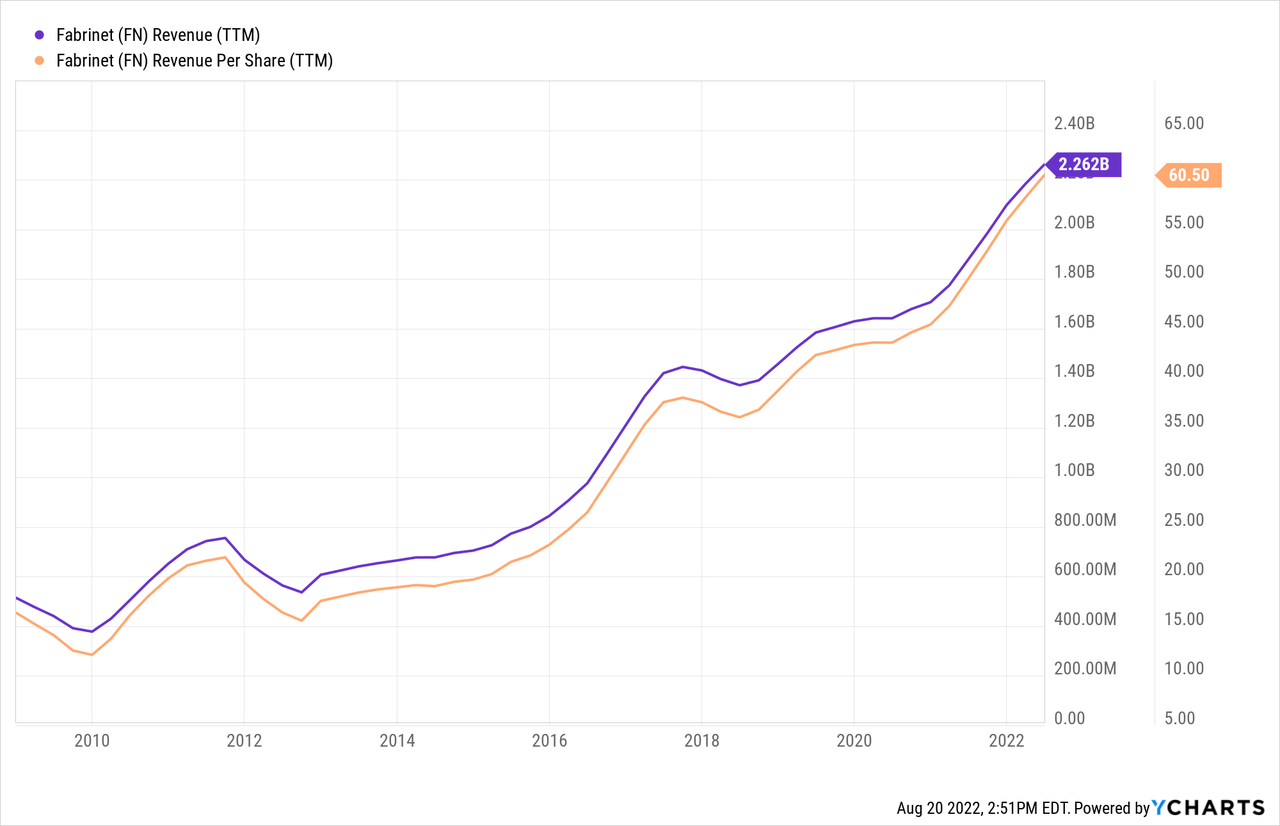

Strong and Sustainable Financial Growth

Fabrinet’s revenues for the twelve months ended in June 2022 increased from $1.88 billion to $2.26 billion, up 20.4%, driven by volume growth in optical communications products, which accounted for 79% of total revenue. The optical communications revenue is further segregated into Datacom and Telecom, which account for 20% and 80% of its total.

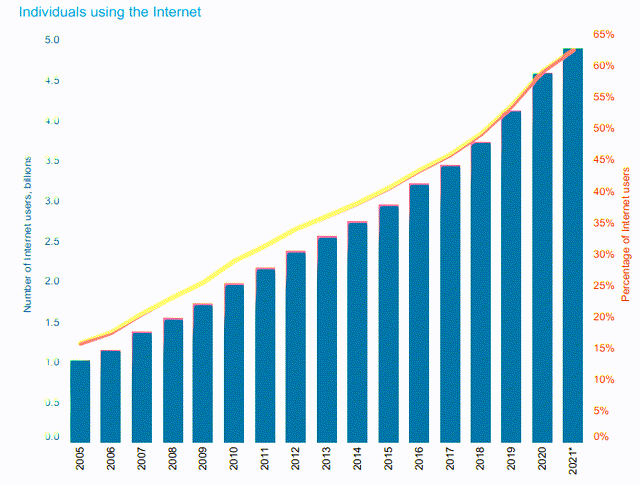

These products are in high demand and are likely to stay in demand with the soaring internet usage across the globe, leading to record revenue for the company, which will likely stay on the same trajectory in the foreseeable future.

The recent upsurge in internet usage, driven by social media, cloud services, etc., has led to higher network utilization and bandwidth consumption, resulting in an increased demand for optical communications and data center infrastructures and carrier and enterprise network expansion.

This has led to rising demand for the company’s optical communications products because many OEMs outsource their production to Fabrinet to reduce costs & expedite their outputs, enabling them to focus on their core functions.

International Telecommunications Union

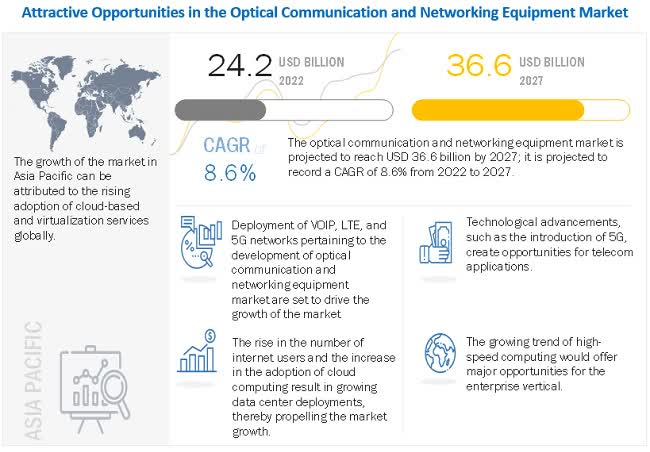

Fabrinet has ample growth opportunities because of its footprint in multiple industries, but the optical communications segment is its bread and butter. According to multiple sources, the industry is on an upward trajectory with a minimum CAGR of 7%.

Markets and Markets

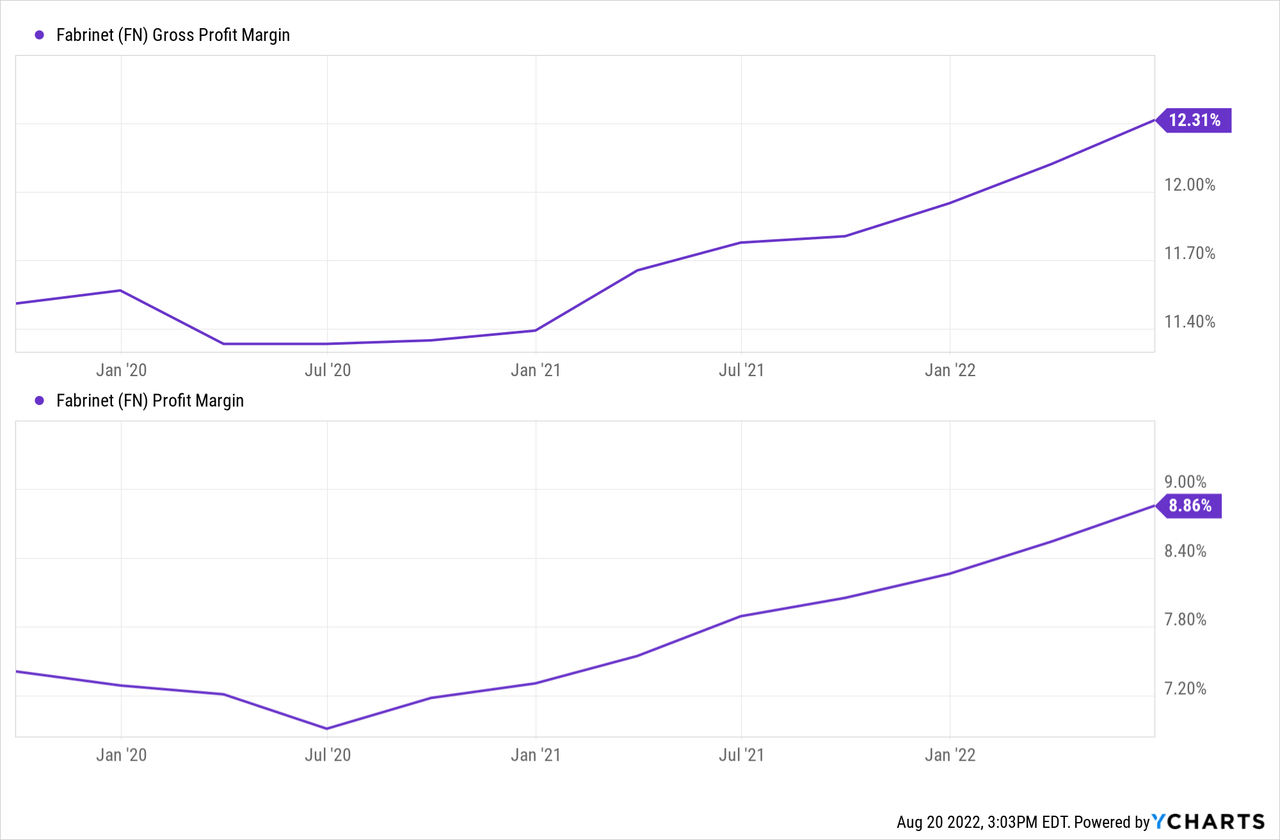

The company’s manufacturing facilities in low-cost regions like China and Thailand enable it to achieve high profitability by widening its cost and revenue spread in times of rising inflation, evident from its growing profitability, which has consistently improved since Q2 2020.

Since the cost of goods sold is the largest part of the company’s expenses, cost controls at this stage are the most important aspect of its margin expansion. The company reduced its COGS from 88.2% of revenue in 2021 to 87.7% in 2022. Accordingly, the company’s annual gross and operating margin grew from 12.1% and 9.5% to 12.6% and 10.3% YoY.

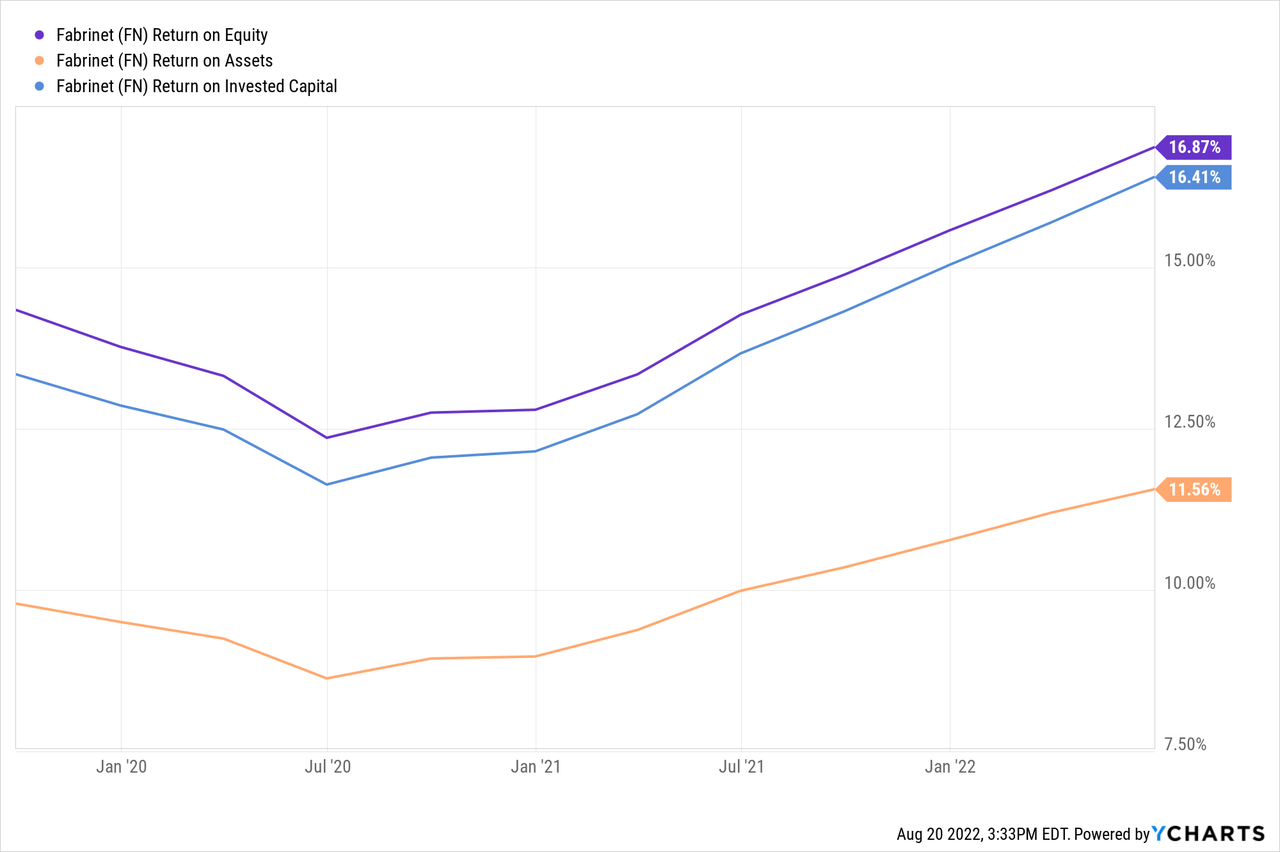

The company’s management effectiveness ratios also paint a bright picture of resource utilization by the management with its growing ROE, ROTC, ROTA, and Asset Turnover. These ratios are about 133%, 162%, 298%, and 105.24% higher than the sector medians. Similarly, its net income margin and net income per employee are also more than double its peers.

Additionally, the significant diversity in Fabrinet’s regional and end-user markets enables the company to leverage growing markets like medical, sensors, industrial lasers, etc., and safeguards against geographical risks.

However, since the company offers specialized vertically integrated products and services that aid in expanding its customer relationships, it is exposed to significant risk pertaining to its client base as a large portion of the company’s revenue comes from a small number of clients, including 25.4% from Cisco Systems Inc. (CSCO), 12.5% from Infinera Corporation (INFN), and 10.3% from Lumentum Holdings (LITE).

To address this, the company intends to expand its client base in Europe, Asia-Pacific, the Middle East, and the United States, specifically to leverage the robust optics and other markets through its precision optical and electromechanical manufacturing services. The company has already established business development centers in Silicon Valley and Israel to attract new clients and transfer their projects to Thailand for volumetric production.

In terms of financial position, the company has ample liquidity with $478.2 million to cover its short and long-term liabilities with a current ratio of 2.83x and long-term debt to equity ratio of merely 1.30%. The strong balance sheet is exemplified by its Altman Z score of around 7x.

A Bit Overpriced Relative to Historical Values

Despite the consistent growth and financial growth performance indicators, the company is trading at around 50% lower forward and TTM EV/S values of 1.45x and 1.65x, and around 40% lower forward and TTM PS/S values of 1.63x and 1.85x.

Concurrently, it has a forward earnings multiple of 18.37x, 20% lower than its sector median. This seems fairly valued for a stock with almost 15.5% forward earnings growth, as evident from its P/B ratio of 3.3x, equivalent to the sector median.

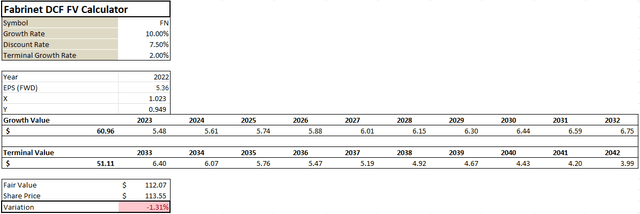

Taking a TTM-EPS-based DCF model with a conservative growth rate of 10% and a discount rate of 7.5% shows that the stock is fairly valued with a negligible FV variation of 1.3%. Any gains with growth metrics above the stipulated assumptions can be construed as upside potential.

The valuation multiples were much better during June when it was trading at around $75.5 per share, compared to the current price of $113.5 per share. The recent share price surge has escalated the valuation multiples higher than FN’s 5-year averages.

Even though the stock appears to be overpriced compared to its historical average, its stability, evident from its 60-month beta of 0.99, offers a great incentive for long-term investors to buy and hold FN to ride through the macroeconomic turmoil.

Conclusion

As with any stock, Fabrinet has a list of pros, including growth opportunities, consistent financial augmentation, a healthy balance sheet, stability, etc., and cons, including slight overpricing, low OCF growth, and a lack of dividends, etc.

In the case of FN, I concur that the pros outweigh the cons and rate the stock as a buy because of its strong and consistent performance through and beyond the pandemic, despite enduring the global supply chain issues. This performance appears to be backed by strong momentum, which is likely to continue in the foreseeable future.

This is an especially positive trait as we tread through an uncertain and unstable macroeconomic environment where investors are looking for durable securities that can withstand a recession and, as a cyclical stock, come out stronger at the other end.

Be the first to comment