Jonathan Kitchen/DigitalVision via Getty Images

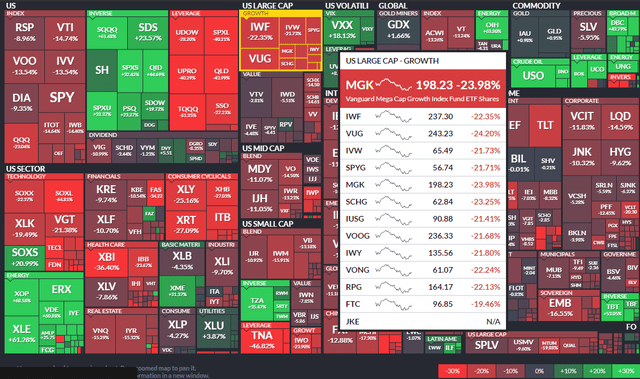

Mega-cap growth stocks have taken a beating so far in 2022. The Vanguard Mega Cap Growth ETF (NYSEARCA:MGK) is down 24% through June 3, sharply underperforming the total U.S. market’s 15% drop. MGK tracks the performance of the CRSP US Mega Cap Growth Index, according to Vanguard Group. At just seven basis points, its expense ratio is paltry, and shares trade with a tight bid/ask spread. The fund is a solid choice for long-term investors seeking to own only the very biggest domestic growth stocks.

2022 ETF Performance Heat Map: MGK Down 24%

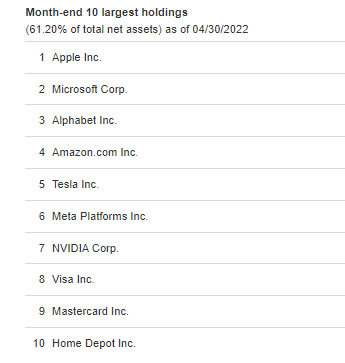

Holding just 108 securities, MGK is concentrated in a handful of companies. In fact, the top 10 holdings account for a whopping 61.2% of the ETF. That means you are really placing your bets on a select group of high P/E stocks by owning MGK versus a broad global equity fund.

MGK: Top 10 Holdings Are More than 60%

Vanguard.com

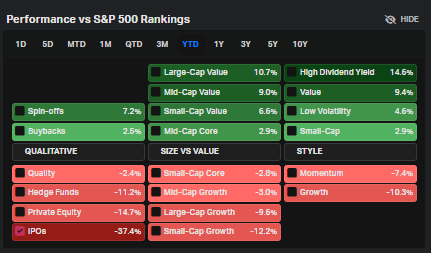

In 2022, the mega-cap growth style has been a rough spot versus other factors. As illustrated below, large-cap growth, similar to MGK, is one of the relative losers on the famed Morningstar Style Box.

Large-Cap Growth Among the Worst Factors YTD

Koyfin.com

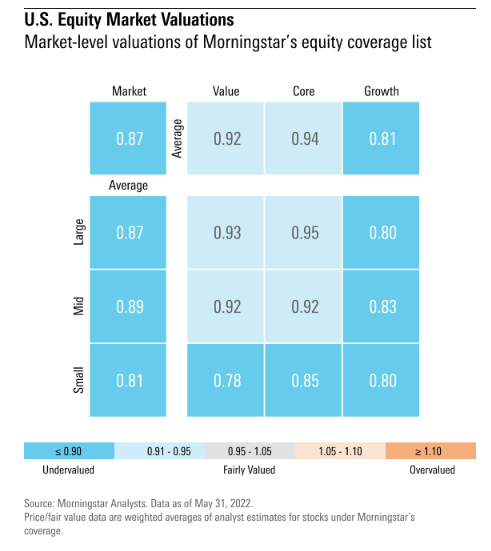

Speaking of Morningstar, the equity research company recently came out somewhat in favor of broad U.S. stock market valuations. Moreover, the Chicago-based firm showcases that large-cap growth trades at a 19% discount to its fair value, among the cheaper styles right now. Apparently, they believe that the 20%-plus drubbing so far this year is good enough for the group to be considered a buy on valuation.

Morningstar: U.S. Stock Market Undervalued

Morningstar.com

What’s important to know about MGK before you go about buying the dip based on a cheap valuation is that the ETF is 53% weighted to the Information Technology sector and 25% in Consumer Discretionary. Energy, up 60% this year, is a measly 0.2% of the fund, according to Vanguard.

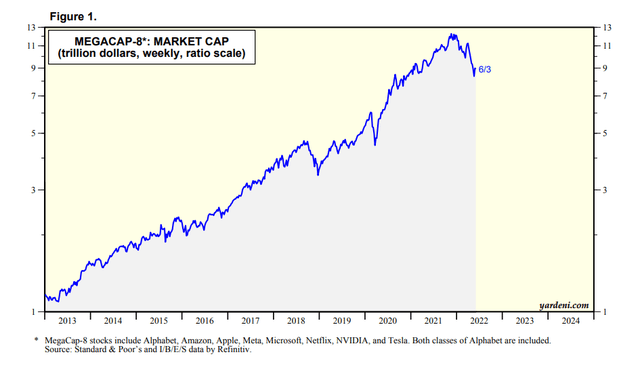

The “Mega-cap 8,” which is Alphabet, Amazon, Apple, Meta, Microsoft, Netflix, NVIDIA, and Tesla, according to Ed Yardeni, dominated the fund. And the group collectively has dropped from a market cap of nearly $13 trillion around the start of the year to $9 trillion today.

Mega-Cap 8: Market Cap Retreats to $9 Trillion

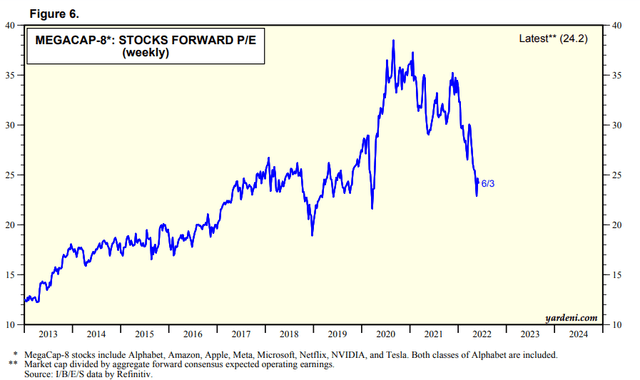

Yardeni also notes that the Mega-Cap 8’s P/E ratio has retreated to its 2017-2019 range. It has done a full round-trip on valuation.

Mega-Cap 8: Valuations Return to Pre-pandemic Levels

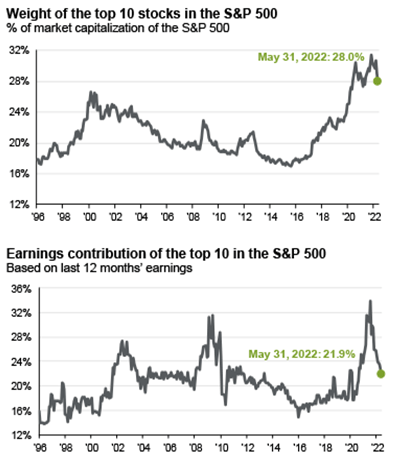

Encouraging for investors concerned about valuations, the top 10 companies in the S&P 500 now account for a smaller piece of the market. At 28%, it’s certainly above the long-term average, but the top 10’s weight is down from a peak of 32%. Moreover, the earnings contribution from this select set of stocks is lower, so the market is not as dependent on those companies to deliver massive earnings anymore.

S&P 500 Top 10: Mega-Cap Growth with a Smaller Weight, Less Earnings Contribution

J.P. Morgan Asset Management

The Technical Take

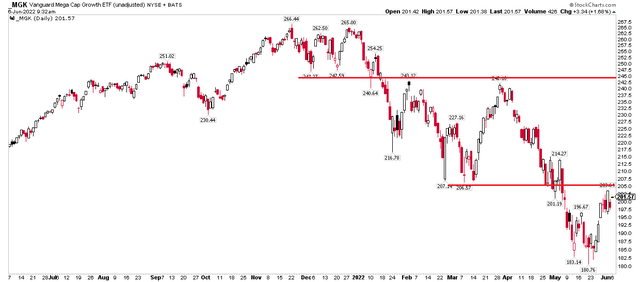

So, what’s my take? I think the valuation case is ok, but not strong. I am adding to a similar fund this quarter, but I am taking my time as I think the group could go lower in Q3. For MGK specifically, I see resistance in the $203 to $206 range. Shares need to climb above that level for the rally to gain more steam. But there’s also clear resistance in the $242-$248 area, too. Overhead supply is significant. That might take time to work through. On the downside, a short position is warranted if price breaks below the $180 May low.

MGK 1-Year Chart: Two Areas of Key Resistance. Watch For New Lows.

The Bottom Line

I think the valuation case for mega-cap growth is improving. Indeed, I am buying some of these companies through other funds. I also think MGK is a great way to play the biggest of big U.S. growth stocks for the long haul. Short-term, though, I am cautious due to two areas of resistance on MGK.

Be the first to comment