bymuratdeniz

Introduction

When it comes to investors, we intuitively often have a ‘more is always better’ attitude towards our companies, thereby wanting the absolute highest earnings possible to help propel their share price and dividends to market-beating levels. Even though I personally tend to carry this view, in the case of Exxon Mobil (NYSE:XOM), I actually feel there can be ‘too much of a good thing’ for investors when oil prices soar into triple-digit levels. Despite foregoing some of the profits after recently sliding back to the mid-to-high $90 per barrel range, I feel that these lower oil prices may actually be good in the medium to long-term.

Detailed Analysis

Regardless of where individual investors sit on the political spectrum, high oil prices it tends to bring unwanted government attention as they fear the voter backlash from higher fuel prices. Despite every oil company profiting, the go-to culprit is the household name, Exxon Mobil who received the brunt of the criticism from President Biden as the largest oil and gas company in the United States.

To avoid any possible accidental implied political bias in my article, I would like to remind readers that former President Trump also undertook a quest to lower oil prices back in 2018, despite the prices of circa $75 per barrel being far below historical highs. Apart from the verbal criticism, the idea of a special tax or levy imposed upon oil and gas companies was also floated, which Exxon Mobil would obviously be incapable of avoiding. This same political risk came to fruition across the Atlantic Ocean with the United Kingdom recently imposing a 25% windfall tax upon its oil and gas industry, although given their relatively small domestic oil and gas industry, the impact is rather muted for the British supermajors oil and gas companies, BP (BP) and Shell (SHEL).

Admittedly, there were accompanying views that any additional tax on the United States oil and gas industry would actually push oil prices even higher as they pull back on investments, thereby potentially offsetting the additional tax expense. Even though I suspect such an outcome would be likely, I would still rather not roll the proverbial dice to find out given the associated uncertainties surrounding how high the tax would be set, when it would be activated and more worryingly, whether the resulting higher oil prices would see even more political interference that may hinder their earnings. Not to mention the medium to long-term implications of higher oil prices for demand, as subsequently discussed.

Thankfully this risk appears to have fallen off the radar during the past month now that fuel prices have eased on the back of these lower oil prices that are now beneath $100 per barrel most days. This allows investors to still enjoy very strong oil earnings but with fewer worries of higher taxes possibly eroding their cash windfall and most importantly, it also lowers the risks of inadvertently spoiling their long-term gas earnings bonanza as Europe decouples its gas supply from Russia.

Unlike oil prices that are frequently in the public domain as they influence the price at the pump, in my observation, gas prices normally receive relatively less attention from the general public as they do not have a visual reminder every time they fill the tank on their vehicle. Even though high gas prices still have wide-ranging impacts on everyday life, most notably through electricity, it feels more distant than oil prices and thus as a result of the lower public interest, the industry faces less political risk if their earnings soar as a result of high gas prices instead of high oil prices.

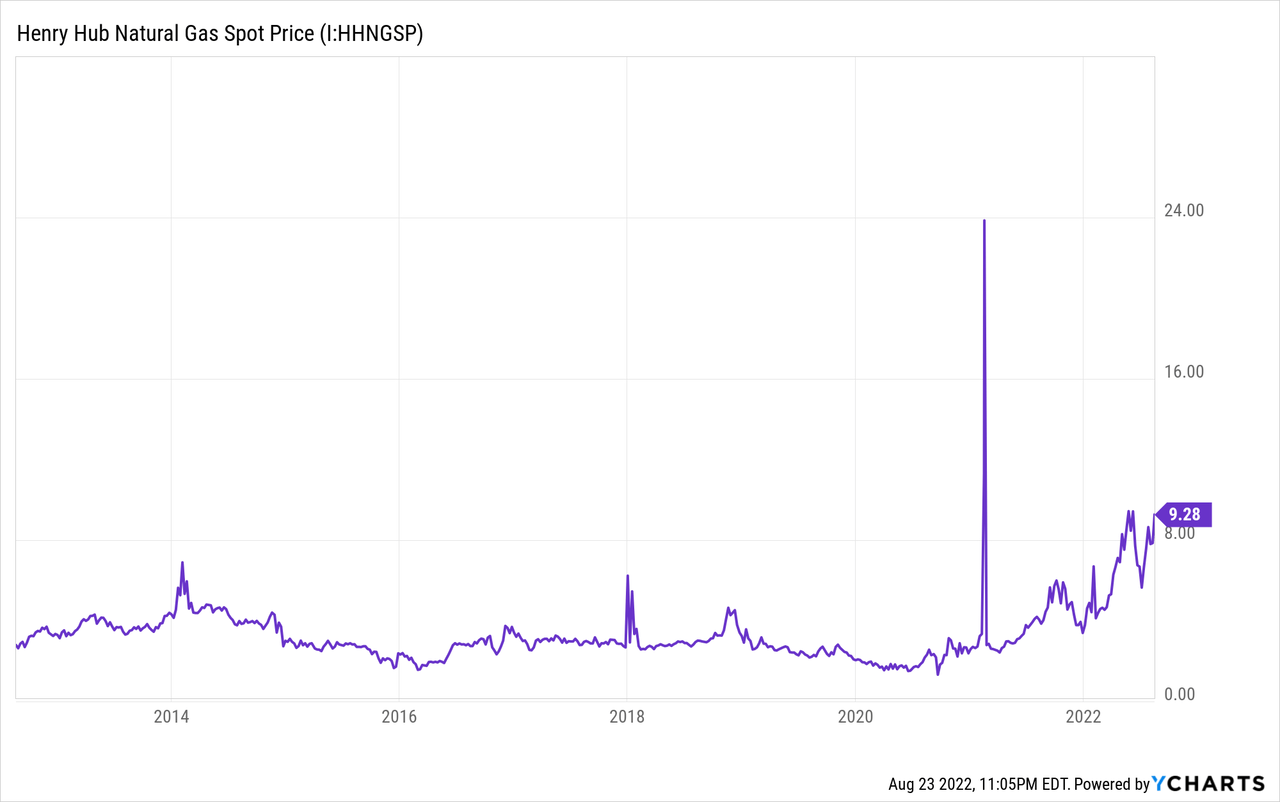

Even though oil prices often dominate the discussion surrounding Exxon Mobil, gas still forms a sizeable portion of their production. During the first half of 2022, their total oil and gas production was a massive 3.704mboe/d of which 2.282mboe/d was oil and associated liquids, as per their second quarter of 2022 results announcement. This means their gas production was 1.422mboe/d and thus comprises a formidable circa 38% of their total production, which largely stems from their once controversial acquisition of XTO Energy back in 2010. Despite their high hopes early in the shale production boom around the time of this acquisition, gas prices ultimately went through a severe winter starting in 2015 and lasting until as recently as 2021, as the graph included below displays.

Even though gas prices were climbing during 2021, they were turbocharged during 2022 as Russian troops marched into Ukraine and set off a pivotal geopolitical shock that will shape the continent for decades to come. The ride is never smooth but despite this inherent volatility, gas in the United States prices are now consistently trading for over $9mmbtu for the first time in over a decade, helped along by the world scrambling to secure LNG supply. This is a world of difference versus the often circa $3mmbtu level seen throughout the past half-decade and importantly, it sees a very strong outlook that should see this former painful era well and truly in the rearview mirror.

The inherent volatility of gas prices makes it virtually impossible to quantify the exact benefit with certainty, similar to every commodity, although a solid qualitative case remains visible. Since gas sees very strong fundamentals following the Russia-Ukraine war, it creates very profitable prospects for Exxon Mobil whose once maligned gas production is now poised to benefit through feeding the increased demand for United States LNG to Europe.

It remains debatable at what speed Europe can decouple its reliance upon Russian gas exports but nevertheless, Europe is undoubtedly seeking any alternative outside of Russia to reduce its strategic weakness from a national security perspective. Any doubts about this outlook in the early days of the war have since been dissolved with Russia frequently turning their gas supply off under the pretense of maintenance, which is widely considered to be retaliation to sanctions imposed over their invasion of Ukraine. Apart from sending gas and thus electricity prices in Europe parabolic, it also strengthens their resolve to source gas outside of Russia and thus this means increased demand for North American LNG and by extension, very strong support for their gas prices.

In my view, this actually represents a far greater opportunity for Exxon Mobil than what is offered by high oil prices because in the case of gas, it actually represents a structural change in the global energy market that stands to perpetually into the future for decades to come. Whilst the prospects of lower Russian oil exports following Western sanctions also represent a structural change, it seems relatively smaller and easier to navigate, as evidenced by oil prices already sliding back to around their level before the invasion began.

It would be disappointing for shareholders to see these very promising long-term multi-decade gas earnings hindered simply because of a short-term oil price spike during 2022 that resulted in a special tax or levy imposed upon their earnings. Thanks to these lower oil prices helping ease political pressure, it significantly reduces the risks of investors seeing such a disappointing outcome as they are more capable of flying under the radar, proverbially speaking.

Even though these first two points are the most important, it should also be considered that the higher oil prices climb, the more it hinders demand in the long-term, as alluded to earlier. This dynamic exists for every commodity but when it comes to fossil fuels, especially oil, the medium to long-term implications are more pronounced as the world transitions to clean energy. Even though gas sees a medium to long-term place to help manage the transition and replace thermal coal, which should help recover any demand destruction from high prices, the same cannot be said for oil demand given its heavy end use in transportation.

Since oil demand sees threats from electric vehicles, it means that a portion of demand destruction from high prices will never return as more consumers are pushed towards electric vehicles in response to crippling fuel prices. This is not to suggest that their shareholders should hope for rock-bottom oil prices to simply shore up demand but rather, it serves as a reminder that there are no free lunches with massive short-term earnings likely coming at the expense of future earnings.

Conclusion

Despite sounding counterintuitive, I feel that these lower oil prices that are now trading around $90 to $100 per barrel may actually be good for their shareholders versus when they were well into triple-digit levels a few months ago. Even though they forego some of their short-term earnings, it frees up the company to enjoy their gas windfall that in my view, sees far better fundamentals right across the short to long-term given the pivotal geopolitical fallout from the Russia-Ukraine war that creates structural changes in the global energy market. At the end of the day, as investors we cannot control oil prices but this article nevertheless serves as a reminder that there are two sides to high oil prices and vice-a-versa with lower prices and thus with their share price near record highs, I believe that a hold rating is appropriate.

Be the first to comment