Richard Drury

Article Thesis

The world is currently experiencing a major energy crisis. Exxon Mobil (NYSE:XOM), as one of the largest energy companies in the world, is well-positioned to benefit from that.

Exxon Mobil will likely be immensely profitable this year, and some believe that oil prices and natural gas prices will climb further during H2. But even if oil prices were to pull back, Exxon Mobil could remain a pretty profitable company that offers compelling shareholder return potential.

The World’s In An Energy Crisis

For many years, governments, NGOs, and even many companies have been talking about a shift towards renewable energy. Many companies even pushed themselves toward becoming greener. But the world’s energy hunger continues to grow, and so far, renewables aren’t able to supply the energy the world needs. There had been calls for dropping oil prices with the purported reason for those falling prices being that a growing number of EVs will reduce global oil consumption. But at least so far, those predictions have not come true at all. In fact, oil demand around the globe continues to rise, as EV buying has not put any dent in the world’s hunger for diesel, gasoline, etc.

That is not too surprising. There are hundreds of millions of gas-powered cars in the world, and several dozen billion of new gas-powered cars are added every year. The fact that a much smaller number of EVs are also sold per year does not mean that the overall number of gas-powered cars is shrinking. Ships, machinery, trucks, airplanes, and so on also all need oil or oil-derived products, as there is no possibility to power those with electricity at scale.

Add to that oil demand for other purposes, such as the production of plastics or the manufacturing of medicine, and the demand picture looks very strong. OPEC announced its demand estimates for 2022 and 2023 a couple of weeks ago. The cartel believes that global oil demand will rise by 3.4 million barrels per day, while another 2 million barrels per day of additional demand is expected for 2023. In total, this means that global oil demand will grow by 5 million barrels or even more from 2021 to 2023. This is, for reference, roughly half of Saudi Arabia’s production in additional demand.

I do believe that there is also a good chance that oil demand could continue to grow in 2024 and beyond. Billions of people in developing and emerging countries want to raise their standard of living. They want to purchase cars, travel, live in larger homes, and so on. Add to that resilient strong demand from industrial nations, despite their efforts to grow renewable energy output, and the global oil demand picture looks very healthy.

At the same time, global demand for natural gas is also very strong. It is needed as a component for the chemicals industry, is used for cooking and heating (where demand is very resilient versus recessions), and it is increasingly used for electricity generation.

BP Energy review

In the above chart, we see that global consumption of natural gas has risen drastically over the last two decades. Even consumption of coal has risen, and that is a much dirtier fuel, both when it comes to CO2 emissions as well as when it comes to other emissions, such as NOX and particulates. From an ESG and public health perspective, it makes a lot more sense to use natural gas than coal. It thus seems reasonable to assume that coal will be the first energy source to be phased out. Replacing it with natural gas as a weather-and daytime-independent energy source (unlike wind and solar) would make sense, and would be highly beneficial for global natural gas demand.

The demand picture for both oil and gas is thus very healthy. And yet, supply is constrained. Energy companies have underinvested for years, starting in 2014, when oil prices first started to drop. A growing focus on free cash generation has led to less growth investment. Add unaccommodating policies and growing regulation from different governments around the world, pressure from ESG-friendly investors, and insufficient offtake capacity (pipelines not being allowed), and energy companies had a lot of reasons not to invest heavily into new production.

So demand is strong and continues to grow, and at the same time, supply is constrained, as the world has tried to move away from fossil fuels too fast. The result is an environment where markets are very tight and where inventories decline, which leads to high energy prices. This is especially true when it comes to natural gas in Europe, where supply disruptions due to the Russia-Ukraine war add even more upwards pressure on prices.

XOM: An Energy Giant That Should Benefit

When markets are tight and prices are high, producers/suppliers of the in-demand goods naturally benefit. Exxon Mobil is the largest supermajor in the world in terms of production and market capitalization, and it should be one of the biggest beneficiaries of the current situation. It did, for the record, not cause this situation. In fact, it had been withstanding different forces (Engine No. 1, NY AG, etc.) that wanted to force it to produce less oil and gas — if those had succeeded, the energy crisis would be even larger, as global supply would be even lower.

Exxon Mobil generated free cash flows of $11 billion during the first quarter, but the second quarter most likely was way stronger.

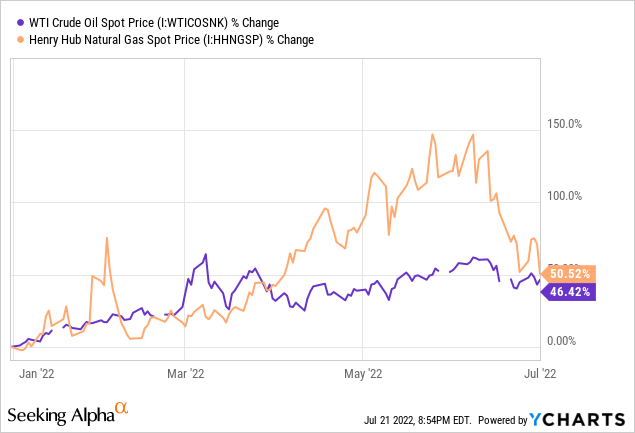

From the beginning of the first quarter to the end of the second quarter, both WTI oil and US natural gas rose by around 50%. That naturally benefits Exxon Mobil’s profits. On top of that, Exxon Mobil’s profits rose due to an increase in American crack spreads, which makes its refining business more profitable, all else equal. As a result, Exxon Mobil has stated that its refining profit in Q2 could rise by up to $5.5 billion, relative to the first quarter, where crack spreads were at a relatively normal level, whereas they are abnormally high today.

Free cash flow can be somewhat lumpy, due to non-cash impacts on profits and due to the timing of payments, both when it comes to those that XOM makes and those that XOM receives. There is thus no guarantee that Exxon Mobil’s free cash flow on the refining business will grow by $5 billion as well, as does its net profit. But due to FCF already standing at $11 billion in Q1, and with large improvements for both the refining business and the production business, I believe that FCF will come in at $15 billion for Q2, at least. That would be up just $4 billion versus Q1, while refining profit alone will jump by more than that, thus $15 billion is likely a rather conservative estimate. But even that would mean $60 billion in annual free cash flow, and XOM would generate free cash worth 4.1% of its market capitalization during a single quarter. If XOM were to keep that up, its free cash flow yield would be north of 16%.

Exxon Mobil’s dividend costs the company around $3.7 billion per quarter, Exxon Mobil would thus likely have surplus cash flows of at least $11 billion for the second quarter.

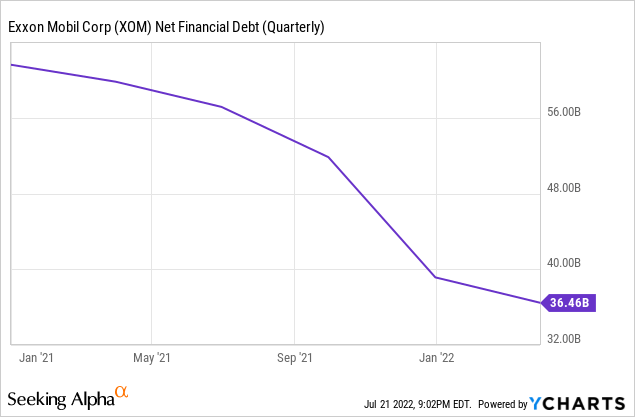

Since Exxon Mobil has successfully cleaned up its balance sheet over the last two years, there is no large need to reduce debt further. The company has paid down 40% of its net debt over the last five quarters, and net debt now stands at just 0.4x this year’s expected EBITDA. Deleveraging isn’t really needed, but XOM may still want to pay down some debt. If they used $6 billion of their Q2 free cash flow for debt reduction, net debt would come down to a round $30 billion, or 0.3x this year’s expected EBITDA. This would still leave $5 billion for buybacks for the quarter. Exxon Mobil could thus buy back around 1.5% of its float per quarter even while reducing net debt at a hefty pace ($24 billion annualized) and while continuing to pay a solid 4% dividend yield.

If XOM decides to forego further debt reduction, it could buy back 12% of its float on an annualized level (calculating with $11 billion in post-dividend FCF) while still paying its dividend and keeping net debt flat. In other words, XOM’s shareholder return potential is immense with energy prices where they are today.

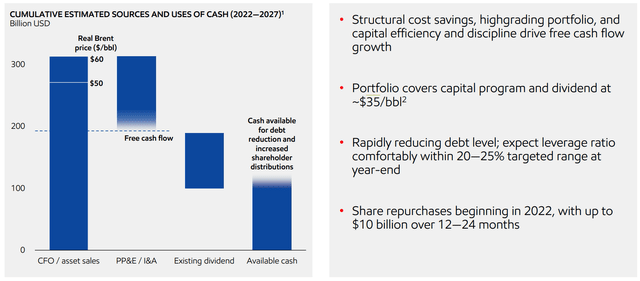

But even in a lower oil price scenario, which I don’t see materializing in the near term, XOM would still generate very solid free cash flows. The company has guided towards the following cash flows in a $6ß Brent scenario:

Exxon Mobil sees operating cash flows of more than $300 billion through 2027 with Brent at just $60. Free cash flow would still total around $190 billion cumulatively, or a little less than $30 billion per year. In other words, even if Brent drops from more than $100 to just $60, which would be an immense drop considering how tight supply is, then XOM would still be able to finance its dividend without any problems while being able to buy back shares for many billion dollars — $12 billion per year, roughly, if it keeps net debt flat.

Exxon Mobil trades at an enterprise value to EBITDA ratio of 4.2 right now, which is a very low valuation. The same holds true when we look at its free cash flow multiple, as shown above. XOM is thus attractively valued today, at least if one assumes that energy prices will remain high. I do believe that there is a high likelihood (although no guarantee) for that. In fact, some analysts believe that energy prices will continue to climb — Goldman Sachs (GS) has famously called for $140 oil.

Risks To Consider

No investment is without risk, and that holds true for Exxon Mobil is well. It naturally is dependent on energy prices, and even though the current macro environment looks very favorable, there is no guarantee that this will remain the case. A new, hefty COVID wave that leads to new lockdowns could hurt global oil demand, for example.

Politics also is a risk. A windfall tax could eat into Exxon Mobil’s profits. It would not make a lot of sense, as the world has not enough energy today, which is why governments should encourage production instead of making things tougher for energy companies. But still, a windfall tax is possible, and XOM could be negatively affected by such a measure.

Takeaway

The world is experiencing an energy crisis right now. One can argue who is to blame for that, but it is pretty clear that XOM is one of the key beneficiaries. In this energy crisis, Exxon Mobil will generate enormous profits. Since the balance sheet is already pretty clean, there is a high likelihood that investors will receive hefty payouts over the coming quarters, as XOM has to put these billions of dollars of cash to use. The energy crisis is bad news for the world, but good news for XOM and its shareholders.

Be the first to comment